A Capital Efficient Approach for Managing DB Plan Assets

- “Capital efficiency” is a phrase used to describe the effective deployment of assets in achieving desired risk and return characteristics.

- Despite some flattening in the 10s30s curve year-to-date, we believe that the attractiveness of all-in yields and the expected decline in overall rate levels continue to make the case to be bullish on duration and to lock in attractive yield levels.

- By increasing allocation to long duration fixed income, DB plans can accomplish hedging objectives more efficiently.

- Reduced equity beta strategies, such as minimum volatility equities, can be used to manage a plan’s overall beta to stocks and further improve its risk/return profile.

Following a 40-year bull market in fixed income, investors are now immersed in a new world in which yield is obtainable. Investment grade all-in yields have risen to 5.5% — the highest level since 2009 — and speculative grade all-in yields are at a healthy 8.0%.1

However, it’s worth considering that the end of the credit cycle is drawing nearer. While the timing is unclear, rates are poised to retrench (see: 2024 Mid-Year Global Market Outlook). In addition, structural forces such as aging demographics, slow productivity growth and disinflation from COVID-era peaks are set to put downward pressure on rates. Already, all-in yields have dwindled since the fall of 2023. The curve has remained inverted given CPI surprises at the start of 2024.

For pension plan sponsors, this means that they are entering a new environment with funding status strained. Already, the corporate pension plan funded status was 103% in April 2024, versus 109% in January 2023.2 With a potential unwind in some of the strong year-to-date performance in equity markets (see US Equities Keep Rolling: Could It Really Be This Easy?), plans could face a double whammy of lower equity asset values and lower yields. (A decline in yields would likely increase the value of liabilities more than assets, as corporate DB plans tend to have a mix of assets, including equities and fixed income, while liability values are based on long duration high quality corporate discount curves.) Notably, even if equities continue their strong momentum, the funding headwinds could persist. In this piece, we explain why a capital efficient approach is a compelling way to increase the allocation to growth assets and hedge this gap.

Heading Off Funding Challenges While Managing Portfolio Risk

As plans progress down their de-risking glidepaths, an important objective is to hedge both the duration and credit spread exposures inherent in plan liabilities. And these exposures are substantial; for example, a hypothetical pension plan’s liabilities may exhibit 14 years of duration, while assets have only 6 years. While many plans have already transitioned from US Aggregate (6.0 years of duration) to US Long Government Credit (13.7 years) or similar,3 these plans still embed a significant unhedged risk: If 40% of plan assets are invested in Long GC products, this still leaves an 8-year underweight duration position at the plan level (or even longer if a plan is underfunded). This inherent 8-year duration “bet” is meaningful. With rates expected to fall, plan sponsors must ask: How can I protect my plan’s funding ratio against declining yields, and can I do so while conforming with my plan’s risk appetite?

Capital Efficient LDI

Below, we outline two capital efficient LDI strategies for consideration in today’s market environment.

