Why ETF Growth Is Booming

From their ability to democratize investing access to their liquidity and unique in-kind structure, ETFs offer investors a diverse set of benefits not found in other investment vehicles. Having demonstrated their resilience over the past three decades, ETFs continue to attract a growing number of investors — and it’s easy to understand why. Investors who use ETFs are more confident and more satisfied with their portfolio performance than those who don’t use ETFs.1 Read on to learn more.

The Original ETF Innovation Sparked Remarkable Industry Growth

State Street Global Advisors is proud to have launched the original ETF innovation in 1993 in response to the 1987 market crash — infamously known as “Black Monday.” In the decades following, the ETF industry as a whole has endured periods of market strength and stress. And through it all, ETFs have demonstrated their value and resilience.

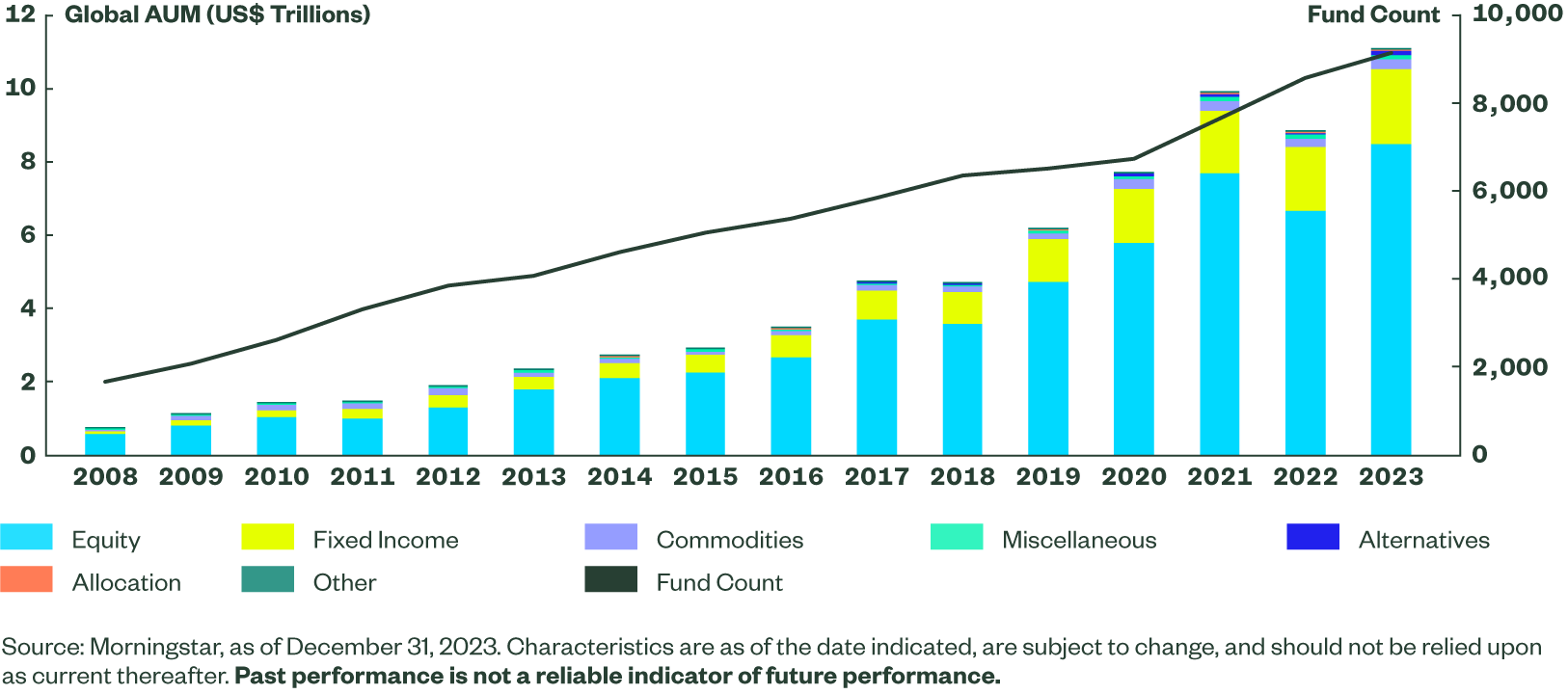

As ETFs’ popularity has grown over the years, so too have the number of product offerings — stretching across geographies, demographics, investment strategies, asset classes, and everything in between. With a cumulative annualized growth rate (CAGR) of 19.8% since 2008, ETFs reached US$11.1 trillion assets under management (AUM) as of December 31, 2023.2 And the number of ETF offerings globally has risen to 9,149 funds (Figure 1).3

