Finishing Strong and Preparing for the Year Ahead

Equity markets, led by the US, are on track to finish the year close to or at all-time highs. Since the Global Financial Crisis (GFC), developed market equity returns have been remarkably strong, and above long-term averages. Returns recently have been driven by a concentrated band of stocks. We reexamine the current market environment, assessing what it may mean for future returns.

The Death of the Cult of Equities

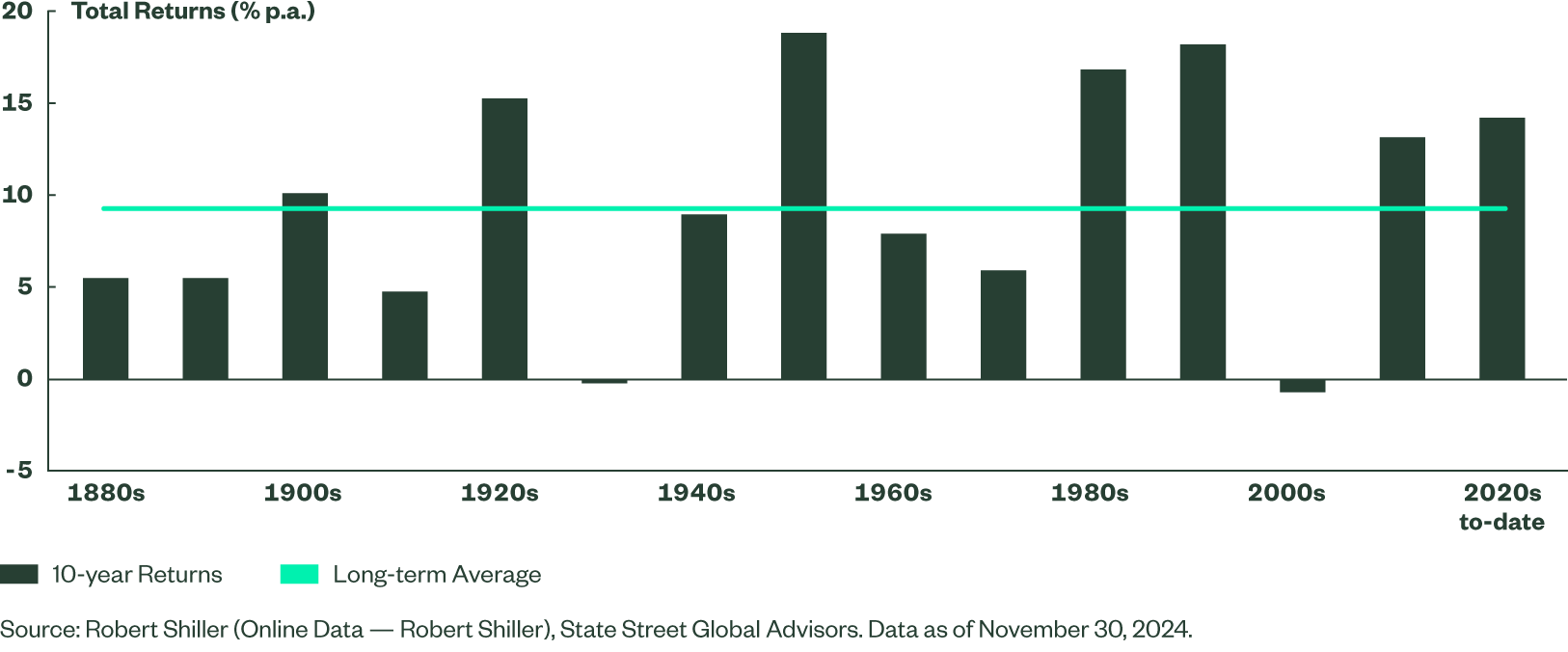

The phrase “The Death of the Cult of Equities” reemerged again in the early part of the last decade, echoing a refrain first launched in a Bloomberg Businessweek article in 1979. In the decade plus since that publication, developed market equities, as measured by the MSCI World Index, have been in robust health, returning 12% per annum. Since the inception of the MSCI World Index, equities have returned 9.7%. In the US equity market, where we have a significantly longer history, a similar story holds, with recent returns above average.

