The Case for US Innovation and Growth

US large cap growth stocks have enjoyed a strong run – but can their dominance continue? Here’s why we believe there is further upside potential, particularly for innovative high-quality companies, and how an actively managed approach can help generate alpha over the long term.

The greatest concentration of high-quality innovative growth companies are domiciled in the US. US technology companies, specifically, are 75%* of global tech market cap. This is not a coincidence: the US market offers a long list of traits that have enabled this dominance, including:

- less overbearing regulation

- strong rule of law and intellectual property protection

- a strong history of entrepreneurship supported by the largest venture capital community

- a rewarding compensation system that allows for talent to flow and innovative growth companies to form, and

- a generally favorable tax environment.

*Source: Empirical Research

As a result, investing in US large cap growth stocks has proved particularly rewarding –even more so relative to value or international stocks over the past decade or so. Such a prolonged period of outperformance has prompted many to argue that a value or non-US equity rally is imminent. But in our view, these arguments lack substance because they don’t address the fundamental factors that have led to this dominance.

We believe that growth companies in the United States offer many dominant, high-quality, innovative, asset-light business models capable of compounding strong sustainable growth. The US equity market, especially growth equities, provides access to some of the world’s most innovative companies in the semiconductor, AI, software, medical technology, biotech, internet services, ecommerce, robotics and industrial automation sectors, to name a few. Many of these companies operate on a global scale, driving improvements in operating leverage, returns, and free cash flow generation. This provides increased capital for companies to reinvest in further innovation that enhances their competitive advantage.

Our Approach

The Fundamental Growth and Core Equity team does not try to second-guess the short-term style preferences of the market – nor do we think investors are well served in trying to do so. In our view, investors should have a dedicated allocation to high-quality, premier US growth companies because this area of the US market offers potentially the greatest long-term opportunities for capital appreciation – something that is not as readily seen in other asset classes, styles, or geographies.

Unfortunately, this part of the market also contains companies with unproven business models: high-leverage, fad stocks that can fall as fast as they rise, or have sky-high valuations that create massive downside risk. Without a doubt, it pays to be selective when investing in this segment. This is where our actively managed fundamental approach can make a difference.

