Six Grey Swans That Could Move Markets in 2025

The only constant in life is change, as the saying goes. Being prepared to adapt to new circumstances and recalibrate expectations is an essential tool for investors. That’s why each year we consider some less likely – but still possible – scenarios that could move markets, if they come to pass.

At State Street Global Advisors, we define a Grey Swan as a scenario that typically has a very low likelihood of occurring, yet is one that carries risk with potentially broad investment implications. In our Global Market Outlook 2025, we shared our base case views on how we expect the year ahead to unfold. But forecasting is not an exact science, and so we pressure-test our theories and think through the ‘what-ifs’ for scenarios that diverge from our base case.

We believe that contemplating alternative scenarios should form a part of investor thinking as it allows for quicker reaction to revise portfolio allocations should these or similar situations materialize. By teasing out possible outcomes at the outset, investors should be better placed to determine whether and how to implement appropriate strategies, whether or not such eventualities come to pass.

In a world where market outcomes can often defy expectations, preparing for those less likely — but potentially significant — events like our Grey Swans, can empower investors to stay ahead of the unexpected. We assess a number of less probable Grey Swan scenarios and consider their potential investment implications.

1. A Surprising Reset in Europe

No part of the world is seemingly quite as poorly prepared for 2025 than Europe: wars on its borders driven by great power politics beyond its control; a rigidly managed, overregulated economy with an aging population; a monetary union with attributes more akin to a fixed exchange rate regime; and an industrial base that has been shedding key features of its competitiveness.

However, it is precisely because Europe has hit its nadir and is so unloved by investors that makes a rousing comeback conceivable. In this Grey Swan scenario, President Donald Trump’s administration squeezes Europe on trade, energy, and defense, but successfully de-escalates the war in Ukraine and helps bring about further calming of the wars in the Middle East. This triggers a shift in sentiment across the continent and the risk perception of global investors. In addition, the German national election in late February delivers a new government with a mandate to reform the “debt brake” (a rule that limits German debt levels) and promote growth. It may not be a full-on Keynesian revolution, but Germany surprises to deliver a fiscal impulse of nearly 2% of GDP while also implementing supply-side growth reforms. But Germany is just one part of this turnaround story. Higher growth is also linked to a continent-wide boost in defense spending, a sector that has a particularly high fiscal multiplier given that most of the production chain is regional. This also translates to higher imports of US arms, but alongside commitments to large-scale purchases of US energy on a longer-term basis it also helps Europe avoid a lengthy trade war with the US. And while the price structure might be higher than previous Russian gas supply, it preserves the competitiveness of many European industries — especially as other trading nations remain impacted by US trade tensions.

Upward economic growth revisions for both Germany and the rest of the eurozone also help to stabilize fiscal stress in France, facilitating the passing of a budget that enjoys market confidence. By the end of the third quarter, forecasts for growth and bond yield differentials for the US and Europe have narrowed, underpinning a euro rebound and a resurgence in European equity market performance. As Figure 1 shows, this would not be entirely ahistorical, given that the euro has performed better in recent periods during a Republican administration.

Figure 1: EUR/USD Through US Presidential Administrations (2004 – 2024)

2. China and the Emerging Markets Pain Trade

If one was to characterize the views of emerging markets (EM) equity investors of late it could be captured in a single word: disappointment. The EM growth story has, by and large, been relatively good, but unlike the developed markets experience, these GDP gains have not been passed along to equity investors.