Increasing Allocation to Long Duration Bonds

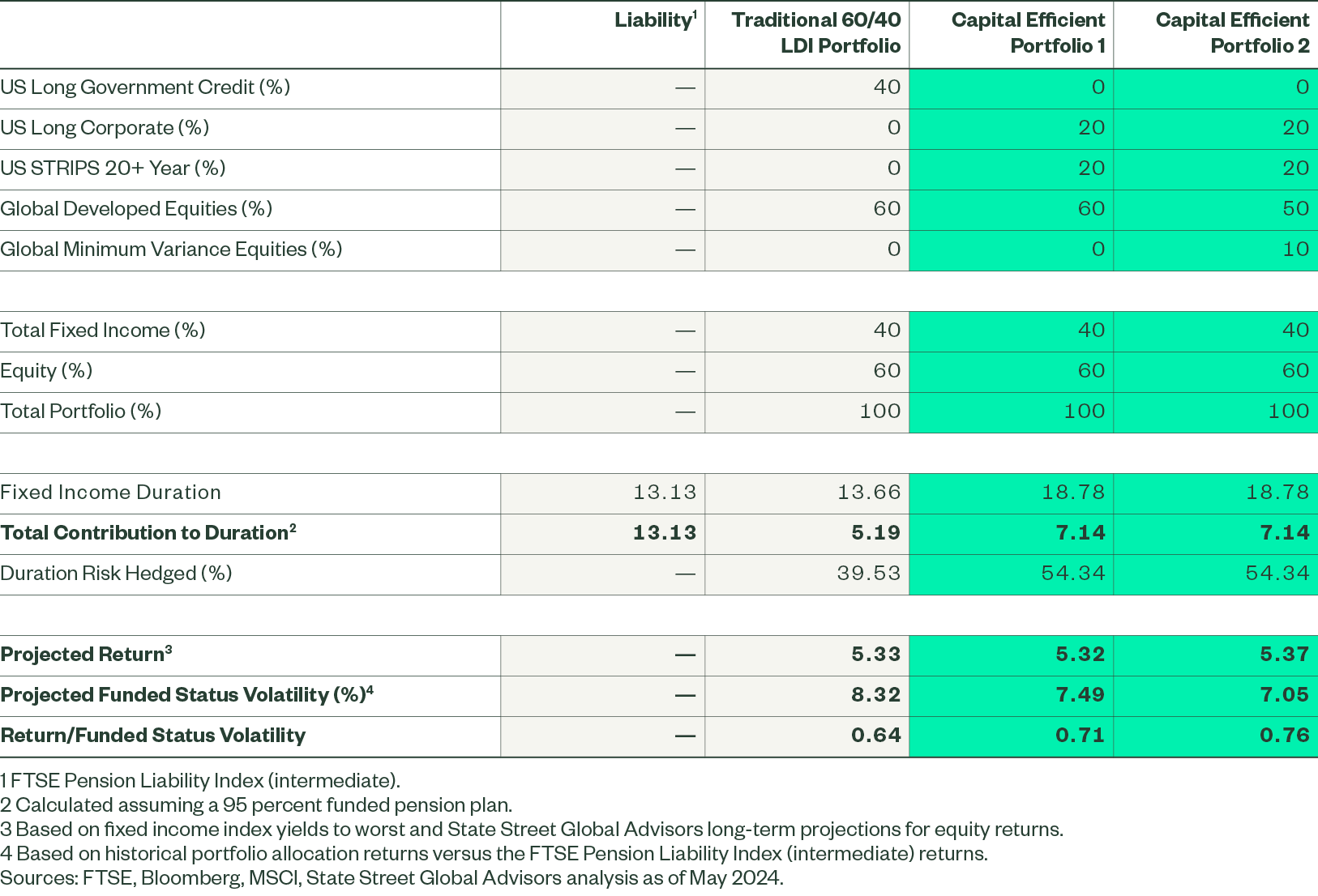

For plans that are de-risking, rather than simply shifting assets out of their existing equities allocation to fund an increased long government/credit allocation, we suggest that they consider further extending the duration of their fixed income allocation using long STRIPS. This allows them to increase their hedge of liabilities without changing their overall asset allocation. In Figure 1, we change the composition of a hypothetical plan’s fixed income allocation from 40% Long GC to 20% US Strips 20+ year and 20% US Long Corporate — while leaving their 60% equities allocation untouched. We reference this portfolio as “Capital Efficient Portfolio 1.” This provides several benefits to the plan, including: a substantive increase in fixed income duration, virtually no give-up in expected returns given today’s higher yields, and a meaningful decline in projected funded status volatility.

Introducing Lower-Volatility Equities

Introducing an equity allocation with less volatility (but comparable upside) provides similar benefits. The addition of a minimum volatility equity strategy greatly improves the efficient frontier of possible investment allocations. Our suggestion of increased allocation to long duration fixed income allowed for an improvement to the return/funded status volatility ratio. Adding a minimum volatility strategy, on the other hand, enables plans to further reduce funded status volatility while maintaining comparable return upside. This addition shifts the efficient frontier up and to the left. This happens because such strategies typically seek to provide market-equivalent returns over a full cycle by reducing market sensitivity and protecting against drawdowns, which can ultimately help to preserve a plan’s capital base. While the return outcomes are similar over time to market-cap weighted equity allocations, minimum volatility equities can greatly improve a plan’s ability to track liability returns because they reduce exposure to equity volatility.

Figure 1: A Capital Efficient Approach Can Provide a Wide Range of Benefits to DB Plans

Hypothetical Portfolio

In “Capital Efficient Portfolio 2” (Figure 1), we have examined the benefits of increasing allocation to long duration bonds, as well as introducing minimum volatility stocks. The grid illustrates the incremental benefit in the return over funded status volatility ratio when both concepts are introduced into the portfolio.

Closing Thoughts

Every DB plan strategy should reflect the unique return goals, risk profile, and desired end game for the plan. We believe that many DB plans would greatly benefit from considering a capital efficient approach, which offers a greater ability to meet multi-faceted objectives. We’ve provided two examples of sample portfolios with duration extension and minimum volatility strategies. However, there are other capital efficiency strategies, including concepts for application in the not-for-profit space in which long duration assets hedge a substantial amount of equity beta risk. Here, the return of the negative stock/bond correlation may prove beneficial. These potential changes to a plan’s asset allocation can markedly improve its risk/return profile. In particular, a capital efficient approach could mitigate risks in an environment where bond yields could fall and equity markets remain volatile.