Real Assets Insights: Q1 2024 Sticky Inflation as Oil and Gold Surge

Real Assets Strategy ended Q1 2024 with a strong performance from all underlying assets. Looking forward, commodities are positioned to improve, with the energy and precious metals sectors likely to lead during a period of supply constraints and rising geopolitical risks.

Global economic activity improved, with both services and manufacturing sectors advancing during the quarter. The flash purchasing managers’ index (PMI) data from S&P global continued to allay recession worries. The data showed that the US economy was still growing steadily, while the European economy was rebounding from a downturn. Business activity in Japan remained solid, while conditions in China improved.

Inflation readings in advanced economies moved closer to their respective central banks’ targets but saw modest upticks during Q1, specifically in the United States (US). Labor market conditions softened slightly but remained tight.

Risk assets advanced during the quarter, supported by resilient macroeconomic data and strong earnings. Developed markets outperformed emerging markets, driven by the strong performance of growth stocks. Global bonds were negative as higher inflation prints, strong economic data and reduced rate cut expectations lifted yields higher. The US dollar index jumped after declining in Q4 2023. Commodities also advanced, led by precious metals.

Quarter in Review

Real assets stumbled at the start of the year but rallied toward the end of the quarter, with inflation in the US proving stickier and raising concerns about the timing of the anticipated rate cuts by the US Federal Reserve (Fed). The US Consumer Price Index (CPI) started 2024 with receding expectations. However, the recent print, led by housing and other services components, pushed it to 3.5% YoY, while supercore inflation, which is core services excluding energy and housing, accelerated to 4.8% YoY.

Commodities and natural resource equities retreated initially but surged on robust demand and the disappearance of any recession conversation. Rising rates put a damper on infrastructure and real estate as global growth equities advanced. Real rates were modestly higher for inflation-linked bonds. The Real Assets strategy struggled initially but closed out Q1 with a strong performance in March. It ended the quarter with a gain of 1.1%, slightly lagging its composite benchmark. The longer-term 3- and 5-year returns remained solid at over 6%. Since its inception in 2005, the strategy has provided an annual return of 4.0% and has maintained its 20 basis point (bp) lead over its composite benchmark annually.

Commodities registered positive returns for the quarter, buoyed by energy and gold prices. The energy sector was led by crude oil — both West Texas Intermediate (WTI) and Brent — which posted double-digit returns. The move was a result of a rise in demand forecasts, along with the ongoing supply cuts by OPEC+, potential supply disruptions, and the increasing tensions in the Middle East. Meanwhile, natural gas fell sharply on the close of an unusually warm winter, leaving higher inventories. Gold advanced for the second straight quarter to new highs in anticipation of rate cuts by the Fed, robust central bank purchases, fear of resurgent inflation and geopolitical uncertainty. Industrial metals and agricultural commodity sectors declined, but select raw materials such as copper and agricultural softs, such as cocoa, sugar, and cotton, surged on supply concerns.

Global natural resources followed commodities, led by energy companies within the integrated oils, exploration and production industries, while metals/miners and agricultural names detracted.

Utilities and energy sectors within global infrastructure produced positive returns but were limited by the industrial names in airport services, highways/railways and marine ports/services, which came up short.

US Real Estate Investment Trusts (REITs) were plagued by the continued movement higher in interest rates. The divergence across the real estate complex was highlighted by the resiliency of the consumer, with positive contributions from hotel/resort, retail and data center sectors against a cautious corporate outlook as evidenced by declines in the diversified and industrial sectors.

US Treasury Inflation-Linked Securities (TIPS) were modestly positive to flat as real rates peaked in February before settling down to a modest increase of 10 bp for the 5-year and 15 bp for the 10-year securities. Market-based inflation expectations for the US, measured by five-year break-evens, rose by 20 bp during January to 2.40% before reverting just as quickly and finishing the quarter at 2.26%.

Investment Outlook

In an improvement of expectations from the end of last year, commodities are positioned to rally further in 2024, with mixed results coming from various sectors, as global economic forecasts have been adjusted upward. Fundamentals for oil have improved and could support elevated prices. The energy sector, led by crude oil, is experiencing a further increase in demand, especially for gasoline and jet fuel. This is driven by heightened usage in India and supply constraints from the Organization of the Petroleum Exporting Countries, along with ten other oil-producing countries (OPEC+), and limited growth prospects from other producers. Geopolitical risks abound and the most recent escalation in the Middle East and beyond cannot be ignored.

