Implementing Your De-Risking Strategy: Plan-by-Plan Considerations

Strong equity performance and still-elevated Treasury rates have boosted the funding status of US corporate defined benefit (DB) plans, prompting many of them to explore de-risking by shifting to higher fixed income allocations. However, just how to de-risk is a highly important call for plan sponsors to make, as implementation can impact the plan’s effectiveness and operational efficiencies.

For plans seeking to de-risk, the optimal mix of fixed income investment styles is not one-size-fits-all. Rather, each plan’s funding status and unique circumstances are key in deciding how to combine indexing, active, or systematic approaches. We can summarize our views as follows:

- Well-funded plans may want to lock in their current liability streams using an index building-block approach, in which various fixed income sectors are combined to create a bespoke fixed income exposure.

- Less well-funded plans may want to consider taking an active approach and accepting greater tracking error volatility of their liabilities in exchange for opportunities for alpha and higher expected returns. This could improve funded status over time.

- A systematic active approach can offer a differentiated and complementary source of alpha alongside fundamental active managers, and can play a versatile role in an liability-driven investing (LDI) portfolio.

Background: With Equities’ Solid Performance and Yields Still High, De-Risking Is in Focus

On the back of a rapid progression of Federal Reserve (Fed) rate hikes that started in early 2022, interest rates are significantly higher today than at any time between 2008 and the recent tightening cycle. At the same time, earnings growth and credit fundamentals have held firm, and equities have soared to record highs in 2024. As a result, corporate DB pension plans’ funded status has improved substantively over the past several years (Figure 1). Funded ratios for the Milliman 100 are at about 104%.1 Many plans will be looking to lock down their liability streams in this environment by de-risking and shifting from return-seeking assets to liability-hedging assets; i.e., increasing their fixed income allocations.

De-Risking Implementation: Evaluating Options for Indexing, Active and/or Systematic Fixed Income

Plan sponsors have a wide range of options to de-risk their portfolios, such as pension risk transfers, participant buyouts, or asset allocation-based solutions. There is no one-size-fits-all approach. What makes the most sense for a given plan will be based on their objectives and their unique liability streams, plan longevity, risk aversion, and other circumstances.

