Gaps and Overlaps in SMID-Cap Exposure Why the Index You Choose Matters

Not all small- and mid-cap (SMID) indexes are alike. Here is why using the Russell Small Cap Completeness Index – and not the Russell 2500 – can help protect against risk and offer broader market exposure when paired with an S&P 500 allocation.

When constructing a menu of index options for participants, many plan sponsors want to offer exposure to the small and mid-cap universe as a stand-alone option that diversifies and complements the large and mega-cap S&P 500 Index. The Russell 2500 has been a frequently used SMID-cap index since its launch nearly 30 years ago. But, when paired with the S&P 500 Index, this Index may expose participants to unexpected risks due to differences in index construction.

Comparing the SMID-Cap Options

The Russell 2500 Index is a subset of the Russell 3000 Index that carves out the smallest 2500 of the 3000 stocks represented. It does not take into consideration any gaps and overlaps with the S&P 500.

By contrast, the Russell Small Cap Completeness Index measures the performance of all Russell 3000 Index companies – but excludes the S&P 500 constituents. This method is designed to eliminate any overlap with the S&P 500 and can address gaps where they exist, to give a more comprehensive view of the broader market beyond the S&P 500.

Gaps and Overlaps with the S&P 500 Index

The S&P 500 Index is the most common choice for US large-cap exposure. But when it comes to adding small and mid-cap allocations, choosing between the Russell 2500 and the Russell Small Cap Completeness can have a significant effect.

