Leveraged Loan Beta Exposure Through Indexing

Due to technological advancements in fixed income trading, the leveraged loan market is now a viable option for indexing.

At State Street Global Advisors, we take advantage of our experience as an index manager to efficiently sample the risk profile of the LSTA Index, and we also use value-add approaches such as investing in the primary market, the middle market and smaller loans. Our approach to leveraged loan indexing can provide loan beta exposure with lower costs and potentially higher risk-adjusted returns.

Advancements in Fixed Income Trading

Live Leveraged Loan Dealers on the Octaura Platform 1

Increase in CLO Volumes from 1H23 to 1H24

Median Bid-Ask Spread for Leveraged Loans in June 2024

1 Sources: Barclays CLO and bid/ask spread data as of 1H2024. Octaura dealer data as of September 30, 2024.

More Insights

Matthew Coolidge, CFA, discusses our process for leveraged loan indexing and our management of some of the most pressing challenges in indexing for this asset class.

We explain how a thoughtful approach to broadly syndicated loans can help investors allocate to a truer representation of the liquid senior loan market .

Private credit has attracted investors in recent years due to many of the same reasons that investors allocate to leveraged loans and high yields bonds. However, it is important to understand the differences in risk profile between the three types of exposures.

We have designed and implemented a loan indexing strategy that closely aligns to the performance contour of the asset class.

Comprehensive Fixed Income Platform

Under our broader fixed income platform, we manage strategies across the entire fixed income universe, leading to breadth in our offerings, strong trading relationships, and in-depth insights into market liquidity and flow dynamics.

As the market structure (depth, breadth) for loans has continued to evolve and the asset class has expanded in both size and adoption by investors, many of the challenges to leveraged loan investing have become more manageable. Our flexible investment vehicles — including commingled funds, separately managed funds, separately managed accounts, single investor vehicles, and ETFs — allow investors to access the benefits of leveraged loans such as still-low default rates and attractive coupons.

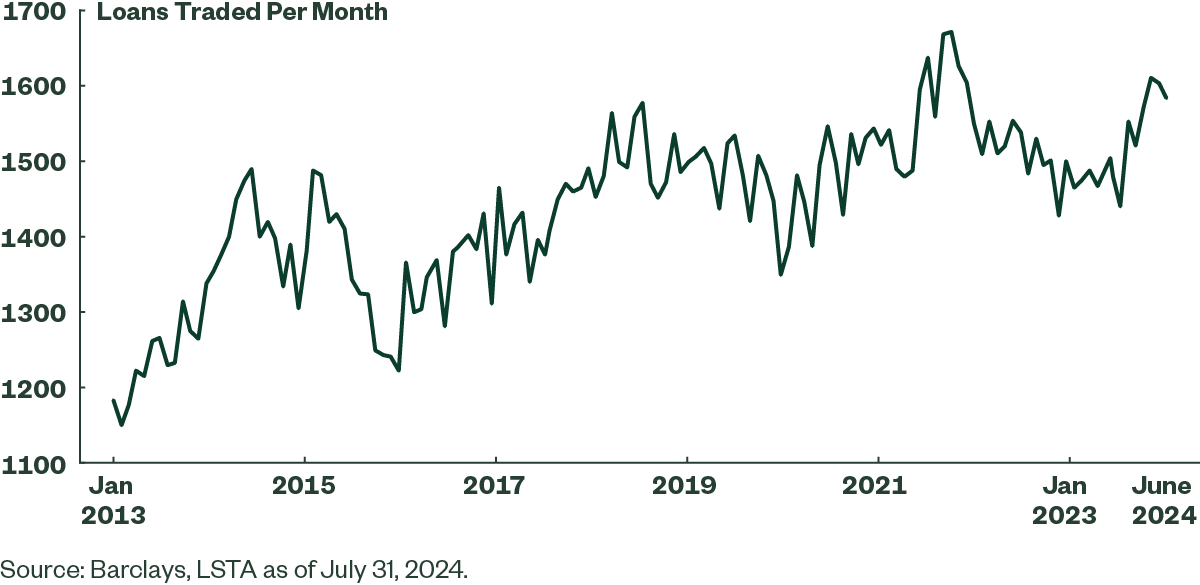

Loans Traded per Month

Connect with Our FICC Team

Make the Complexities of the Leveraged Loan Market Work for You

While the loan market remains an over-the-counter market with challenges such as illiquidity, low transparency and long settlement times, State Street Global Advisors’ decades of experience as an index manager allow us to harvest the premiums available in the market and create a loan solution that best meets the specific goals of our clients.