Building a Better Benchmark for Leveraged Loan Indexing

While investors in the floating-rate senior loan market generally benchmark their allocation to one of the large, broad indices available, these indices often include loans generally not held in typical open-end funds (including ETFs) or separately managed accounts. These smaller, illiquid loans represent a part of the asset class generally associated with private credit investing, including middle market loans.

By using an index more representative of the investor experience — a truer loan market beta —we can better assess performance, improve the viability of tighter-tracking index investing, and more easily quantify exposures to broadly syndicated, liquid loans versus allocations to private credit.

In this piece, we explain how different loan segments behave, how portfolios are constructed, and how we define a broadly syndicated loan universe.

Understanding the Broadly Syndicated Loan Market

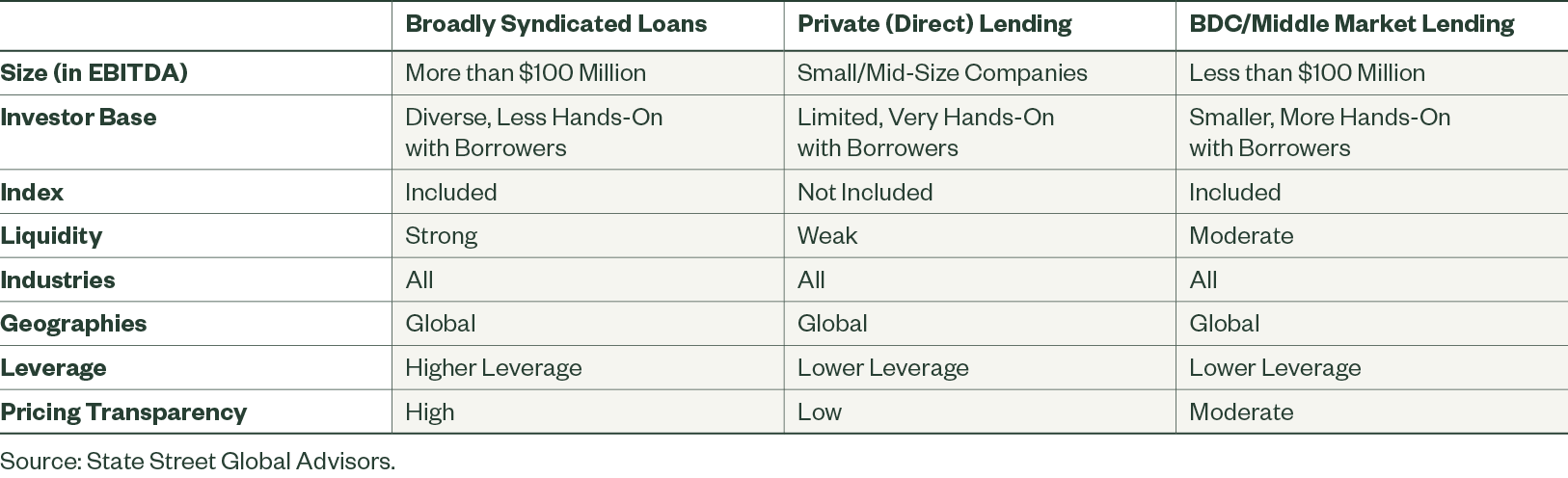

In the modern marketplace, below-investment-grade (IG) companies now have many other avenues for raising debt-funded capital beyond syndicated loans, and these markets have also seen significant growth over the past decade (see Making Private Credit Allocations vs. Leveraged Loans and High Yield). That said, private direct lenders or business development companies (BDCs) have different expected returns and investment options from what’s traditionally known as the broadly syndicated loan market (Figure 1).

The terms “broadly syndicated loan universe” and “middle market loans” could yield 10 different definitions from 10 market practitioners. With that in mind, we are taking a shot at definitions that make sense for investors, and crafting an investment universe around these parameters.

Figure 1: Sub-IG Borrowers Have a Wide Range of Options for Debt Funding

Accessibility Across the Loan Size Spectrum

For investors seeking to access the leveraged loan market, the typical options are mutual funds, separately managed accounts (SMAs), or exchange-traded funds (ETFs), and one institutional fund. However, many of these vehicles rely heavily on the broadly syndicated loan market, and only include a small allocation — if any — to small/middle market company loans. Legacy institutional index strategies only track the largest 100 loans, too.

The Index versus Reality: Traditional Funds Do Not Typically Hold Smaller Loans

Portfolio managers typically filter these illiquid loans out, and instead offer them in less-liquid vehicles and products with longer investment horizons and managed flow structures. These types of vehicles match the long holding periods to their stated maturities because the underlying loans don’t trade.

