Gold 2025 Outlook: More Room to Run

Despite a resilient US dollar and gold’s spectacular 2024 run, we think its price could go as high as $3,100/oz in 2025. Central bank buying remains strong; consumer demand from India and China is growing; and we see more investors seeking gold due to expected rate cuts (with financial positioning not stretched, historically or normalized), geopolitical tensions, and worsening fiscal deficits.

2024 has been nothing short of spectacular for gold. Rising geopolitical tensions, growing consumer demand for gold in Asia, and robust central bank purchases of the precious metal pushed its price up to set 41 new closing highs in the first 10 months of the year,1 peaking at a record $2,778/oz in October.2

Although gold’s momentum stalled in November as Donald Trump’s win at the polls drove a surge in risk assets and the US dollar, we think its price still has room to run in 2025.

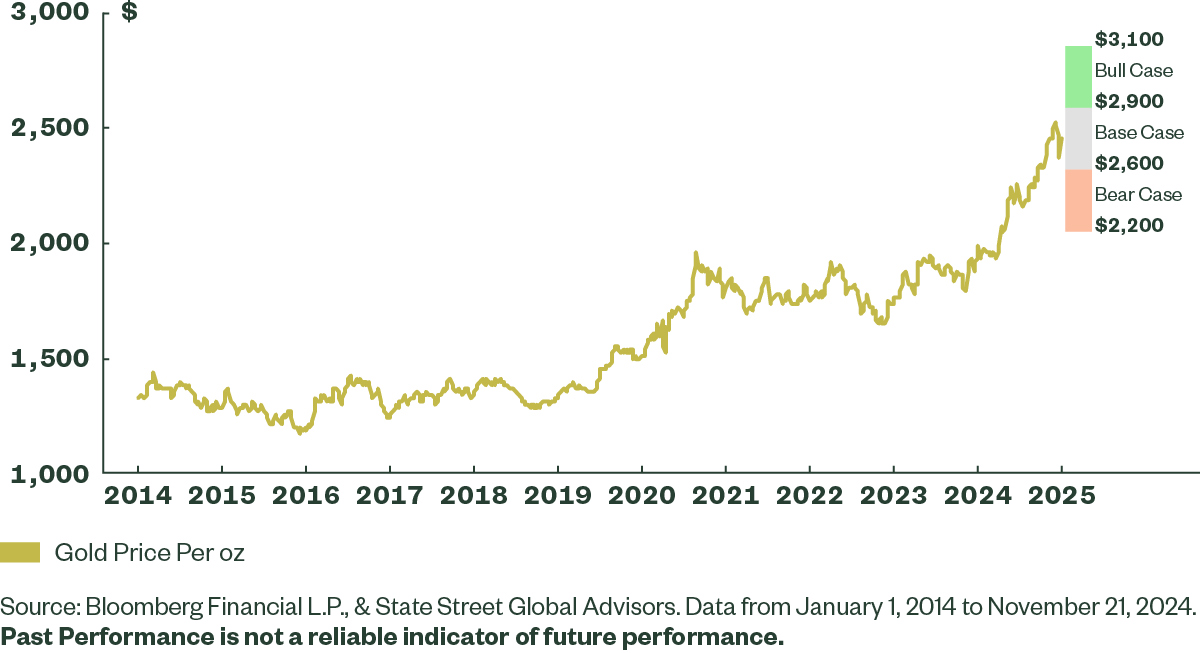

Our base case is for gold to range between $2,600 and $2,900 in 2025, with the potential to rise to $3,100 under certain economic scenarios.

There are three good reasons to be bullish on gold:

- Strong central bank purchases of gold are expected to continue unabated, helping to offset any negative impact a strong dollar might have on price.

- Consumer demand in China and India is growing as local gold mutual funds and ETFs proliferate and regulations encourage gold ownership.

- Monetary easing and the potential for the new Trump administration’s fiscal policies to raise deficits and stoke inflation should lower the opportunity cost of buying gold versus the US dollar or Treasurys.

