Collective Investment Trusts: Lower Costs and Greater Flexibility

Though plan sponsors are increasingly including collective investment trusts (CITs) in their defined contribution plans, mutual funds are still the favored investment vehicle, possibly given participant familiarity, the perception of “portability,” and the ability to access publicly available information. However, CITs offer a number of advantages over a mutual fund. Here we’ll provide an overview of:

- CIT and mutual fund characteristics

- CIT regulatory considerations

- CIT advantages specific to DC planning

Plan sponsors continue to look across investing best practices, including defined benefits strategies, to enhance defined contribution (DC) plans. Through this exercise, CITs are gaining in consideration and use, as they offer the potential for lower costs and more options for accessing institutional-quality investment strategies while maintaining ERISA fiduciary standards. Although traditionally offered by large plan sponsors, CITs are now being considered by smaller plans and are expected to continue capturing a growing share of DC plan assets across a spectrum of savings plans.

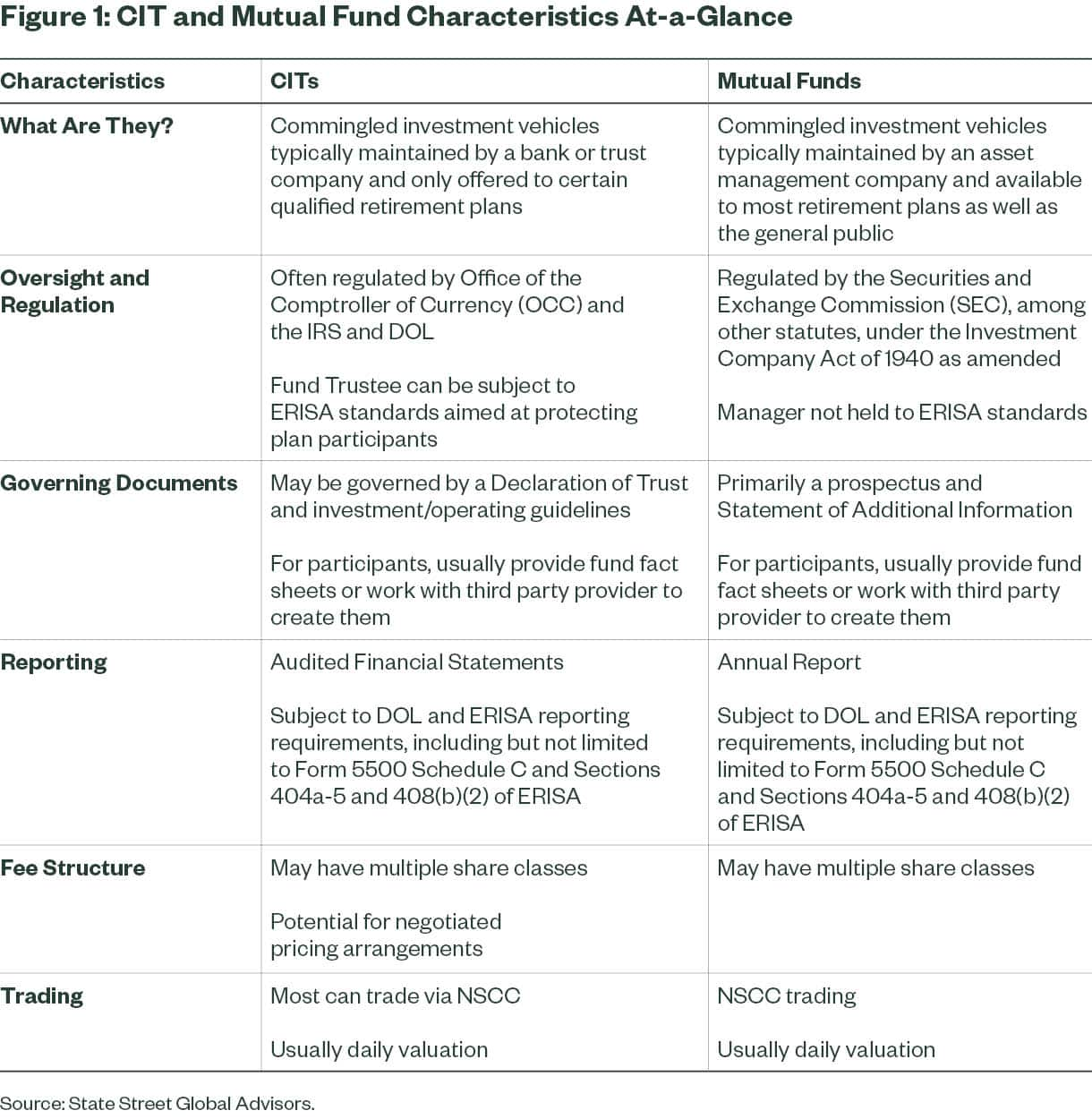

CITs and mutual funds typically serve a similar function within a defined contribution plan, providing participants with high quality, professionally managed investments that, in most cases, offer daily valuation and liquidity. Both may offer a variety of pricing structures to suit different market segments.

