Position for Macro Volatility with Real Assets

With the US presidential election, stubborn inflation, and geopolitical conflicts stoking market volatility, real assets — with their ability to fight inflation and low correlations to traditional assets — may help keep portfolios on track.

For nearly 40 years, a global peacetime dividend between the world’s economic superpowers, combined with increasing globalization, created a powerful one-two punch to stabilize interest rates and inflation at benign levels. As a result, long duration investments such as stocks and bonds performed well. The traditional 60/40 investment portfolio thrived in this environment.

Today, rising geopolitical tensions and deglobalization in the aftermath of the pandemic threaten to destabilize the global economy through higher rates and inflation. Investors may need a different set of investments in a diversified portfolio to achieve their long-term goals and objectives.

Investors should consider:

- Gold for its low correlations to both stocks and bonds and historical trend of preserving purchasing power during periods of above-average inflation.1

- Inflation-sensitive assets like inflation-linked bonds, infrastructure, real estate, and natural resource equities.

- Agriculture, energy, and metals and mining industries, all likely to benefit from stubborn inflation and potentially higher commodity prices.

US Economy Beating Expectations

The US economy, aided by massive amounts of fiscal stimulus, continues to defy consensus expectations for a meaningful slowdown. Instead, the mid-May Federal Reserve Bank of Atlanta GDPNow estimate for annualized real GDP growth for the second quarter is a robust 3.6%.2 At the same time, several major economies including the United Kingdom, Europe, Japan, and China are emerging from recent bouts of weakness.

Should something go unexpectedly wrong, global central banks such as the Federal Reserve (Fed), Bank of England, European Central Bank, Bank of Japan, and People’s Bank of China stand ready to lend support to their respective economies through monetary policy accommodation. In addition, considerable progress has been made in taming inflation since it peaked two years ago in the summer of 2022. As a result, several central banks, including the Fed, are expected to begin cutting interest rates later this year.

Supported by determined fiscal and monetary policies, steady economic growth has combined with strong labor markets, growing corporate profits, and healthy consumer spending to create an attractive backdrop for risk assets. But much of this favorable environment for risk taking is already reflected in stretched valuations and high asset prices. Many stock markets around the world are at or near all-time highs, credit spreads are historically tight, and most measures of capital market volatility are remarkably subdued.

