High Yield in Focus

Each month, the SSGA Investment Solutions Group (ISG) meets to debate and ultimately determine a Tactical Asset Allocation (TAA) to guide near-term investment decisions for client portfolios. Here we report on the team’s most recent discussion.

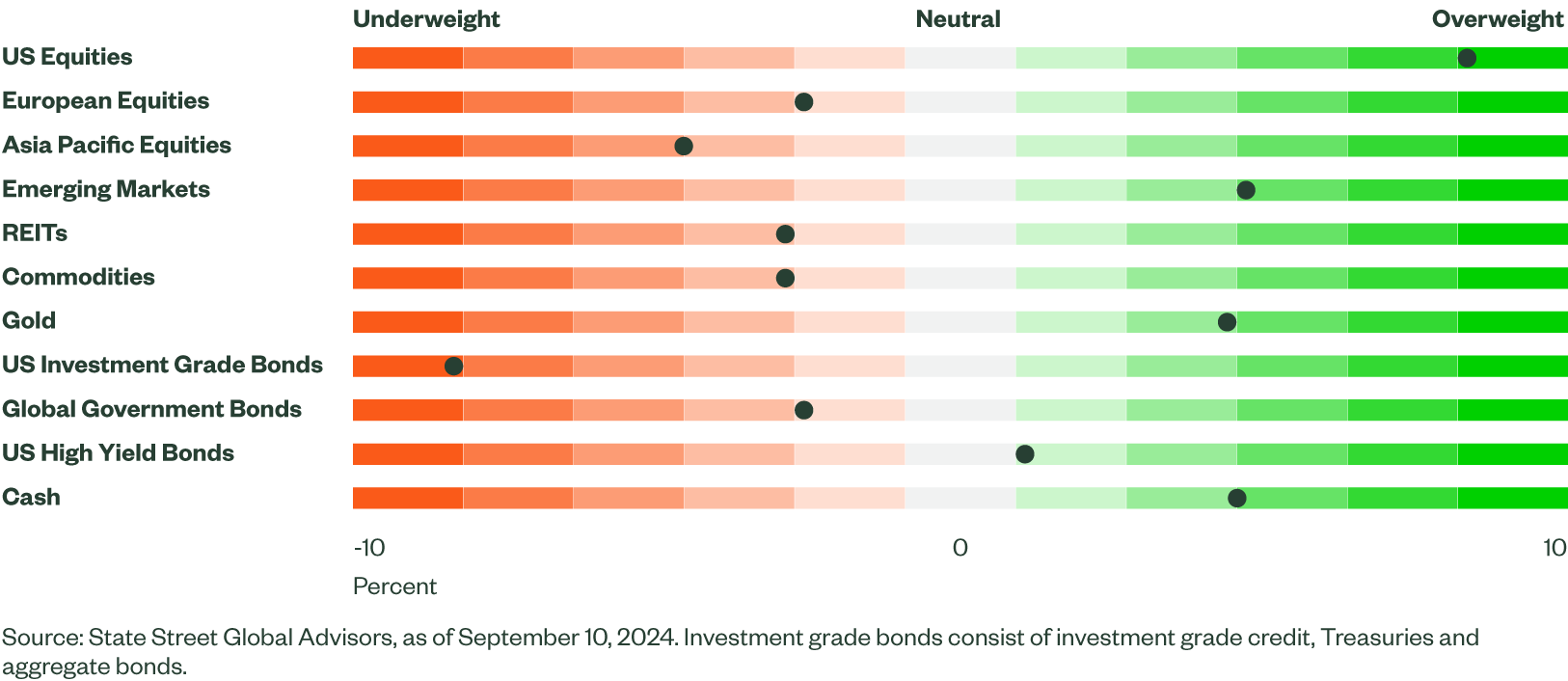

Figure 1: Asset Class Views Summary

Macro Backdrop

Similar to last month, we see data consistent with our call for a soft landing: inflation is decelerating, growth remains stable, and the Federal Reserve (Fed) has begun to cut rates.

Manufacturing activity remains weak — global Purchasing Managers’ Indices (PMIs) are still in contraction. However, service activity improved across many regions last month and remains expansionary.

In the United States (US), activity measures still appear solid. After deteriorating in Q1, US gross domestic product (GDP) accelerated more than expected in Q2, and was revised higher due to better consumption. Further, fundamentals appear reasonable enough to support demand moving forward. Financial conditions continue to ease as yields have fallen and equities have generally moved higher—likely to ease further as the Fed begins cutting rates.

Household wealth grew, driven by increasing real estate values, rising equity markets, and healthy cash yields, pushing net worths higher. Finally, we still believe labor market dynamics are reasonable. August non-farm payrolls were lower than expected, but rebounded from July. The economy continues to add jobs, supporting growth. Layoffs have ticked up but are not alarming, and unemployment claims remain inconsistent with recessionary periods. Wage growth remains solid, with average hourly earnings ticking higher and staying above pre-COVID levels.

Initial estimates of Q3 growth are positive, with the Atlanta Fed’s GDPNow tracking at 2.5%.

