How to Build a Bond Ladder

A bond ladder strategy is designed to generate reliable income regardless of how interest rates move, providing the stability investors need to fund their goals, like retirement.

Uncertainty over the Federal Reserve’s monetary policy has caused unprecedented rate volatility, challenging today’s bond investors who rely on income from their portfolio to fund specific expenses or financial goals, like retirement.

Building a bond ladder — a diversified bond portfolio that targets sequential maturity dates — can create a more reliable income stream, while minimizing the impact of interest rate moves.

What Is a Bond Ladder?

A bond ladder is a portfolio of bonds with different maturity dates spaced out at regular intervals. As an investment strategy, bond ladders are designed to produce more predictable income and outcomes for investors, potentially helping them better achieve their investment goals.

A diversified bond ladder strategically structures bonds into “rungs” based on their maturity dates, instead of selecting bonds based only on returns and grade.

How Does a Bond Ladder Work?

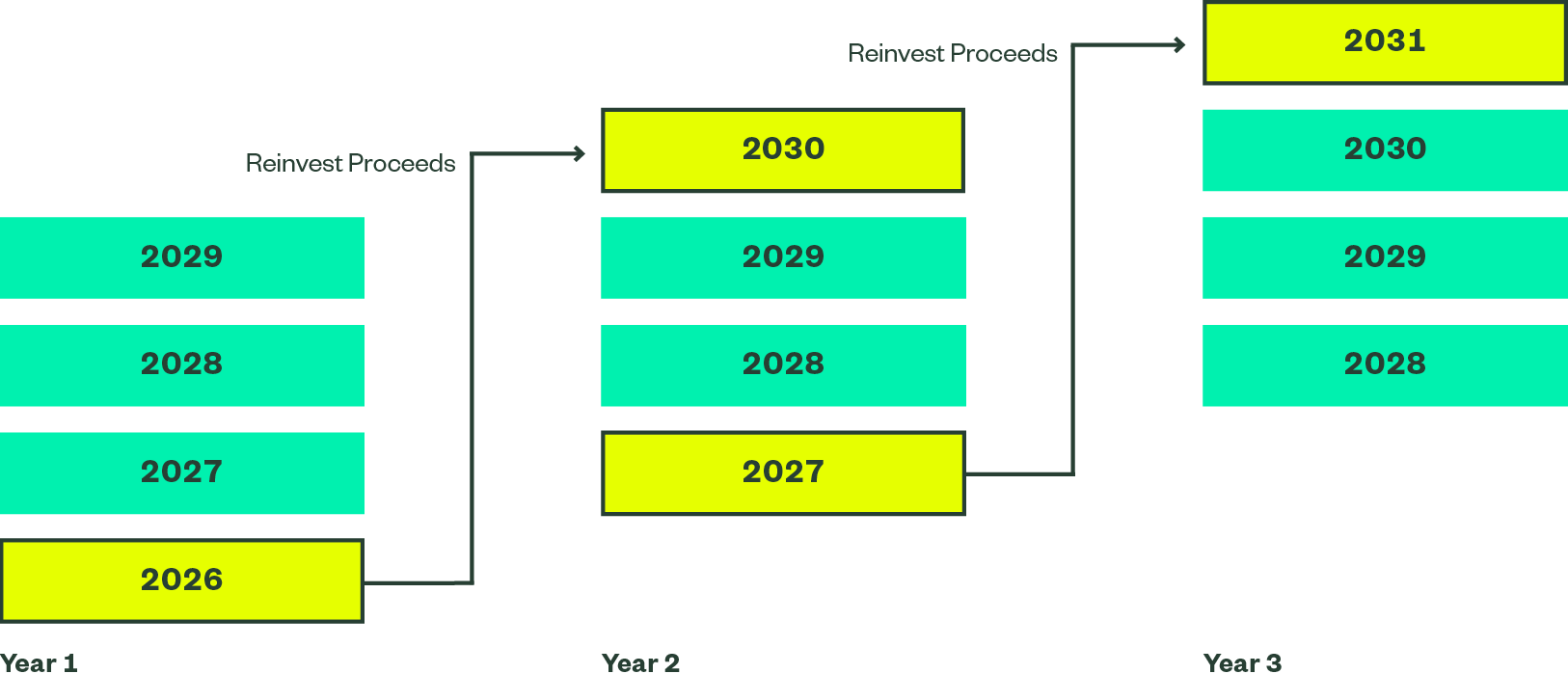

Each rung of the bond ladder is made up of bonds maturing at or about the same time. Because sequential rungs of the ladder mature at different but regularly scheduled intervals — for example, one year, two years, three years, and so on — bond ladders offer reliable income. And as individual bonds reach maturity, you can reinvest the proceeds in new, ideally higher-yield bonds or put the proceeds toward current expenses.

Many investors use the income from their bond ladder to fund retirement or other financial goals, like tuition payments or the mortgage on a second home. Others appreciate that a ladder provides regular reinvestment opportunities, making their bond core more flexible and liquid.

What Are the Benefits of Bond Ladders?

A bond ladder can improve the diversification and liquidity of your core bond allocation.

Imagine you have $100,000 to invest in bonds. Investing the entire amount in one or two bonds maturing at the same time, or at arbitrary maturity dates, doesn’t adequately diversify your bond portfolio or position you to capitalize on potential changes in interest rates.

On the other hand, laddering your core bond exposure can provide you with current diversification, potential future opportunities, and specific safeguards should interest rates fluctuate.

Investors use a bond ladder strategy to:

- Meet Income Needs

As each bond within the ladder matures, it provides a predicable amount of income, minimizing the impact of changes in interest rates. This is helpful if you have predictable expenses, like a mortgage, or rely on regular income to fund your retirement.