Global Macroeconomic Landscape Grows More Fragile

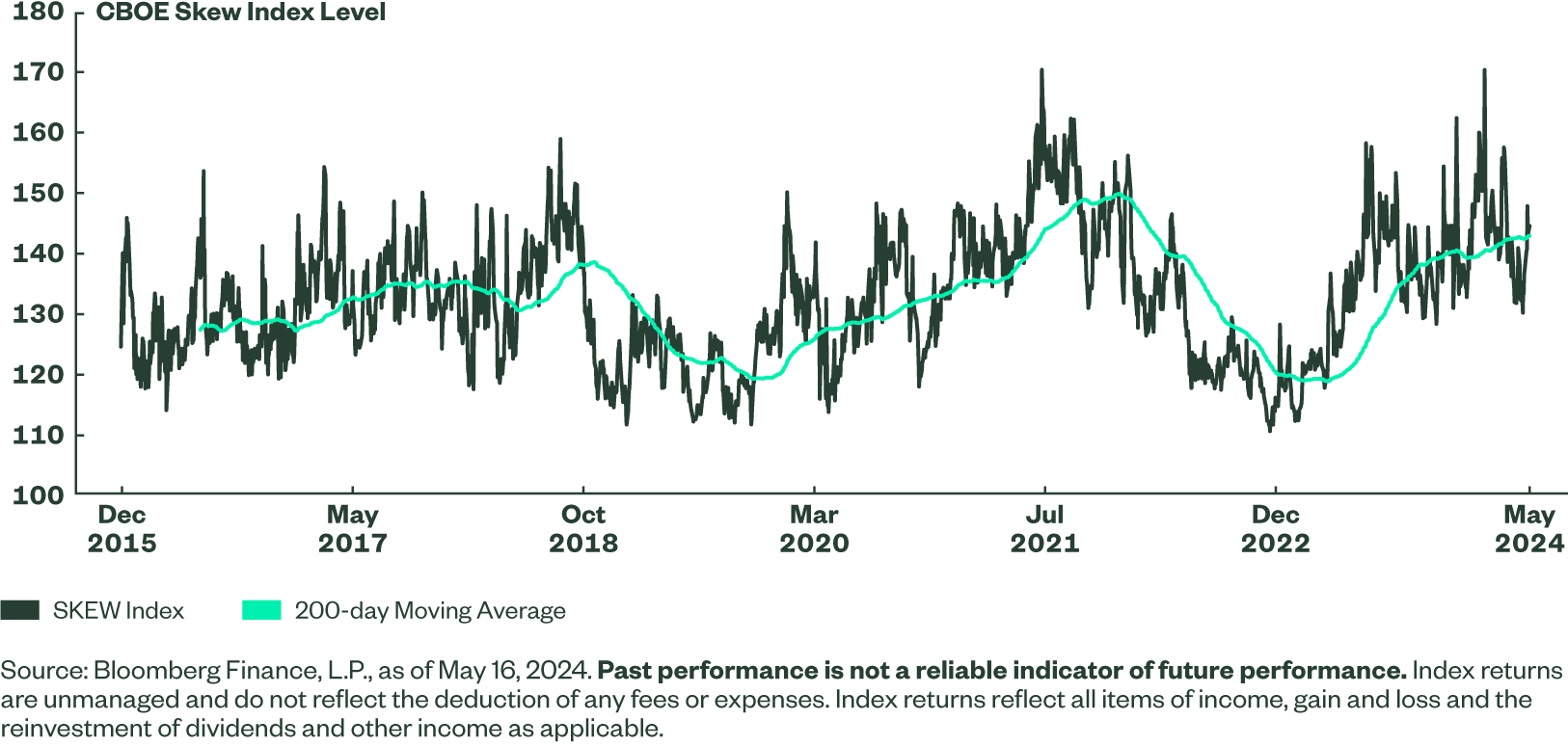

Market volatility likely will be exacerbated by the fact that more than 40% of the world’s population is eligible to vote in an election this year.3 November’s US presidential election promises to be one of the closest and most divisive races in US history. Investors should brace themselves for greater election headline risks.

Meanwhile, the probability of a monetary policy mistake is rising. Central banks are desperately trying to find the right balance between inflation and economic growth.

If central bankers cut interest rates prematurely, they risk repeating the stop and go monetary policy mistakes of the 1970s that enabled inflation to come roaring back. If they wait too long, central bankers risk producing an unwanted recession, capital market catastrophe, or possibly both — the more typical monetary policy mistake. Regrettably, central bankers find themselves in an unwelcome Catch-22 situation.

Ballooning fiscal deficits resulting from extraordinary government spending to combat the negative consequences of the pandemic likely brought future economic growth forward. Governments must now issue an increasing amount of sovereign debt to fund those deficits. This is especially true in the US and it’s happening at a time when central banks, including the Fed, and other natural purchasers of sovereign debt are buying fewer bonds.

As a result, the supply of sovereign debt is rising while demand is falling. This likely has contributed to higher and more volatile interest rates than many market participants had anticipated. This could destabilize the global economy and result in a correction in lofty asset prices.

Stubborn inflation is possibly the greatest risk to macro stability.

Supply-demand imbalances in the housing and labor markets remain. For example, the supply of affordable housing remains too low while demand remains high. Similarly, in the labor market, the supply of qualified skilled workers is constrained but businesses’ demand remains high. These imbalances could put upward pressure on housing prices and wages, ultimately further fueling inflationary pressures.

The multi-decade transition from fossil fuels to alternative sources of cleaner energy has been far more inflationary than many policymakers expected. The transition has increased the demand for commodities and natural resources required to leave fossil fuels behind while supply remains constrained, pushing prices higher.

Geopolitical tensions in the Russia-Ukraine war, Middle East conflict, and friction between the US and China over Taiwan could damage the global economy and bolster inflation. Rising trade protectionism — like the recent increased tariffs on Chinese imports from semiconductors to solar cells and medical products — likely will hurt the global economy and result in higher prices.

Diversify Portfolios Given Shifts in the Macro Environment

In a more volatile macro environment with higher interest rates and sticky inflation, a different mix of investments may be needed in a diversified portfolio to enable investors to reach their long-term goals and objectives.

Long duration Treasurys, for example, haven’t provided the expected diversification benefits or added protection that many investors anticipated this year. In fact, for the first time ever, long duration Treasurys have delivered negative performance in the 10-months following the last Fed rate hike in July 2023. Long duration Treasurys have experienced a notable drawdown since August 2020 and have delivered virtually no return since 2012.4

Long duration bonds may not be investors’ best option for income and stability. Instead, including more real assets in a diversified investment portfolio could be an increasingly attractive option for investors.

Building a 5-10% real assets allocation, drawing equally from stocks and bonds and/or funding it using elevated cash balances, could help further diversify portfolios and better prepare them for today’s macro volatility, higher interest rates, and inflationary environment.

Implementation Ideas

To position for increasing macro volatility with real assets, consider: