European Equities Continue to Find Favor

Each month, the SSGA Investment Solutions Group (ISG) meets to debate and ultimately determine a Tactical Asset Allocation (TAA) to guide near-term investment decisions for client portfolios. Here we report on the team’s most recent discussion.

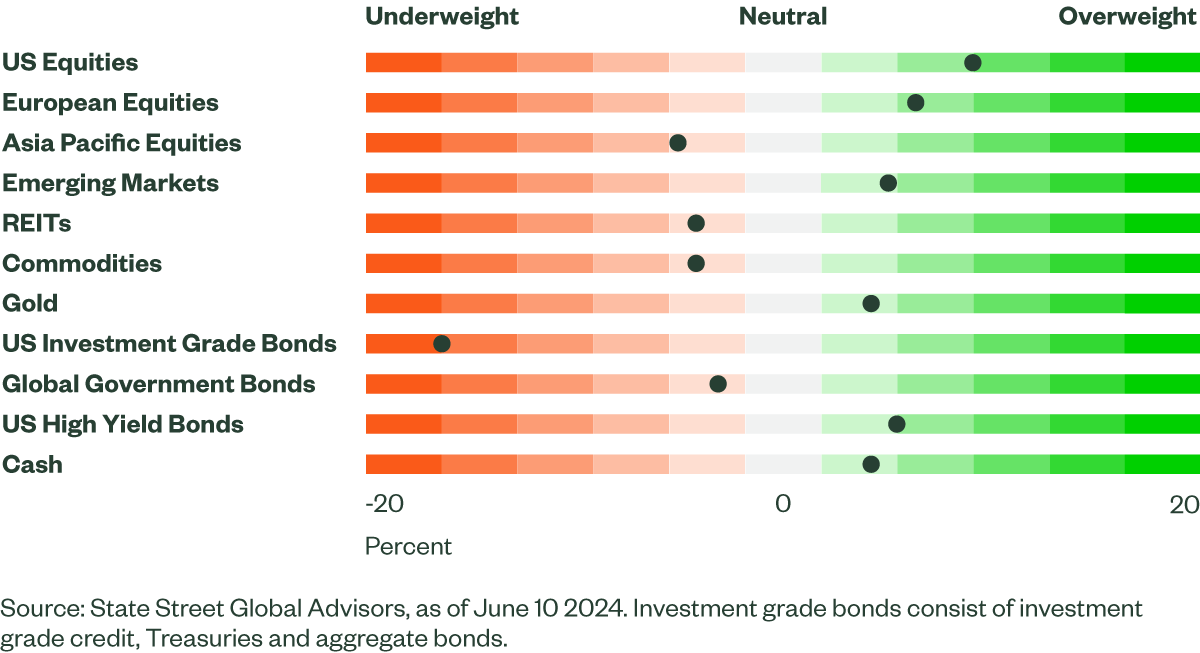

Figure 1: Asset Class Views Summary

Macro Backdrop

After a strong start to the year, the US economy experienced a patch of weaker economic data before a string of strong prints over the past week. While economic activity in the US is softening, it remains solid. Outside of the United States (US), economic growth appears to be bottoming out. Some sectors of the global economy are experiencing disinflation, but overall, inflation remains elevated.

Last month, we discussed the improved supply and demand dynamics of the labor market — and that remains intact. While May’s Automatic Data Processing (ADP) private payrolls underperformed, non-farm payrolls showed some robust details: not only did the headline number outpace expectations by a wide margin, but there were also solid service sector job gains in several industries. Additionally, average hourly earnings rose more than forecasted and accelerated month over month. Lastly, several metrics — including jobless claims — are near pre-pandemic levels. Overall, the labor market is better balanced but still strong.

Economic activity measures are mixed across regions but generally signal positive growth. In the US, manufacturing activity seemed to have bottomed out but declined further in May — falling deeper into contraction as new orders decreased. On a broader scale, JP Morgan’s global purchasing managers’ index (PMI) for manufacturing advanced in May and remains in expansionary territory, with improvements in new orders.

