US Elections Finish Line in Sight: Revisiting Our Outlook

Kamala Harris securing the Democratic presidential nomination may have changed the probabilities of the US election outcome. However, a sweep, Democratic or Republican, would have material consequences for most asset classes.

Across our US elections articles this year, our macro view has consistently stated that inflation and rates were most vulnerable to one party consolidating power. Any disorderly bear steepening of the yield curve would boost the US dollar (USD) while weighing on equities. Regardless of the election results, we expect fiscal stress to emerge thereafter and the bond market could become a policy constraint in the US.

From a regulatory and broader policy analysis, we had predicted sector dispersion would be narrower than in the previous two cycles. Even so, we consider this to be an opportune way to position for the election, as we would expect market responses to the presidential ticket irrespective of the congressional makeup.

Given the developments on the Democratic side of the ticket, we thought it would be beneficial to provide an update on how the various election outcome scenarios could impact sectors and asset classes.

The Core Scenarios

For clarity, we summarize the four core election outcome scenarios and their impact on policy and regulation in the aftermath of the election. The scenarios are:

- A Republican sweep with full Republican control of all branches of the federal government

- A Trump victory with a split Congress where the Democrats control the House and the Republicans have a majority in the Senate

- A Harris victory with a split Congress as in scenario 2

- A Democrat sweep

In terms of probabilities, we believe that the presidential race remains a coin toss, but that a split Congress is likely (i.e., well above a 50% chance). Between the two tail outcomes, a Republican sweep is much more conceivable than a Democratic one, which we view to be a remote outcome.

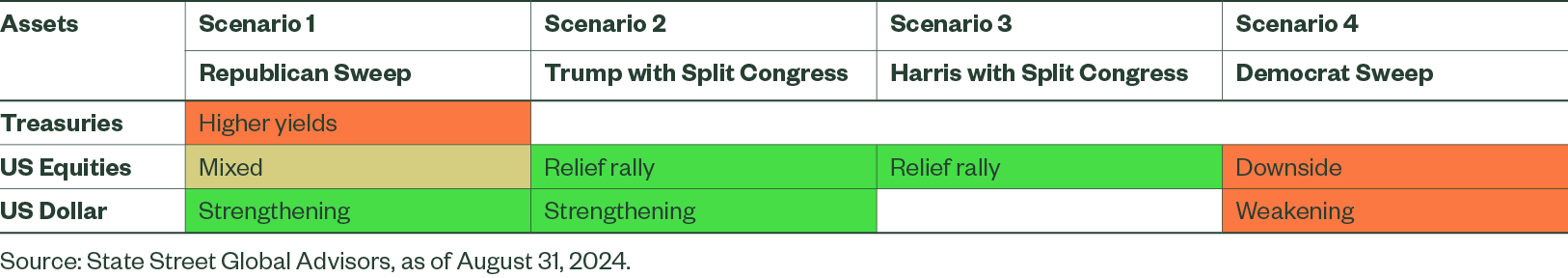

Figure 1: Core Scenarios and Asset Class Views

Bonds Versus Equities

In Figure 1, we highlight the potential impact to Treasuries, US equities, and the US dollar across the various core scenarios. The fiscal-monetary policy mix will largely determine the slope of the yield curve. With the caveat that we anticipate a soft landing and no near-term recession, we foresee the yield curve being driven by macro fundamentals in most election scenarios.

The exception is in the case of a Republican sweep (Scenario 1) as that could deliver a disorderly steepening of the curve by lifting inflation expectations on the back of debt-funded tax cuts, higher tariffs, more restrictive labor market policies, and changes to the governance of the Federal Reserve. Together, these factors could also drive a strengthening of the US dollar despite Trump’s desire to weaken the currency. Equities would likely be volatile as some sectors would benefit from tax cuts and favorable regulatory changes, whereas others would face higher financing costs.

Scenario 2 would include the same regulatory stimulus, but the fiscal picture in our view would be diluted, delivering a more modest currency appreciation and only a slightly steeper yield curve.

In contrast, we would expect the bond market to largely ignore the election in Scenario 3 and perceive it as status quo. In both cases, the stock market would likely be relieved that the election uncertainty was over and rally toward year-end in the typical seasonal pattern.

A Democrat sweep appears to be negative for equities given more expansive regulation and the prospect of material tax increases for both corporations and higher income earners.

Sector Specific Rationales

In 2016, the S&P 500 Index rose a mere 3% in November post the election. Yet, the surprise Trump win prompted a significant 17% dispersion in net returns between the best-performing sector (Financials) and the worst-performing one (Utilities).

