China’s Latest Stimulus: Boosting Price, not Earnings

The PBoC this week announced another round of stimulus. The focus on the equity market is new and has the potential to drive a short-term rebound in Chinese stocks.

On September 18, the US Federal Reserve (Fed) delivered an outsized 50 basis points (bps) rate cut and signaled convincingly that more cuts are coming. The US equity market responded enthusiastically. Now, the benefits are spreading overseas. In what we strongly believe was no simple coincidence, Chinese authorities, namely the People’s Bank of China (PBoC), this week announced another round of stimulus to support its economy and equity market. The focus on the equity market is new and has the potential to drive a short-term rebound in Chinese stocks.

However, the actions simply target the “P” (price) component in the price-to-earnings (P/E) debate, while doing little for “E” (earnings). Unless the earnings part of the equation changes on a sustainable basis and more investor-friendly policies are adopted, a sustained repricing of Chinese equities will remain difficult to achieve. This is not to say that there is no compelling value in select Chinese equities, but we believe it requires active management to harvest it effectively. Gold may emerge as the unintentional winner amid these policy moves.

Summary of Policy Actions

Below are the key actions taken by the PBoC this week:

- 20 bps cut in 7-day reverse repurchase rate to 1.5%

- 30 bps cut in medium-term loan facility rate (MLR) to 2.0%

- 50 bps cut to reserve requirement ratio (RRR); further 25-50 bps cuts possible later this year. Reductions will not apply to small banks

- 50 bps cut (on average) to rates on existing mortgages

- Cut in down payment requirement on second homes from 25% to 15%

- Increase in funding support ratio for housing relending program from 60% to 100%

- RMB800 billion (about $110 billion) preferential lending to support stock purchases and buybacks

- The possibility of a market stabilization fund was floated, but no details offered

Stimulus Injection Triggers

This announcement comes at a time of intensifying deflationary pressures in China, a telltale sign of insufficient demand. Money supply growth has been flashing disinflationary even pre-COVID but turned outright deflationary in 2023, and dramatically so of late (Figure 1).

This is not the sort of warning sign authorities anywhere can simply ignore. Action was needed, but had previously been doled out in a tentative fashion. This was because the extent of the deflationary signal was initially concealed by the global inflation surge following the COVID reopening. But growing reports of risks to the growth target and the Fed’s recent dovish pivot have finally allowed the rollout of more meaningful measures without too much fear of undue currency weakening.

Assessing the Policy Package

Will this approach work? The answer depends on how one defines the goal. We believe there will be a marginal lift to growth, possibly a visible (if short-lived) lift to market performance, but no change in the underlying trajectory on either front.

