Bond Yields Rise as US Election Draws Near

Weekly Highlights

Up 6.3% YoY

Extremely weak

Up nearly 50 bp in past month

Rates are still restrictive

Expansion slows down sharply

Remaining low

Drive down by base-effects

Up from 1.6% and above consensus

Weakest since March

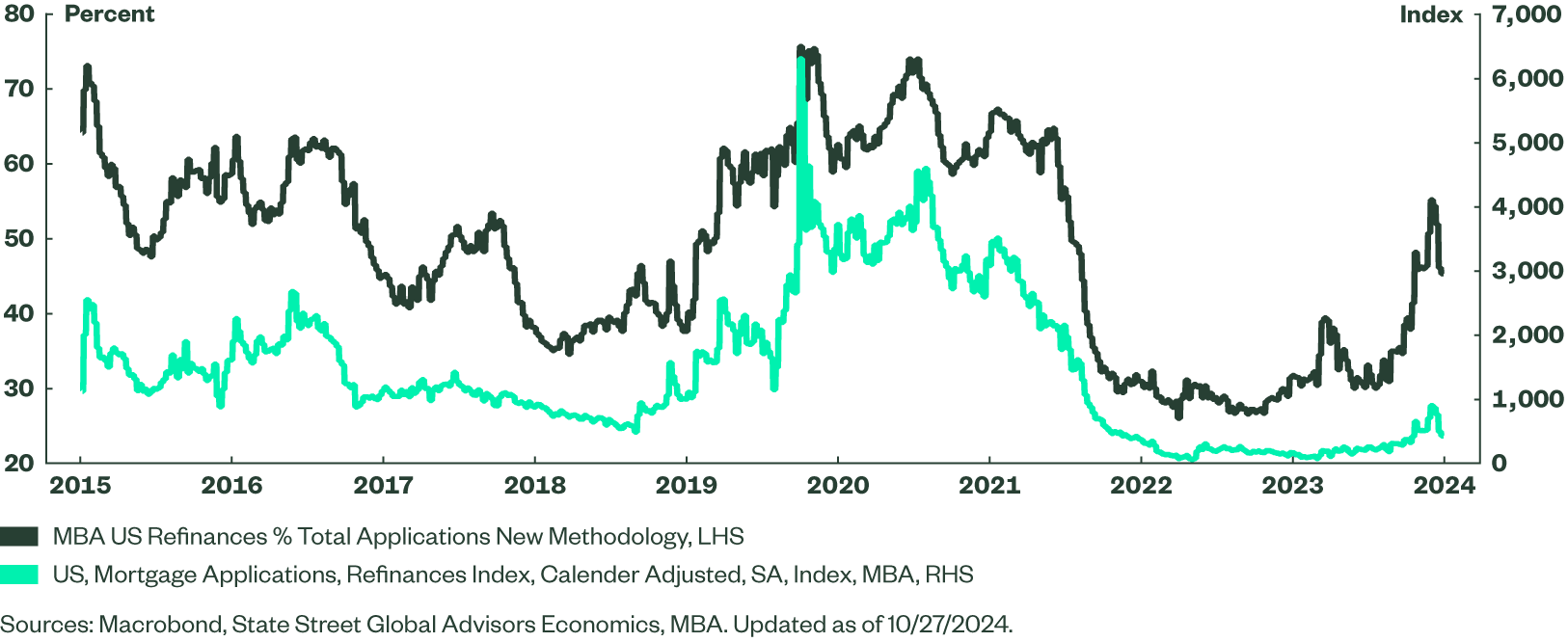

US: Rates Volatility Stalls Housing Revival

Since mid-September, 10-year yields have risen from 3.6% to over 4.2%. The intensifying war in the Middle East, resilient incoming domestic data, and market repricing of potentially more inflationary policies under a second term for President Trump, are all likely contributors to this move. As expected, the 30-year fixed mortgage rate has followed this shift higher: having dipped o 6.08% in mid-September, bit bounced back to 6.54% by the third week of October. The increase in mortgage rates has had an immediate effect on mortgage demand, especially on refinancing activity. Refinancing accounted for about 55% of all mortgage applications in the third week of September but that share has declined nearly ten percentage points since (Figure 1, page 2). The scope for refinancing activity this cycle was always going to be limited given the majority of homeowners have secured mortgages below 5.0%; any move higher in rates further dims this potential.