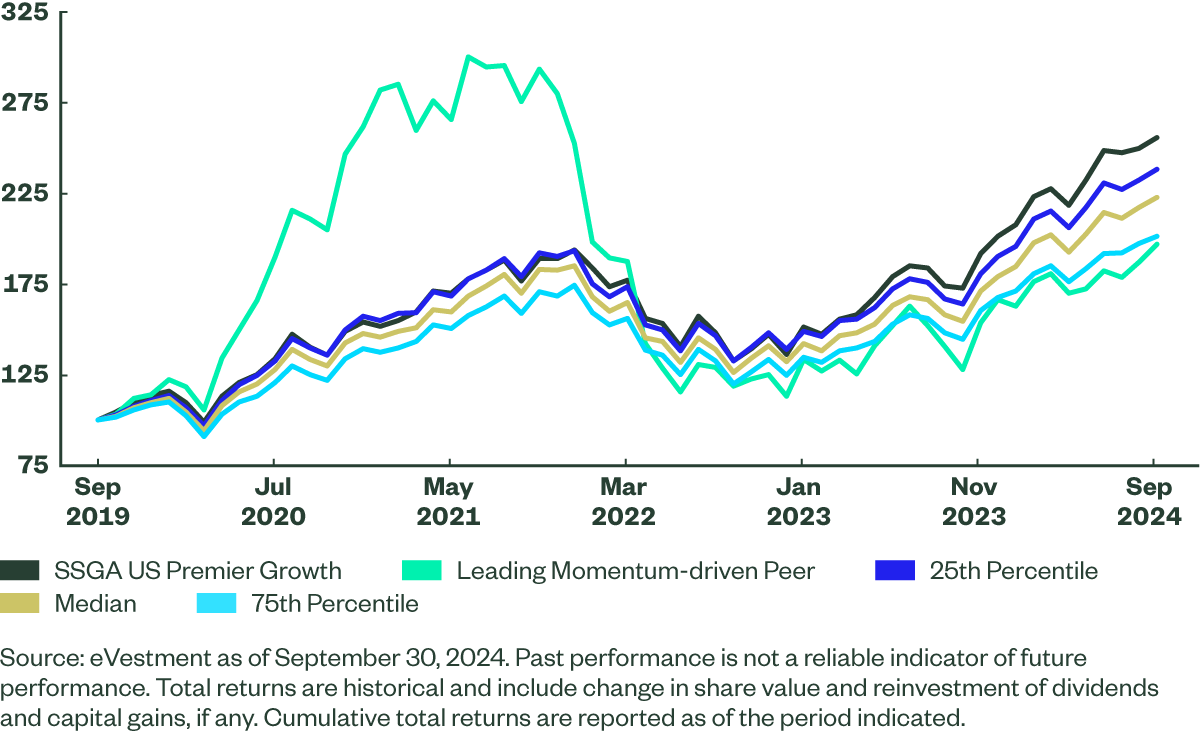

Figure 1 illustrates our differentiated approach. We compare US Premier Growth to a leading momentum-driven growth manager (green) and the US Large Cap Growth peer group in general (gold) during the strong growth cycle of the past five years. By not chasing growth-at-any-price and employing a rigorous selection process, US Premier Growth has handily outperformed over the cycle with much less risk and volatility.

Figure 1: Growth of $100 Over the Past 5 Years

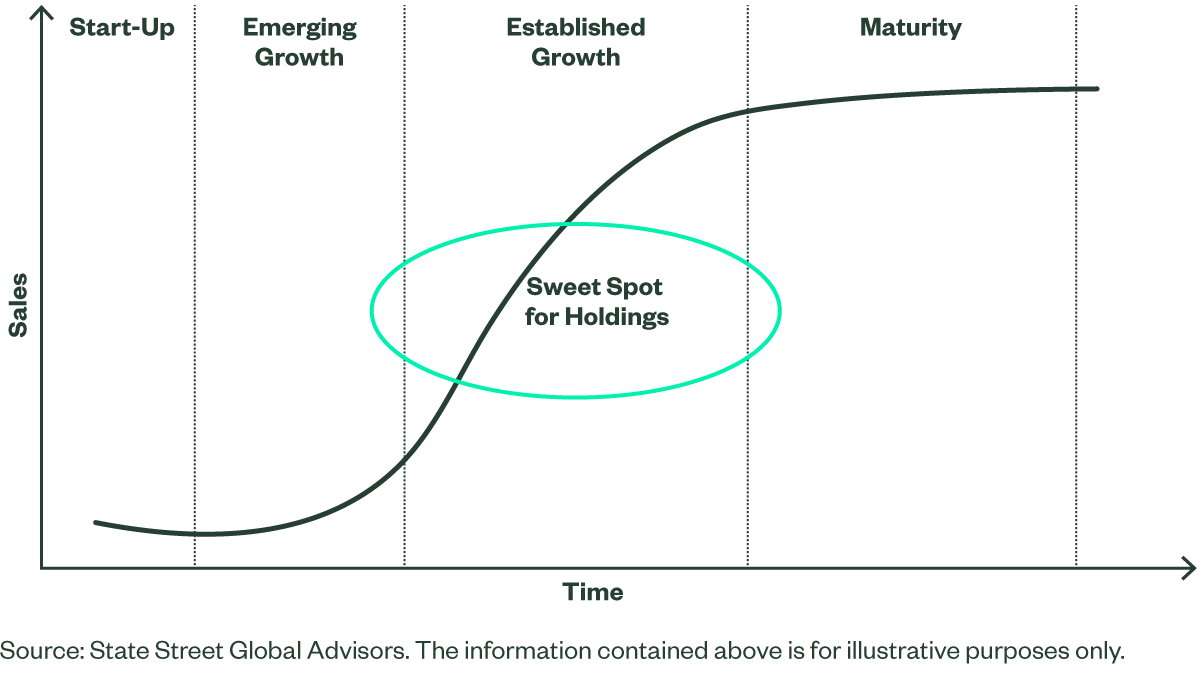

As you can see in Figure 2, we are looking for companies with a strong competitive moat around their business that is driving them from the murky world of promising, but un-tested, emerging growth companies into established growers, capable of delivering double-digit earnings growth with a long runway before hitting maturity. At the same time, we avoid many of the mature, limited-growth companies found in the Russell 1000 Growth benchmark.

Figure 2: Company Life Cycles

US Premier Growth Equity Strategy

State Street’s US Premier Growth Equity Strategy is a growth strategy centered around quality growth at a reasonable price principles. It is not just a collection of high-growth momentum names that are the mainstay of many other portfolios in the category. Despite a strong run by the Russell 1000 Growth Index, we believe our discerning active approach is a better way to harvest the opportunities among large- and mid-cap growth equities in the US. Our strategy does not depend on style momentum, but instead is driven by the ability of portfolio company holdings in aggregate, to compound at a mid-teens growth rate throughout the economic and market cycle.