Equity markets have had another stellar year, and the risk-on tone has been strengthened by President-Elect Trump’s pro-growth and business-friendly policies. But there’s also no shortage of anxiety about the tail risks of inflation, rising government debt, and worsening geopolitical tensions.

In fact, high net worth investors surveyed in our 2024 Gold ETF Impact Study have nearly doubled their allocations to gold in the past year and cited its safe-haven* status as the reason.

We don’t see this changing and expect the secular demand trends underpinning gold’s price and its status as a safe haven to continue enhancing gold’s appeal as a core portfolio asset, even if capital markets strike a risk-on tone in 2025.

Can a Strong US Dollar Hurt Gold?

Gold is a dollar-denominated asset, so a stronger US currency has been a headwind at times. But that model has been broken in the past few years by unprecedented central bank buying of the precious metal.

Central banks are on track to purchase 2,700 tons of gold since 2022, the fastest pace in recent history.3 Their consistent buying in the past three years, even as dollar-denominated gold prices have surged, suggests central banks have been motivated by long-term strategic considerations more than price sensitivity. We expect them to continue adding to their gold reserves in the year ahead.

Gold’s inverse relationship with the US dollar also has been misunderstood over the years. Since 1973, gold has posted average cumulative returns of 133% during US dollar bear markets and -9% during periods of dollar strength.4 History would suggest that over the long-term, the benefit of holding gold to protect against currency weakness has the potential to outweigh any drag from currency strength.

In fact, the US dollar is as strong today as it was at the turn of the century, while gold has appreciated 813% in the same period (Figure 1).5

De-dollarization: Preparing for the Worst?

The impact of rising geopolitical tensions and moves by certain countries to reduce the dollar’s dominance in trade and global finance cannot be overstated.

Central banks, notably those in emerging markets, have been net buyers of gold every year for the past 15 years to diversify their dollar-heavy reserves.6 The pace of their purchases began to pick up when trade tensions between China and the US worsened during the first Trump administration. That laid the groundwork for a more pronounced trend among countries to view foreign exchange diversification as a matter of national security.

Central bank purchases of gold have since gone into top gear after the US weaponized the dollar in 2022, through financial sanctions on Russia after its invasion of Ukraine. Gold has soared from $1,942/oz at the end of first quarter 2022 to $2,689/oz.7

Now central banks in developed markets have become overt buyers of gold.

Central bankers rarely divulge specific gold allocation targets publicly, yet the Central Bank of Poland announced its strategic intention to increase gold reserves from 13% in 2023 to 20%. It has since purchased 130 tons in 2023 and 61 tons in 2024.8

Poland’s move underscores gold’s role as a safe-haven* asset, free from credit risk and immune to devaluation because of another country’s economic policies. It raises the potential for other developed central banks to follow suit and expand their gold reserves.

The Trump Effect

Markets immediately cheered the 2024 Election results, potentially believing President Trump might have a better chance than President Biden of mediating a settlement between Russia and Ukraine. An end to the conflict would certainly be welcomed, but it doesn’t mean the global push to reduce the dollar’s dominance will go away, or that countries will slow their efforts to de-dollarize their central bank reserves. In fact, Trump’s proposed tariff policies may exacerbate the de-dollarization trend.