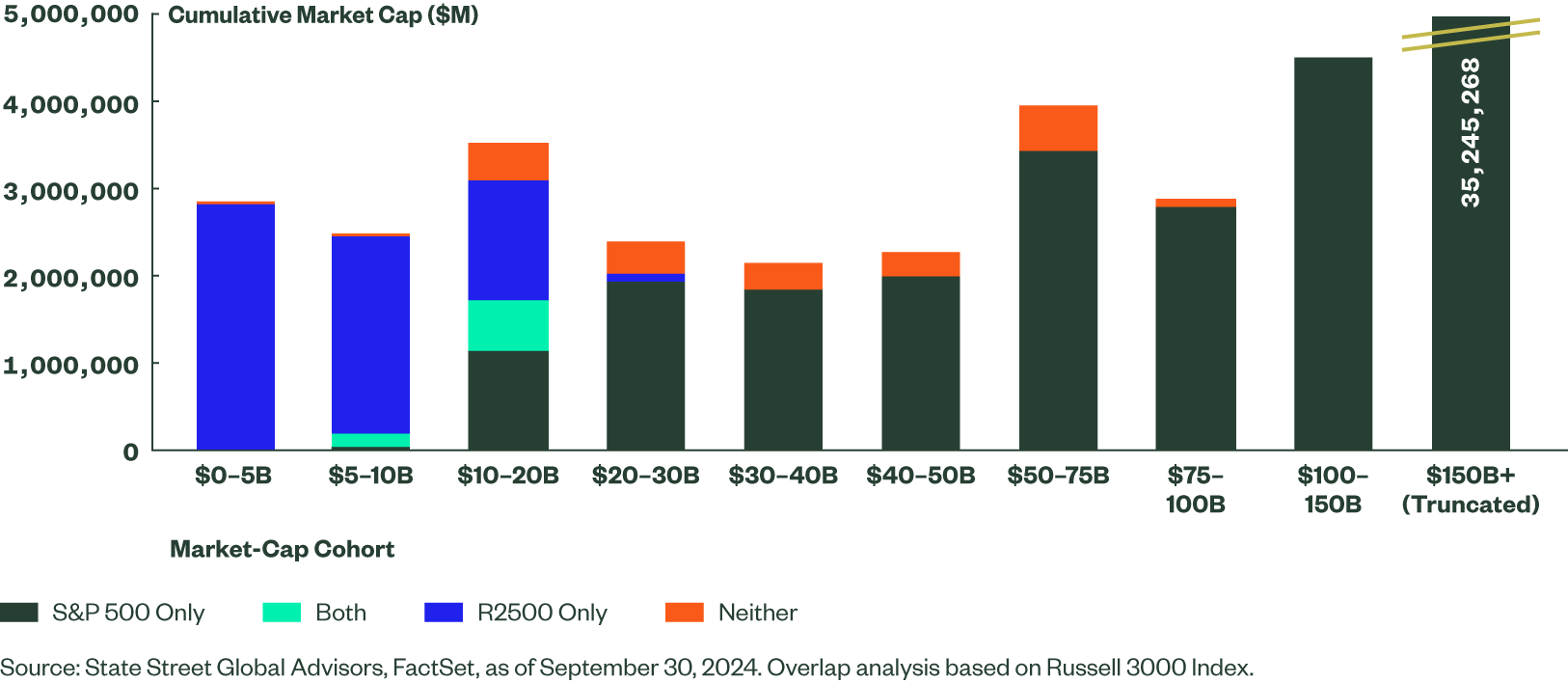

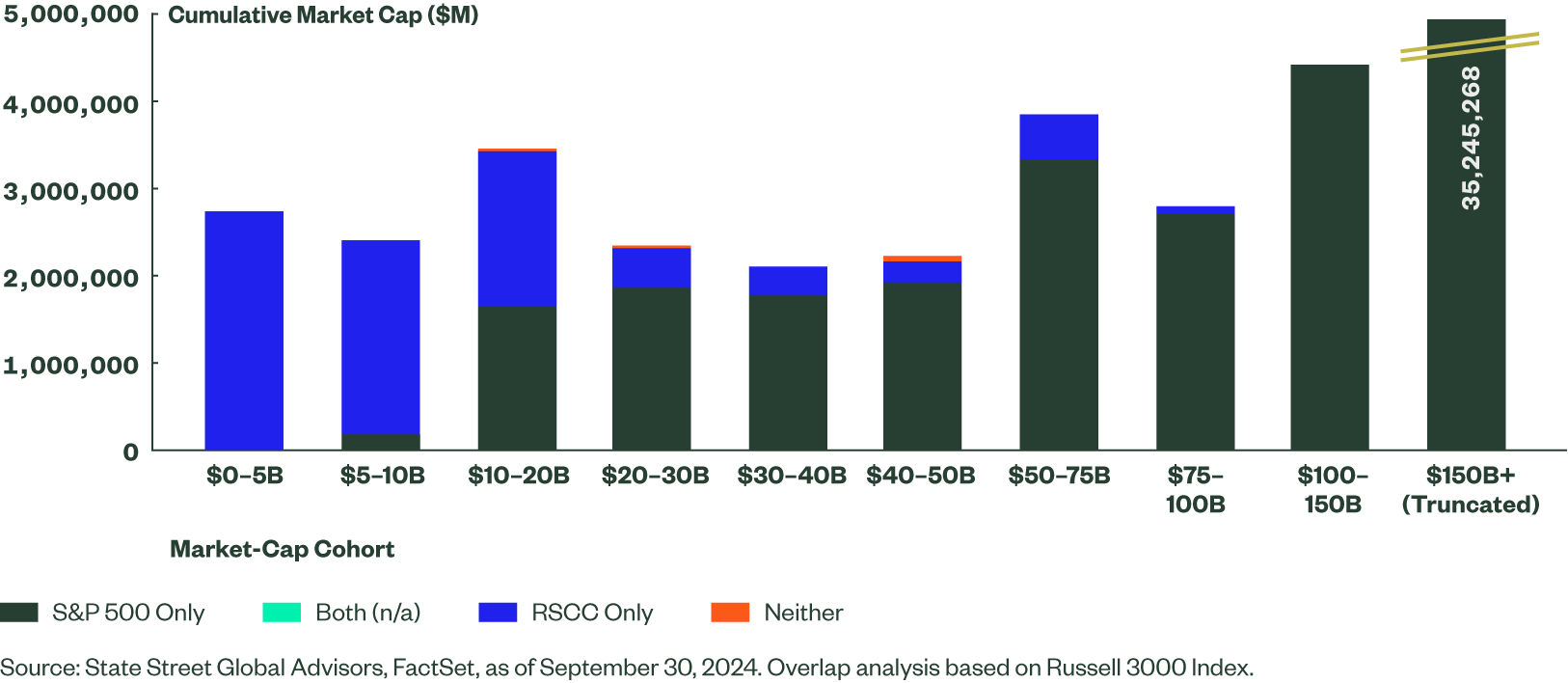

The charts below (Figure 1) show the difference in exposure when pairing the S&P 500 with the Russell Small Cap Completeness versus the Russell 2500.