Read our recent blog An Unusual Mortgage Refinancing Cycle Ahead for a fuller discussion of the mortgage/housing sector dynamics in the US.

Existing home sales remain exceedingly depressed, in fact making a new post-GFC low in September. At 3.84 million annualized, existing home sales continue to undershoot even the Covid-era lows. Year-over-year comparisons do not appear too negative, but that is only because sales already underwent a violent correction lower in 2022 as the Fed began raising interest rates so the basis for comparison is already depressed. Meanwhile, supply is steadily improving as some sellers no longer can delay a move. The number of existing homes available for sales is 24.5% higher than a year ago and stands at 4.3 months’ worth of sales. Apart from a single month in the early days of the pandemic, this is the highest inventory level since June 2019. Unsurprisingly, this has helped tame price increases. The median price of an existing single family home rose a moderate 2.9% y/y.

New home sales picked up 4.1% m/m in September, but it remains to be seen whether the improvement lasts given the rates volatility. Sales were 6.3% higher than a year ago while the median price was unchanged. Homebuilders have curtailed construction this year to better manage inventory, with reasonable success. Current inventory sits at 7.6 months’ worth of sales, the low end of the one-year range, well below 2022 highs of around 10% but above 2018-19 levels. Notably, the number of completed homes available for sale is now the highest since September 2009.

Week in Review

Catch the whole story...

There's more to the Weekly Economic Perspectives in PDF. Take a look at our Week in Review table – a short and sweet summary of the major data releases and the key developments to look out for next week.

Canada: Further Rate Cuts to Stimulate Growth

With headline inflation below 2% y/y and core measures, albeit above target, continuing to move lower, the Bank of Canada (BoC) has shifted its focus to growth. As widely expected, the BoC quickened the pace of easing with a 50bps policy rate cut to 3.75% at the October meeting.

The BoC now projects 1.2% and 2.1% GDP growth for 2024 and 2025, respectively, which are still above our forecasts. We think that ongoing mortgage resets and a sharp decline in population growth might lead to weaker household consumption and GDP growth. The BoC expects inflation to remain close to target over the projection horizon as excess supply will offset upward pressure from shelter and other services.

Governor Macklem stated in his post-meeting conference that further rate cuts are likely if the economy evolves in line with the BoC's updated forecast. However, the bank will still be highly data-dependent in making decisions about the timing and pace of future rate cuts.

In our view, weaker H2 growth will lead to another 50 bp rate cut in December; even with that, the rate is still restrictive for the state of the economy. We expect four consecutive 25-bps cuts to bring the policy rate to 2.25% by June 2025.

Political Uncertainty in Japan

Data at the time of writing suggested that the ruling Liberal Democratic Party (LDP) would fail to secure a majority in the October 27 election, meaning that political uncertainty is looming large in Japan, a new and critical factor for markets. There are now downside risks to the yen and equities. The Nikkei was tracking the LDP and the opposition leading in 125 seats each, both short of the required majority (233). The LDP governed Japan in 65 of the last 69 years and the likelihood of a minority government means potential policy uncertainty. Nonetheless, we expect the policy normalization path in Japan to continue and look for a potential positive externality: an upside surprise in this year’s shunto wage negotiations. This is because we believe that low real wage growth was perhaps a bigger reason why the LDP lost its majority and not last year’s corruption scandals.

Separately, Tokyo CPI inflation eased to 1.8% y/y in October primarily due to base-effects in energy. However, the BoJ core (excluding fresh-food & energy) rose two-tenths to 1.8% and was above the consensus of 1.6%. Sequential growth accelerated too, to 0.5% m/m from 0.2%. This primarily implies that underlying price-pressures are intact, despite unfavorable base-effects. The BoJ is likely to keep policy unchanged this week. But, despite the political uncertainty, we expect them to retain their confident guidance on growth, inflation and their policy normalization.