- Manage Interest Rate Risks

The diversity of a bond ladder means you avoid getting locked into a single interest rate. Recall that there is an inverse relationship between interest rates and bond prices.

In a rising rate environment, existing bond prices typically decrease as yields on newly issued bonds increase. As rates decrease, the opposite happens.

A ladder helps smooth out the impact of interest rate fluctuations because it holds bonds maturing every year, quarter, or month, depending on the number of rungs in the ladder.

- Increase Flexibility

Investing across maturity dates presents tactical reinvestment opportunities. As bonds mature, you can reinvest the proceeds strategically in new bonds based on prevailing interest rates. For example, long-term bonds typically offer higher rates than short-term bonds, so maturing bonds can be reinvested at the end of the ladder to pursue higher potential returns.

How Bond Ladders Defend Against Interest Rate Risks

When rates are rising, you can reinvest proceeds from bonds that have matured into new, longer-term bonds with higher rates. This helps to offset the lower yields of rungs that will mature in subsequent years.

When rates are falling, you can choose to reinvest less of the maturity proceeds into long-term bonds with lower rates and, instead, rely on existing rungs that hold bonds already purchased at higher rates. You can then reinvest maturity proceeds in short-term bonds while you wait for rates to rise.

By staggering points of maturity, you avoid locking all your capital into a single interest rate for several years or having to sell your bonds early to take advantage of the rise in interest rates.

The diversification and future reinvestment opportunities bond ladders offer also help defend against inflation, which can erode the purchasing power of the generated income.

How to Structure a Bond Ladder

Bond ladders can be created using corporate bonds, certificates of deposits, Treasury notes, municipal bonds, bond mutual funds, or target maturity bond ETFs. Investors generally prefer to use high-quality, non-callable bonds and avoid junk bonds or high risk bonds. Importantly, the bonds must have varying maturities; often investors stagger bonds with one- to two-year intervals between maturity dates. But you can plot maturities out in any way to coincide with when you need to receive income.

Bond Ladder Terms Defined

- Rungs

A rung is made up of a bond or collection of bonds that are all maturing at or around the same time. The number of rungs you create depends on the amount you have to invest and your goals.

