2024 Midyear Global Market Outlook

Risk assets have proved resilient in 2024, although the anticipated bond bounce has not yet materialized. Rate cut expectations have been trimmed amid persistent inflation but we maintain our soft landing forecast. However, risks for investors warrant attention.

Since we published our Global Market Outlook (GMO) in December 2023, risk assets have remained resilient in the face of increased uncertainty, powering ahead despite stickier-than-expected inflation and a deepening Middle East conflict. Meanwhile, bond markets, regarded as the likeliest winner for 2024, have struggled as inflation lingered, spawning “higher for longer” concerns. We continue to see fixed income as a bright spot for investors given current yield levels, slowing growth, and continued disinflation. We remain cautious on risk assets and favor quality stocks in equity markets. We continue to believe emerging markets will remain vulnerable given the global landscape, but do see pockets of opportunity within emerging market debt and select emerging market equities.

Our outlook for 2024 was a year of “Positioning the Pieces” as investors weighed multiple factors within the macroeconomic environment to assess how they converge. This picture has not shifted. We believe many factors remain in flux and investors should focus on right-sizing their positions and getting portfolio implementation right. Most importantly, we stress the need to retain flexibility to respond as clearer signals develop.

Macroeconomic Outlook: Finding Stable Ground for a Soft Landing

Headlines have been dominated of late by uncertainty around the future path of the US Federal Reserve’s rate decisions. Our stance has not changed since the start of the year. We believe disinflation will continue in the US and economic activity will be weaker this year relative to last year. A soft landing is still our base case scenario and we anticipate the Fed will be in the position as early as this summer to lower interest rates.

At the beginning of this year, we highlighted disinflation and slowing growth as being the two core trends, which in turn open the door to the next big trend — monetary policy easing. In the US, none of the three trends above has been fundamentally altered despite a string of hawkish inflation prints at the start of 2024. In fact, while the US did not participate much in the global slowdown in 2023, it looks increasingly poised to join it in 2024. We do not want to make too much out of the softer-than-expected first-quarter GDP report, but we note that our forecast is somewhat below consensus on US growth for the remainder of the year. We see broadening signs of momentum loss in consumer discretionary spending, expanding signs of erosion in labor demand, and widening signs that the big fiscal impulse to growth is beginning to fade.

This is by no means a negative story. In fact, it is a very good story of moderation, normalization, and getting to a soft landing. Moderation in demand facilitates moderation in inflation — both in labor and goods/services markets — and allows for rate cuts that preserve and nurture the soft landing.

Outside of the US, we look for the European Central Bank (ECB) to deliver a first cut in June, Bank of Canada in July, and Bank of England (BoE) in August. In Japan, we look for a 15 basis point hike to 0.25% in the latter part of the year.

Cutting Through the Noise

Noise in the data and idiosyncratic developments should not be mistaken for trend changes or permanent shifts in approach. Dramatic pronouncements about big changes in equilibrium variables, such as the neutral interest rate, should be avoided in a world still finding and defining the “new normal” following the unprecedented Covid-19 shock. Being open-minded makes sense, while rushing to conclusions does not. Naturally, there are risks to the outlook. Indeed, geopolitical risks loom large in one of the most momentous global election years on record. Yet risks to the baseline should not be conflated with the baseline itself. This is why we have reiterated our more dovish view on inflation and rates even as the market swung widely in the other direction.

Geopolitical Outlook: Risks Are Now Peaking

2024 was always going to be a turbulent year on the geopolitical front. US elections carry their own inherent policy risks that directly affect the world’s largest capital market and indirectly impact the majority of global public assets. This year’s elections are occurring against a backdrop of deeper rifts in the global order, several armed conflicts, fiscal headwinds, and protectionism.

As a consequence, the coming months will have a higher-than-normal threat of geopolitical shocks that affect markets. This election year comes amid a secular trend of continued global fragmentation, which has weakened traditional crisis stabilization mechanisms (i.e. international institutions and norms) that have managed conflict actors and exercised crisis management in recent decades. In short, the global order has frayed, and malicious actors have more room to maneuver in an election year than they might otherwise have.

