Elections Extend US Dollar Strength

President-elect Donald Trump’s victory bolstered investor expectations of robust US growth and higher yields given his emphasis on fiscal stimulus and deregulation, while tariff threats also support the USD. Tactically, we are now positive on CAD.

Similar to the previous month, the currency markets were fueled by relative growth and yields in November. Of the two, growth is likely more significant, as it serves as the primary determinant of monetary policy and yields now that inflation is under control.

However, the narrative is less straightforward than in recent months, as the risks of high tariffs and a potential trade war — imposed by the incoming Trump administration — are likely to have a greater impact on currency markets going forward. We expect a more modest and gradual approach than President-elect Trump promised on the campaign trail.

The net result is prolonged US dollar strength, supported by superior growth, higher yields, and its appeal as a safe haven. Broad dollar indices have already tested — and briefly surpassed — the October 2023 high and could approach the 2022 high if aggressive tariff policies or substantial fiscal stimulus through tax cuts materialize.

In Europe, ongoing growth struggles, lower short-term yields, and regional political risks weigh on the euro, Swiss franc, Swedish krona, and, to a lesser extent, the British pound, which benefits from greater yield support. The Australian dollar appears more attractive, with the Reserve Bank of Australia (RBA) likely to hold rates at appealing levels well into 2025, supported by stable — albeit lackluster — growth and sticky inflation. However, it is difficult to see an Australian dollar rally amid disappointing Chinese stimulus and the threat of substantial US tariffs on China.

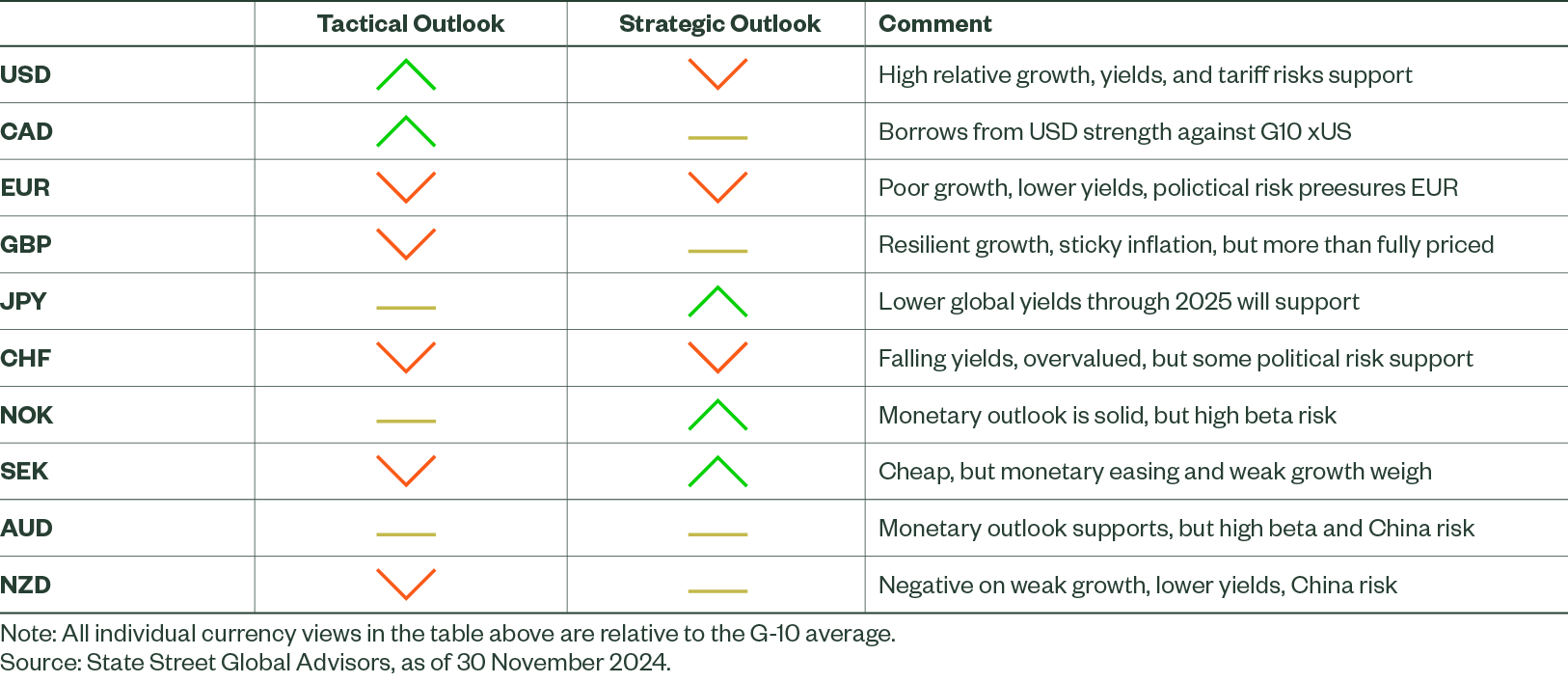

Figure 2: November 2024 Directional Outlook

The yen is perhaps better positioned for outperformance, especially against European currencies, as the Bank of Japan (BoJ) gradually raises rates while maintaining some safe-haven appeal. That said, a significant yen rally against the US dollar is likely delayed due to higher US yields and a stronger growth outlook. We prefer expressing a long position in the yen versus the Swiss franc.