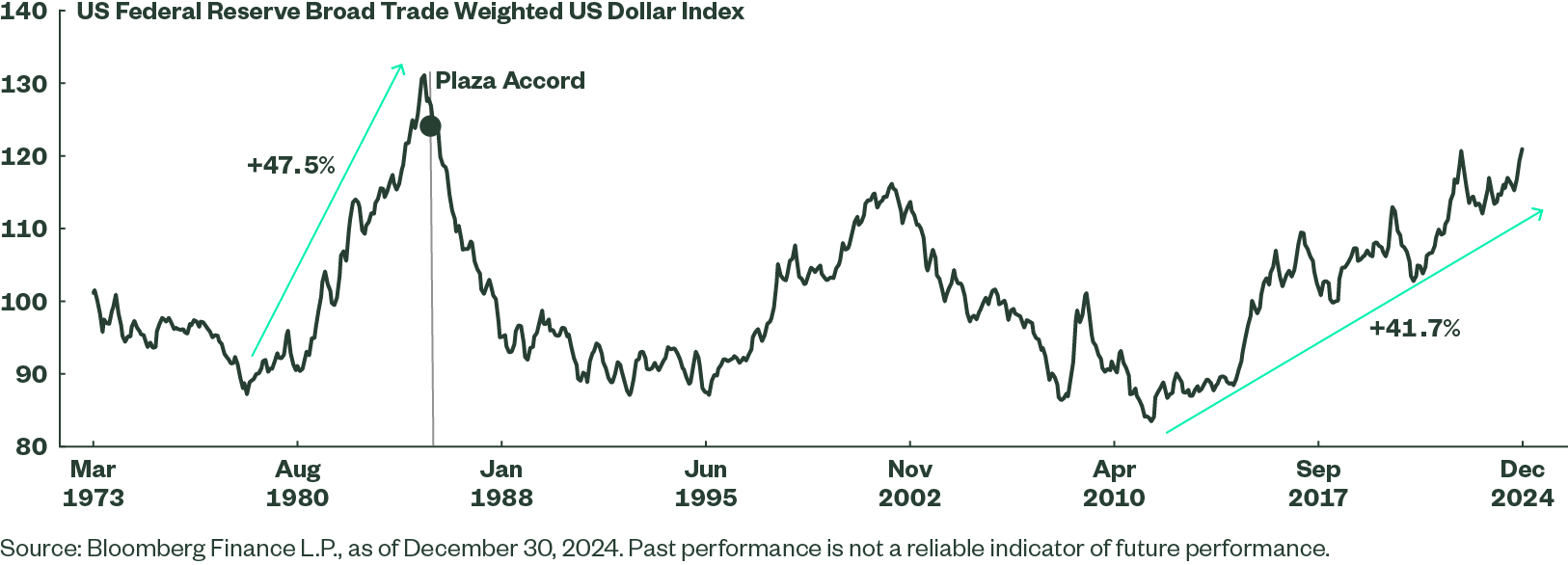

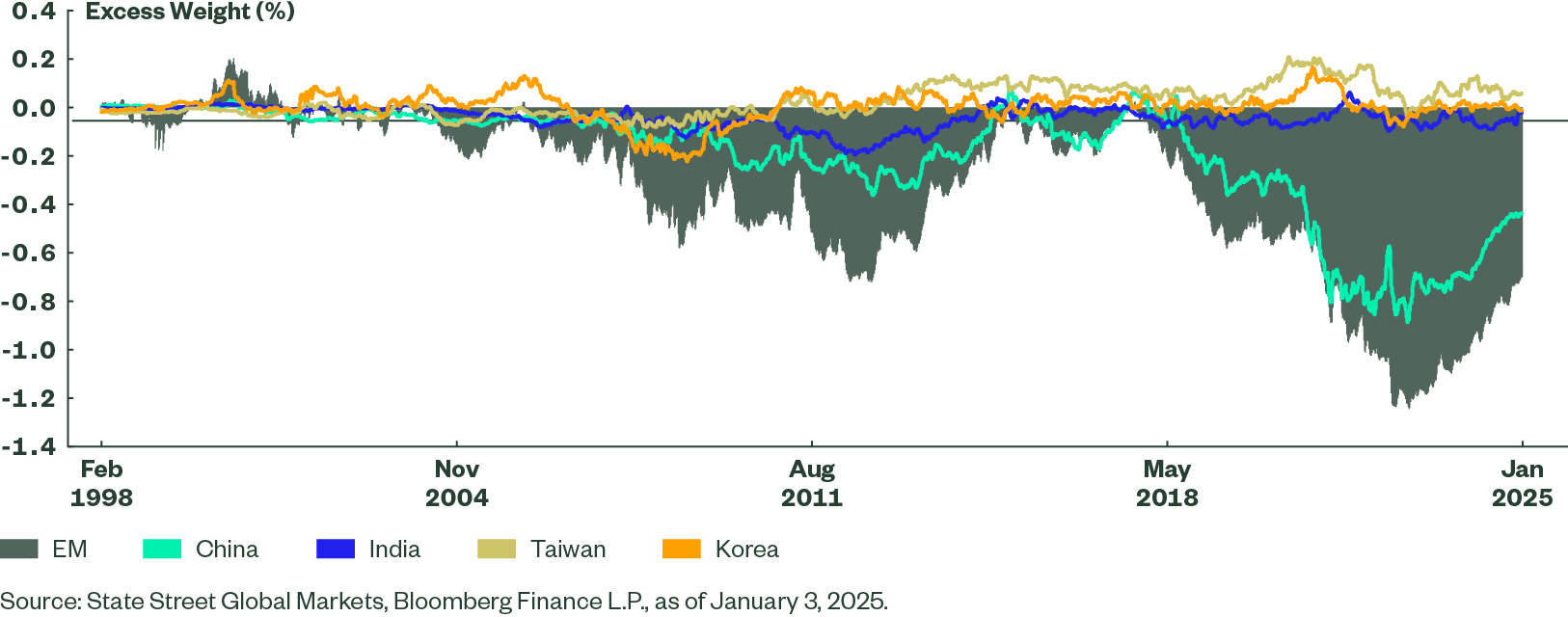

This disappointment has manifested in two major ways. Global investors are at near-lifetime lows in terms of EM positioning – mainly through underweights to China (the largest market in the standard EM index ), as reflected in Figure 2. However, this sets up a very clear potential ‘pain trade’. This is a scenario that catches many investors on the wrong side of a position which moves against them – in this case being underweight, or even short, Chinese equities.

In this Grey Swan, the Chinese government gets serious about delivering a strong reform package. After trying almost everything else, there was a hint of real movement in the fall of 2024, when the government announced a series of measures that caught the market off guard. It didn’t last, as investors soured on specifics, but the shift in focus of the authorities was instructive. Building on this, China takes more substantial steps toward reform. This, more than anything, would improve the short-term prospects of the asset class and prompt investors to re-evaluate their current views. As we saw in September 2024, the moves could be fast and furious; the short-China trade is already ‘long in the tooth’ by conventional standards.

