Yen: Opportunistic, but Limited Intervention

The Japanese currency is back in the spotlight. We look at the yen’s recent volatility and share our perspectives on its trajectory over a medium-to-long-term view.

The Japanese yen has been on a rollercoaster of late – weakening to levels not seen in over three decades against the US dollar, and then bouncing back with force. A more dovish than expected Bank of Japan (BoJ) meeting on April 25 sent the yen up sharply to 160 versus the US dollar. This was followed by an abrupt fall after what appears to be two instances of currency intervention directed by the Ministry of Finance (MoF). The first intervention occurred overnight on April 29 (EST) and again just after the New York market close on May 1. Looking forward, we see ample upside for the yen, with limited downside. However, the timing of gains will be driven by movements of the Federal Reserve (Fed) and will likely take time.

Outlook on the Yen

Our view on the yen has not changed. We expect global interest rates, particularly US interest rates, to be the primary driver of the yen. Because we believe that US disinflation will resume and US growth will slow back to and slightly below trend, we see a rally in the yen of around 20% over the next two to three years versus the US dollar (a fall in the US dollar/Japanese yen (USD/JPY) exchange rate). This move is consistent with a compression in US dollar/Japanese yen interest rate carry of 200-250 basis points and would take the USD/JPY exchange rate down to a level of 125-130 from its current level of 153. We expect Fed rate cuts to deliver 1.5-2.0% of that carry compression and BoJ rate hikes to account for an additional 0.5% between now and mid-2026. A hard landing in the US would send US rates and USD/JPY even lower (yen higher).

The recent strength in US inflation and growth make the timing of Fed rate cuts and sustained yen appreciation highly uncertain. So long as US growth and inflation keep the Fed on the sideline, we expect the yen to remain weak and weaken further if US yields break to new highs. However, we think further yen weakness will be limited for three key reasons.

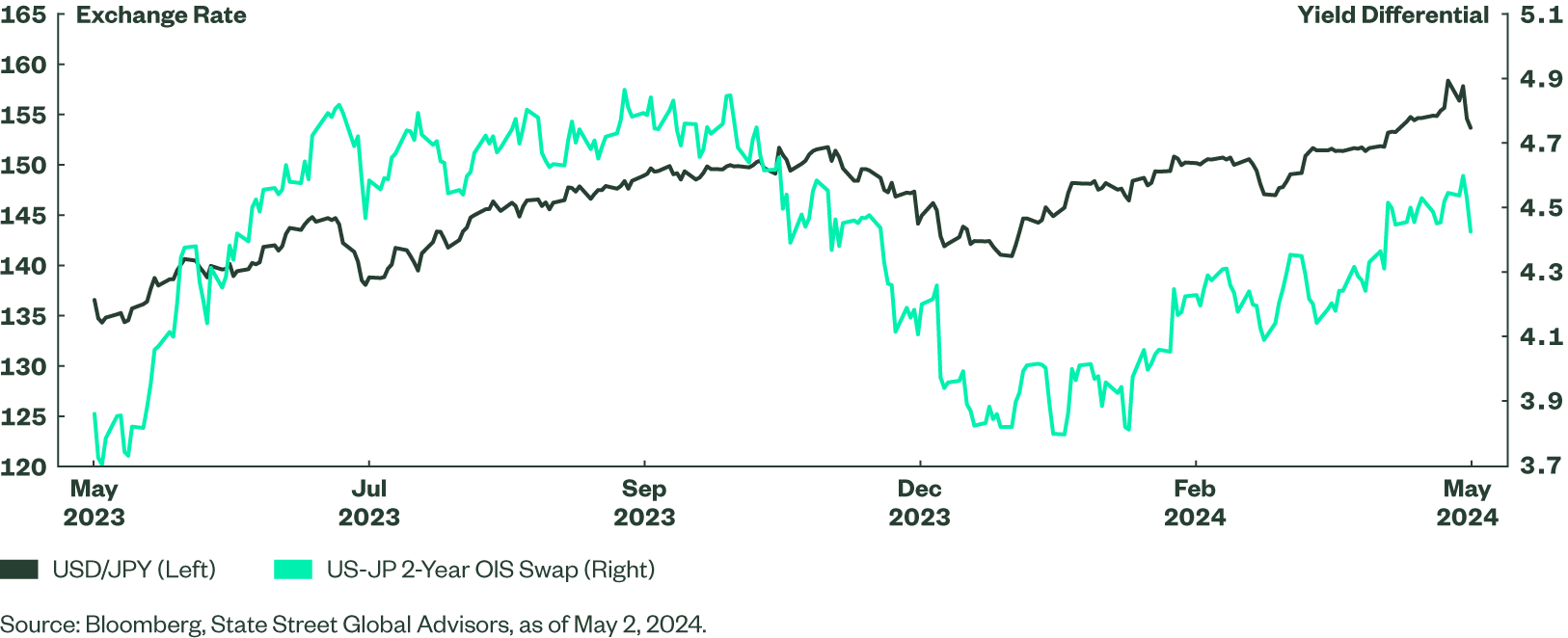

- Excessive rally. USD/JPY’s rally to 160 last Monday was excessive relative to current yield differentials.

- Intervention propels volatility. Yen intervention directly interrupts further downside and increases volatility, making speculative shorts less appealing. It is common to lament the futility of currency intervention, but in this case we believe it will be largely successful because a) the yen is historically cheap relative to long run fair value, b) the yen is fair to cheap against current interest rate differentials, and c) investors are already quite short the currency.

- Yields peaking. We believe US yields are nearing a high. Fed Chairman Powell stressed that policy rate hikes are unlikely even if inflation remains above target – instead, they are likely to simply hold at current levels and wait. At the same time, sustaining the recent string of upside surprises in US inflation and employment appears unlikely as expectations reset higher and data such as the pick-up in part-time employment, weak National Federation of Independent Business (NFIB) small business hiring intentions, and the low Job Openings and Labor Turnover Survey (JOLTS) quit rate all suggest better balance to fuel a return to disinflation.

Figure 1: USD/JPY Is Overreacting to Yield Differentials

The Bottom Line

Even with our view that yen downside is limited, and in the next two to three years we will see a 20+% appreciation, we think short-to-medium-term investors will struggle to justify paying the 5.5% annual carry costs given the uncertainty regarding the timing of appreciation. For investors with a long-term horizon, we think it may be wise to consider a two-fold approach: 1) take profit on short yen positions and 2) use weakness to gradually build long yen exposure versus a lower-yielding currency such as the Swiss franc.