Figure 1: US Equity Returns by Decade

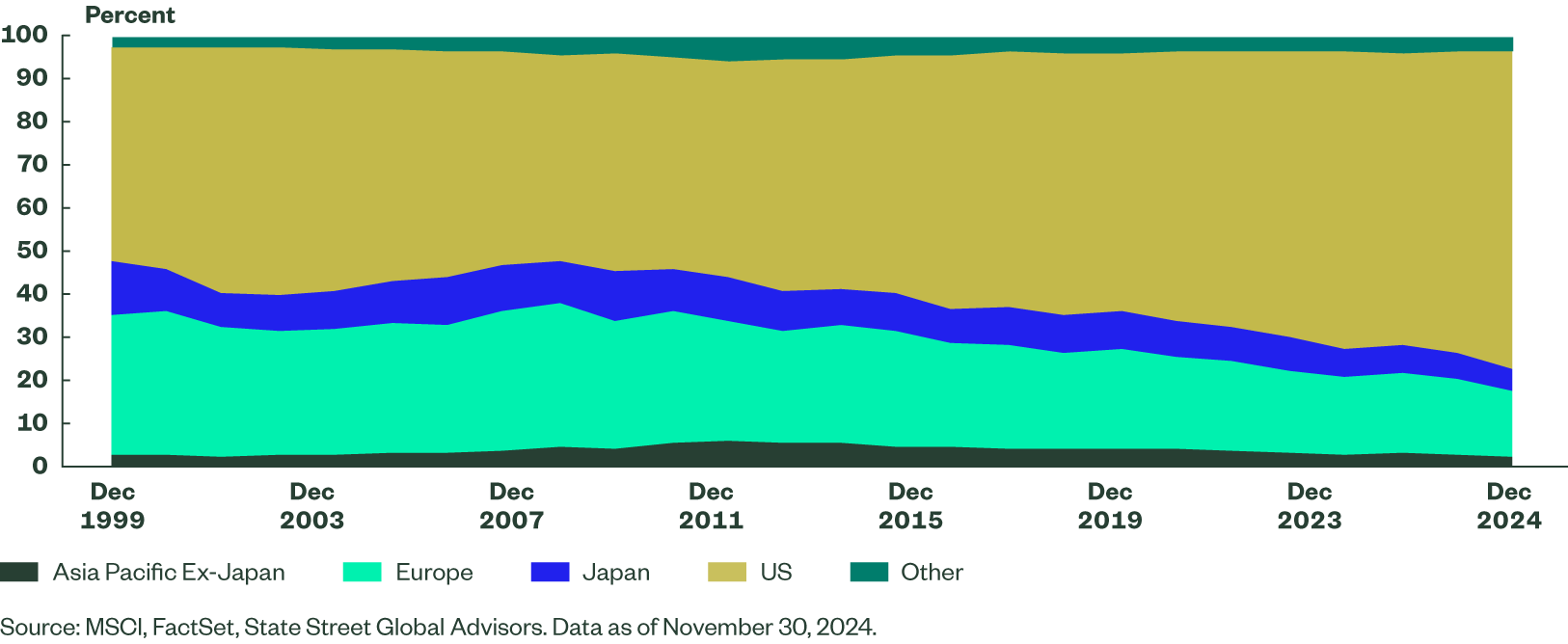

Returns in recent years, however, have become more and more concentrated in the US equity market, and in a few stocks in that market. The US equity market currently makes up 74% of the weight in the MSCI World Index, significantly above the long-term average of 57%.1