The conflict and rising tensions in the Middle East represent a clear example of this trend. Notwithstanding some recent developments, skeptics may claim that a regional war has thus far been averted and make the argument that crisis containment is working. But this view understates the severity of actors breaking precedent and crossing new thresholds as witnessed with the October 7 Hamas attacks, Israel’s response, and Iran’s various interventions (both direct and via proxies). Crisis averted does not mean crisis resolved, and the escalation risk remains greater today than it did a few months ago.

Aside from the Middle East tensions, several other regions present the potential to reset risk perceptions. Foremost, the centrality of East Asia in the world’s global supply chain means that any headline risk could have an outsized market impact. For example, negative developments or events on the Korean Peninsula, in the Taiwan Strait, or in the South China Sea could suddenly upend risk sentiment even in the absence of a material economic event.

Are Markets Underestimating the Risk?

Against this backdrop, one might imagine this current acute phase of elevated risk to be reflected in global risk premia. Instead, standard gauges of risk such as the CBOE Volatility Index (VIX) remain below historical averages (Figure 2), and the cost of hedging against equity drawdowns, currency depreciation, or credit deterioration remains well below post-pandemic averages and close to the multi-cycle lows seen in 2023. The exception of late has been higher volatility in bonds and currencies and a sharp rise in demand for gold, the latter of which is also seeing a surge in demand from both Chinese state-backed bodies and retail buyers. In sum, as a growing trend of global fragmentation further reinforces the uncertain landscape, investors should prepare for volatility until such time as calmer times prevail. Geopolitical unrest is likely to continue impacting the commodity complex, further clouding upside-and-downside risks related to inflation.

Fixed Income Outlook: Phase Transition

While some aspects of fixed income markets have changed since the start of the year, much remains the same. Overall, bonds retain their place on center stage with impressive yields, abating (slowly) inflation, and a strong but slowing economy that has convinced the Fed that the next rate move will be lower. A similar picture is unfolding outside the US (with the exception of Japan), creating ample opportunities for global fixed income investors.