Additionally, few active managers offer strategies in middle market loans because it’s resource intensive to build a team that can source and underwrite middle market loans. As a result, smaller, less liquid loans are typically directed to private credit, CLO, or larger public asset managers.

Meanwhile, the typical investor in mutual funds, SMAs or ETFs — even institutional investors with strong market standing — are often only exposed to larger loans which trade daily and offer a considerable degree of price transparency (i.e., those loans found in the broadly syndicated loan market). However, small/middle market or illiquid loans are found in the broad market loan indices, creating a mismatch in the way that managers are investing and the way that the loan indices are constructed.

Since most active managers do not participate in the less-liquid subset at index weights, if at all, there are major differences in exposures, beta, and returns versus the index for most loan allocations.

Common characteristics of a broadly syndicated loan universe include issuers with EBITDA over $100 million, diverse investor bases, and somewhat liquid trading in secondary markets. Middle market loans are generally made to businesses with less than $100 million in EBITDA and lower leverage metrics, and with a more hands-on relationship with a smaller number of investors. These characteristics are cloaked by broad indices, which include a wider universe than investors have available.

There is a degree of gray area in loans that meet multiple criteria or fit in multiple categories. These loans are typically smaller or mid-sized. While it is easy for portfolio managers to separate small, thinly — if ever — traded loans from larger loans that trade daily and offer a considerable degree of price transparency, most broad market indices do not separate based on liquidity. These indices include more liquid loans as well as their less-liquid or illiquid cousins, which most mutual funds and separately managed accounts (SMA)s will get very little, if any, exposure to.