Yet there are some key differences between mutual funds and CITs, including how they are regulated, their cost structures and the degree of flexibility that each may offer plan sponsors.

What is a CIT?

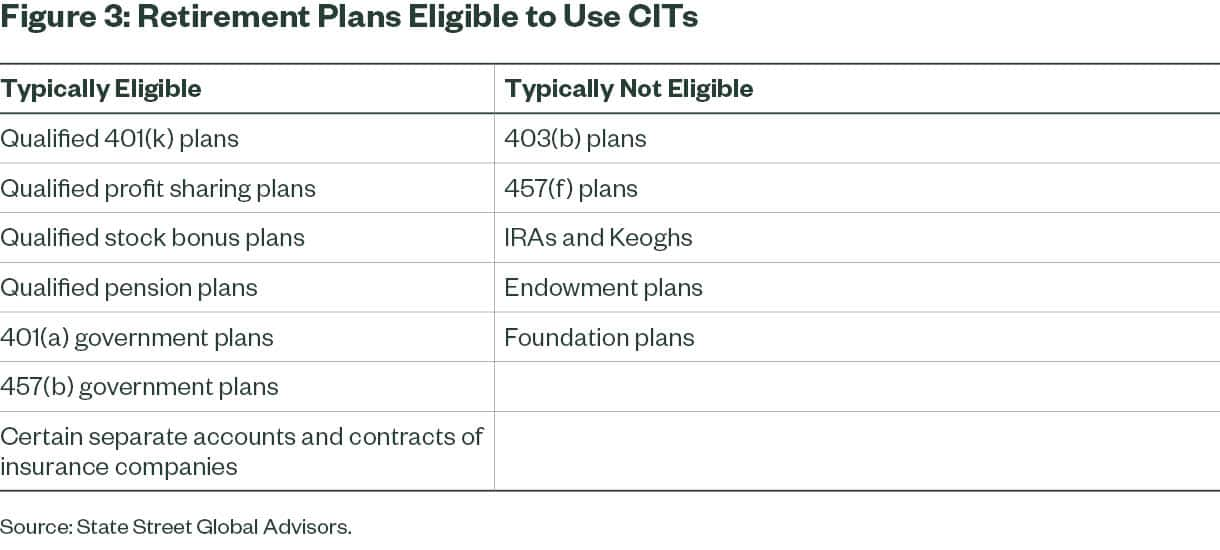

Many CITs, like mutual funds, are pooled investment vehicles managed collectively under a common investment strategy. Like mutual funds, CITs offer daily valuation and liquidity and a variety of pricing structures to suit different market segments, but unlike mutual funds, CITs aren’t available in the retail market. Instead, many CITs are maintained by a bank or trust company and only offered to certain qualified retirement plans. In addition, CITs have a separate set of regulators from mutual funds and typically are restricted from making fund information available to the general public (though participants invested in CITs can access fund information from their plan sponsor or recordkeeper).

Regulatory Structure of CITs

Mutual funds are regulated by the Securities and Exchange Commission (SEC) and are typically available to both retail and institutional investors. CITs, on the other hand, are generally only available to certain qualified retirement plans and do not have publicly available fund information and tickers. CIT providers are often regulated by the US Office of the Comptroller of Currency (OCC), as well as the IRS and Department of Labor, and typically available only to tax exempt entities. CITs may be governed by a declaration of trust and investment/operating guidelines. Many CIT managers are also held to ERISA fiduciary standards, meaning they must manage plan accounts solely in the interest of the plan’s participants and beneficiaries.