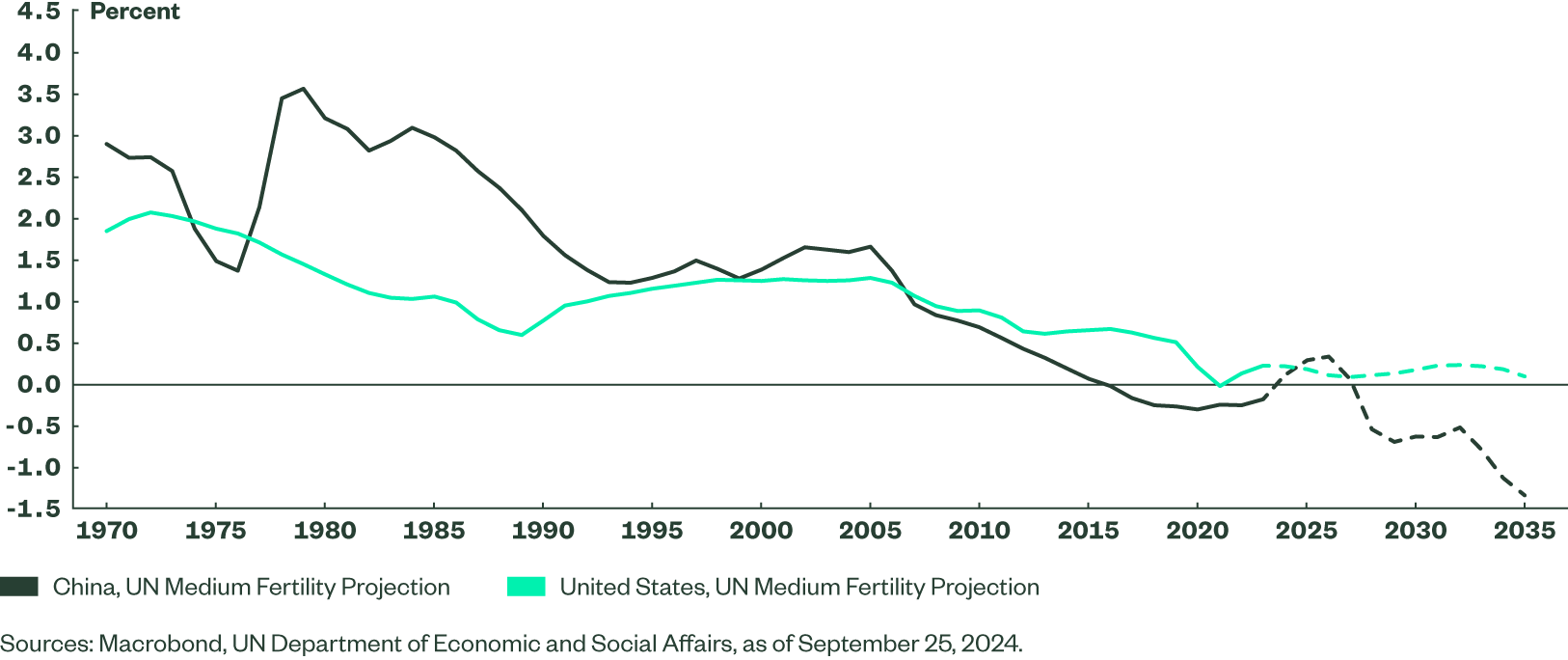

We believe strongly that China is no longer a 5.0% economy. There is simply no denying the gravitational pull of China’s worsening demographics (Figure 2). Incidentally, China recently approved plans to raise the retirement age for the first time since 1978, which we view as a bigger positive for long-term growth than this week’s package.

There is also no denying—even putting geopolitics aside—that the world is not growing fast enough to support the export-oriented growth pattern that China has relied on in the past. The sooner Chinese authorities recognize this reality, the better: There is little value in propping up an artificially elevated growth target.

Figure 2: Working Age (15-64) Population Growth

Given this, will the aforementioned measures boost growth? Marginally so, in our view. To put things in perspective, had the announcement been made before finalizing our forecasts last week, we would have likely lifted our 2024 growth forecast to 4.8% (from 4.7%, where it has stood since June) and the 2025 forecast to 4.5% (from 4.2% where it has stood since March).

Why not a larger impact? For the same reasons prior stimulus packages have had little effect. This is not a problem of insufficient liquidity; after all, Chinese households have one of the highest savings rates in the world. It is a problem of insufficient demand, and in turn, a problem of confidence. It had long been accepted as fact that housing demand in China was as much a function of investment demand as a function of genuine shelter demand. Nothing squashes investment demand faster, and more thoroughly, in our view, than repeated negative returns on that investment.

The Chinese government aims to convince people to get back into the housing market and seems surprised by their muted response. It should not be. The latest round of measures will likely speed up the process of digesting the supply overhang, but drive little to create genuinely new demand. There is even a risk that, having seen better terms with each new intervention, would-be buyers wait for even sweeter deals down the line. The reduction in the mortgage rate for outstanding mortgages is significant, but the savings are as likely to be tucked away as they are to be spent.

Potential for More Meaningful Impact on Equities

Measures aimed at the equity market represent a new element and could prove more visibly helpful. Chinese policymakers are currently willing to offer up public funds to help finance stock purchases. If one doesn’t want to “fight the Fed,” one also probably doesn’t want to “fight the PBoC.”

That being said, this liquidity injection can lift the “P” (price) in the P/E discussion, but does nothing to sustainably increase the “E” (earnings). Unless this dynamic changes on a sustainable basis, it will be difficult for China’s equity market to close the underperformance gap to global peers (Figure 3).

The Bottom Line

The stimulative growth effect of the September 24 stimulus measures is modest. Their range, however, betrays a renewed sense of urgency in addressing the challenges (further contours of which were outlined on the 26th). This suggests more may be in store, perhaps in the form of substantial fiscal stimulus. But not all fiscal stimulus is created equal: The “what?” and “how?” matter just as much as the “how much?”.

Ultimately, the Chinese government must recognize that it is difficult to deepen domestic capital markets while also curtailing the growth of certain sectors, aggressively investigating private sector leaders, and capping the scope of achievable returns. China may have a massive domestic capital pool, but even the largest countries benefit from foreign capital and the innovation and creative forces that usually accompany it. That capital, however, demands certain protections and guarantees, presently not fully in place in China.

This is not to say that there is no compelling value in select Chinese stocks; there most certainly is. Harvesting that value effectively requires active management at this juncture. For the near term, the rising tide of stimulus may lift all Chinese equity boats, but beyond that, a more discerning approach is needed. Gold may be the unintentional winner in this current environment.