In Europe, the economy appears more brittle, especially in Germany and France, where higher savings rates and weaker consumption persist. While economic growth has been subpar, unemployment remains very low, wage growth is stable, and monetary easing should provide some support.

China continues to disappoint—recent data on manufacturing activity and industrial production suggest the region may continue to struggle. Economic growth eased in Q2, and domestic consumption has been disappointing. Although exports have been solid, they may weaken as trade tensions rise. Policymakers must find ways to stimulate demand to prevent further declines in growth and stubbornly low inflation pressures.

The conditions are in place for the Fed to begin lowering interest rates, and fundamentals suggest a gradual easing cycle as opposed to more aggressive cuts. The three-month core Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) readings are coalescing around 2%. The labor market continues to soften, and economic growth remains steady.

The August CPI print outpaced expectations – the surprise was mainly driven from core services, specifically owners’ equivalent rent. While stickiness in core services is concerning, we expect service price pressures to ease. Recent Producer Price Index (PPI) and CPI inflation readings do not change the narrative, but should help keep the Fed on a more measured easing cycle.

We will monitor prices paid in PMIs and the Manheim used car index, which has risen over the past two months in part due to lower lease maturities and a rise in layoffs. State Street Global Advisors’ outlook projects the Fed to reduce rates by 100 bp in total in 2024.

Outside of the US, the European Central Bank reduced rates by 25 bps again. With wage growth holding steady and inflation and economic growth remaining low, there is room for further expected easing, with December being the likely scenario. For the Bank of Japan, macroeconomic data remains firm and inflation is healthy, which should allow for another rate hike, likely in December.

Directional Trades and Risk Positioning

The intersection of multiple factors has soured investor risk appetite when evaluated through our Market Regime Indicator (MRI). Despite an upward revision to Q2 US GDP, growth concerns have increased due to falling oil and copper prices and mixed economic data, across both activity measures and employment. Elsewhere, ongoing tensions in the Middle East, weaker China growth, and uncertainty around the US election have weighed on investor sentiment.

In our quantitative framework, the equity trend signal – evaluating price trends over multiple look-back periods – continues to support risk appetite. However, weakness in other parts of the model signals increasing risk aversion. Elevated implied volatility and poor risk asset demand signal higher levels of risk aversion. Additionally, while sentiment spreads between risk-on and risk-off market segments have improved, they still indicate less risk appetite. Lastly, our analysis of credit market sentiment points to less optimism among investors. Overall, our MRI indicates a slightly elevated level of risk aversion, which can be a headwind for risk assets.

From an asset class perspective, our equity forecast has softened but remains positive, while our fixed income expectations deteriorated.

Falling support across multiple factors drove our forecast for equities lower. Analysts’ expectations for both earnings and sales remain positive but are softening, and price momentum is less beneficial. Elsewhere, support from quality factors has edged lower, while valuations remain weak.

Yields have continued to rally, but our quantitative model signals rates may have declined too far and expects a correction, with rates moving higher. Manufacturing activity has improved relative to our lookback window but still implies lower rates. However, nominal GDP is running above the yield on long-term Treasury bonds, and interest rate momentum has flipped, as both signals point to higher yields. Prospects for high yield improved, as our model predicts slightly lower spreads. Equity momentum supports high yield, and lower government bond yields imply lower financing costs and tighter spreads for high yield.

Amid elevated risk aversion and softening forecasts, we have meaningfully reduced our allocation to aggregate bonds and executed a small reduction to our equity overweight. Proceeds were deployed to cash with small additions to tail-risk assets, gold, and long government bonds.

Relative Value Trades and Positioning

Within equities, there were minimal changes to our regional forecasts, and we made no changes to our positioning. Our model continues to favor the US and emerging markets, thus maintaining a healthy overweight to both regions.

The US continues to rank well across all factors except value, while emerging markets are supported by strong quality factors and positive sentiment indicators. Our outlook for Europe and Pacific equities remains unfavorable. While Europe continues to exhibit attractive valuations, sentiment indicators are negative and deteriorating. Analysts’ expectations for both sales and earnings are positive and have improved for Pacific equities, but weak quality factors, unattractive valuations, and poor macroeconomic indicators weigh on our forecast.

On the fixed income side, poor government bond forecasts led us to reduce exposure to long government bonds and cash, while increasing our allocation to high yield bonds. At the total portfolio level, this results in a modest sell of long government bonds and a buy of cash. Overall, we now have a slight overweight to long-term government and high yield bonds, alongside a healthy allocation to cash.

At the sector level, we maintained exposure to technology and communication services, upgrading consumer staples to a full allocation and removing the split allocation to financials. Though our outlook for financials remains positive, improvements in consumer staples pushed the sector down our rankings. Financials benefit from positive price momentum, and sentiment is helpful but has softened. Price momentum, sentiment indicators, and quality factors for consumer staples are all positive and have improved, which drove our forecast higher. Technology and communication services both benefited from sturdy price momentum, favorable quality factors, and optimistic sentiment indicators.

Click here for our latest quarterly MRI report.

To see sample Tactical Asset Allocations and learn more about how TAA is used in portfolio construction, please contact your State Street relationship manager.