Back to the Futures: How Derivative Pricing Can Impact Index Funds

In this piece, we discuss how index futures contracts are used in the portfolio management process for indexed equity strategies, and we explain how their use has changed as a result of higher interest rates.

During the Fed’s recent tightening cycle, market participants extensively discussed the impact of higher policy rates on fixed income instruments such as money market funds and fixed rate mortgages. However, there has been less discussion around how pricing in the futures markets has increased alongside higher rates, which has driven up costs for equity index managers who use futures as an instrument to invest excess cash. As a result of the rise in futures pricing, it has become even more important that asset managers are deliberate in their decisions for cash: how much to hold, how much to equitize using the futures market, and how much to sweep into other liquid assets, among other considerations.

Background: The Use of Futures Contracts in Index Portfolio Management

State Street Global Advisors provides daily liquidity to thousands of clients buying and selling units of our indexed equity products. However, if we were to buy and sell individual equity securities every time we received trade orders from clients, we would generate excessive transaction costs and cause market impacts that would drag down fund performance. Instead, portfolio managers will typically try to keep 1-3% of the portfolio in cash or cash equivalents at any given time in order to satisfy client transactions without unnecessarily trading the portfolio. However, this could negatively impact fund performance because in a bull market for equities, the return on cash will likely be lower than the return on equity securities. In order to mitigate the impact of cash balances, portfolio managers will typically seek to “equitize” the cash balance by buying equity index futures, which effectively provides that cash with index exposure until the contract expires at a future date.

At this expiration date, most index managers tend to roll into a new contract as they will always need to maintain cash balances and find ways to equitize it. There are explicit costs associated with futures execution such as exchange fees, execution fees and clearing commissions; however, these costs are low compared to equity trading costs.

Equity Index Futures Contracts Explained

Index futures, a type of derivative exposure, is the most popular and arguably the cheapest method of obtaining synthetic exposure. Futures typically have standardized monthly or quarterly contracts trading on major exchanges (CME, ICE and EUREX) and are guaranteed by a clearing house, thus exposing investors to minimal credit or counterparty risk. Equity index futures are futures contracts on equity indices that are cash settled and that allow traders to buy or sell a contract that is derived from a financial index today, to be settled at a future date. Equity index futures are listed contracts, which means they can be traded on an exchange and are much more liquid than an unlisted or over-the-counter “OTC” contract, which typically occurs via a transaction with a single counterparty. An equity index futures contract allows you to gain exposure to a particular market index such as the S&P 500 or Russell 1000 without directly buying the underlying securities or paying for that exposure above margin requirements.

How Policy Rates Can Impact Futures Pricing

Understanding the Calculations

Index futures prices are a function of the price of the underlying index, the expected dividend yield of that index and the current risk free rate (Figure 1). However, it is rare to see traded futures prices actually equal to a calculated futures price.

Figure 1: Futures Price Calculation

The traded futures price is often above or below the initially calculated price because the risk-free rate is not static. Separately, the expected dividends provided by the index provider might not be what the dealer community has calculated. (The dividend difference is almost always very minimal so this only plays a minor factor in the pricing difference.) The rate difference is a major factor in the pricing difference and is a product of supply and demand.

As the contracts trade, when a dealer is asked to build a futures contract for a client, they need to lean on their treasury and borrow the money needed to hedge the risk related to possible changes in the price of the underlying index. This borrowing rate—called the implied rate—is then passed on to the buyer of the futures contract and used to calculate the futures price instead of the risk-free rate.

