USD Poised for Downward Correction

Positive US employment and inflation data lifted yields, spooking investors about potential Fed rate hikes. Geopolitical tensions between Iran and Israel escalated, bolstering the USD but weakened low-yielding currencies. Tactically, we are now positive on the CAD.

We expect US employment and inflation data to continue to set the tone for currency markets, as well as most other asset classes. To that end, we entered April, expecting the US dollar to grow increasingly sensitive to downside US data surprises as it nears the top end of its 52-week range. While we did not encounter negative surprises, the response to the positive surprises was moderate. We believe that as expectations reset higher, it will become progressively challenging for the economy to deliver the upside surprises needed to extend the rise in US yields and the dollar. Federal Reserve (Fed) Chair Jerome Powell’s dismissal of risks of another policy rate hike further raises the bar.

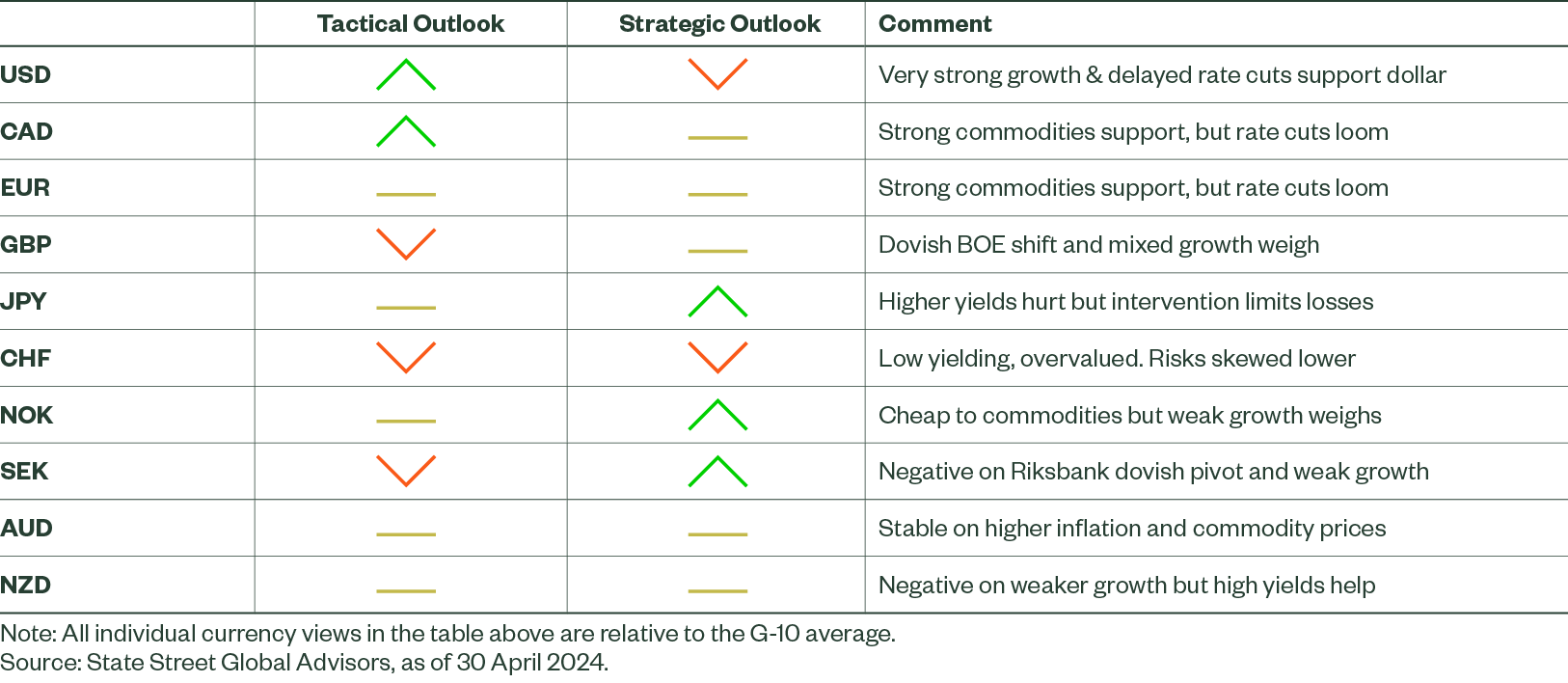

Figure 2: April 2024 Directional Outlook

Thus, we believe that the US dollar is set to trade back down in its range over the next 1–2 months, though we do not expect a sustained dollar downtrend. It remains the top-ranked currency in our tactical/cyclical model, though the signal strength is half of its level over recent months. Against that weaker US dollar, we expect the higher-beta currencies, such as the Australian dollar and the Norwegian krone, to perform well, the yen to stabilize and outperform the Swiss franc, and the euro and the British pound to lag as markets digest the upside growth surprises and focus more on upcoming rate cuts.

US Dollar (USD)

We have long held the view that the US dollar is likely to fall at least 10–15% over the coming years, but is currently in a noisy transition period from a bull to a bear market in a protracted range-trading environment. We recommend long-term investors to hedge a healthy portion of their US dollar exposure; US investors, on the other hand, should consider cutting back on foreign currency hedges.

For those with a shorter horizon, we believe the US dollar is nearing the top of its range and is due for a pullback. However, the dollar remains the top-ranked currency in our models over the tactical horizon due to G10-leading growth, interest rates, and equity market performance. However, despite that positive tactical backdrop, we believe the dollar is a bit ahead of itself following its four-month rally. We believe that as expectations reset higher, it will become increasingly difficult for the economy to deliver the upside surprises needed to extend the rise in US yields and the dollar. Fed Chair Powell’s dismissal of risks for another policy rate hike raises the bar even further. Thus, we believe that the US dollar is set to trade back down in its range over the next 1–2 months.

Canadian Dollar (CAD)