Figure 1a: Gaps and Overlaps with the S&P 500

S&P 500 and Russell 2500

Figure 1b: Gaps and Overlaps with the S&P 500 Index

S&P 500 and Russell Small Cap Completeness

As the charts show, the Russell 2500 has more gaps and overlaps with the S&P 500 compared to Russell Small Cap Completeness. Using the Russell 2500 means an increased likelihood that you either have no exposure to some segments of the market or you may have even more exposure than you thought For instance, there are 68 names that are held in the Russell Small Cap Completeness that are not in the Russell 2500 or in S&P 500. The weight of these names total roughly 3.2% of the Russell 3000 and 22.9% of the Russell Small Cap Completeness, so the impact could be quite significant. Many of these stocks are household names like Spotify and DoorDash. Conversely, there are 60 names held in both Russell 2500 and S&P 500. These overlaps account for approximately 10.1% of the Russell 2500 index. Several of these stocks are well known companies like Invesco and Ralph Lauren. In essence, the overweights and underweights created by pairing the S&P 500 with the Russell 2500 will add risk to participants’ portfolios by making bets on those gaps and overlaps.

If the goal is to manage risk and obtain full market exposure, the Russell Small Cap Completeness may allow investors to achieve this.

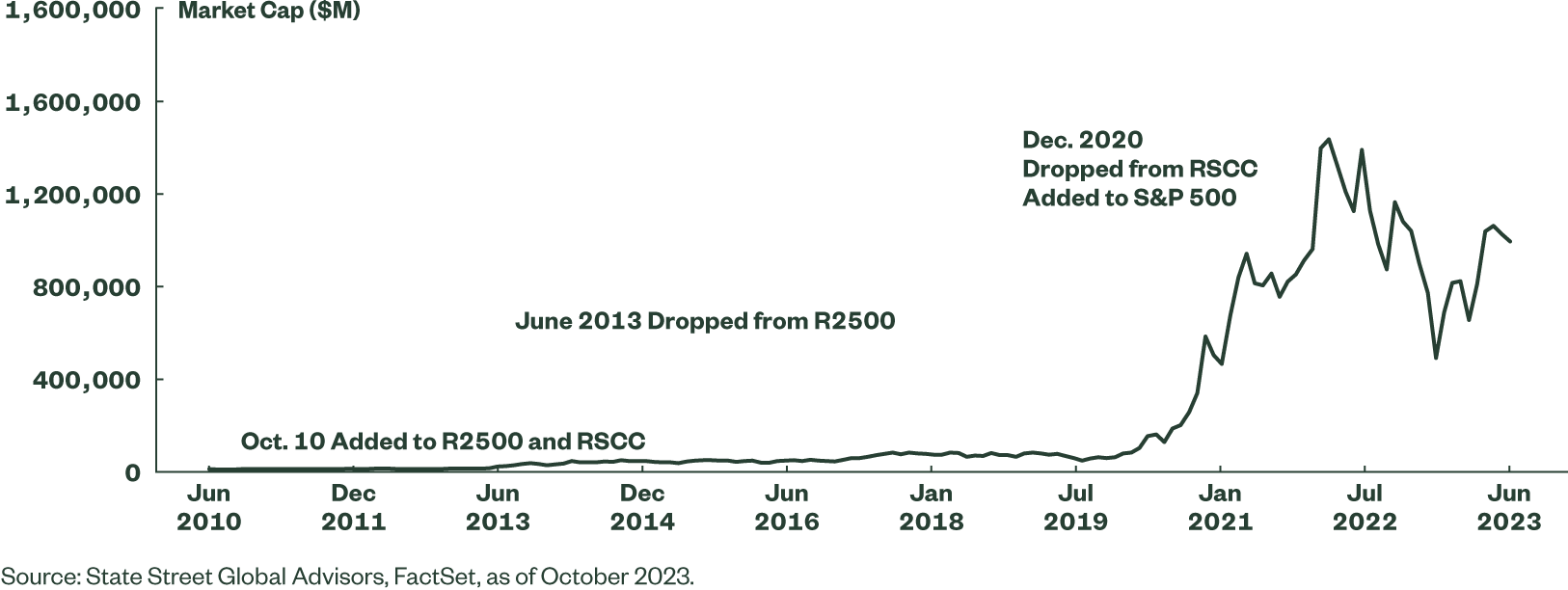

Tesla: A Case Study

Tesla, Inc. offers a notable example of how the gaps can have a significant negative impact. The electric car company was added to both the Russell Small Cap Completeness and Russell 2500 in October of 2010. It remained a constituent in the Russell 2500 until June 2013, when it no longer met the criteria to do so. It represented just 0.24% of the Index when it was removed. Because Tesla was part of the Russell 3000 but not part of the S&P 500 at this point, it remained in the Russell Small Cap Completeness Index.