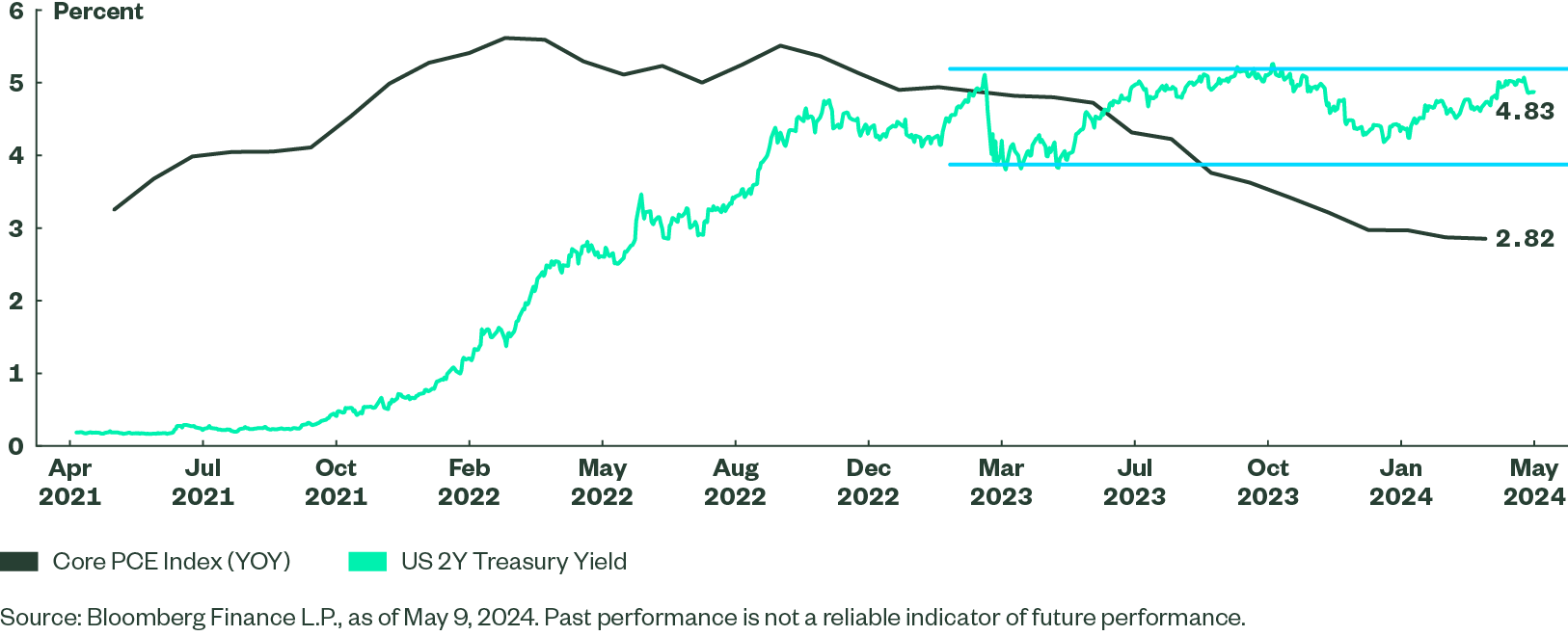

Separating the signal from the noise is critical in assessing fixed income data, and the level of noise can be an indicator of what type of regime we sit in. Increasingly divergent views based on inconsistent economic data can also cause difficulty in evaluating where markets are headed. Coming into 2024 on the back of lower inflation prints, expected cuts to the federal funds rate as early as March, and declining yields and spreads, two-year US Treasury yields fell close to 4% (Figure 3). As inflation metrics remained sticky in the first quarter, those yields retraced as expectations for Fed cuts declined and the timing was pushed back. Despite two very different narratives, and the associated headlines, two-year rates stayed range bound. This all describes a typical phase transition perfectly. Short-term trading and a fast-moving news cycle distract from the crucial question — where do we go from here?

Figure 3: Two-Year US Treasury Yields Remain in Range

The most likely paths that will drive an exit from this range-bound stage of the cycle have the potential to drive meaningful returns for investors given current rate levels. With no shortage of noise in the data, our view focuses on longer-term structural and cyclical factors pointing to moderating inflation and diminished growth. Cracks in the economic and business cycle remain a point of concern. Even with stickiness in the inflation data during the first quarter, the federal funds rate remains firmly in restrictive territory relative to the neutral rate (that we believe is now about 2.75%). This will impact business fundamentals, perhaps compounding an otherwise moderate slowdown. Additionally, the strength of the consumer could subside amid higher mortgage and credit card rates, while small businesses may struggle to borrow.

Our core view is that inflation will continue to moderate, allowing the Fed to implement a series of rate cuts that take short-term rates to more appropriate levels. But getting inflation back to the 2% target may not be necessary given recent signaling by the Fed that unemployment readings also matter. Whether the first rate cut occurs this summer — or how many rate cuts the Fed can squeeze in before the New Year — is ultimately less important than getting the direction right. For that reason, we maintain an extended duration position as our primary risk stance.

Outside of US Treasuries, corporate credit remains less attractive due to extremely rich valuations. We see more opportunities in emerging markets and structured credit such as mortgage-backed securities (MBS) and commercial mortgage-backed securities (CMBS). However, in both sectors investors must wade through real underlying fundamental considerations — for example, corporate real estate or China — warranting a prudent approach. Whether a soft or hard landing comes next, we remain confident that current rate levels offer attractive entry points for investors.

Equity Market Outlook: Challenges to Further Gains

Given our macroeconomic forecast and the current earnings picture, what is our outlook for equities for the remainder of the year? We began the year with a subdued outlook for equities but stock markets have maintained their incredible momentum. Record highs were reached in the US, Europe, and, most notably, Japan amid resilient economic data and robust corporate earnings. However, we believe moderation is still warranted. An ongoing decline in the equity risk premium, lofty valuations (especially in the US), and shifting expectations around interest rates could eventually temper enthusiasm. For the remainder of the year, we see a number of diverse drivers of global equity performance, and these drivers differ across the US, Europe, and Asia. Varied trends across regions suggest that there is a strong case for evaluating the opportunity set along geographic lines.