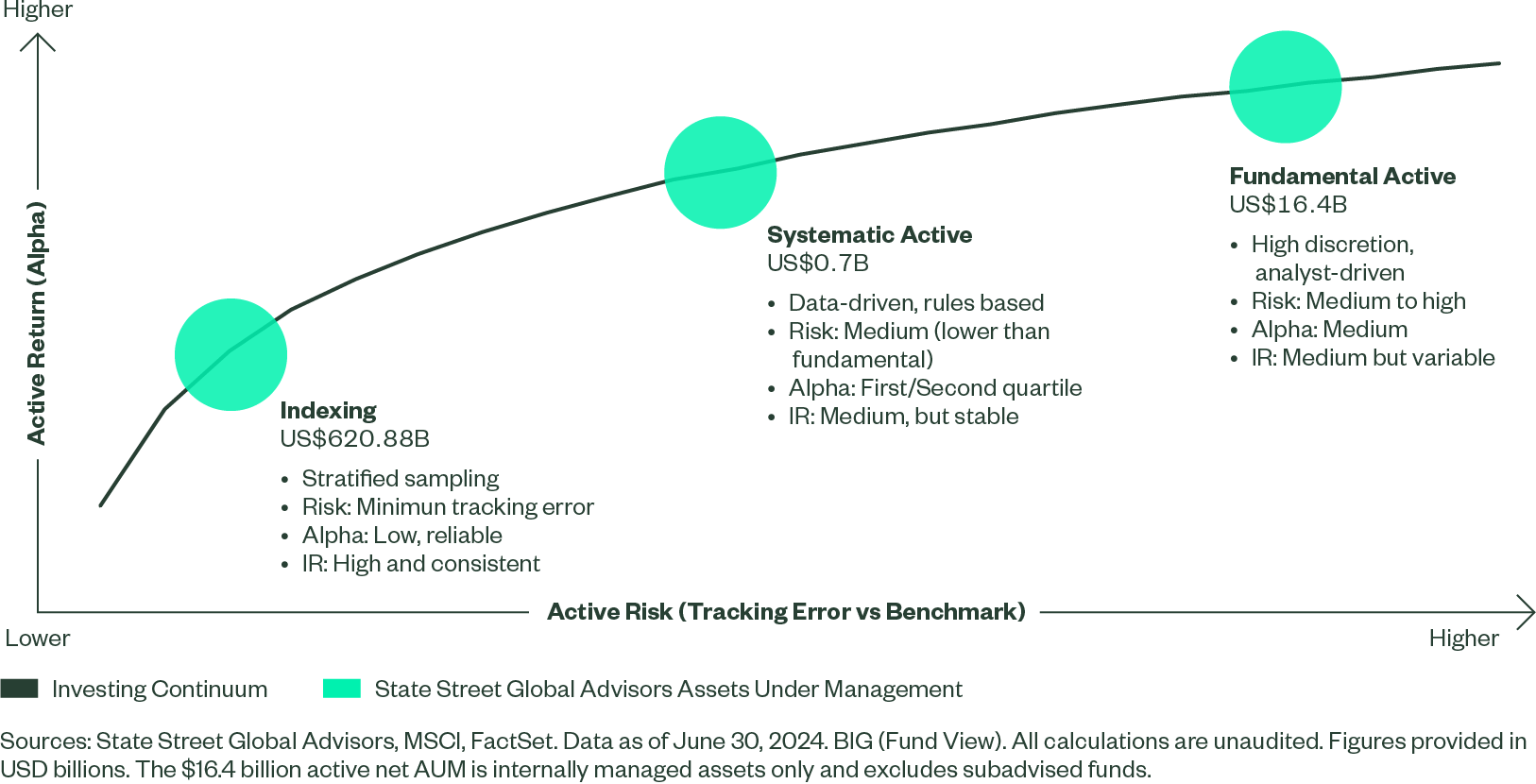

When it comes to fixed income investment approaches in de-risking, plans can choose from indexing, fundamental active, and/or systematic fixed income – or some combination of the three. Each can play an important role and provide a distinct advantage to liability-aware portfolios. Figure 2 shows the continuum of fixed income approaches, which has expanded in recent years due largely to advancements in fixed income trading technology (see The Modernization of Bond Market Trading and its Implications).2