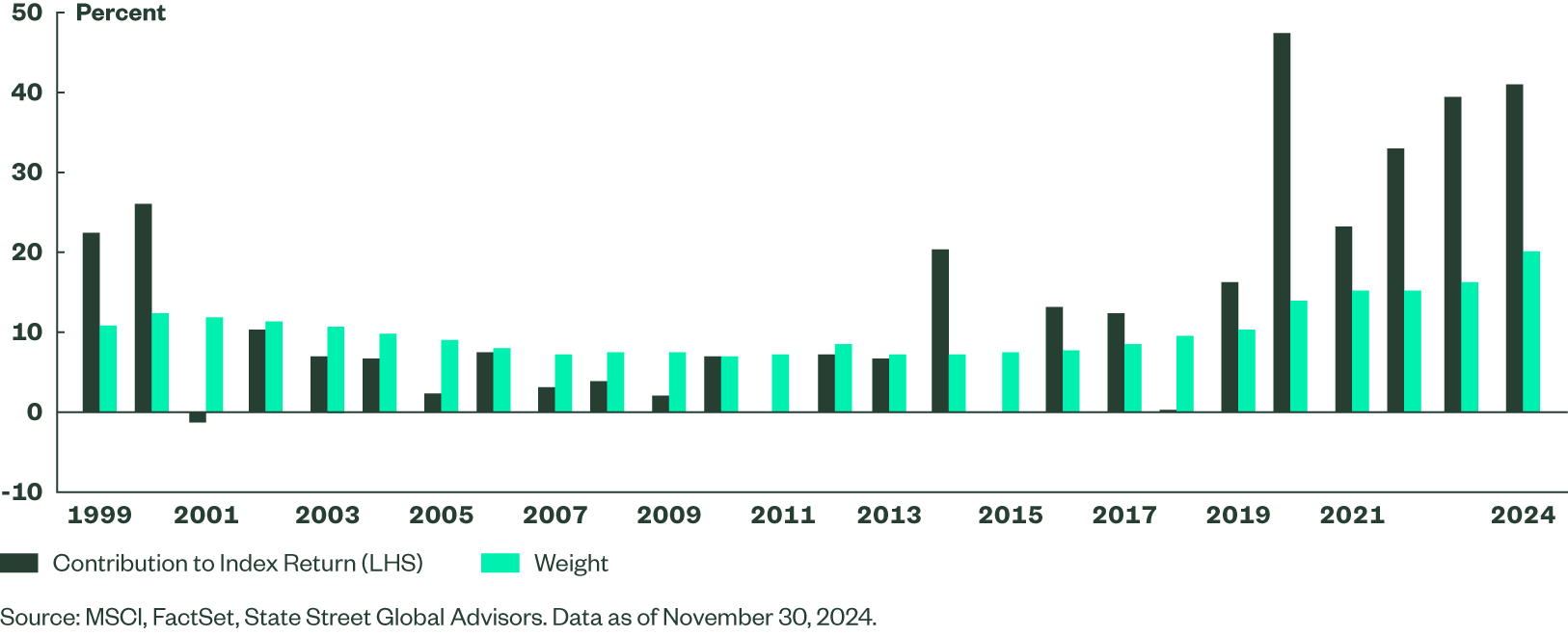

The current cohort of the world’s largest stocks, colloquially known as the Magnificent 7 is a significantly larger proportion of the market than its predecessors and over the past two years contributed 40% of the total index return. This return level is significantly above longer-term expectations and exceeds the returns from past top performing cohorts from past Technology, and Media and Telecommunications bubbles in the late 1990s and 2000s, respectively.

Figure 2: US Weight in World Index at Long-Term Highs

Figure 3: Contribution to Benchmark Return and Average Index Weight of the Largest 7 Stocks in the MSCI World Index per Year