Figure 1: The Impressive Growth of the ETF, 2000 to 2023

ETFs Offer Investors Several Key Advantages

The booming US$11.1 trillion global ETF market has come a long way since the launch of the first equity index-linked fund. As the ETF market has grown and evolved, so too have the ways investors use ETFs, allowing all types of investors to prioritize outcomes with greater efficacy and efficiency.

A few benefits, in particular, have helped to fuel the rapid growth of the global ETF industry:

A Best-of-Both-Worlds Structure

ETFs are a mashup invention: they trade like stocks while offering the diversification benefits of mutual funds. An ETF is a basket of securities that seeks to provide exposure to a broad or specific market segment. But unlike mutual funds, ETFs can be bought and sold in a single trade on an exchange throughout the day — just like stocks.

Many ETFs track the performance of an index and typically charge lower fees than mutual funds. In one trade, they offer diversified, low-cost, transparent, and tax-efficient exposure to multiple holdings.

How ETFs Compare to Mutual Funds and Individual Stocks

| ETFs | Index Mutual Funds | Individual Stocks | |

|---|---|---|---|

| Track an Index | Yes | Yes | No |

| Provide Diversification | Yes | Yes | No |

| Average Net Expense Ratio | 0.57% | 0.84% | N/A |

| Pricing | Market Price | Closing Net Asset Value (NAV) | Market Price |

| Intraday Trading | Yes | No | Yes |

| Minimum Investment | No minimum required | Some require minimums | No minimums required* |

| Tax Treatment | Low impact on shareholder’s level | High impact on shareholder’s level | Impact on individual level only |

Source: Morningstar Direct. Data as of March 7, 2023. Oldest share class of mutual fund used.

*The brokerage through which you purchase individual stocks may have a minimum account requirement.

Equal Access to Markets

ETFs are the great equalizers of financial markets. They make the ability to build wealth more accessible to everyone — from individual investors to the largest institutions.

With ETFs, investors can gain exposure to a full spectrum of investment strategies — including active management, factor-based strategies, and thematics — and everything from traditional asset classes to specialty markets, including innovative segments like AI and digital assets.

The proliferation of ETFs across various asset classes and the more recent introduction of novel ETF structures, from strategies that use derivatives to spot-based commodity and currency exposures, highlight the industry’s adaptability and desire to meet diverse investor needs.

Meeting Investors’ Diverse Needs

Today, ETFs have become key building blocks when making asset allocation decisions. They allow investors to focus on a wide range of portfolio outcomes with greater efficiency. And the surging popularity of ETFs has given rise to remarkable liquidity — making them powerful trading tools, especially amid periods of market volatility.

From strategic asset allocation to risk management, ETFs offer a myriad of use cases that can help investors achieve their investment objectives, showcasing the versatility and effectiveness of these investment vehicles.

ETFs Receive Rave Reviews from Investors

ETFs wouldn’t be as popular as they are if investors didn’t find great value in them. Our 2024 ETF Impact Survey found that the growing number of investors who have embraced ETFs have not been disappointed. A majority of individual investors agree that ETFs have improved the performance of their portfolios — even more so now than at the end of 2022 (Figure 4).

And, we found that investors who use ETFs are more confident than those who don’t (Figure 5); this confidence, in turn, may help them feel better equipped to achieve their financial goals, like building a comfortable retirement.

Plenty of Room for ETF Growth and Adoption

Even given their explosive growth over the past three decades, ETFs still have a long runway for greater adoption — passive and active ETFs account for less than 12% of investable assets globally.4 And as the use cases for ETFs evolve, so too should the opportunities for investors.

Want to learn more about emerging ETF trends and what’s likely to drive future growth? Get our top predictions in our ETF Impact Report 2024-2025.

New Paths to Growth With ETFs

Explore top trends, opportunities, and predictions for future growth in our latest ETF Impact Report.