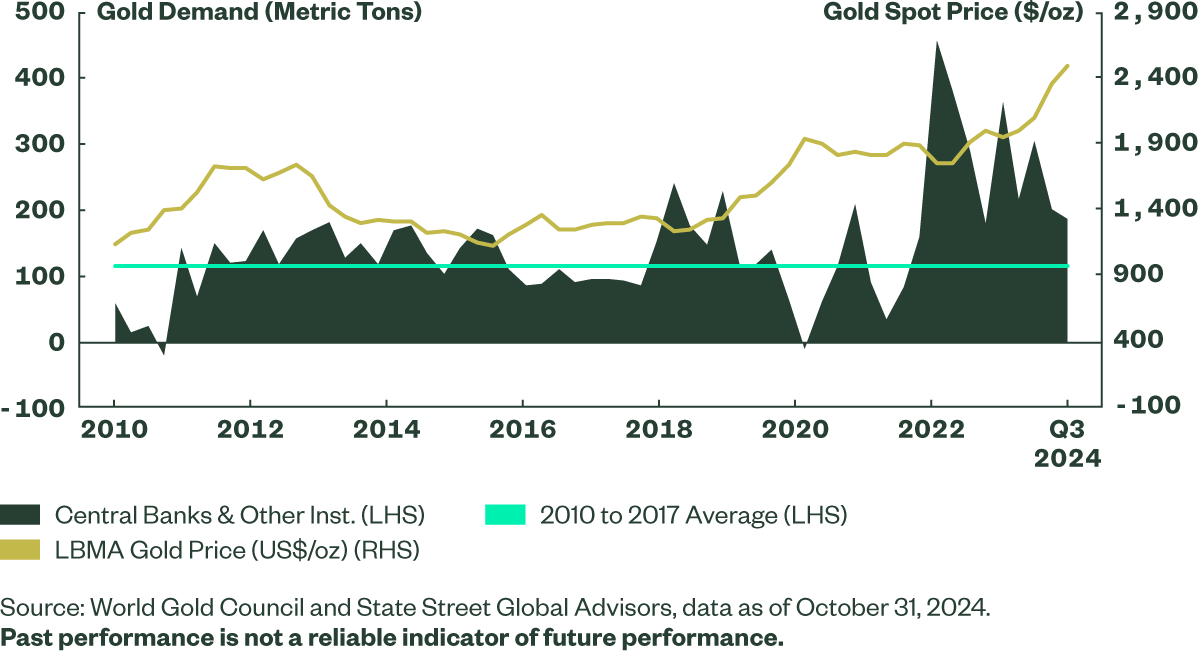

In his first term, Trump’s protectionist trade policies accelerated global central banks’ de-dollarization efforts. Demand for gold spiked in March 2018 after he imposed respective tariffs of 25% and 10% on steel and aluminum imports from all international suppliers, not just China (Figure 2).9

Figure 2: Central Bank Demand Has Historically Anchored Gold

Trump warned in December that he would raise tariffs against the nine group of BRICS countries if they sought to reduce the dollar’s stronghold on trade and global finance.10 Yet, any moves on Trump’s part to raise tariffs against countries seeking de-dollarization could trigger retaliatory measures, potentially fragmenting global trade and forcing multinational corporations to rapidly recalibrate supply chain strategies.

Greater Gold Demand from APAC

Another long-term driver of gold demand comes from the Asia Pacific region, where tremendous economic growth over the past three decades has improved per capita incomes and spurred investment. Between 1990 and 2023, APAC’s GDP per capita has more than doubled and its contribution to world GDP growth increased from about a quarter to over two-thirds.11

Gold funds have proliferated in the APAC region, especially in India and China. Gold holds cultural significance in these two countries, where consumers have long treated the yellow metal as a store of value and a hedge against inflation.

Since 2005, gold funds in the APAC region have increased from three to 128 in number and attracted over $23 billion (Figure 3).12

The government of India has also encouraged investment in gold mutual funds and ETFs by reducing the rate of long-term capital gains tax from 20% with indexation to 12.5% without indexation. It has also reduced the holding period for long-term classification to 12 months from 36 months. India has also sought to boost the jewelry industry by cutting the import duty on gold from 15% to 6%.13

China’s latest economic stimulus efforts have led to a significant rally in Chinese equities and a reduction in real estate interest rates, two trends which could increase consumer savings and more investment in gold funds in 2025. However, the demand for jewelry might be tepid in China’s 2025 “Year of Snake,” traditionally not considered a positive sign for weddings.