Base metals, such as copper, aluminum, and nickel, are responding to global reflation signs, anticipated physical deficits, and near-term impact of sanctions on Russian metals at the London Metals Exchange and COMEX. Expectations of declines in South American grain production, anticipated high US inventories, and seasonally elevated short positions weigh on the agricultural group, notwithstanding the surge in prices observed in cocoa, sugar, and cotton, with supply constraints anticipated for the softs.

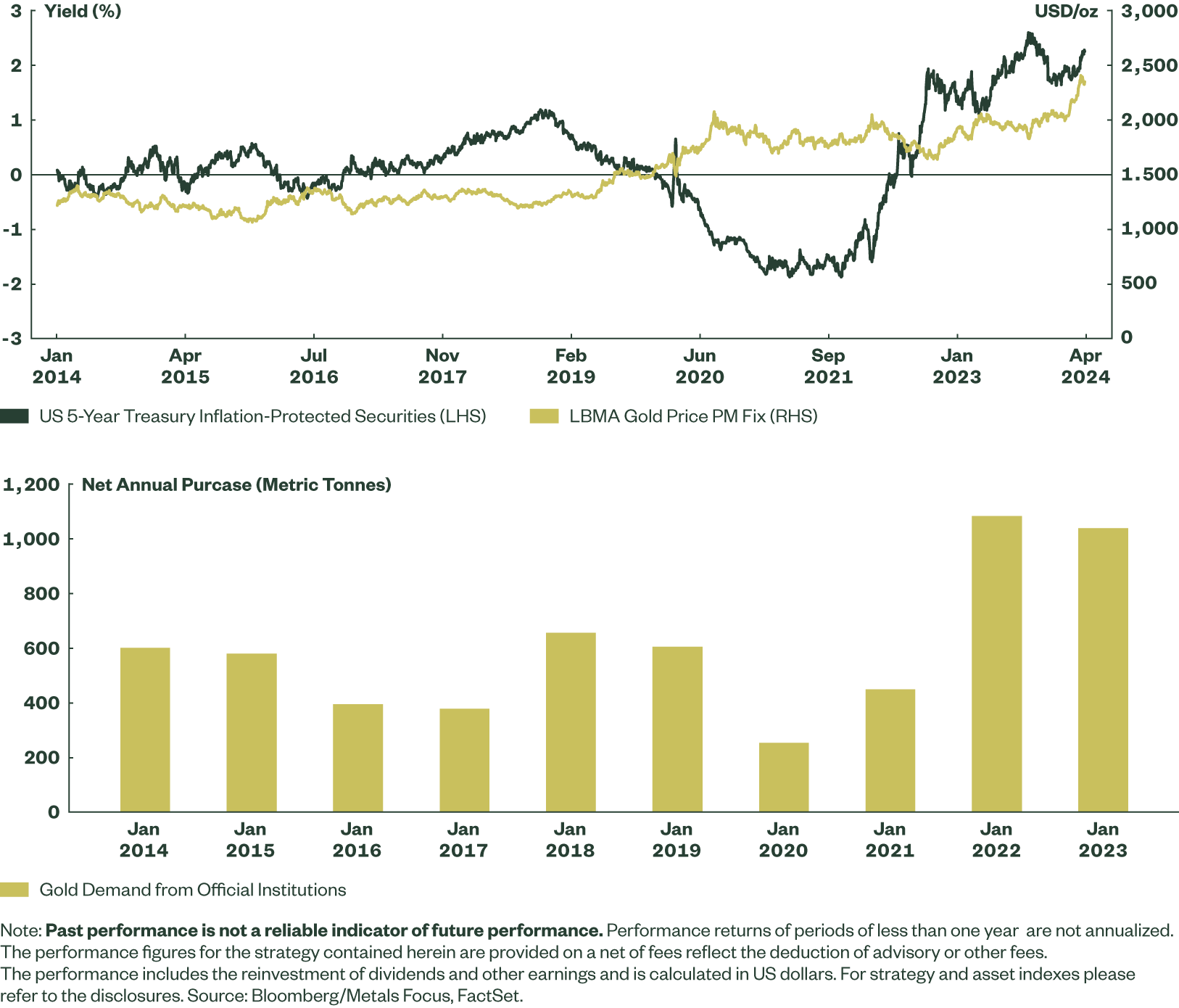

Gold appears poised to advance further throughout the year toward US$2,500/oz in H2 2024 and possibly US$3,000/oz in 2025. Central bank purchases of gold are projected to cross their 10-year average and be the third largest after 2022 and 2023. Strong demand from emerging markets (China, Turkey, and India) and select developed markets (Singapore and Japan) have accounted for 25%–27% of annual gold mine production and offset outflows from physical exchange-traded products. The yellow metal continues to buck expectations in the face of rising real yields, Fed repricing of interest rate cuts, and a rallying US dollar.