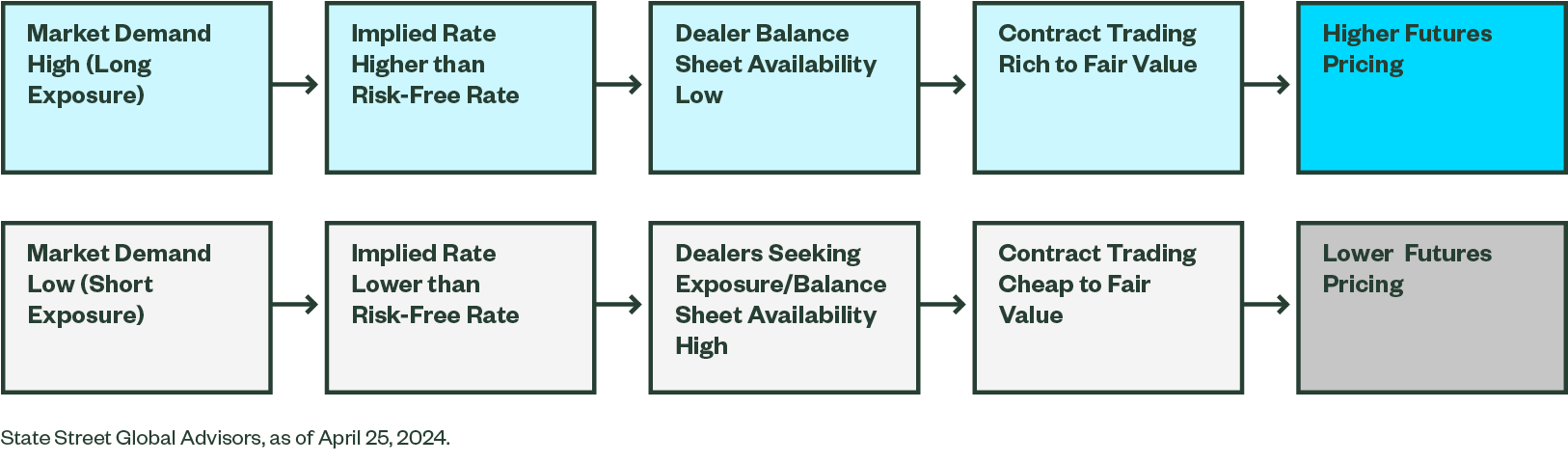

Supply and demand determines this borrowing rate. If a dealer has a higher number of clients wishing to purchase contracts, then this borrowing (implied) rate increases, and the calculated future price is also higher. By contrast, if the buyers’ asks for long and short exposure are the same, they can net off on the dealer’s balance sheet, and the implied rate will be near the risk-free rate (Figure 2).

Figure 2: Supply/Demand for Futures Contracts Determines Calculated Pricing

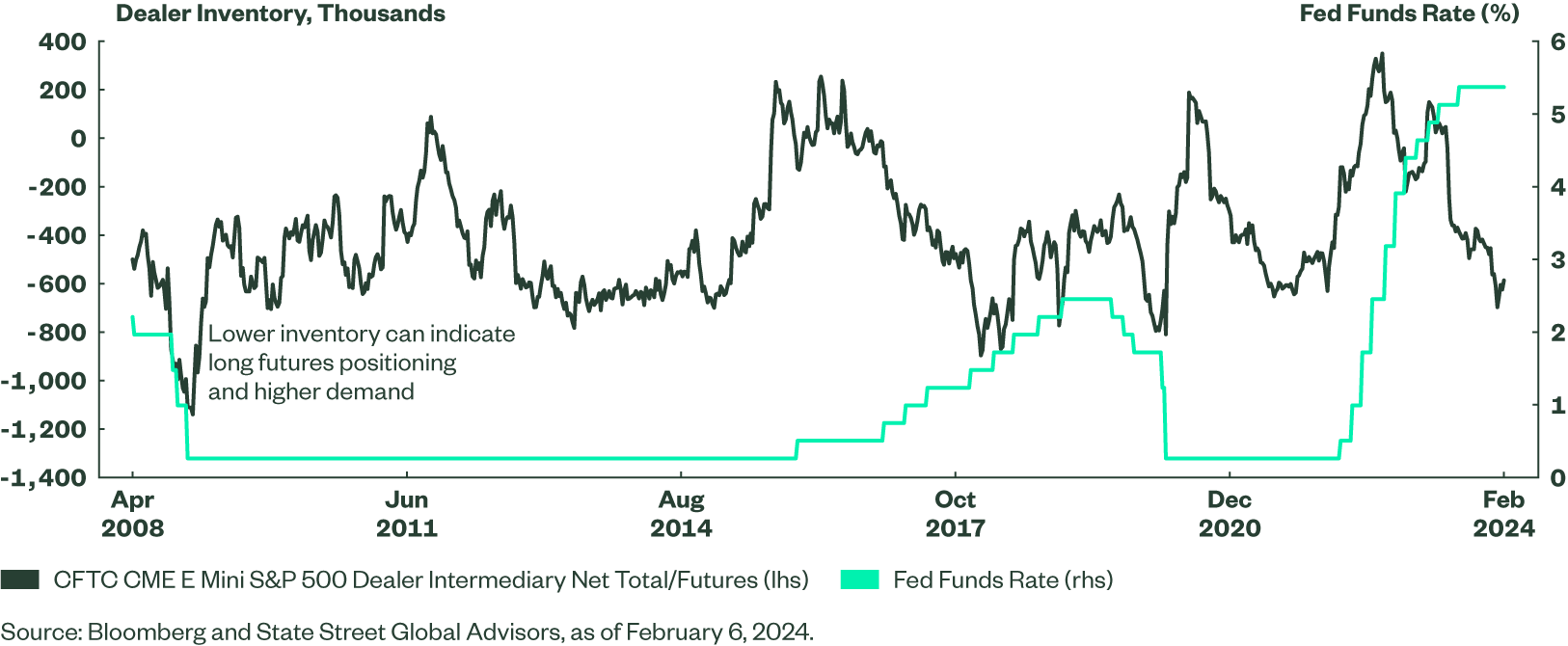

Figure 3 overlays dealer balance sheet data (net S&P futures positions held by dealers) with the implied futures rates of S&P 500 futures contracts. For the balance sheet data, more negative means more futures sold (i.e., a market with long positioning). Figure 3 also shows Fed policy rates post-GFC to current.