The biggest of the pain trades would likely be a rally in the Chinese A-share market, followed by the offshore China names. The flip side is that investors would need to fund these purchases and may look to sell some of the winners of recent years within the EM universe (Taiwan and India come to mind). Moreover, one should always remember that it is invariably the most unloved, lowest-quality names that cause the most pain (Chinese real estate, for example).

The emerging markets are stocked with scenarios that are low in probability terms but could help EM equities in 2025. This could be a US-China trade deal, a weaker US dollar, stabilizing global growth with contained inflation, or a ramping up of merger and acquisition (M&A) activity where developed market companies look to buy EM assets. Any of these ingredients would add fuel to the pain trade of investors that are short or underweight EM -- but none would be as powerful as a new and improved China story.

Figure 2: Institutional Investors Are Significantly Underweight EM – and China

3. A Grey Swan with Echoes of the 1920s and 1970s

The start of 2025 feels like a fork in the road. Could this decade morph into a new “Roaring Twenties”, with a relentlessly booming US stock market accompanied by easy credit and lower regulatory barriers, but with policy missteps that prove disastrous? Or might we get a repeat of the 1970s with stagflation, low economic growth, and rising fiscal debt, but where tough policy choices ultimately usher in decades of prosperity? This Grey Swan explores the interplay between economic, fiscal, and monetary forces that could determine where either path takes us.