Portfolio Construction: Adopting a Longer Horizon to Identify Opportunities Short-term Investors May Miss

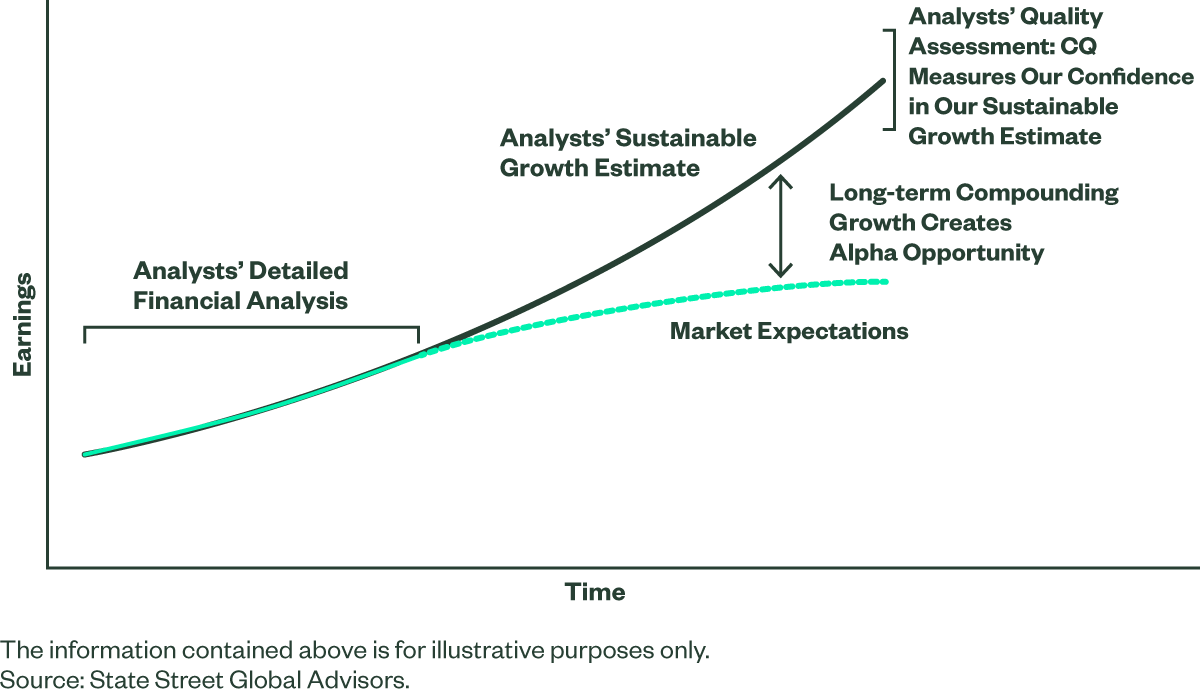

In constructing the portfolio, we apply a rigorous bottom-up approach to unearth quality double-digit growth companies that trade at reasonable valuations. We seek companies that can reliably compound their earnings at a minimum 10% rate over the next three-to-five years. Most sell-side analyst models only go out two or three years on average and conservatively assume a natural fade in growth and returns. This means that if we can identify companies that can sustain growth beyond this short horizon, they are likely to be undervalued by the market, as illustrated in Figure 3. Further, if we can hold these companies for the longer term, 3-5 years or longer, we can let the power of compound earnings growth drive alpha.

Figure 3: Long-Term Compounding Growth Creates Opportunity

Identifying Opportunities: The Confidence Quotient (CQ)

How do we find such undervalued companies? Alongside intense fundamental analysis and proprietary modeling, we score each name on our proprietary Confidence Quotient (CQ) research framework. This is unlike traditional measures of quality that emphasize a simple combination of historical returns, earnings volatility, and debt. Instead, we define quality on a forward-looking basis and focus on qualitative measures such as the competitive moat; our confidence in the management team; the appropriateness of the capital allocation strategy; the transparency of the business model; and the fundamental momentum of the business drivers. We leverage our long-tenured research team (with an average of 20+ years of experience) to quantify these “soft” metrics using our detailed CQ framework. The higher the CQ score, the higher our conviction in our projection of the duration of growth, creating substantial stock outperformance and alpha potential as this compound growth is realized over time.