US Dollar (USD)

Trump’s victory extends the positive US growth and yield dynamic in the eyes of investors due to his focus on deregulation and tax cuts — including the extension of prior tax cuts and the potential for additional reductions. Meanwhile, growth in the United Kingdom (UK), European Union (EU), and China continues to soften.

The risk of the Trump administration implementing aggressive tariffs also supports the dollar, though for less favorable reasons. While the dollar already reflects a fairly optimistic outlook — and we anticipate periodic corrections, as observed in late November — we believe the dollar will remain resilient with an upward bias. Given the strong fundamental outlook, it remains a challenging prospect to sell the dollar.

Our longer-term views remain unchanged. We have consistently maintained that the US dollar is likely to decline by at least 10–15% over the coming years as US yields and growth revert toward the G10 average and the country grapples with high fiscal and current account deficits. If historical patterns hold, any Trump-led stimulus is likely to accelerate the build-up of US debt, which could result in a more challenging long-term outlook for the US economy, corporate earnings, and the dollar. For investors with a horizon of two or more years, we strongly recommend short US dollar positions.

Canadian Dollar (CAD)

Our tactical view on the Canadian dollar remains mildly positive. While we expect the currency to underperform against the US dollar, it appears stronger relative to other G10 currencies. Current growth indicators are weak but stabilizing, and the dovish monetary policy outlook is well priced into interest rates and foreign exchange markets. Notably, we anticipate the Bank of Canada’s (BoC) more aggressive pace of rate cuts to support a growth recovery in second half of 2025. Because the BoC cut rates earlier and faster than most other central banks, it is likely to see the benefits of those cuts sooner.

Ongoing threats of US tariffs remain a concern but seem avoidable, as they are linked to demands for better control of illegal border crossings — a matter the Canadian government can address. The positive shift in our US dollar outlook should keep USD/CAD at or above 1.40 in the near term. Against non-US dollar crosses, which are also struggling to improve growth, the Canadian policy and growth outlook appears more favorable. Additionally, pessimistic investor positioning on the Canadian dollar could provide further support against non-US dollar currencies over the next several months.

Euro (EUR)

We remain negative on the euro both in the tactical and long-term horizons. Despite decent Q3 gross domestic product (GDP) growth of 0.4% QoQ, economic data has softened to start Q4, with weaker-than-expected consumer activity in Germany and downside surprises in both manufacturing and services PMIs. Household balance sheets are strong, and unemployment remains historically low, which is positive.

Political uncertainty, with a snap election scheduled in Germany and budget disagreements in France, is likely to further undermine the government, damaging both consumer and business confidence. Trump’s victory in the US presidential election adds another layer of political risk, given his threats of 10–20% tariffs.

As inflation falls, growth falters, and political risks loom large, the euro is in a very tough spot. Not only do we see near-term headwinds, but our long-term fair value model also suggests that the euro is expensive relative to most G10 currencies, except the US dollar and Swiss franc.

British Pound (GBP)

We retain a negative tactical view on the pound in response to weakness in our economic factor model and poor relative local equity market returns. The pound’s strong performance this year, combined with a deceleration in economic data —especially relative to expectations — suggests that a fair amount of good news is already priced in, at least relative to the dismal expectations at the end of 2023. While absolute growth levels have been acceptable, they are lackluster and trending lower. The autumn budget was expansionary over the medium term, but the higher payroll taxes to finance the National Health Service may weigh on hiring and investment in the near term.

The BoE is likely to remain on hold in December; however, we see a skew toward larger-than-expected BoE rate cuts over the next six months due to the potential near-term tax drag, in addition to the recent deterioration in growth data.

Our long-term valuation model offers a more positive outlook for the pound, as it screens as undervalued relative to fair value. However, sticky inflation and persistently weak potential growth post-Brexit are likely to weigh on fair value, limiting the currency’s upside potential over the next several years.

Japanese Yen (JPY)

We maintain a positive outlook on the yen, albeit less strongly against the US dollar. A 145–155 range for USD/JPY appears likely for the remainder of the year, driven by the uptick in US rates and growth. Where the exchange rate trades within this range will largely depend on US employment and inflation data in early December, as well as the Federal Reserve's economic projections in its December update.

