Insights

Market Forecasts: Q1 2025

Global Economic Outlook

- The pro-growth policy tilt of the new US administration gives US exceptionalism a boost in 2025, but also comes with the risk of a policy misstep in sensitive areas such as trade and immigration.

- Europe faces headwinds of sluggish growth prospects and uncertainty around US policies that requires greater intervention and urgency from Brussels and national governments.

- Global monetary easing has further to go in 2025. While tariff fears have tempered expectations around the extent of rate cuts, central banks will continue to loosen policy — with Japan remaining the most notable exception as higher rates are expected from the Bank of Japan.

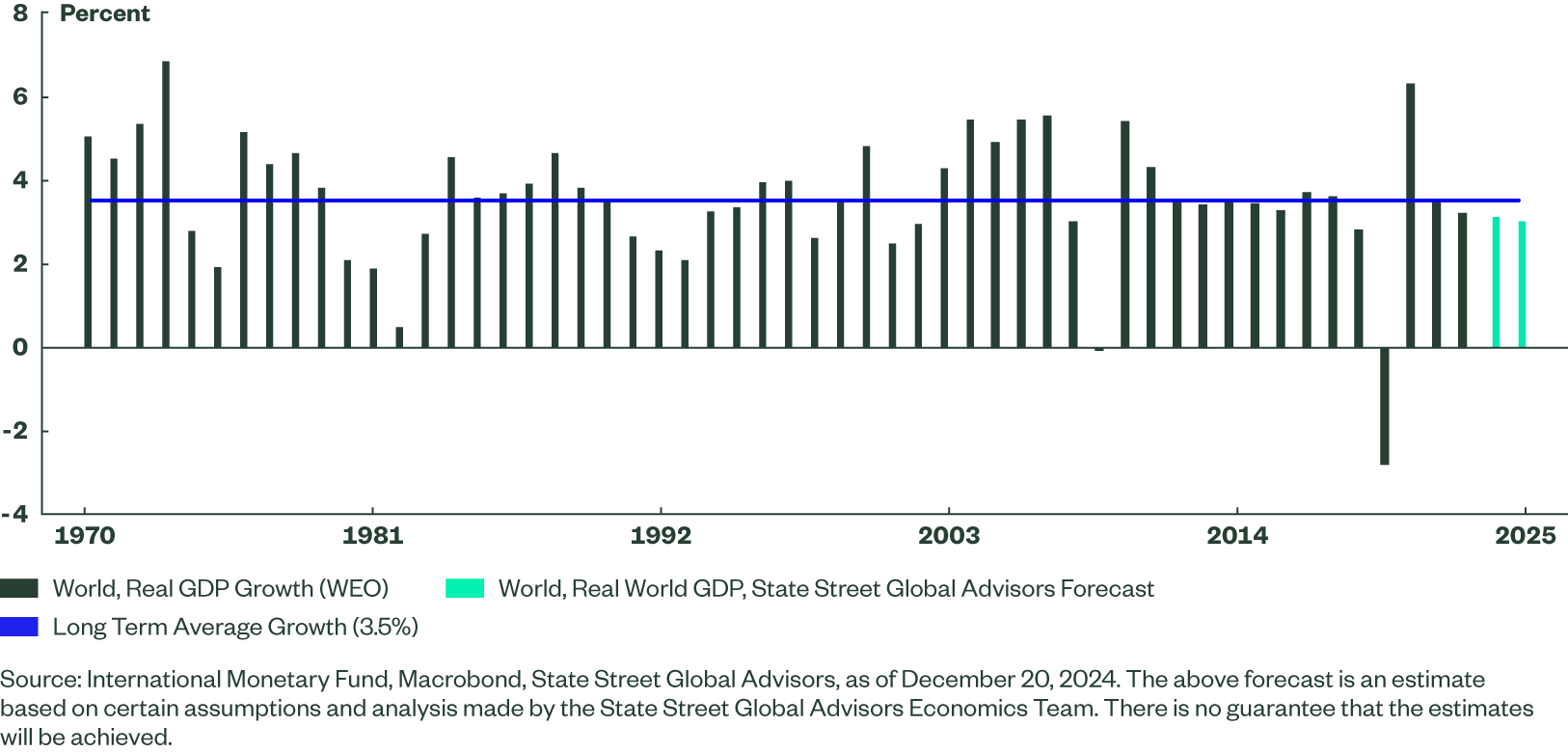

Figure 1: Global Growth Set to Remain Steady, But Risks Lurk

Global Capital Markets Outlook

- We continue to have a constructive view of equity markets, but have pared our level of risk exposure compared with the past calendar year amid less supportive sentiment data and increasingly steep valuations.

- While all capital markets seem to face fatter tails and more two-sided risks in 2025, that is especially true for bond markets where resilient growth, sticky inflation, and concerns surrounding tariffs and geopolitical risks could send yields swiftly higher or lower. We remain underweight bonds as we start 2025.