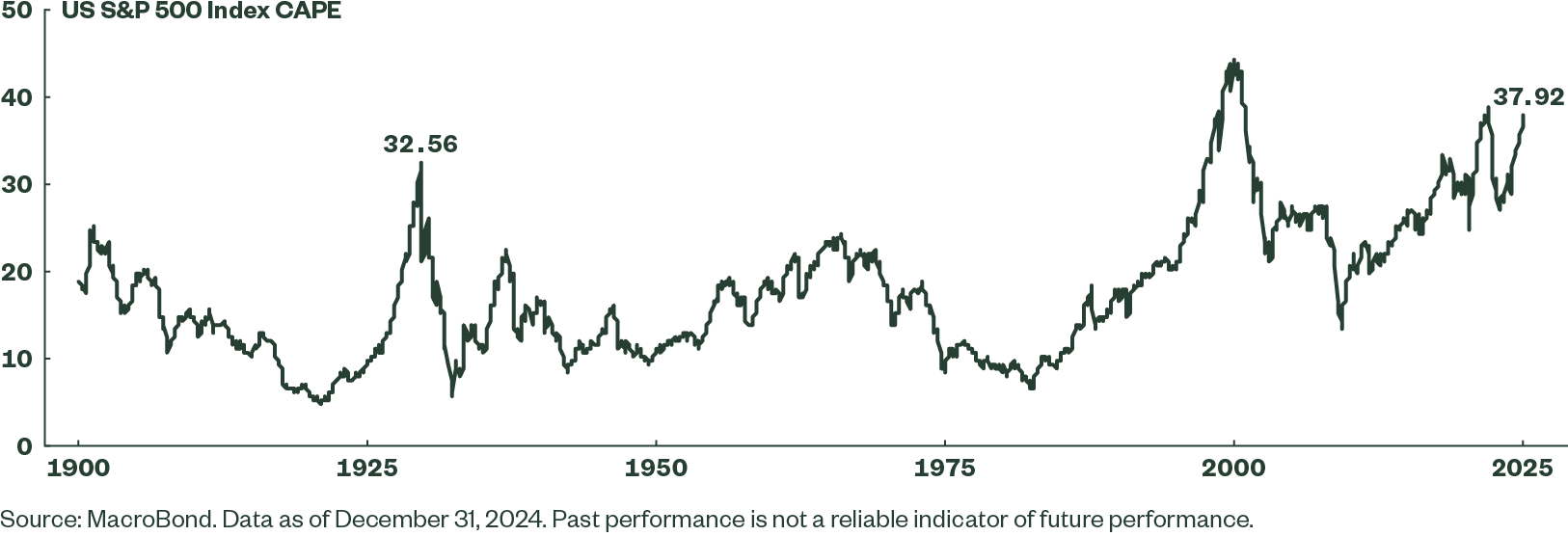

While every decade is different, there are some rhymes with the past: The 2020s have seen the stock market roar ahead, with the S&P 500 gaining 94% in the five years to end-2024. Worryingly, valuations are precipitous, with the cyclically-adjusted price-to-earnings (CAPE) ratio at 37.9 for the S&P 500 as of end-2024. This chimes with the end of the 1920s (CAPE ratio of 32.6 in September 1929 before the crash), as illustrated in Figure 3, when enthusiasm for then-new technology such as telephones, radio, electrical appliances, as well as the ramping up of manufacturing and surging consumption led to an overinflation of market valuations. Regulators at the time made the bad decision (in hindsight) to aggressively tighten margin requirements in the 1920s.

While consumer leverage feels more contained today, an acceleration in the already large and growing US fiscal debt could deliver a knockout blow to consumer confidence. Furthermore, investor uncertainty could spike if bond markets grow skeptical that policymakers have the willpower or means to address it. Add to this the possibility of an error from central banks globally – an unexpected sudden change in Fed policy could create doubt in the market, leading investors to sell off risky assets. Another vulnerability is that a dash to sell US stocks could ensue should the Trump administration’s planned tariff and immigration policies stoke inflationary pressures that fuel rate hike fears.

Figure 3: Cyclically-Adjusted Price/Earnings (CAPE) for US Equities (1900 – 2024)

But this is a Grey Swan that could serve up another scenario. What if the US ends up in a situation more like the 1970s – a decade marked by “The Great Inflation.” The Covid pandemic triggered shocks to food and energy prices not dissimilar to the oil-related shocks of 1978-1979 that drove persistent and hard-to-dampen inflation. Through 2024, inflation remained higher than many expected; meanwhile, geopolitical parallels from the 1970s are also evident, with the Vietnam and Arab-Israeli Wars echoed in today’s conflicts in Europe and the Middle East and the associated spikes in food and energy commodity prices, as well as higher upstream supply chain costs for industries sensitive to US-China tensions.