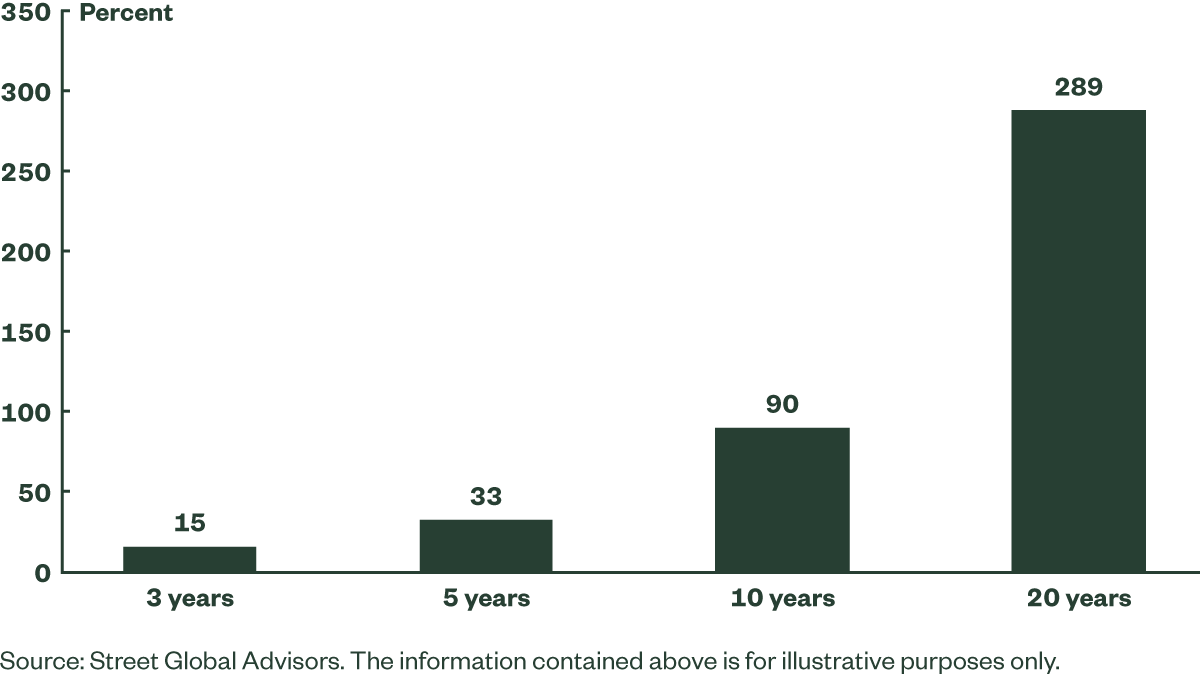

Figure 4 shows the premium that durable growth commands in the market. In this hypothetical example, the valuation premium rises exponentially as the number of years of compound growth increases. We expect the strong quality attributes found in our high CQ companies will lead to steady predictable earnings growth, while our valuation discipline provides downside protection.

Figure 4: The Market Often Undervalues Persistent Growth

We Don’t Chase Growth at Any Price

Attempting to time market valuation swings and sentiment changes is a notoriously difficult job for investors. Our reasonable valuation discipline, which underpins the portfolio strategy, aims to keep up with, or beat, the benchmark in strong ‘up’ years while providing downside protection during market corrections. We believe the strategy is not only an excellent way to participate in exciting innovative long-term US growth opportunities but is a more secure portfolio than our growth and innovation peers in a market storm. This is especially true for funds holding more emerging, yet profitless, concept companies that can fall dramatically if market perception, interest rates, or other conditions change.

Our concentrated portfolio has historically offered a three-to-five-year earnings per share (EPS) growth rate in line with or better than the Russell 1000 Growth Index, but the aggregate price -to-earnings (PE) multiple has been somewhat lower than that benchmark. The Premier Growth Equity strategy has in recent years had a similar standard deviation and beta than the benchmark, further reflecting relatively lower risk and volatility than peers. Additionally, while we are long-term holders, we use position sizing to manage our risk by scaling company weights up or down based on the forward-looking risk/reward.

A Portfolio of Innovative Long-Term, Double-Digit Winners

In summary, our objective is to consistently compound our portfolio over the long run by investing in quality companies, where innovation, brand and other intangibles leads to a strong competitive moat that helps drive durable mid-teens growth and consistently high returns on invested capital. We also aim not to overpay for this growth by focusing on stocks that trade at reasonable valuations. Our approach targets a portfolio of long-term winners that we expect can provide excess returns, while at the same time providing better downside protection than other US Growth funds. This approach is backed by our deep fundamental work, a strong emphasis on quality, and our valuation discipline.