In 2020, there was significant sector volatility in the run-up to the election, and following the election, S&P 500 Index returns rose 8% through the end of November with Energy stocks springing with net returns that were 27% ahead of the weakest sector, Utilities.

In 2024, we expect dispersion to be much more contained than in the previous two cycles. Nonetheless, there are notable performance differences that are dependent on the policy backdrop.

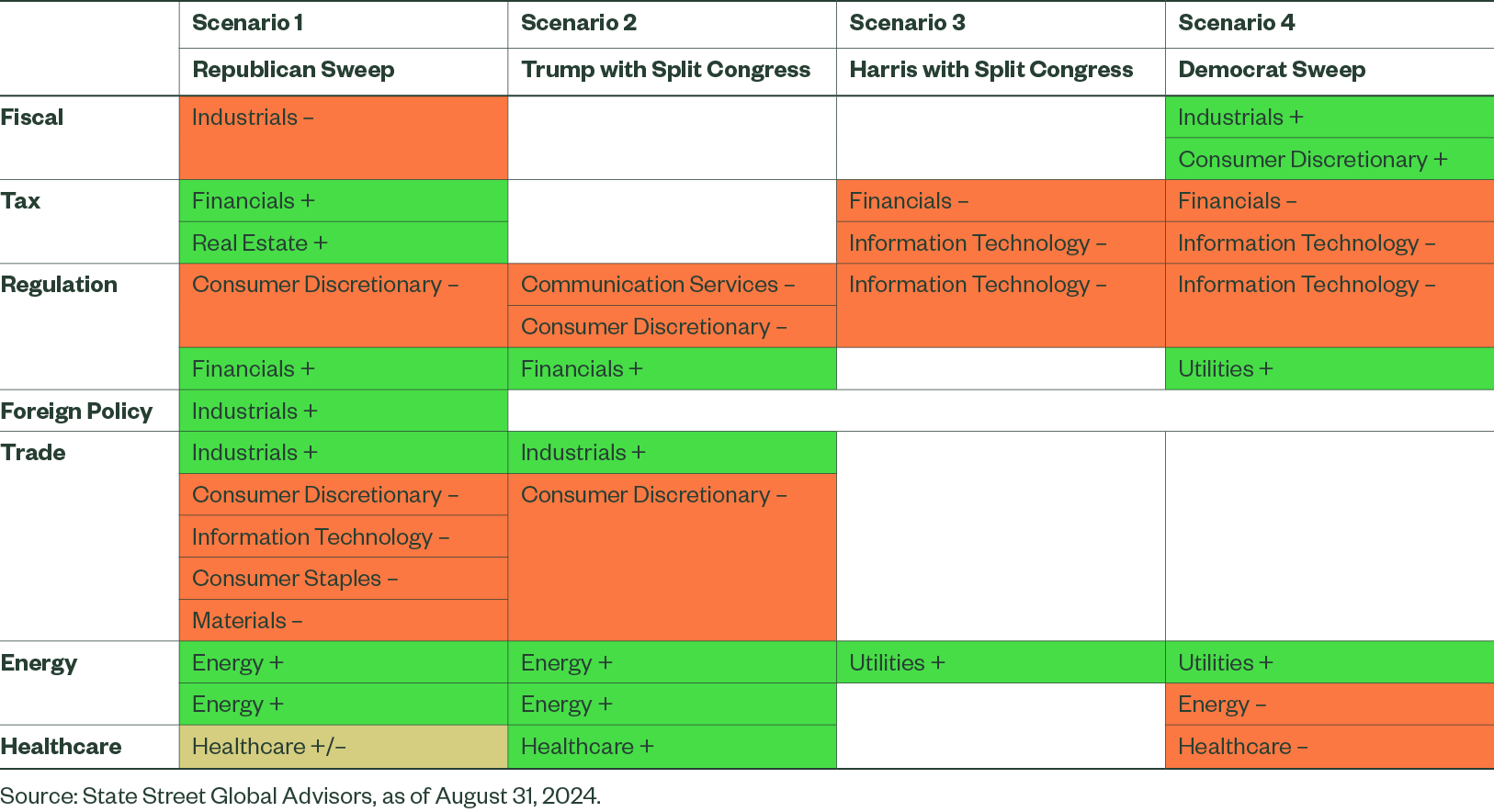

Figure 2: Sector Impact Under Four Scenarios

First, either sweep scenario implies changes to fiscal trajectory and the federal tax code (as well as wider fiscal deficits). Trump has called for parts of the Inflation Reduction Act (IRA) spending to be rolled back, something that could undermine the tailwind that Industrials are currently enjoying.