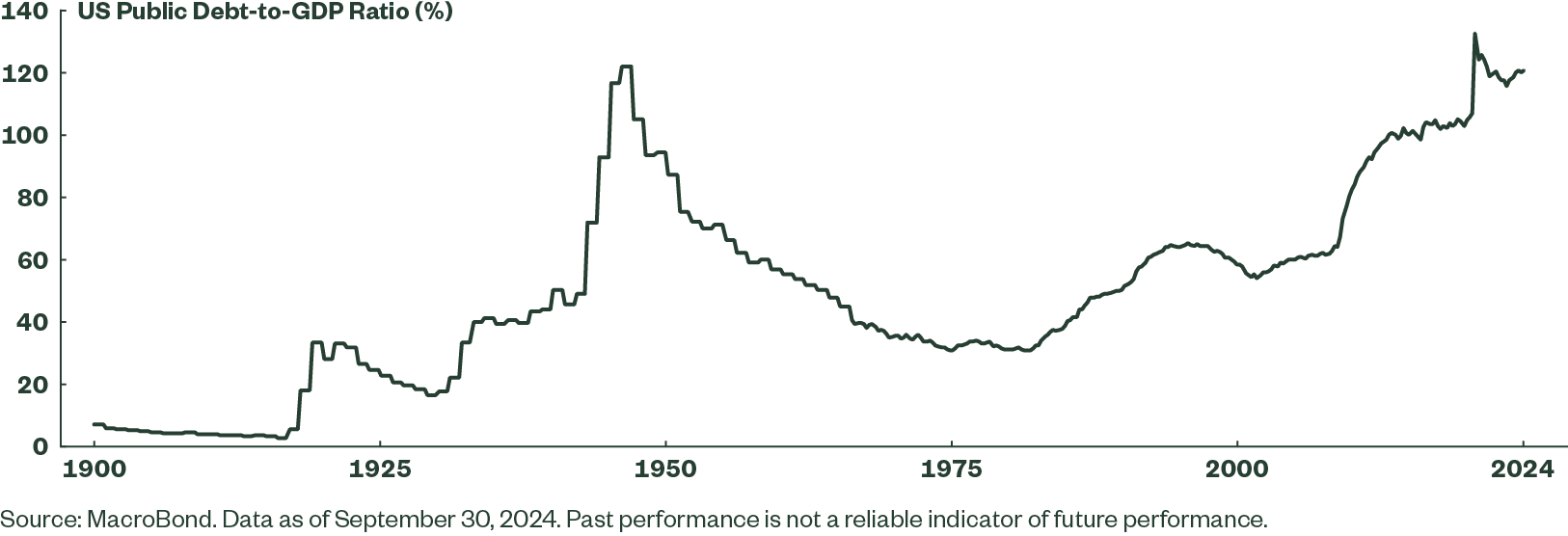

But unlike the 1970s, US debt-to-GDP is hovering near record highs (Figure 4), meaning additional government spending to boost the US economy will be harder to secure. Should inflation prove difficult to tamp down, and engines of growth like fiscal spending have little room to maneuver, we could see dreaded stagflation return.

Figure 4: US Debt Near Record High (1900 – 2024)

What happens next would be key – high price growth and a stagnant economy could be the catalyst for the tough policy decisions to get the US back on track. Policies to address the fiscal debt through spending cuts, tax increases, or economic growth initiatives, require strong political will and execution, much like the drastic measures implemented from 1979 by the Fed under Paul Volcker. Many credit these measures with enabling the long economic expansions of the 1980s and 1990s. A failure to act could lead to a darker fate.

The two scenarios in our Grey Swan reflect a seismic change from the current positive consensus. With many traditional defensive assets (gold, US Treasuries, US dollar, utilities, real estate) not well-priced and not particularly “safe”, investors need to be creative about adding protection and diversification to mitigate against unlikely but plausible outcomes. This may include high quality defensive names within equities and investment grade bonds, managed volatility, and hedging strategies — all while managing asset class exposures in a precise risk-controlled way.

4. Achieving Quantum Supremacy: A Grey Swan for Financial Services?

A breakthrough in quantum computing has always been on the horizon, but never seemed to draw nearer. However, Google’s December 2024 unveiling of its “Willow” quantum chip seems to have brought the future closer. That said, we are still awaiting that ‘transformative’ quantum computing event. In our Grey Swan, a previously unheralded organisation builds upon the success of the Willow chip and announces a further breakthrough in Quantum Error Correction (QEC). This isn’t a marginal improvement; they’ve achieved a dramatic reduction in the overhead required for reliable quantum computation.

Among all the research and development being undertaken, robust QEC emerges as one of the most promising to be achieved more quickly, and potentially most impactful. QEC addresses the escalating error rates tied to increasing qubit numbers which is currently one of the factors holding back the scalability of Quantum Computing. (To learn more about qubits and all things Quantum Computing, read our paper here). This breakthrough would significantly accelerate the development of large-scale, fault-tolerant quantum computers, and could massively disrupt financial services — an industry deeply reliant on cryptography — through its ability to allow quantum algorithms to “break” current industry-standard encryption. Willow has shown that reducing the error rate as the number of qubits increases is achievable.