We also think Japanese consumer demand for gold could pick up in the year ahead, as investors seek out the precious metal as a hedge to protect 2024’s strong stock market gains.

The Japanese government’s regulatory changes to promote mutual fund and ETF investment could also bolster gold-backed investment products in the year ahead.

Rising Deficits Can Boost Gold’s Appeal as a Hedge

Monetary and fiscal policies could also influence the direction of gold in 2025. The true impact will not be known until the size of tariffs and tax policies become clear. The Federal Reserve (Fed) has forecast further rate cuts in 2025, but how many depends on the strength of the economy and how much fiscal policy increases inflationary pressures and federal deficits.

Fiscal deficits, driven by increased government borrowing and spending, produce an array of economic conditions that favor gold. These conditions include elevated inflation expectations, currency depreciation, and heightened uncertainty surrounding the government’s ability to fulfill its debt obligations. When fiscal deficits coincide with a monetary easing environment, as we’re expecting in 2025, the opportunity cost of holding gold instead of buying Treasurys diminishes, enhancing its relative appeal as a safe-haven* asset.

We saw the impact federal government fiscal health can have on gold during the Clinton and Bush administrations.

Gold entered a prolonged bear market during President Clinton’s two terms from 1993 to 2001, falling 19.9% as the Clinton administration built a fiscal surplus by increasing taxes and reducing defense spending. Gold’s appeal was further depressed at the time by a tech-led stock market boom and a strong US dollar.14

In stark contrast, gold’s price rose 221.2%15 during George W. Bush’s presidency from 2001 to 2009. In that period the Fed applied an accommodative monetary policy at a time when government spending sent gross federal debt as a percentage of gross GDP surging 50.44%.16 Gold’s rally at that time was also fueled by economic and foreign policies weakening the US dollar and exacerbating geopolitical tensions.

Many of Trump’s fiscal plans are similar to President Bush’s policies. Trump wants to extend the Tax Cuts and Jobs Act’s sizeable tax breaks, increase defense spending, curb immigration, and introduce higher tariffs.

Combined with anticipated rate cuts by the Fed, Trump’s policies could recreate the dual tailwind of a growing fiscal deficit and accommodative monetary policy which catalyzed gold’s bull market during Bush’s presidency.

Potential Scenarios and Trading Ranges

Gold’s price could vary according to how the Trump administration’s policies evolve. We see three potential outcomes:

- Base Case (50% Probability): Gold has a potential trading range between US$2,600/oz and US$2,900/oz. Under this scenario US growth continues to surprise to the upside, causing inflation metrics to remain higher than expected, and the fed funds rate to stay higher than the projected 3.25% to 3.50% from September 2024. In this case, gold-backed ETF flows fluctuate throughout the year. Meanwhile, consumer demand for gold in Asia remains steady, while robust central bank gold buying creates a “soft floor” on the precious metal’s price.

- Bull Case (30% Probability): Gold trades between US$2,900/oz and US$3,100/oz. This occurs if US growth slows down enough to create weakness in the labor market, enabling the Fed to cut rates to 3.25% to 3.5% by the end of 2025. Gold-backed ETF inflows are mostly positive all year and consumer demand for gold in Asia strengthens as lower rates weaken the US dollar. Central banks continue to buy gold.

- Bear Case (20% Probability): Gold trades between US$2,200/oz and US$2,600/oz if US growth accelerates far more than expected, as the new administration’s business-friendly initiatives strengthen the manufacturing sector. Sturdy growth puts pressure on inflation, causing the Fed to pause on rate cuts, and higher interest rates strengthen the US dollar as foreign flows into US assets increase. Meanwhile, Asia demand weakens in the short-term due to prolonged US dollar strength. Gold-backed ETFs experience outflows, but gold’s price finds a floor from continued robust central bank buying.

Figure 5: Range of Outcomes for 2025 Skewed to the Upside

Get more insights from our Gold Strategy Team.