Figure 3: Policy Rates Are a Key Component of Futures Prices

Beyond Supply and Demand: Buying on Margin

Another way that rates impact futures pricing is related to cash flow. When purchasing a futures contract, a buyer typically only posts (in cash) an average of 5% of the exposure on margin. Therefore, they have that remaining 95% available until the contract expires. The whereabouts of the other 95% is meaningful; it is reasonable to assume that it could be posted into a money-market or interest-earning account.

The challenge is that if futures pricing rise, the rate received from the money market fund could be lower than the implied rate in the futures contract; in other words, the futures price could exceed what’s being earned in the money market account. For example, if the implied rate on the futures contract is 5.80%, but the interest rate being earned on non-margin cash is only 5.30%, then the buyer would pay for that “richness”—quantified as 50bps over funding levels (paying 95% times 5.80%, while earning 95% times 5.30%). If an account does nothing with the non-margin cash, then the buyer could pay the full 580bps of richness. On the other hand, if the implied rate of the futures contract is below the rate of where the cash is invested, then the futures contract seller be paying that difference.

The Relationship Between Implied Rates and Dealer Balance Sheets

In general, higher availability on dealer balance sheets (e.g., lower demand) correlates with lower futures pricing (implied rates). However, this relationship can change with dramatic shifts in central bank action. For example, in 2015, the Fed started its hiking cycle. Dealer balance sheets were still near-0, but implied rates were ticking higher because of increased reference rates (Figure 3). This situation continued until 2016, when the higher rates were met with increased positioning.

From 2017 to 2019, the typical relationship held, as balance sheets were building (supply/demand in futures rose), while the implied rate started to tick higher. Positions continued to build until the pandemic in March 2020, when policy rates fell, decreasing the reference rate. At the same time, positioning fell, and implied rates declined. Indeed, positioning briefly crossed zero into investors being net short futures. Then, in 2022, futures positions were falling again, but nonetheless implied rates increased, as policy rates began to rise dramatically.

This brings us to 2024, when rates remain elevated. At the same time, dealer positioning is very stretched (i.e., there is significant demand for futures exposure). This creates a perfect storm in which interest rates are at their peak, positioning is near its highest (supply availability is low), and implied rates are also high (Figure 4).

Figure 4: Current Market Trends Point to Elevated Futures Prices

| Trend | Pressure on Futures Pricing |

| Dealer Balance Sheet Availability: Very Low | Upward |

| Policy Rates: Near Peak Levels | Upward |

| Implied Rates: Elevated | Upward |

Source: State Street Global Advisors, as of April 16, 2024.

Adapting Our Approach

As mentioned, portfolio managers will typically seek to maintain a cash balance of 1-3% in allowable funds in order to satisfy every day portfolio costs as well as to meet potential client redemptions. This cash is effectively given market exposure through futures contracts that most closely align with the index that th fund is seeking to replicate. Given the increase in cost to equitize cash, portfolio managers (PMs) now need to be much more thoughtful in determining the optimal amount of cash to keep on hand. While increasing interest rates certainly can impact a PM’s decision about how much cash to keep in the fund, the need to maintain a cash balance is still extremely important to the investment process, and so a balance must be struck.

Alternative Cash Management Tools

Notably, rising rates have increased the cost of futures contracts used to equitize cash, but it has also increased the yield that can be earned on the cash itself. When possible, portfolios will sweep any cash positions into interest bearing vehicles. At State Street Global Advisors, we have multiple options that provide diversified, liquid, and low risk solutions similar to money market funds that allow cash to earn a yield while serving as collateral for the futures contracts used to equitize it.

Furthermore, PMs can consider alternative means of cash equitization through instruments such as ETFs (Exchange Traded Funds), P-Notes (Participatory Notes), and Total Return Swaps. Each of these alternatives also come with their own costs and benefits, but these can be viable tools for achieving the same results as futures. PMs are continuously reviewing those options and ascertaining which is the most appropriate vehicle for each fund on a case-by-case basis.

To summarize, our Index Futures investing approach is as follows, on a portfolio-by-portfolio basis:

- Identify optimal amount of cash required to keep on hand

- Determine most appropriate mechanism to equitize cash

- Ensure any cash on hand is swept into an appropriate interest baring account to offset costs of cash equitization

The Bottom Line

Rising rates have impacted equity index portfolio management, as the cost of index futures contracts used to reduce cash drag has risen. State Street Global Advisors PMs seek to identify the optimal amount of cash to keep on hand. In addition, they take a collaborative approach to interfacing with trading counterparts to determine the most efficient, as well as low-cost, vehicles and implementation for cash equitization.