Lower Costs and Increased Flexibility

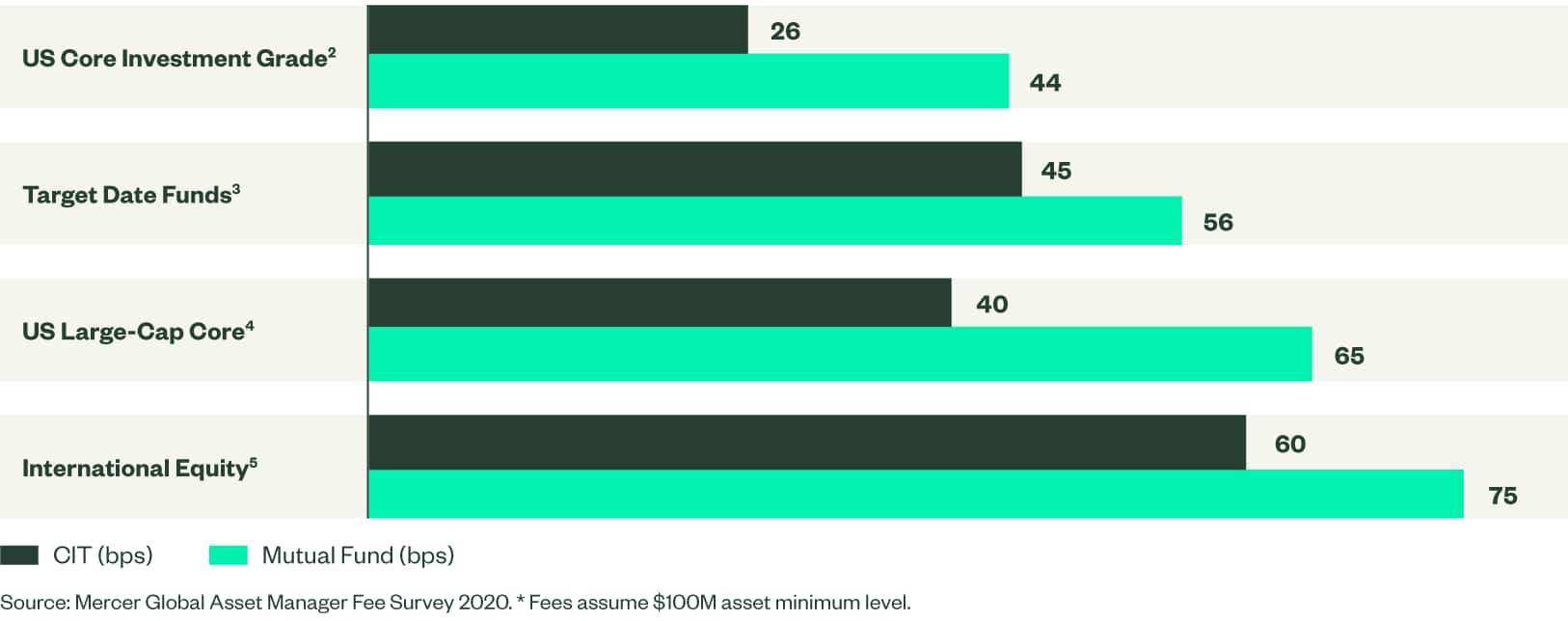

Amid increased public attention to DC plan expenses, many sponsors are looking for lower cost solutions. CITs typically have lower expenses than mutual funds due to lower overhead.

Figure 2 Comparing Total Expense Ratios (TERs) for CITs vs. Mutual Funds:

CITs May Offer Lower TERs Than Mutual Funds, Extending Greater Cost Advantages

CITs may also offer more flexibility in pricing, allowing for customized arrangements based on overall plan size. As plan-level assets within a CIT increase, for example, fees could potentially decrease.

Finally, CITs also benefit from certain tax advantages which translate into material cost savings, especially with international investments. Based on our findings, an investor is eligible to reclaim an additional 16 basis points in dividend withholding tax in a CIT versus a mutual fund benchmarked against the MSCI ACWI ex US IMI Index.1 Lower fund costs can translate into increased retirement savings to participants.

An Institutional Approach to Investing

As referenced earlier, many CITs designed for retirement plans are managed exclusively to meet the needs of tax-exempt investors, making them an attractive choice for many plan sponsors. With an institutional focus, CITs can offer DC plan participants the type of high-quality, low-cost investment strategies enjoyed by pension funds and other institutional investors. Furthermore, CITs can provide sponsors access to alternative investment strategies that may not be available in a mutual fund. As institutional investment vehicles, many CITs allow plan sponsors more flexibility in designing and naming their investment menu. Customizing the name of investment strategies can help participants better understand the products in which they are investing.

Growth on Recordkeeping Platforms

A growing number of recordkeepers are now able to support robust reporting services for CITs, and plans of all sizes can now access certain CITs through most recordkeeping platforms. For sponsors considering CITs, we suggest having an in-depth conversation with your recordkeeper about their capabilities, available investment options and any changes to current service that may be associated with the addition of CITs. A recordkeeper’s experience and expertise can be a valuable resource when introducing CITs to a plan.

Exploring Your Options

The choice of whether to use CITs, mutual funds or both in your plan will likely depend on the type of plan you offer and your objectives as a plan sponsor. We believe the current CIT market provides a diverse selection of asset classes and differentiated share classes well-suited to the needs of DC plan.

The following questions are meant to help spark investment committee and consultant conversations as sponsors explore various vehicles for their DC plan:

- How can you best serve the investment needs of your participants?

- What impact would lower fees have on your participant’s long-term investment success?

- What types of investment vehicles can your current recordkeeper support?