Looking beyond the short term, we anticipate further yen strength, with USD/JPY moving toward 135–140 by the end of 2025. This projection aligns with an expected 25–50 basis point increase in Japanese policy rates and approximately 100 basis points of rate cuts from the Federal Reserve throughout the next year.

In the event of a recession, the yen could easily trade well into the 120s against the dollar, with even greater gains against higher-beta, commodity-sensitive currencies. Altogether, these factors position the yen as one of the most attractive currencies in the G10 over the next 12–18 months.

The primary risk to this outlook is a broad reacceleration of US and global growth and inflation. Even under such circumstances, while the yen may face challenges against the US dollar, it is likely to outperform currencies from regions with weaker growth, particularly in Europe.

Swiss Franc (CHF)

We remain negative on the franc over the tactical and strategic horizons. The franc is the most expensive G10 currency according to our estimates of long-term fair value, has the second-lowest yields in the G10 (likely the lowest by June 2025), and core inflation is the lowest in the G10. Meanwhile, the real trade-weighted franc remains at the upper end of its 30-year range, and the Swiss National Bank (SNB) is cutting rates.

We expect the SNB to become more amenable to direct currency market intervention to weaken the franc once the policy rate reaches 0.50%, likely by March 2025. Given that a significant portion of the inflation undershoot is directly linked to franc strength via import prices, we believe it makes sense for the SNB to shift its focus from rate cuts to a weaker currency policy. Overall, we see the franc transitioning toward a prolonged reversion down to our estimate of its long-term fair value.

Norwegian Krone (NOK)

Our tactical model signals have shifted to neutral relative to the G10 average, reflecting improved local equity market performance. The krone remains historically undervalued compared to our fair value estimates and is supported by steady long-term growth potential and a strong balance sheet. In the near term, however, we expect NOK to remain volatile and directionless as oil markets grapple with declining tensions in the Middle East, potential increases in OPEC+ production, and ongoing policy uncertainty in Europe and the US.

Swedish Krona (SEK)

Our tactical signal for the krona turned slightly negative during November, largely due to underperformance in Swedish equity markets. Weak equities, rapid monetary easing, and a deteriorating EU growth and political outlook suggest further downside risks for the currency.

On a brighter note, Sweden's economic outlook has improved, supported by stronger retail sales and better-than-expected Q3 GDP growth. Moreover, the Riksbank's aggressive easing measures lay the foundation for a more robust growth trajectory next year as monetary stimulus takes effect. The krona remains significantly undervalued relative to its long-term fair value and cyclically depressed. As global growth stabilizes and yields decline with the Federal Reserve and other central banks ramping up easing efforts, the krona has substantial room to recover. Consequently, while we remain slightly negative on the krona for now, we anticipate a more optimistic outlook later in 2025.

Australian Dollar (AUD)

Our tactical models remain neutral on the Australian dollar. Growth challenges in China, the absence of concrete fiscal stimulus from Chinese policymakers, and the potential for significant US tariffs on China pose barriers to sustained currency strength. On the positive side, while growth remains lackluster, it is stable, supported largely by robust government expenditures. The RBA's decision to hold rates and the fact that inflation remains above target provide yield support, particularly relative to the more dovish policies of the ECB, Riksbank, and Bank of Canada.

The Australian dollar’s depressed valuation offers a cushion, likely reflecting growth risks and tariff concerns, which should help limit further downside. Longer-term prospects are mixed. The currency is undervalued relative to the US dollar, British pound, euro, and Swiss franc, offering room for appreciation. However, it remains expensive against the yen and Scandinavian currencies.

New Zealand Dollar (NZD)

Our tactical model remains negative on the New Zealand dollar, though the signal has improved from being the weakest in the G10 last month to the fifth weakest, largely due to better local equity market performance. The benefits of New Zealand’s traditionally high yields are rapidly eroding as the Reserve Bank of New Zealand (RBNZ) continues easing monetary policy amid disinflationary pressures and near-recessionary conditions. Any residual yield advantage is likely to be offset by persistent growth challenges and a weak external balance, with the current account deficit at -6.7% of GDP. Additionally, risks of a US-China trade war pose a headwind for the currency, given China’s significance as a key trading partner.

While we believe the RBNZ’s rate cuts are necessary and beneficial in the long term, the positive effects will take time to materialize. Until then, the outlook for the New Zealand dollar remains challenging. Longer-term prospects are mixed. Our estimates of long-run fair value suggest the currency is undervalued against the US dollar and Swiss franc, offering potential for appreciation. However, it remains overvalued relative to the yen and Scandinavian currencies.