US Markets: Inflation Uncertainty Continues

The S&P 500 Index hit new highs before partially retreating in April as sticky inflation data prompted the Fed to “recalibrate” its thinking on the likely pace and magnitude of rate cuts. While we have concerns about higher yields and the ramifications of any misstep in earnings, equity markets have generally held up well due to improved economic data and some respite in May from hotter-than-expected inflation data. In fact, corporations are aggressively buying back stock and returning capital to shareholders as a result of higher margins, creating a catalyst for positive momentum. However, fewer rate cuts could spawn volatility along with the following side effects:

Decreasing Equity Risk Premium: As yields back up on higher-than-expected inflation prints, additional compensation is demanded for owning stocks over bonds. This in turn tends to put downward pressure on stock prices.

Weaker Earnings: While we have seen positive full-year EPS revisions, mainly in the technology sector, there are concerns that (1) restrictive monetary policy could dampen corporate earnings, partly because of the impact of high rates on consumer spending, and (2) evidence of margin compression outside the tech sector is emerging. Households are feeling the strain as debt loads have started to climb.

Our bias for growth stocks remains in place despite some strong performances in value-heavy sectors such as energy, financials, and industrials sectors. The best outcome for value would be where the cost of debt falls but without impairment to economic growth. In this scenario, should the equity market rally continue to broaden out beyond growth stocks, we would maintain our preference for higher-quality names and sectors.

European Markets: Still Looking for Sustained Growth

Europe’s performance since last October is impressive, but returns have still lagged the US in this period. We maintain a cautious stance due to mixed economic data, modest growth and negative earnings revisions so far this year. Europe’s economic and corporate fundamental picture has improved somewhat, with the eurozone composite purchasing managers’ index (PMI) back above 50 (indicating growth) in March and April. However, recent declines in retail sales and industrial production signal that growth remains fragile, raising questions over the robustness of fundamentals.

Profit margins continue to show resilience, but sales growth peaked in September and input costs have likely bottomed out, while more cautious consumers will inevitably hit earnings (Figure 4). Although the household savings rate is still relatively strong, and unemployment is hovering near record lows, the threat from a weaker consumer grows as the macroeconomic backdrop deteriorates.

The greater representation of cyclical companies in Europe means the region’s markets would also be impacted by slower economic growth should the ECB resist lowering rates ahead of other major central banks for fear of weakening the euro and thereby importing inflation. Stocks that meet the “quality” criteria are also less plentiful in the region with lower earnings growth expectations offsetting the relatively more attractive valuations.

Japanese Markets: The Reform Narrative Underpins Japanese Equities

The resurgent Japanese stock market saw the Nikkei 225 Index finally surpass its 1989 peak this year. A pick-up in Japanese inflation has allowed companies to lift prices, potentially boosting revenue and earnings, while rising wage costs may be offset by greater consumer propensity to spend. Increased government spending and export growth also underpin the case for Japanese equities. There have been some signs of profit-taking, but we note the following:

Investment Boost: The BoJ’s exit from negative interest rate policy in March along with shareholder-friendly policies could spur continued foreign investor interest. Japanese corporations with large cash reserves could reinvest in domestic growth opportunities in order to keep pace with inflation.

Earnings Revisions Uptick: Potential for positive earnings revisions due to higher interest rates and investment income, bolstered by a stronger US economy.

Corporate Governance Reform: The continuing Tokyo Stock Exchange drive to improve companies’ corporate governance and capital efficiency could help create higher-quality, more profitable companies and push the market towards more sustainable growth.

Even after Japan’s stock market surge, the tailwinds from governance reforms, share buybacks, and an expansion of tax-exempt retail schemes contribute to an investment backdrop worthy of attention.

Emerging Markets: The Strong Dollar Remains a Headwind

With the strength of the US dollar showing no signs of abating, we remain generally cautious about emerging markets. We noted as 2024 began that a higher-for-longer interest rate environment had been priced into emerging market equities. While we do not see much value in emerging market equities in aggregate, pockets of opportunities remain, particularly in those countries benefiting from the ongoing reorganization of global supply chains.

As a whole, the geographic dispersion we have seen across equity markets suggests that investors should be thoughtful about their regional allocations and the underlying risks. As supply chains continue to adapt and rising trade protectionism affects what consumers buy and from where, investors should focus on how this will play out across different regions.