Reconstructing the Broadly Syndicated Loan Universe

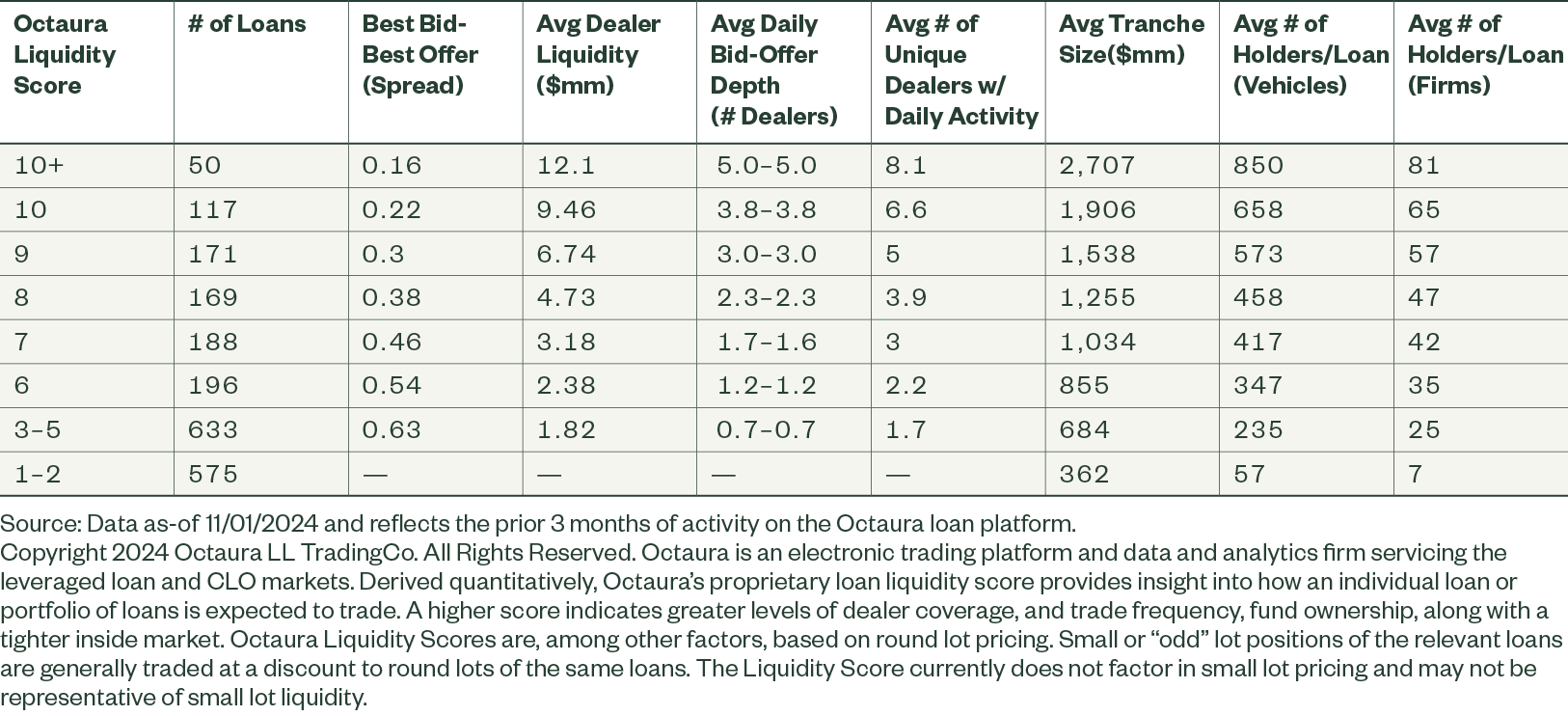

The most straightforward way to systematically carve out the middle market loans from the broader universe is by using loan size as the threshold parameter. We have observed a degradation in liquidity at the $450 million to $600 million and below loan size (smaller loans generally issued by smaller companies and typically directed to private credit managers, BDCs, and CLOs (Figure 2)).

Derived quantitatively, Octaura’s proprietary loan liquidity score provides insight into how an individual loan or portfolio of loans is expected to trade. A higher score indicates greater levels of dealer coverage, and trade frequency, fund ownership, along with a tighter inside market. The liquidity score is a relative ranking from 1 to 10+ comparing the liquidity of that loan to the rest of the universe on any given day. Figure 2 shows the attributes of each liquidity score rating bucket for the past 3 months.1