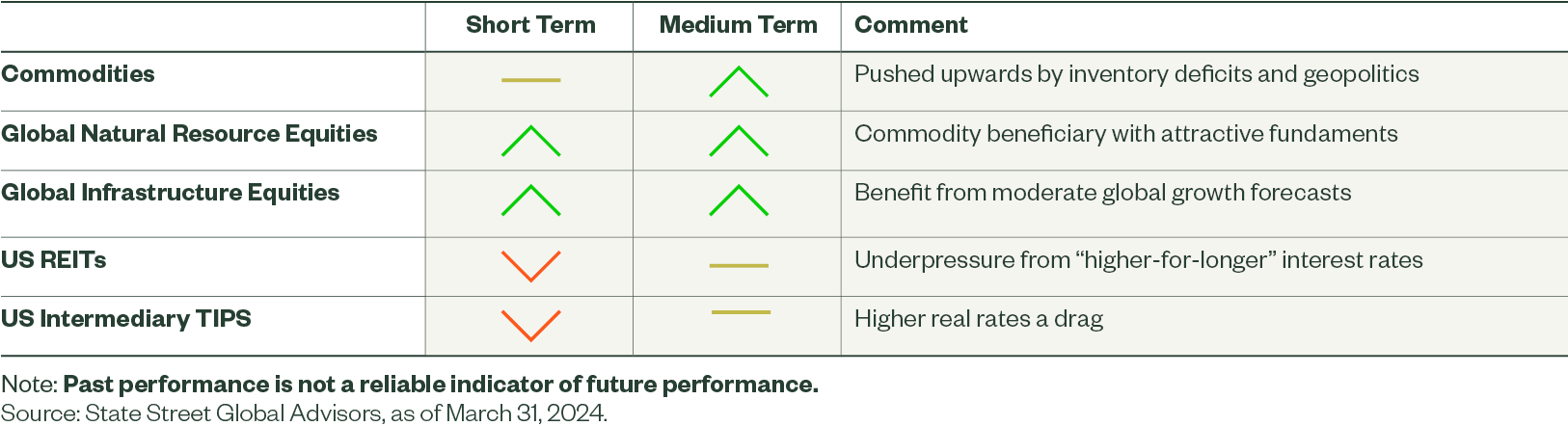

Figure 3: Short and Medium-Term Outlook

Natural resource equities appear positioned to benefit from the improved global economic picture and the rise in commodities. Further, higher interest rates due to inflationary pressures may be beneficial to the natural resource group, relative to other sectors, so long as they do not derail or hamper growth. This should help bolster earnings and cash flows for 2024 for both energy and miners.

There appears to be no change to the capital expenditure discipline shown by these companies and that has positioned them with attractive valuations and the ability to provide stable income streams to investors.

Listed infrastructure should also gain from the rosy outlook for growth prospects and their high-quality characteristics should perform well in a below-trend environment. Transportation and logistical services — such as marine ports, railways, airports, and toll roads — are well positioned. While increased energy commodity pricing would be beneficial to midstream energy operators, such as pipelines and storage facilities, certain rate-sensitive industries within the group may be held back by the higher-for-longer interest rates. Greater financing costs and tighter financial conditions would have a potentially negative impact on earnings and cash flows.

Real estate continues to struggle in the face of better economic results. The delay in the Fed’s interest rate cuts and the market view that rates may stay higher for longer are headwinds for real estate. Concerns over refinancing requirements are warranted, but the low leverage ratios and the focus on fixed rate and unsecured debt have resulted in healthy balance sheets and have opened the door to future acquisitions and merger activity. The public and private real estate valuation gap has been slow to narrow and further write-downs in the private space are likely.

As market consensus coalesces around nominal rates at higher levels in 2024 than forecasted at the beginning of the year, inflation-linked bonds may lag as real rates climb higher. Inflation has come down significantly since its peak in mid-2022 but has levelled off and is even inching higher recently, with service inputs proving stickier as a result of a strong labor market and resilient consumer demand. Shorter-duration exposure would be more desirable over core or longer-duration bonds.

Inflation and Real Assets

Inflation prints over the last three months have done little to alleviate concerns about a second wave of inflation, as we highlighted in our last quarterly, and suggest that the strength in price pressures at the start of the year might be more than a speed bump. Also, there were upside surprises to both the consumer and producer price measures over the first three months.

Consumer prices have been driven higher by stubborn services, which have been strong across many components. Core goods have continued to decelerate, but they seem to be nearing a bottom, hovering around the rate experienced over the seven years prior to COVID-19 (Figure 4).