Global services activity continues to drive growth and appears to be on solid footing. In the US, the ISM services PMI returned to expansionary territory. Activity in the euro area and Japan also remains strong, with solid new orders. Additionally, JP Morgan’s services PMI rose further into expansionary territory — showing improvements in new business — and has generally trended higher.

The Bank of Canada and the European Central Bank (ECB) both kicked off their highly anticipated monetary easing cycle with twenty-five bp cut to their target rates, but the path forward for central banks remains uncertain. In Europe, wage growth is elevated, and inflation remains high, as acknowledged by the ECB. In the US, persistent services sector inflation, resilient economic growth and households being less sensitive to interest rates kept some Federal Reserve members hawkish. Looking ahead, central banks will need to see more cooling in labor markets and further progress in core inflation.

Economic data prints continue to support our expectations for a soft landing, but numerous risks remain that could challenge this outlook.

Directional Trades and Risk Positioning

Investors appeared complacent despite the softer economic data in May, which reduced implied volatility and sent our Market Regime Indicator (MRI) into euphoria. However, a string of surprises -- hawkish comments from the Fed, hotter-than-expected inflation in the eurozone, better non-farm payrolls, and an upside surprise in average hourly earnings – seemed to remind investors that the path forward won’t be without hiccups. All three factors moderated from their very euphoric levels, with implied volatility in currency and risky debt spreads landing in a low-risk regime. Implied volatility in equities has gradually moved into a normal regime. Overall, risk appetite remains strong, with our MRI settling in a low-risk regime.

From a quantitative perspective, our forecast for equities softened but remains positive, while our fixed income expectations improved.

Equity valuations weakened and macroeconomic factors turned negative, but sentiment indicators continued to improve. Additionally, price momentum remained firm and strong quality factors provided support for global equities.

Within fixed income, manufacturing activity remained above our lookback value, suggesting higher rates. However, our model expects recent interest rate momentum to continue, with yields moving lower. Our expectations for high yield have improved, as lower equity volatility and positive equity momentum imply tighter spreads.

Given the improvement in risk appetite and expectations for tighter spreads, we executed modest buys of equity and high yield bonds, funded from aggregate bonds.

Relative Value Trades and Positioning

Within equities, our expectations for Europe continued to improve, and the region is now one of our largest overweights. Sentiment indicators remained negative but have shown improvement, while valuations and quality factors further buoy the region.

However, our forecast for US equities is less positive this month due to weaker sentiment indicators, which have been deteriorating over the past few months and just turned negative. Despite firm macroeconomic and quality factors, price momentum has softened. During the rebalance, we reduced US equities and allocated the proceeds to Europe. Overall, there is now less dispersion among our equity forecasts, leading to a more regionally diversified overweight position.

On the fixed income side, our models forecast lower government bond yields, prompting us to deploy sidelined cash into long Treasury and aggregate bonds. Additionally, we extended our underweight position in non-US government bonds due to a weaker outlook for Germany and Japan. After accounting for relative value and directional trades, there has been a small reduction in aggregate bonds at the total portfolio level. Following the rebalance, we hold modest overweights in cash, long treasury and high-yield bonds.

Finally, at the sector level, we maintained allocation to industrials, while upgrading energy to a full allocation. We removed exposure to financials and communication services in favor of technology. The onshoring shift has supported the industrials sector, which exhibits positive price momentum and benefits from strong macroeconomic factors.

Energy remains attractive due to excellent operating returns, desirable valuations and constructive macroeconomic factors. In contrast, weaker sentiment measures and lower earnings and sales estimates led to the downgrading of communication services and financials. The improved outlook for technology is from more robust price momentum and better projections for both sales and earnings.

Click here for our latest quarterly MRI report.

To see sample Tactical Asset Allocations and learn more about how TAA is used in portfolio construction, please contact your State Street relationship manager.