The benefits for many industries from reliable, scalable quantum computing could be immense – from medical developments to optimizing factory floors or global supply chains and identifying fraud and risk patterns in financial transactions, amongst others. The implications of a near-term innovation that upends current timelines also focuses attention on developments that might stop a chaotic and confrontational scenario where nation states, private companies, and bad actors (criminal organizations, rogue states) are set against each other. One is the development of Post Quantum Cryptography (PQC) which would be impervious to current quantum algorithms — Apple has already stated that it is making the encryption that protects iMessage chats “quantum proof”. In 2025, the race between the development of unbreakable cryptography and quantum computing commences in earnest. Could the next Nvidia or Google emerge from this contest? Or more pertinently, who might be the biggest losers?

5. Disruptive Event Leaves Markets in the Dark

Everything is connected. It’s a trite expression that’s overused to rationalize a series of coincidences or events that have knock-on consequences and can tiresomely end with “if a butterfly flaps its wings…”. But connectivity is a very real component of how the world today operates. Technological advances have been at the heart of increased connectivity since the first telegram or first steam engine. Today we talk about connectivity in terms of broadband and satellites and power grids and other utilities. But what if our reliance on those connections was exposed?

In this Grey Swan, a combination of natural disasters and local grid failures following simultaneous foreign-based cyberattacks triggers broad power outages and brings economic activity to a standstill for nearly a week in several major US states. There are rolling failures of one type or another throughout the country for months on end. The ramifications would be enormous. The economy, heretofore widely expected to grow rapidly in 2025, enters a technical recession.