Our model signal turned positive on the Canadian dollar thanks to a stronger, more broad-based rally in commodity prices, although we continue to expect the currency to struggle against the US dollar. The weakness in Canadian employment and inflation will likely lead the BoC to cut rates before the Fed. Against non-US dollar members of the G10, Canadian fundamentals look better, despite lagging behind the recent uptick in commodity markets. However, a significant risk to the strength of the Canadian dollar against the rest of the G10 is a potential downward correction in the US dollar following its strong year-to-date rally. Just as US dollar strength helped the Canadian dollar against the rest of the G10, any weakness in US dollar, even if temporary, is historically a major headwind.

In the long term, looking through the weaker cyclical picture, the Canadian dollar looks more attractive as it is cheap to our estimates of fair value relative to the euro, the Swiss franc, and the US dollar and its long-term potential growth is poised to improve on an aggressive increase in immigration and substantial plans to invest in sectors such as green energy technology.

Euro (EUR)

We maintain a neutral view on the euro against the G10 average and a negative view against the US dollar. On the positive side, we have seen better-than-expected economic data and a larger improvement in year-ahead growth forecasts for the European Union (EU), as well as improved short-run relative equity market performance. On the negative side, continued disinflationary trends suggest a potential rate cut from the European Central Bank (ECB) in June, contrasting with the expectations for the US, Australia, and Norway to maintain higher rates for longer. While currency markets have been mostly focused on relative monetary policy outlooks, the expectation of structurally low growth driven by high levels of EU regulation, low productivity, and a difficult outlook for the German growth model is likely to limit enthusiasm to drive the euro higher.

British Pound (GBP)

Our factor models have shifted decisively negative on the near-term pound outlook. The positive UK growth surprises relative to weak expectations and presumed Bank of England (BoE) caution to cut rates may have been enough to lift the pound from deeply discounted territory in Q1, but more recent economic data is no longer consistently surprising in a positive direction. We see risks to the pound from the near-stagnant economy, disinflation (transition to monetary easing), and the growth constraints from high fiscal and current account deficits.

Our long-run valuation model has a more positive pound outlook — the currency screens as cheap to fair value. However, we expect sticky inflation and chronically weak potential growth post-Brexit to likely to weigh on fair value, somewhat limiting that potential pound upside over the next several years.