Looking ahead, there needs to be a deceleration in both services and rents to bring inflation closer to the Fed’s 2% target, but that could prove challenging. There also exists the potential for a re-acceleration in rent inflation given that real-time measures such as the Zillow Observed Rent Index (ZORI) or Apartment List Indexes appear to have bottomed.

Additionally, immigration has likely contributed to some of the deflationary wage inflation pressures, but its impact could turn inflationary with higher demand for rentals, driving up shelter costs or, at the very least, limiting a reduction in inflation.

While the most recent labor prints have not been as robust as headline numbers would suggest, with the majority of jobs being part-time and from the government, there are still signs of a tight labor market. Wage growth continues to decelerate but remains elevated and, combined with a solid labor market and the fact that consumers are less sensitive to higher rates than in previous cycles, should support demand and keep pressure on service prices.

The San Francisco Fed has run an analysis looking at cyclical versus non-cyclical inflationary pressures (Figure 5). Cyclical pressures represent categories where prices are more sensitive to overall economic conditions and are more likely to be driven by demand. Examples include housing, other non-durable goods, food services and recreational services. Non-cyclical pressures represent categories where prices are more sensitive to industry-specific factors and are more driven by supply. Examples include healthcare and financial services, motor vehicles, clothing, and other durable goods.

Figure 5 highlights how non-cyclical contributions to core Personal Consumption Expenditures (PCE) have already unwound after spiking during the COVID-19 pandemic and will be less of a support for lower inflation moving forward. Should growth remain resilient — slower positive growth moving forward — the contribution from cyclical factors will remain elevated.

The jump in monthly inflation readings has pushed three-month trends higher and is concerning. The core CPI and PCE, even the supercore CPI measure, have all accelerated in 2024 and have played a role in the Fed becoming more cautious on its outlook for both inflation and rates (Figure 5). Overall, inflation has eased from very high levels, but recent prints and trends illustrate that the challenges of getting inflation down to 2% and risks to the upside remain.

We expect global growth to slow but remain positive, and thus see support for oil going forward. On this note, economic activity measures remain encouraging, with some global manufacturing PMIs improving and service PMIs remaining in expansion. Supply dynamics remain tight, with OPEC+ extending cuts throughout this quarter and limited spare capacity outside Saudi Arabia. While the impact is likely minimal at present, geopolitics can create uncertainty around supply, with the ability to disrupt near-term production at a time when demand remains strong. All eyes are watching for escalations in the Israel/Hamas war and the brewing Israel/Iran conflict, and the US’s recently reinstated sanctions on Venezuela’s oil and is considering more sanctions on Iran’s oil exports, both of which could tighten supply in the near term.

The reimposed sanctions on Venezuela will cap crude production growth and limit Venezuela’s ability to sell oil directly. The US might allow Chevron to continue its joint venture with Venezuela’s national oil company to help minimize the rise in oil prices, but both Venezuela and Iran have been important sources of increased production outside OPEC+.

Further, Ukraine has targeted Russian oil facilities in a series of attacks that have taken an estimated 14% of Russia’s oil refining capacity offline. Lastly, US shale production should continue to slow from record levels in 2023, with guidance from earnings calls reflecting a desire for greater spending restraint and a focus on shareholder returns. Overall, supply and dynamic fundamentals for oil appear favorable.

Despite rising real yields, gold prices have surged to all-time highs, but prospects still look bright with numerous structural supports. In the near term, geopolitical risks should outweigh prospects for less rate cuts. In the longer term, a higher frequency of geopolitical crises may be observed, while the Fed ultimately shifts monetary policy at some point, bringing real yields lower, which is supportive of gold.

Figure 7: Gold Price, Real Yield, and Gold Demand from Central Banks

Recent inflation trends are worrying and risks to the upside remain, which should continue to buoy gold. The rising US deficit helps gold to retain a more attractive safe haven status relative to bonds, and while it is expected to shrink, it may remain elevated as there appears to be little appetite from the US Congress to rein in spending.

Central banks maintained a robust pace of gold purchases in 2023 and that should continue as many central banks look to continue diversifying their reserves. Facing a reeling property market, slumping stock market, and declining government bond yields, Chinese investors have turned to gold to park their large savings accumulated during the pandemic and this should continue through 2024.

Real Assets Strategy

At State Street Global Advisors, we have a seasoned, diversified multi-asset strategy that combines exposure to a broad array of liquid real asset securities that are expected to perform during periods of rising or elevated inflation.

The asset allocation is strategic and utilizes indexed underlying funds. It is being used by a variety of clients as a core real asset holding or as a liquidity vehicle in conjunction with private real asset exposures. The strategy is meant to be a complement to traditional equity and bond assets, providing further diversification, attractive returns, and a meaningful source of income in the current environment.