As the company grew, its footprint in the Russell Small Cap Completeness grew along with it. Due to certain criteria, though, Tesla was not eligible to join the S&P 500 until December 2020, and the stock was removed from the Russell Small Cap Completeness at a weight of 6.94%. It was the largest stock to ever be added to the S&P 500 Index and was immediately a top ten name with a weight of 1.69%.

As a result, investors who paired the Russell 2500 and the S&P 500 for their SMID exposure missed out on Tesla stock returning 2,866% performance from July 2013 to December 2020.

Figure 2: Tesla’s Market Cap and Index Inclusion

Tesla's Inclusion in Indexes

In absolute return terms, Tesla had a return of 421% when it was in the Russell 2500 Index versus 16,679% during its longer tenure in the Russell Small Cap Completeness Index.

Figure 3: Tesla Over 60 Times Contribution to Return in RSCC Relative to R2500

| Index | Dates Included in Index | Weight at Inclusion | Weight at Removal | Return During Index Inclusion | Contribution to Return (From Date of Inclusion Until Removal) |

| Russell Small Cap Completeness | Oct 1, 2010 — Dec, 18, 2020 | 0.01% | 6.94% | 16,679% | 12.01% |

| Russell 2500 | Oct 1, 2010 — Jun 28, 2013 | 0.01% | 0.24% | 421% | 0.19 |

Source: State Street Global Advisors, Factset, as of October 2023.

While Tesla offers a dramatic example of ‘gap risk,’ this scenario could occur with any stock that does not fall in the range for Russell 2500 while simultaneously not qualifying for the S&P 500 Index. Or conversely, if a participant has a larger weighting than intended in a stock due to overlap, and that stock underperforms, that adds another layer of unexpected risk that could be avoided with the methodology used by Russell Small Cap Completeness.

Conclusion

Investors have countless choices as to how they want to construct their overall portfolio. While there are many considerations in the decision-making process, it is important to take existing holdings into account as part of the asset allocation. When paired with S&P 500, Russell Small Cap Completeness may be superior to Russell 2500 if an investor’s goal is to manage risk and obtain full market exposure. The S&P 500 and the Russell Small Cap Completeness complement one another and minimize risk by providing full market exposure without gaps or overlaps.

Contact us if you’d like to have a conversation with a DC Strategist about optimizing US SMID-Cap exposure.

Appendix

Figure 4: Russell 2500

| Index Characteristics | Russell 2500 | Russell Small Cap Completeness | Russell 3000 |

| Average Market Cap (in billions) | 7.821 | 15.400 | 869.505 |

| Median Market Cap (in billions) | 1.486 | 1.494 | 2.232 |

| Largest Stock by Market Cap (in billions) | 51.79 | 86.055 | 3488.475 |

| Names in the Index | 2,468 | 2,476 | 2,978 |

Source: Russell as of October 31, 2024.

Figure 5: Russell 2500

| Top 5 Holdings | Index Weight |

| Smurfit Westrock PLC | 0.40 |

| EQT Corporation | 0.34 |

| EMCOR Group, Inc. | 0.32 |

| Lennox International Inc. | 0.30 |

| Packaging Corporation of America | 0.30 |

| 1.66 |

Source: Russell as of September 30, 2024.

Figure 6: Russell Small Cap Completeness

| Top 5 Holdings | Index Weight |

| Apollo Global Management Inc | 0.91 |

| CRH Public Limited Company | 0.89 |

| Marvell Technology, Inc. | 0.86 |

| Spotify Technology SA | 0.75 |

| Workday, Inc. Class A | 0.72 |

| 4.13 |

Source: Russell as of September 30, 2024.