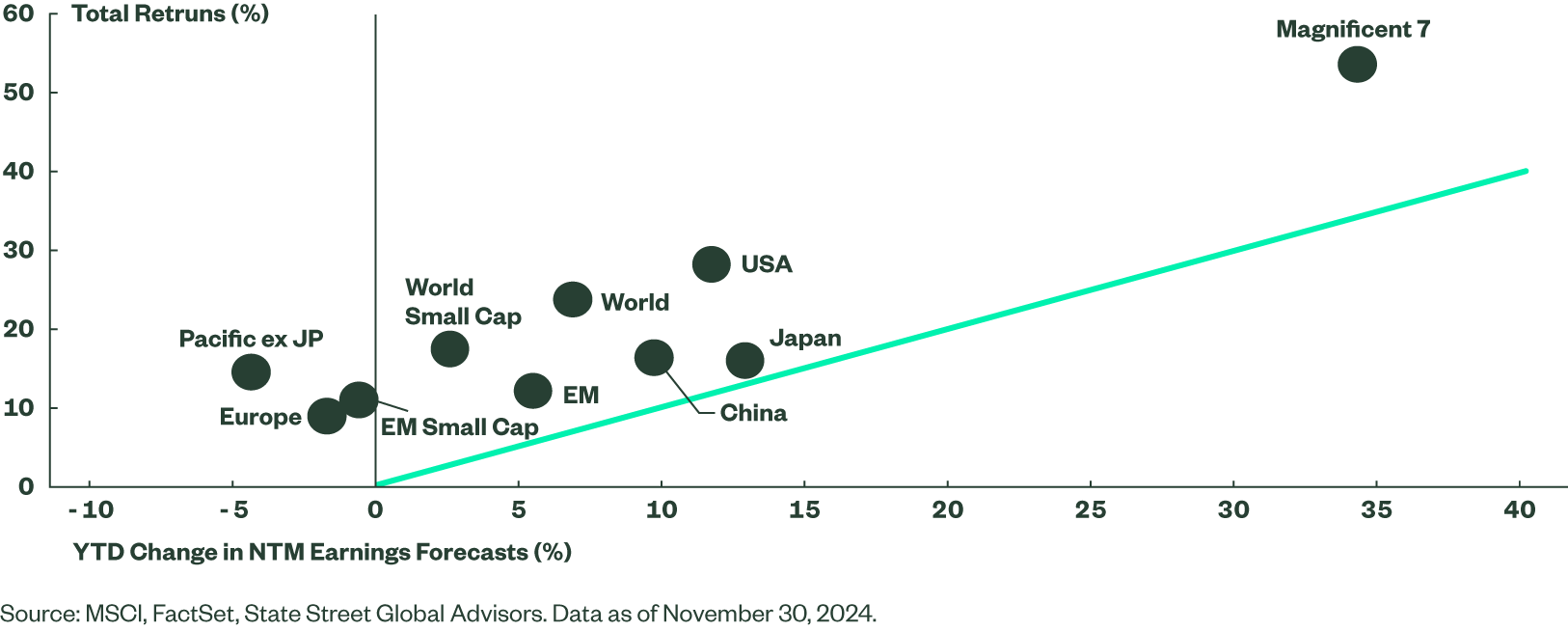

While this extreme positioning creates concentration risk for indexed investors, it does not necessarily represent irrational positioning in the markets. Over the past year there has been a strong correlation between returns and changes in earnings expectations, with stock prices following the direction earnings. We show this trend in Figure 4, although we should note that as demonstrated by all the data points above the diagonal line, returns appear to be outpacing fundamentals— i.e., equity returns have been boosted by valuations getting more expensive.

Figure 4: YTD Total Returns and Changes in 12m Forward Earnings Expectations

As a result of the significant re-pricing across most equity markets, valuations now appear to be stretched even if not quite at extremes. Comparing current prices to earnings expectations over the next twelve months, the US market, for example currently trades at 23x earnings, while Europe is around 13x earnings, and emerging markets small caps are at 14x. The standouts are the Magnificent 7 stocks, which on average trade at 40x earnings over the next twelve months.

The Bottom Line

Since the GFC, equity markets have generated robust returns, yet have become much more concentrated and more narrowly led. While fundamentals have largely driven this alpha generation, and in particular led by the exceptional performance of US stocks and the US economy, we think some re-assessing of the nature of the equity markets is worthwhile as we look forward to 2025. A healthy broadening out of market leadership, into previously unloved areas such as small caps or emerging markets, for example, could accompany a soft-landing scenario and be positive for market direction.

Given the very strong returns over recent years and stretched valuations particularly from the largest stocks, we would warn against extrapolating recent returns into the future. Returns for cap-weighted indices over the next decade may well be lower than those we have got used to. In a lower return world, incremental positive returns generated from active management could be more highly prized. We believe investors should start to reassess the balance of indexation with lower active risk (enhanced) approaches within the core of their portfolio along with fully active management in sectors where they believe they will be commensurably rewarded. Investors should prepare their portfolios accordingly as the next decade may be one of vigorous markets and healthy active management.