Japanese Yen (JPY)

The recent strength in US inflation and growth makes the timing of Fed rate cuts and sustained yen appreciation highly uncertain. So, as long as US growth and inflation keep the Fed on the sideline, we expect yen to remain weak and weaken further if US yields break to new highs. That said, ongoing intervention in support of the yen, our expectation of limited additional upside in US yields, and large short yen positions in the marketplace should limit further yen downside over coming months.

In the long term, we see a rally in the yen of around 20% over the next 2–3 years versus the US dollar (a fall in the USD/JPY exchange rate). This move is consistent with an anticipated compression in USD/JPY interest rate differential by 200–250 basis points, potentially bringing the USD/JPY down to 125–130 compared to its current level in the mid-150s.

Swiss Franc (CHF)

The franc ranks the lowest in both our tactical and strategic models, as it has for most of the past few years, though we have seen an unusual few months of stronger signals this year. It remains the most expensive G10 currency per our estimates of long-run fair value, and has the second-lowest yields in the G10, and inflation is falling faster than expected. With the real trade-weighted franc still at the upper end of its 30-year range and the Swiss National Bank (SNB) cutting rates and amenable to intervention to prevent franc strength, we believe we are in the early stages of a prolonged reversion back down toward our estimate of its long-term fair value.

Norwegian Krone (NOK)

Our models upgraded the krone outlook as it lags the rebound in oil prices over the past few months — year-to-date Brent crude is up 14%, and the krone is down 2.6% against the G10 average. The signal is fairly weak; technically, we are neutral, but it is now the third strongest behind the US and Canada. Inflation may have surprised to the downside last month, but it is uncomfortably high at 4.5% YoY. At that level, we expect the Norges Bank to remain hawkish longer than the ECB, BoE, Riksbank,

and BoC.

Thus, short-term valuation relative to commodities and expected yields now fully offset pessimistic signals from our economic growth-based models. In the long-term, the outlook is more convincingly positive. The krone is historically cheap relative to our estimates of fair value and is supported by steady long-run potential growth.

Swedish Krona (SEK)

Our models shifted negatively on the krona in April. Despite depressed expectations, growth continues to disappoint, while the relative policy monetary outlook favors sustained krona weakness. We believe that the Riksbank will cut sooner and faster than the ECB, the BoE, and the Fed — something that would be very welcome news to the heavily indebted household and property sectors, but not great for the currency over the short run. The currency is very cheap relative to long-run fair value and cyclically depressed, but we struggle to see a catalyst for sustained relief at this point.

Australian Dollar (AUD)

Our models remain in the neutral range for the Australian dollar but improved from a slight negative to a positive bias in April due to high-for-longer yields and rising commodity prices. The energy-led commodity rally did not translate well to Australia due to weakness in other key export prices such as iron ore. In April, that commodity rally broadened as iron ore prices rallied near 15%. We also see scope for support from a stabilizing to slightly improved Chinese economy and pledges from Chinese officials to maintain a steady level of stimulus.

In the long term, the Australian dollar outlook is mixed. It is cheap versus the US dollar, the British pound, the euro, and the Swiss franc, and has room to appreciate, but is expensive against the yen and the Scandinavian currencies. Here, the Chinese story is less positive as we see a structural downtrend in Chinese growth as well as a rotation toward domestic consumption and higher value-added industries, which is likely to gradually reduce the growth rate of Australian commodity export demand.

New Zealand Dollar (NZD)

We are neutral to negative on the New Zealand dollar over the near term, though less negative compared to last month due to improved commodity prices. Ongoing challenges to growth and the weak external balance — the current account is –6.9% of GDP — more than offset the benefit of New Zealand’s high yields. We also see some support from stabilization in China.

In the long term, our New Zealand dollar outlook is mixed. Our estimates of long-run fair value suggest that it is cheap versus the US dollar and the Swiss franc and has ample room to appreciate, but is expensive against the yen and the Scandinavian currencies.