Figure 2: Octaura Liquidity Scores Are Generally Lower at Smaller Tranche Sizes

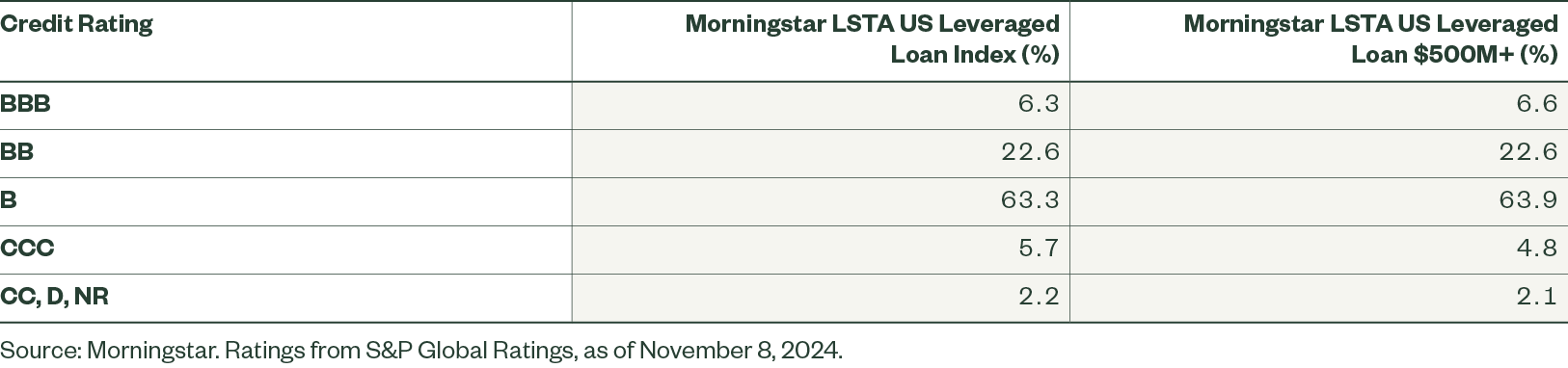

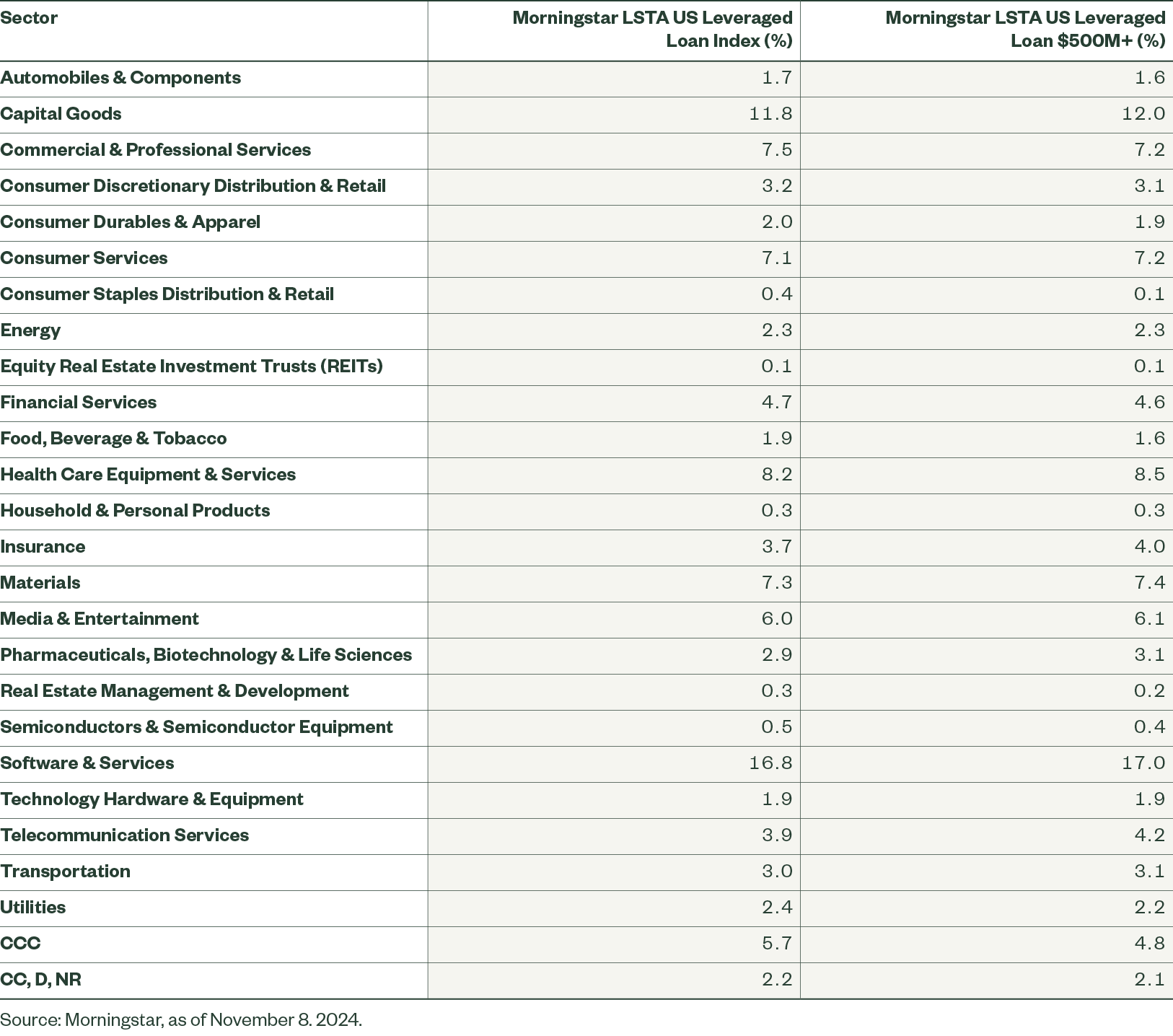

Putting a $500 million threshold as the floor for our broadly syndicated loan universe, a which creates a subset of loans with more reliable trading and pricing activity, carves out a large number of constituents, purely by count. Of a 1345-loan broad Morningstar LSTA US Loans Universe,2 354 would fall under this floor, or 26%. However, this cohort only represents 9% of the assets of the broad index. Historically this smaller-loan cohort would represent 9–14% of the index, though with private credit refinancing many smaller deals in 2024, this weight has dropped to the lower end of the range. With the bulk of the broad universe remaining, credit quality and industry weights remain similar and the overall objective of investing in a broadly diversified universe of floating rate senior loans remains (Figures 3 and 4).

Figure 3: Credit Quality Buckets, Broad Index versus $500M+ Index

Figure 4: Industry Buckets, Broad Index versus $500M+ Index

The Way Forward: Truer Exposure to Loan Beta

In our indexed loan platform (see: Capturing Leveraged Loan Beta: How Index Strategies Can Be an Effective Vehicle for Loan Market Exposure), we seek to redefine the broadly syndicated loan universe to be more liquid, fully investable, and closely aligned with the expectations of public income investors (not of BDC or private credit investors). Rather than offer funds tracking the broad market index, we are indexing our strategies to the broadly syndicated loan universe, as we define it (i.e., the largest 86%–91% of loans). We define the broadly syndicated loan universe as issuers rated below investment grade, and loan sizes above $500 million.

In this way, State Street Global Advisors can provide exposure to a core loan market, one that is more in line with the true risk/return profile that leveraged loan investors can attain in the public market. Benefits of our investment process include:

- Exposure to the public, syndicated loan market: The $500+ million subset we invest in is a “close cousin” of the traditional broad loan market, with more reliable and transparent trading.

- Savings on fees: Investors can maintain exposure to the attractive characteristics of the asset class (including floating-rate, higher-yielding, and senior-secured3 exposure), but save their fee budget for specialist private credit managers, who demand higher fees.

- Fully indexed capital structure exposure: Investors can gain access to senior secured loans in an indexed portfolio method with tighter tracking, aligning with other parts of the capital structure.

- Allocation through the credit cycle: With our investment process, we can adjust exposures at the top level as the credit cycle and fundamental credit backdrop shifts, complementing exposures to high-yield bonds and awaiting private credit’s capital calls.