More critically, some elements of the Tax Cuts & Jobs Act (TCJA) introduced under Trump in 2017 are set to expire in 2025. While technically “permanent” at 21%, the corporate income tax rate could see a potential increase, becoming a bargaining chip to finance the extension of other tax breaks (e.g., the top individual tax rate as well as business owner pass-through) – this is something that we consider more probable under a Harris administration.

In 2017, proposed cuts boosted the shares of IT, banks and insurance providers, consumer companies with domestic earnings, and real estate investment trusts (REITs). These sectors could be expected to disproportionately suffer any reversal.

Kamala Harris’s recent outline of tax increases (e.g., an increase of the corporate tax rate from 21% to levels around 25-28%, quadrupling taxes on stock buybacks to 4%, repealing the deduction for foreign-derived intangible income) would bode poorly for the broader equity market, as well as discretionary consumption in the US. However, Harris doubling down on industrial policy would support Industrials.

Regulation: Who Benefits and Who Is at Risk?

A wave of deregulation could be beneficial to Financials, particularly banks, but it would likely be smaller than in the previous Trump administration. Higher rates and a steeper yield curve should be helpful to bank margins, although this could be offset by slower loan growth and higher delinquencies for banks.

Financials and others could also benefit from Republican changes to sustainability investing, with fewer requirements on carbon footprint reporting and limits on the investment industry to develop and market environmental, social, and governance (ESG) products. This would further widen the operational remits between US and European asset managers.

The regulatory path under Harris would mirror that of Biden’s, including continued antitrust measures, though a Democratic Congress would also help tighten rules to pressure companies to decarbonize.

Foreign Policy: Rearmament to Continue?

Our detailed views on the geopolitical spillovers are outlined in a recent article. A Trump presidency is expected to reinforce G7 defense spending growth, benefiting arms contractors. In addition, Trump’s penchant for tariffs on capital goods and likely reshoring would also bolster the competitive position of the Industrials sector, particularly in the US.

Harris’s relatively short tenure in national politics before becoming vice president gives limited insight into her personal foreign policy views. We expect her to maintain the status quo, apart from a possibly less supportive approach to Israel.

Trade: What About Geopolitics?

While tariffs are rising either way, they could be more disorderly with Trump. Expectations of Trump 2.0 include the imposition of punitive trade tariffs on Chinese goods, as well as select tariffs on other net surplus exporters or countries not aligned with the US. The inflationary pass-through overall to headline CPI would be less than 0.5%, but it could mean a hefty price rise for imports in select industries.

Energy: Moving Closer or Further Away From Transition?

Energy originally appeared to be the biggest beneficiary of a Trump election. This still holds true, yet Harris has greatly moderated her energy policy platform and thus the gap is not as large as expected. Potential Republican actions could affect the extension of fossil fuel operations and a pullback on environmental regulation. An expansion in the size and scope of drilling auctions would be relevant to the oil and gas majors and would likely see the US cement its position as the world’s largest producer of crude oil. Energy has fallen recently in tandem with the oil price amid concerns of slowing Chinese and US demand. However, we see tailwinds from both a geopolitical angle and the possibility of higher-for-longer inflation.

Conversely, this scenario could prompt investors to reduce exposure to Utilities, benefiting less from the shift to renewable energy under a Republican-dominated executive. However, Republican support for building new data centres, the requirement for which is growing rapidly with AI-stimulated use, offers upside for electricity demand.

The durability of IRA subsidies and credit remains contested, but on this issue Trump appears to have moderated the risks of cuts to incentives for the manufacturing and ownership of electric vehicles. Such cuts would negatively impact autos, component manufacturers, and charging station suppliers, which predominantly sit within the Consumer Discretionary sector.

Healthcare: A Way to Cut Costs?

This has not been a healthcare-focused election. Even under a unified Republican government, we do not expect the Affordable Care Act to be repealed. Selective threats to the premium tax credits which expire in 2025 and removing coverage for parts of the population are a negative for the managed care names and would put hospitals at greater risk on uncompensated care.

More challenging could be a Democratic sweep where reduced prescription drug prices for Medicare and a cap on the cost of insulin and out-of-pocket drug costs could weigh on pharmaceutical stocks.

The Bottom Line

Identifying sectors that are more likely to benefit from the election outcome is difficult in a tight race. However, there are specific segments that are more election-sensitive. At a sector level, we think changes to the regulatory burden and trade policies carry the most weight. Meanwhile, at the asset class level, the impact on inflation and rates is the key variable. As in the past, investors may implement views by way of sector allocations, both in the US and internationally, in order to optimize portfolios for the outcome of this year’s election.