Rethinking the Role of Bonds in Multi-Asset Portfolios

Bonds have traditionally been used as a diversifier in classic 60/40 portfolios. However, bonds’ diversification benefits have been called into question in recent decades, as stock-bond correlation has fluctuated and oftentimes moved positive. On top of this, bonds themselves have become more sensitive to overall market risks.

In this piece, we discuss why we believe that long-term investors may be using too much of their risk budgets for bonds, since they are no longer consistent in their role as diversifier and are now higher-beta assets. We then outline how diversification-driven allocation to bonds can be adjusted in the current environment, and we provide our expectations for bonds in 2025.

Diminishing Diversification Benefit

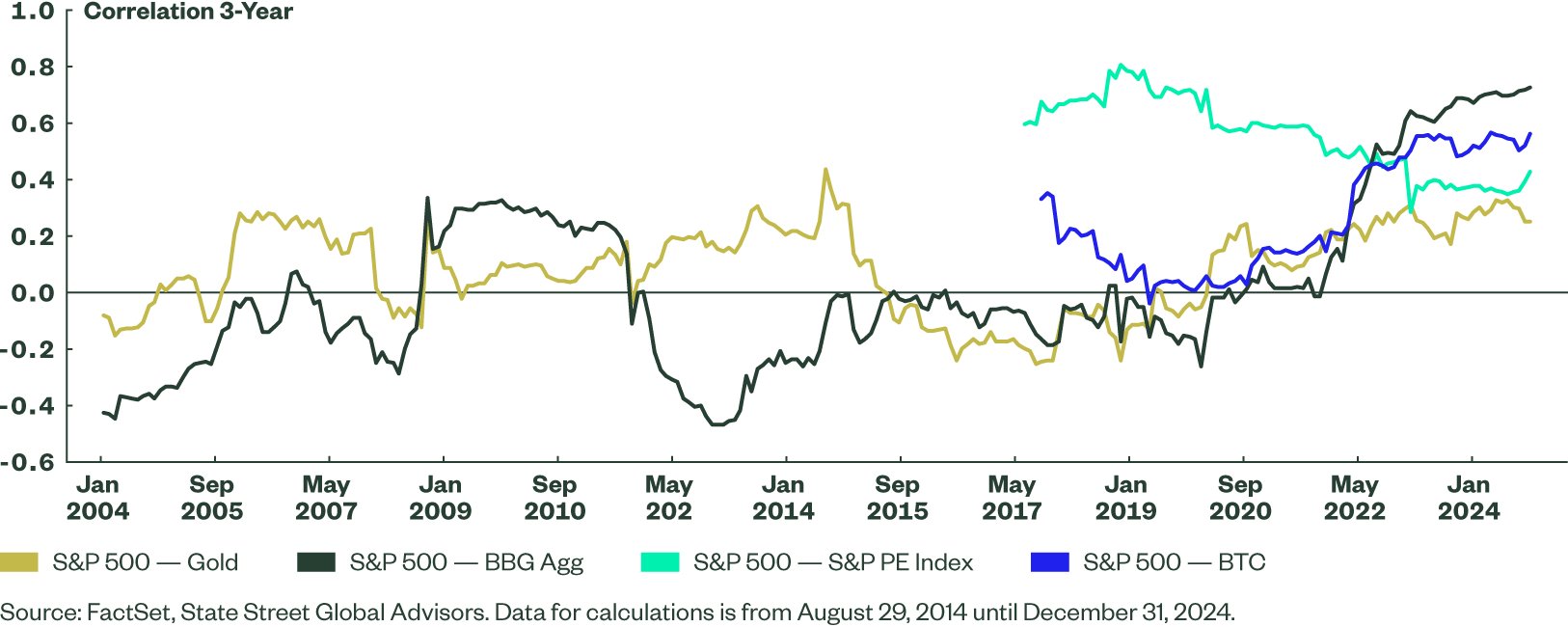

Bonds have typically been used as a portfolio diversifier rather than an engine for returns. Long-term investors have typically accepted the lower returns of bonds relative to equities so that the portfolio has a ballast — an asset uncorrelated to equities — that can outperform in unfavorable markets in which risk goes out of favor. Negative stock-bond correlation in the past has allowed a 40% allocation to bonds to fulfill their function as a diversifier. In the 2000s, the stock-bond correlation was mostly negative. However, since the Great Recession, stock-bond correlation has oscillated based on whether the market has a palate for risk, whether investor concerns are tilting toward inflation or growth, or other trends, and has turned positive in many periods (see: The Global Trend of Positive Stock/Bond Correlation). This decoupled relationship between stocks and bonds poses the following question: Do we need to adjust our thinking on bonds' typical role of diversifier in long-term portfolios?

Bonds’ Increasing Impact

It’s especially important to consider the role of bonds because they have started to make a greater contribution to returns. Bonds’ contribution to 60/40 portfolio performance has been limited throughout the past 25 years; instead, stocks have been the predominant driver of returns (Figure 1). More recently, fixed income has expanded its contribution to portfolio performance, as higher rates have increased the attractiveness of bonds to pension funds and other yield-conscious investors, and U.S. Treasury bonds posted a strong 4.5% yield over the past 12 months.1

Figure 2 shows that today’s 60/40 portfolio beta — its sensitivity to overall market performance — is at among the highest levels in the past 15 years. Meanwhile, bonds’ beta has also ratcheted higher. Therefore, both bonds and stocks are now more stimulated by higher levels of overall market risk, at a time when fixed income is playing a bigger role in portfolio returns.

