Expectations Improve for US Equities

Each month, the SSGA Investment Solutions Group (ISG) meets to debate and ultimately determine a Tactical Asset Allocation (TAA) to guide near-term investment decisions for client portfolios. Here we report on the team’s most recent discussion.

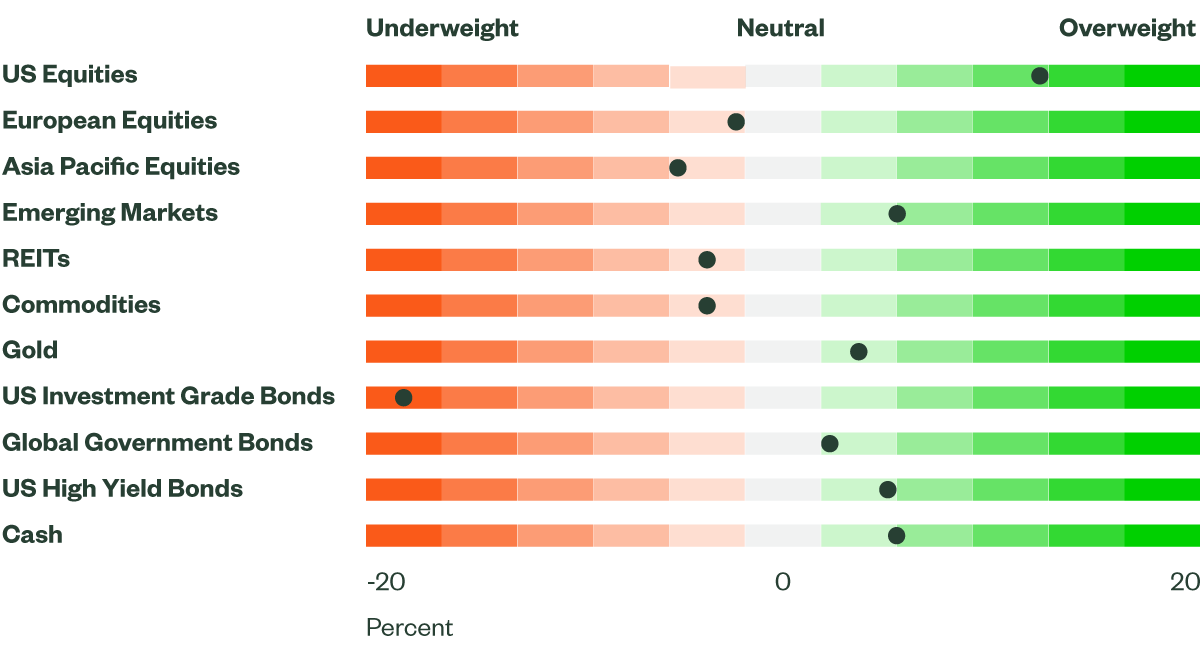

Figure 1: Asset Class Views Summary

Macro Backdrop

Internally, State Street Global Advisors has held the view that a soft landing is still achievable as long as growth slows but remains positive; inflation continues to decelerate; and the Fed begins easing monetary policy. Over the past month, we have seen progress in macroeconomic data, supporting this view. Growth has moderated in the United States (US) — recent inflation data indicate that disinflation is back — and the Fed’s commentary has become more dovish, raising hopes for an expected cut in September.

The US economy exhibited more signs of moderation, while economic activity data outside of the US disappointed. Generally, we experienced weaker activity, better labor market dynamics, and some signs of stress for consumers. Global manufacturing activity seems to have bottomed out but hasn’t been able to recover — with June purchasing managers’ index (PMI) readings falling across many countries. Services, which has been a source of strength, is softening globally as PMIs in the US and Japan began falling into contraction territory in June.

Labor data, though mixed, continued to illustrate a more balanced market, with the job openings to unemployment ratio falling to 1.22 — very close to pre-COVID levels. For consumers, the backdrop is not dire, but delinquencies have picked up, wage growth has continued to moderate, and unemployment has risen to 4.1%.

June’s consumer price index report was welcome news and it followed inflation readings from the previous month, which showed easing price pressures. However, producer prices disappointed – June’s data outpaced expectations and the previous month’s reading was revised higher. Despite this, there are other signs of relief as price-paid measures for both manufacturing and services fell for the second consecutive month.

Furthermore, the number of small businesses planning to hike prices continued to fall, according to the National Federation of Independent Business’ small business survey. While there are still some risks to the upside, recent data is encouraging. The Fed is likely to need another month or two of progress before becoming comfortable with easing rates. However, board members do appear more optimistic that inflation will return to target.

Directional Trades and Risk Positioning

Over the second half of June, our Market Regime Indicator (MRI) started to move up into a normal risk aversion regime as the unexpected call for snap elections in France injected some turbulence into global equity and currency markets. More recently, conditions eased, and MRI settled back into low risk — a regime that is typically beneficial for equity markets.

From a quantitative perspective, our forecast for equities improved and remains strong, while our fixed income expectations declined.

Broad strength across multiple factors in our quantitative model buoys our equity forecast. Positive equity returns this year have stretched valuations, but balance sheets are resolute and analysts’ expectations for both earnings and sales are robust. Additionally, price momentum supports further appreciation for equities.

After improving last month, expected returns for fixed income fell in July due to interest rate momentum, which suggests a slight bias for higher rates. Q1 US gross domestic product (GDP) was below expectations, but nominal GDP is still running well above long-term treasury yields, implying rates should continue to rise. Our forecast for high yield is positive but weaker than last month. The current level of government yields suggests financing costs are high and spreads should widen. However, lower equity volatility and positive equity momentum support our outlook.

Given the improvement in risk appetite and better equity forecasts, we purchased equities using proceeds from aggregate bonds, high yield bonds, and cash.

Relative Value Trades and Positioning

Within equities, our expectations for the US improved, but forecasts for non-US developed market equities declined. Elsewhere, prospects for emerging markets remained favorable. In the US, an upgraded macro score, particularly the macro cycle factor, pushed our forecasts higher. The US appeared attractive across all factors except value.

For Europe, our diminished forecast was driven by expectations for sales and earnings, which deteriorated further and remained negative. Despite healthy balance sheets and attractive valuations, price momentum is only neutral.

Emerging markets are bolstered by firm quality and sentiment indicators. During the rebalance, we reduced our exposure to European equities, reallocating proceeds to US large-cap and emerging market equities.

On the fixed income side, slightly weaker bond forecasts prompted us to reduce exposure to long government bonds and redeploy into cash. Cash offers a generous yield and can help mitigate any bond volatility resulting from geopolitical uncertainty.

After accounting for relative value and directional trades, the overall portfolio sees a modest increase in cash holdings. Following the rebalance, we hold an overweight to cash, long government bonds, and high yield bonds.

Finally, at the sector level, we maintained allocations to technology and energy, while rotating from industrials into communication services. Energy remained attractive due to favorable valuations, good balance sheet health, beneficial macro factors, robust sales, and strong earnings expectations. Stout price momentum, advantageous macro factors, and excellent sentiment indicators helped to uphold our constructive outlook for technology.

Our forecast for industrials contracted due to collapsed sales and earnings expectations. Elsewhere, softer price momentum and macro factors pushed the sector down in our rankings. Our improved outlook for communication services was driven by better sentiment and sturdy price momentum with the sector ranking near the top across both factors.

Click here for our latest quarterly MRI report.

To see sample Tactical Asset Allocations and learn more about how TAA is used in portfolio construction, please contact your State Street relationship manager.