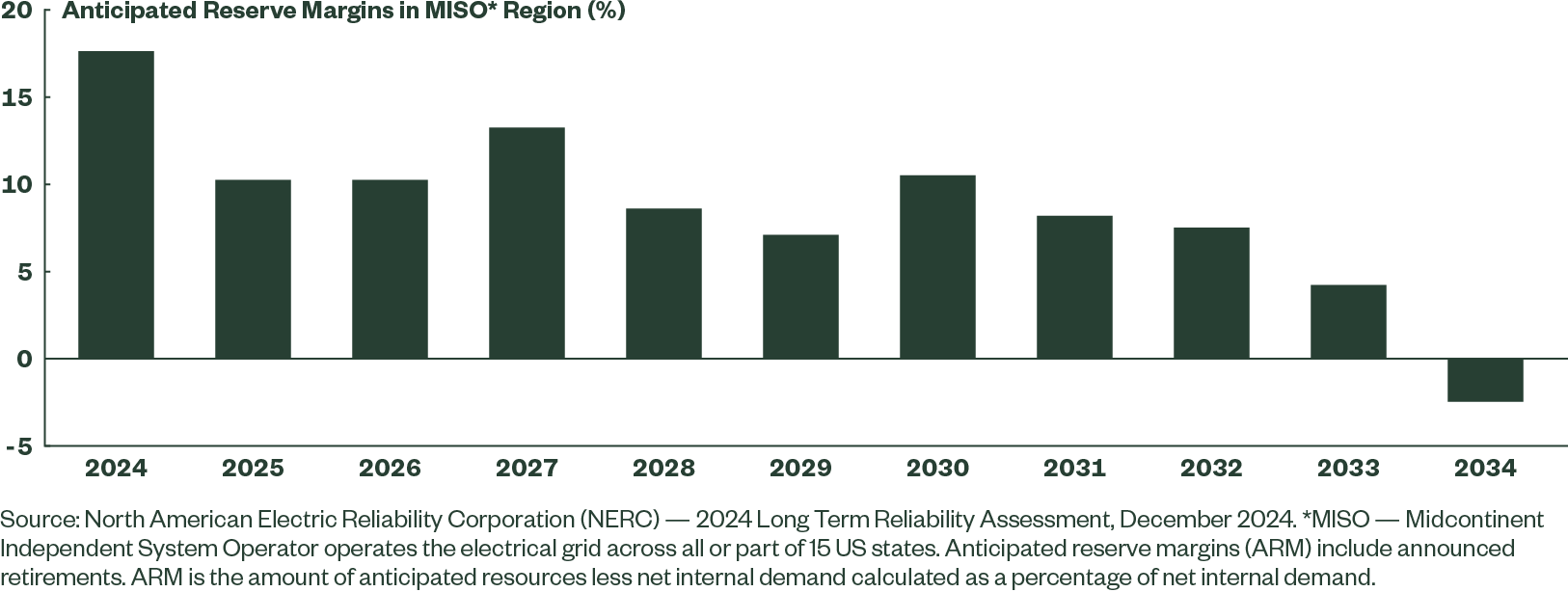

The crisis receives major media coverage and ignites intense political scrutiny. There is a thorough review of US power infrastructure resilience. Technology and power utility executives testify in endless congressional hearings and there is only one bleak conclusion: the grid infrastructure cannot dependably fend off sabotage/cyberattacks. Reality bites that the country is already poorly positioned to reliably meet day-to-day energy demand (Figure 5), never mind meet the high energy requirements to drive the notional AI revolution.

It is crisis management and strategy review time. The new US administration launches "Operation Warp Speed for Energy Security". The US adopts a force majeure approach to regulatory/approvals streamlining. The US works closely with Canada to boost bilateral energy cooperation, something Canada eagerly agrees for economic reasons and as the agreement fends off tariff threats. A major funding program is approved that takes an “all of the above” approach to national energy security. Some of the regulatory powers currently residing with state governments are temporarily taken over by federal authorities. State authorities agree to a common blueprint to facilitate cross-state consistency of approach. The US experience is a wake-up call for European policy makers, especially in Germany, on the need to urgently take remedial action to shore up energy resilience in Europe. Germany approves a 10-year exception period from debt limit rules to fund a similar program.

For investors, the shock is intense as US stocks sell off – with US equities accounting for about two-thirds of the MSCI All Country World Index, the pain is felt in portfolios around the world. And the sell-off is replicated to varying degrees elsewhere. A flight to quality sees sovereign yields decline as the Federal Reserve and other central banks cut rates. For those with portfolios diversified across asset classes and geographies, the impact is softened and those with downside protection strategies and ample liquidity find themselves well placed to participate in the recovery when it comes.

Figure 5: Threat of an Electricity Shortfall Already a Risk

6. A Trump Plaza Accord

US President Donald Trump has been very clear about his distaste for the large US trade deficit and has repeatedly stated his preference for both higher tariffs and a weaker US dollar to increase the competitiveness of US products. However, strong US growth, high interest rates, and robust corporate earnings have attracted steady capital inflows to the United States, pushing the broad trade-weighted dollar up about 20% since Trump left office in 2021 — including a post-election bump after his November victory. President Trump’s proposed policies of lower taxes, deregulation, and tariffs only strengthen the fundamental case for additional dollar appreciation.

In this Grey Swan scenario, we consider the possibility that President Trump uses the threat of tariffs to force a coordinated intervention by the US, European Union, United Kingdom, Japan, and China to weaken the US dollar and improve the US trade balance — similar to the Plaza Accord in September 1985. The Plaza Accord was an agreement between West Germany, UK, France, Japan, and the US to weaken the greenback, which had appreciated nearly 50% on a trade-weighted basis in the 1978-1985 period. The program was hailed as a success with a 20% fall in the dollar by the end of March 1987, which then extended to a 30% decline by the end of 1988 alongside an improved US trade balance.

While such an agreement is far from our base case, it is entirely plausible. Japan has already sold close to US$140 billion via interventions since 2022 to prop up the yen and would undoubtedly welcome some help in this endeavor. Given China’s ongoing struggle to spur domestic growth, reduce leverage, and battle deflation, it doesn’t seem unreasonable that they could be convinced that a 10% appreciation in the renminbi is far less disruptive than the threatened 60% (or more) tariffs. The EU and UK could follow suit as chronically anemic growth and the importance of exports to the US may create a greater fear of tariffs than of a weaker US dollar.

It is difficult to see a repeat of the success of the Plaza Accord without weaker US growth and lower US yields, but a 10-15% move lower in the dollar is credible, at least for a time. This would directly improve the relative performance of non-US assets. To the extent that a deal to weaken the dollar avoids large tariffs, it would reduce risk premium and further improve the performance of non-US assets apart from the pure currency translation effect. Currency volatility would also likely spike for a time as some investors would be forced out of overweight US dollar positions and grapple with the uncertain magnitude and duration of intervention. As for the ultimate goal of reducing the US trade deficit? A weaker dollar would surely have a marginally positive impact over time, but so long as US growth remains above potential the demand for imports would remain robust and likely mute any improvement.

Figure 6: Nearing a New Plaza Accord Moment?