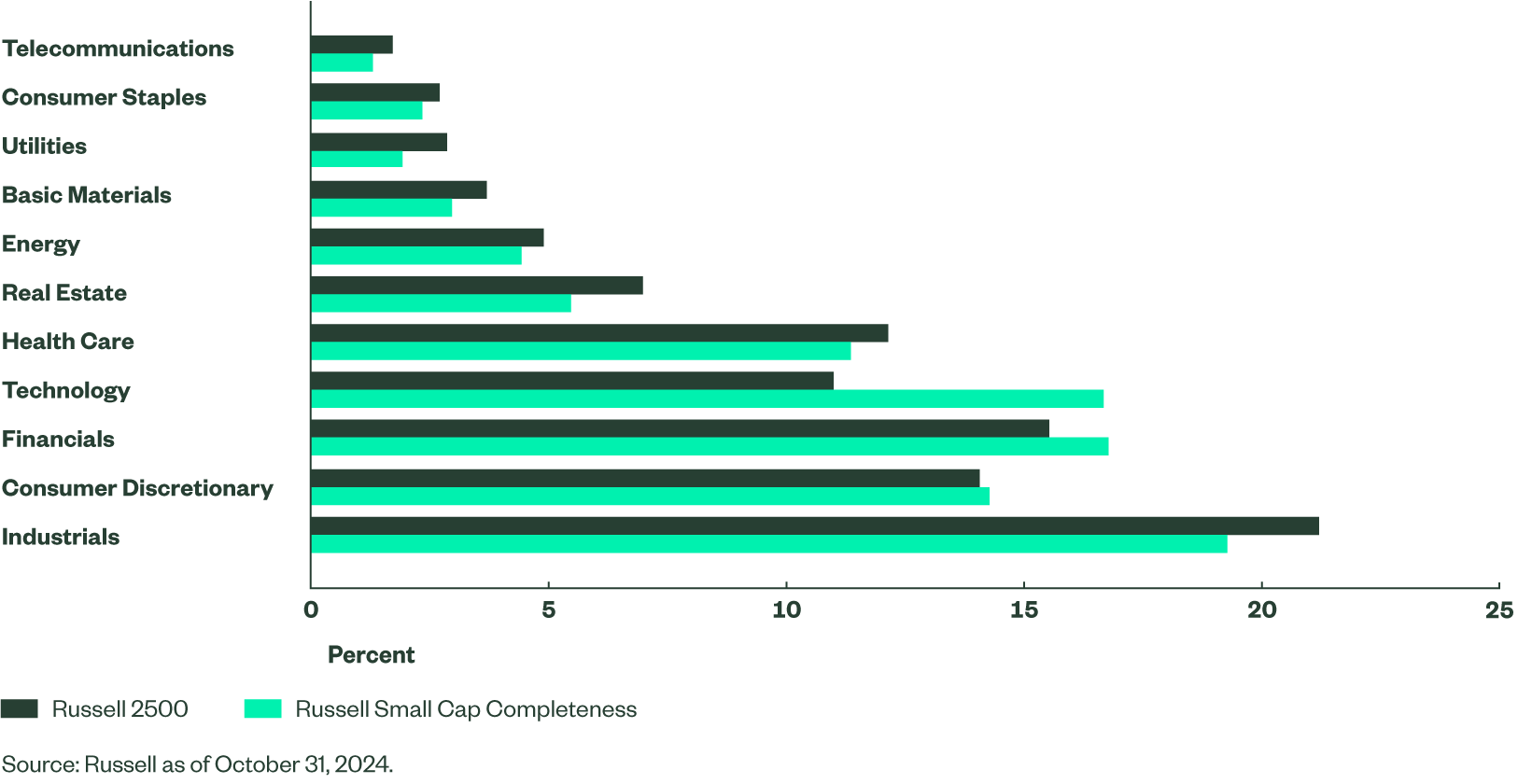

Figure 7: Sector Weights (%)

Figure 8: Performance

| YTD | 1Y | 3Y | 5Y | 10Y | |

| Russell Small Cap Completeness | 12.95 | 38.04 | 0.21 | 10.95 | 9.54 |

| Russell 2500 | 10.27 | 33.08 | 1.51 | 9.81 | 8.92 |

Source: Russell as of October 31, 2024. Index returns reflect capital gains and losses, income, and the reinvestment of dividends. Index returns are unmanaged and do not reflect the deduction of any fees or expenses.