More rungs create more diversity, which can help you avoid losses resulting from sudden market shocks. - Spacing

The spacing of the rungs refers to the time interval between two rungs’ dates of maturity. This can be anything from a few months to multiple years. It’s generally recommended that investors maintain rungs of uniform spacing.

The more liquidity you want, the closer maturities should be to each other. This ensures a steady income stream from maturing bonds. Retired investors, for example, may choose to create rungs that mature at intervals of one or two months to ensure a monthly income.

Be sure to keep your investment goals and need for liquidity in mind when determining the spacing of your bond ladder.

Choosing Between Individual Bonds and ETFs to Create Your Bond Ladder

You can build your bond ladder by researching and selecting individual bonds based on their rating and maturity, or by investing in target maturity ETFs. Factors to consider include:

| Consideration | Individual Bonds | Target Maturity ETFs |

|---|---|---|

| Complexity and Resources | Makes building and managing the bond ladder a resource- and time-intensive process given the complex and fragmented nature of the bond market. | Simplifies the process of creating a bond ladder, as the bond selection and management process is taken care of by the fund manager. |

| Diversification | The minimum investment amount needed to achieve adequate diversification is higher as individual bonds generally have a par value of $1,000.¹ | Adequate diversification can be achieved at a lower cost since fixed income ETFs trade at around $40 per share.² |

| Control | Using individual bonds offers investors better control over their bond ladder. | Investors have less control over bond purchases or tactical trading decisions made by the fund manager. |

| Credit Research and Risk Management | To ensure prudent risk management to optimize yield and minimize default risk, investors will need to spend considerable resources and time constructing and monitoring their portfolios. | Asset managers have dedicated research analysts and portfolio managers and can leverage their firm’s resources and technology to manage the portfolio effectively. |

| Management Fees | Eliminates the added expense of paying management fees to a fund manager. | Asset managers take a fee for managing ETFs, so check the ETF’s total expense ratio (TER) before you invest. |

| Trading Costs | Investors who buy bonds in smaller quantities may end up paying higher trading costs, which can erode yields. | Institutional investors are generally able to receive better pricing terms given the larger transaction size. This often results in lower trading costs and better execution. |

Further, compare individual bonds, bond mutual funds, and bond ETFs to learn more.

Steps for Building a Bond Ladder

There are three key steps to building a bond ladder.

You can choose to put your entire bond allocation in the ladder, or you can keep some aside to invest in more speculative bonds.

Base your decision on how actively you want to manage the bond ladder and your investment purpose and risk appetite. Divide the total capital by the number of rungs to determine how much to invest in each rung using an equal-weighted approach.

Use quality bonds (A-grade or higher) to reduce default risks. Avoid high risk bonds and callable bonds that can weaken that rung if they are called. Also consider factors like potential tax implications or credit guarantees from corporate versus government bonds.

Make sure to check the bond’s rank, risk, interest, duration, and time frequency. You can choose to invest in riskier bonds elsewhere in your portfolio, if you have the appetite, but they shouldn’t be a part of your bond ladder.

Should You Build a Bond Ladder?

To determine whether a bond ladder strategy is feasible for you and to plan its structure, consult with an advisor and/or consider the following:

How much money do I have to invest in bonds?

Building a strong bond ladder means buying multiple bonds at once. But most individual bonds cost $1,000 or more per unit. Such prices can make adequately diversifying your ladder prohibitively expensive. Instead, consider using lower-cost target maturity ETFs or mutual funds which can make building a bond ladder more affordable.

Do I have the flexibility to hold bonds until maturity?

A bond ladder’s effectiveness comes from its timed ladder structure. Only invest as much money in a bond ladder as you think you won’t need before the date of maturity. Selling bonds before maturity will upset your ladder strategy and could possibly result in a loss.

If you sell bonds before their maturity and interest rates have risen, the market value of those bonds may be down. And, after the sale, you’ll no longer have an effective ladder as one or more of the rungs will be missing. It will also impact regular coupon or interest payments, liquidity, and your reinvestment opportunities.

Bottom line: Ladders satisfy an emotional need for certainty, which may matter more than anything else for some investors.