Figure 2: The Fixed Income Investing Continuum

Incorporating Funding Status

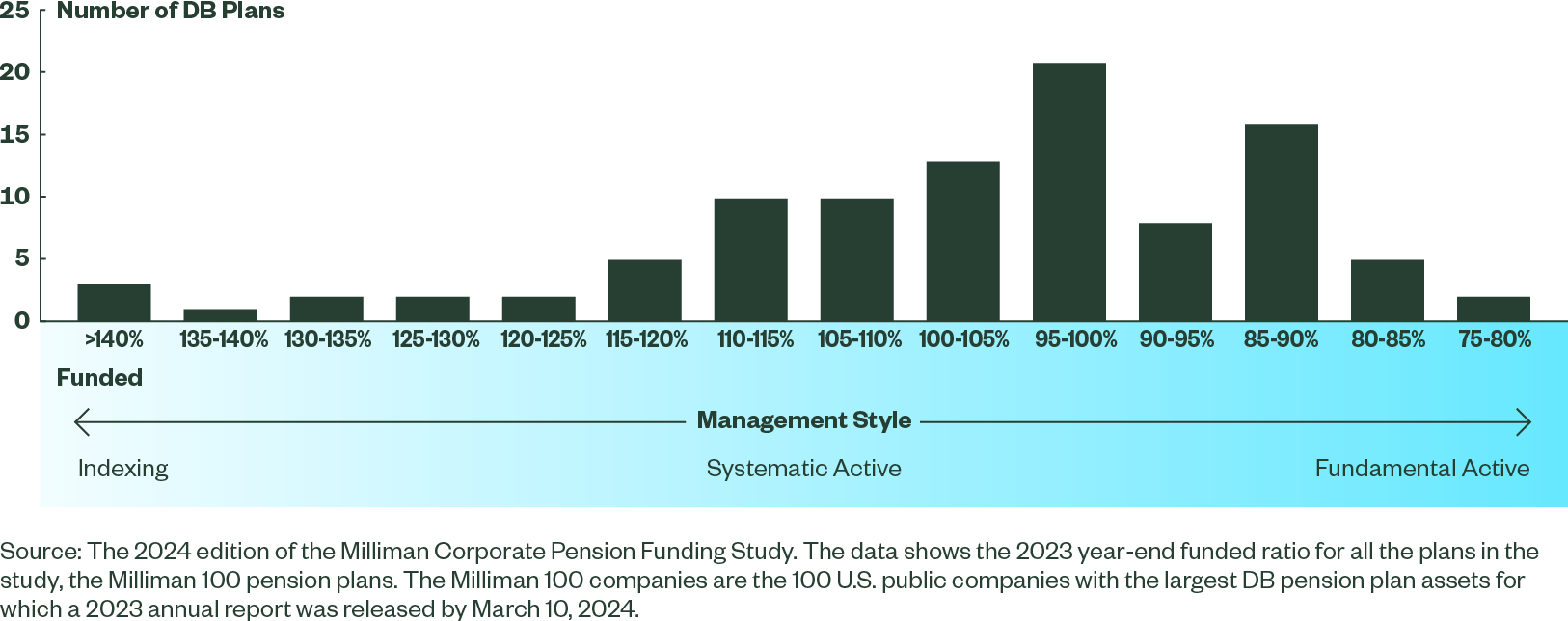

One practical approach that some clients have found helpful is to frame their investment approach decision in the context of overall funding status. The distribution of funded ratios from the largest US corporate DB plans (Figure 3) shows that while the average plan is about 100% funded, there are a wide range of funded statuses in the DB landscape – from greater than 140% funded, to between 75% and 80% funded. What does the client’s funding status suggest is the most preferred location for them along the fixed income continuum?

- Well-funded plans whose overarching objective is to minimize funded status volatility may prefer the precision of an index building-block approach, in which plans can effectively minimize tracking error to their liabilities with a low-cost approach. With building blocks, various fixed income sectors (such as investment grade corporate bonds and/or Treasury bonds) are combined to create a bespoke fixed income exposure (see De-Risking Effectively Using Fixed-Income Building Blocks).

- Less well-funded plans may be willing to accept a greater level of tracking error on their liabilities in exchange for additional yield, spread, and expected return, with an eye toward improving funded status over the longer term. These plans may prefer an active approach. Historically, first- or second-quartile fundamental active long credit managers have generated excess returns of +60-90 bps, gross of management fees, with information ratios of 0.6 to 0.9 over the 5- and 10-year period through June 2023 (source: eVestment). One important consideration on the downside is that active managers will tend to underperform during equity market drawdowns.

- With advances in bond trading and market structure, we believe a systematic active approach also has an important role to play in the de-risking landscape. Skilled systematic managers can potentially generate competitive alpha in a differentiated way from fundamental managers.

Figure 3 shows these key points graphically. As we move from higher to lower funding status, we suggest plans move from left to right (less active to more active) on the fixed income continuum.

Figure 3: Lower Funded Status Levels May Imply More Active Management Along the Continuum

Putting De-Risking into Practice

Putting De-Risking into Practice

As corporate DB plans are thinking through how to de-risk their portfolios, it is crucial for them to ask: What fixed income approaches make sense based on our plan’s funded status and unique circumstances? We explain why funding status may make active—or less active—management styles preferable for specific plans. We also discuss tools that can help plans implement the most effective de-risking strategies based on their goals and requirements.