Bonds are now providing less of a diversification benefit than in the past, but are also requiring a higher portion of investors’ risk budgets. In our view, bonds’ diversification benefits — or lack thereof —and their rising contribution to returns do not justify the risk.

Reallocating from Bonds as a Portfolio Hedge: Exploring Other Asset Classes

Even though inflation has cooled and stock-bond correlation is currently negative, upward inflationary pressures may return, given potential changes to US fiscal and tariff policies in 2025. It is important to consider other asset allocation frameworks for low-beta investments that can allow investors to reach their hedging goals. We suggest investors seek real returns in assets such as gold that have exhibited low correlation with equities markets (Figure 3).

Figure 3: Real Assets Such as Gold Can Be Effective Diversifiers

Where to Look: Private Equity

It is generally assumed that private equity (PE) returns have a high degree of correlation with publicly traded equity returns. Indeed, some key drivers of PE returns are influenced by many of the factors that underpin public equity performance, such as corporate profitability. This close relationship is intuitive, as both are long-only equity exposures and are likely driven by the same fundamental risk factors, yet different in timing. Diversifying properties of private equity are the result of low volatility characteristics that are the product of performance smoothing due to the longer investment horizons they provide.

Where to Look: Gold

In The Global Trend of Positive Stock/Bond Correlation we highlighted how growth and inflation trends can help explain changes in stock-bond correlation.2 Specifically, higher inflation expectations may increase bond yields and decrease the equity risk premium, causing both stock and bond values to fall simultaneously (positive correlation).

By contrast, gold pricing might benefit from higher inflation expectations. Fundamentally, when the economy overheats and overall prices increases, gold holdings are often seen as a safe haven and an attractive hedge against inflation. According to the World Gold Council, “Gold’s performance during times of crisis, its long-term store of value, and its lack of default/counterparty risk are key drivers behind gold ownership.”

Figure 4 shows that, historically, global holdings of gold move in the opposite direction of 10-year yields, suggesting that periods in which inflation is higher (causing central banks to boost rates) coincide with periods in which flows to gold increase. Overall, gold may perform as a potential reallocation path for those who seek to diversify their equities market exposure.

The ownership structure in gold ETFs and physical assets is similar from the top level; 40% of SPDR Gold shares are held by institutions,3 while physical gold is mostly held by sovereigns, central banks, and institutional investors. Gold is one of only a few traditional assets that are used as reserves, along with currencies.

Where Not to Look: Crypto

Bitcoin investments have positive correlation to equities. Named “digital gold” by many, the digital currency has fundamental similarities to gold; however, BTC should be considered separately because of significant differences and characteristics.

- Potential Higher Correlations with Stocks in the Future. The approval of Bitcoin ETFs and the increased institutional adoption of cryptocurrencies have boosted BTC's credibility and integration into mainstream finance. As BTC becomes more integrated with traditional financial systems, its price movements will increasingly reflect broader market trends, potentially increasing future correlations with stock indices.

- High Intraday Volatility. The internal volatility of BTC may undermine its usefulness as a hedge. While the intraday volatility is declining gradually, on average, Bitcoin’s price can range 30% from high to low bounds as a percentage of the closing price.

- Similar Investor Profile in BTC and Transformative Tech. Cryptocurrency and tech industry equities are closely related and driven by similar investor sentiment — those buying BTC and high-quality tech stocks have similar profiles, and BTC and the “Magnificent 7” have had some of the closest rival returns in the past few years. While the S&P 500-BTC correlation remains positive (Figure 5), the Magnificent 7 tech names and the S&P are highly correlated as well, closely following crypto-index movement. A positive outlook on tech sector stocks, previous strength in Magnificent 7 names, and support for the crypto industry could cause BTC to continue performing in line with the S&P 500 Index, undermining its strength as a hedge.

Flight to Quality During Short-Term Market Turmoil

Recent market turmoil in August 2024 (related to the Bank of Japan rate hike and the unwind of the yen carry trade) offers a live look into investor behavior during down markets. At that time, investors did seek US Treasuries as a way to express a risk-off posture. The 10-year US Treasury yield in August dropped to its lowest level since mid-2023, when a weaker consumer price index reading came out and investors feared that the Federal Reserve would be less aggressive in rate cuts.

Investors’ preference for Treasuries as a safe haven does not prevent us from suggesting that they seek other frameworks for diversification over the long term; however, it implies that during large market selloffs over a short-term period, investors will still hedge with sovereign government debt. This is true despite the data showing the inconsistency of stock-bond correlations, and implies that investors may behave differently when volatility, rather than inflation, is at the forefront of market concerns.

The Bottom Line

Variations in stock-bond correlation have highlighted the importance of balancing across asset classes and maintaining flexibility during shifts in market characteristics. Whereas bonds in the portfolio may increase its beta, other asset classes could provide portfolios with diversified returns and limit risks related to pure equity movements.

Investors should account for the factors that drive changing correlations in order to determine which asset classes may best diversify their equity allocations; the factor we noted most, historically, is inflation. However, in the most recent equity pullback (August 5, 2024), investors did flock to the classic US Treasuries hedge — even though in longer-term theory that could increase their market exposure. In practice, inflation was not the main concern for investors during that short period; volatility was. For long-term investors, we continue to suggest allocating to assets other than bonds to diversify portfolios; however, investors need to consider that US Treasuries allocation may still play its role in short-term periods when volatility is the focus.

Outside of its role as diversifier, we consider bonds relatively more attractive than equities currently, as equities are overvalued and highly concentrated in a small set of tech companies (see Global Market Outlook 2025). Still, investors need to rethink the role that bonds play and how they may impact the portfolio amid a potentially inflationary environment in the US going forward.