US Snapshot

COVID-19 has impacted almost every aspect of people’s lives globally. While the short-term financial implications of the pandemic are top of mind for many individuals, we were interested to see whether this climate would change long-term savings behavior. In this year’s Global Retirement Reality Report (GR3), we investigate the impact that COVID-19 has had on personal finances and sentiment around retirement planning. In this report, we share the results of our survey of defined contribution (DC) participants in the United States.

Key Findings

In comparing retirement sentiment against the 2018 GR3 data set, Americans continue to be the most confident nation surveyed. However, this optimistic outlook does not come at the expense of the current reality. In 2020, though few respondents had experienced a deterioration of income or lifestyle, many expressed anxiety about their “new normal” and cited changes to immediate spending and saving habits. These practical measures are expected to be short-lived, while long-term retirement investing strategies have remained on track, suggesting little variance in participant behavior.

But the participant experience will most likely be drastically altered and both plan sponsors and retirement plan advisors have an opportunity to light the path ahead, from workplace benefit policies to corporate governance actions to new investment solution guidance.

Key Finding #1: 73% of Americans consider their financial situation to be the same or better during the COVID-19 crisis

To qualify for the survey, respondents must have had access to a workplace-sponsored DC retirement savings plan and been working at least part-time. In the US, the ability to meet these criteria suggests a more financially secure survey population, particularly as nearly 40% of working Americans didn’t have access to a DC plan pre-pandemici and, as of June 2020 data, US unemployment was still a historically high 13.3%.ii Survey confidence quotients may be higher than national sentiment, as 53% of respondents reported that their financial situation is the same, with 19% describing it as either “slightly” or “a lot” better.

This sense of stability is echoed in the employment circumstances, with 49% reporting no impact from the pandemic, followed by 21% who reported a reduction in hours and 10% who reported a reduction in pay. Few had been furloughed (5%) or laid off (3%).

Key Finding #2: The US leads in retirement confidence

American optimism is a studied phenomenon. Alexis de Tocqueville, a 19th-century French observer of American life, remarked that the national outlook had “a lively faith in the perfectibility of man … [seeing] society as a body in a state of improvement.”iii Belief that the present is bound for a greater future and individuals can participate in that betterment is a uniquely sanguine — and American — view.

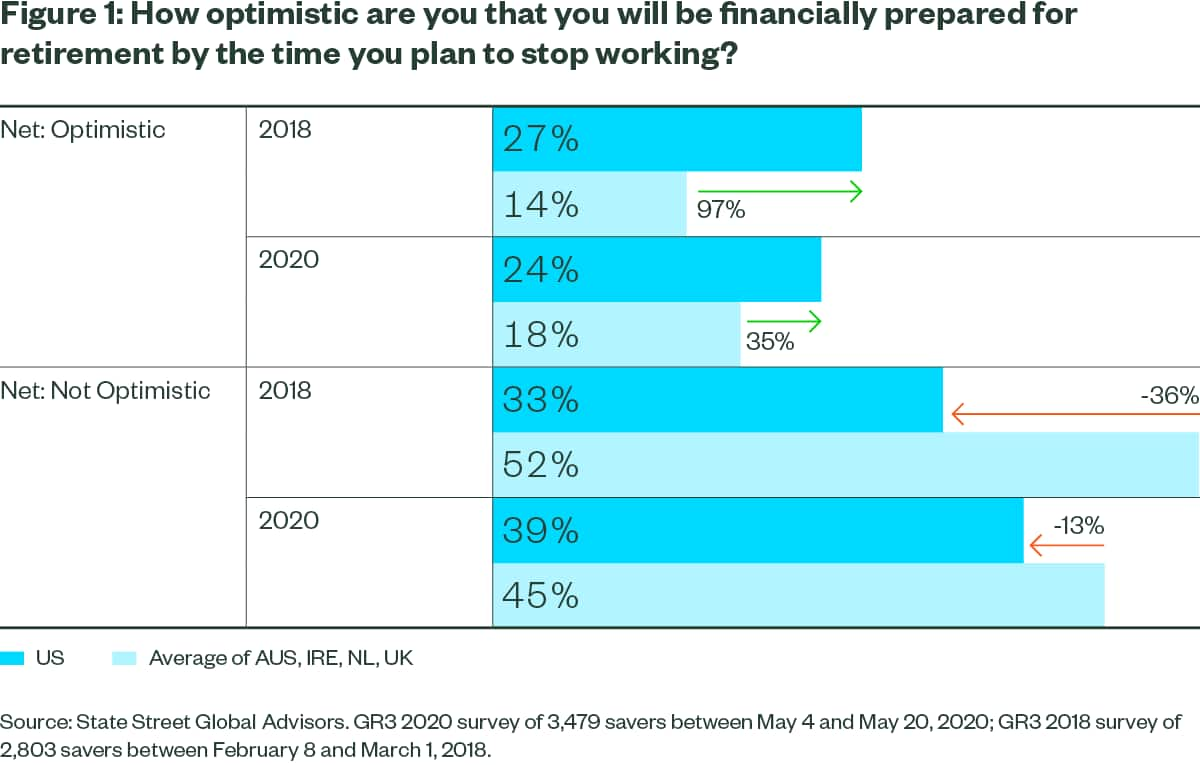

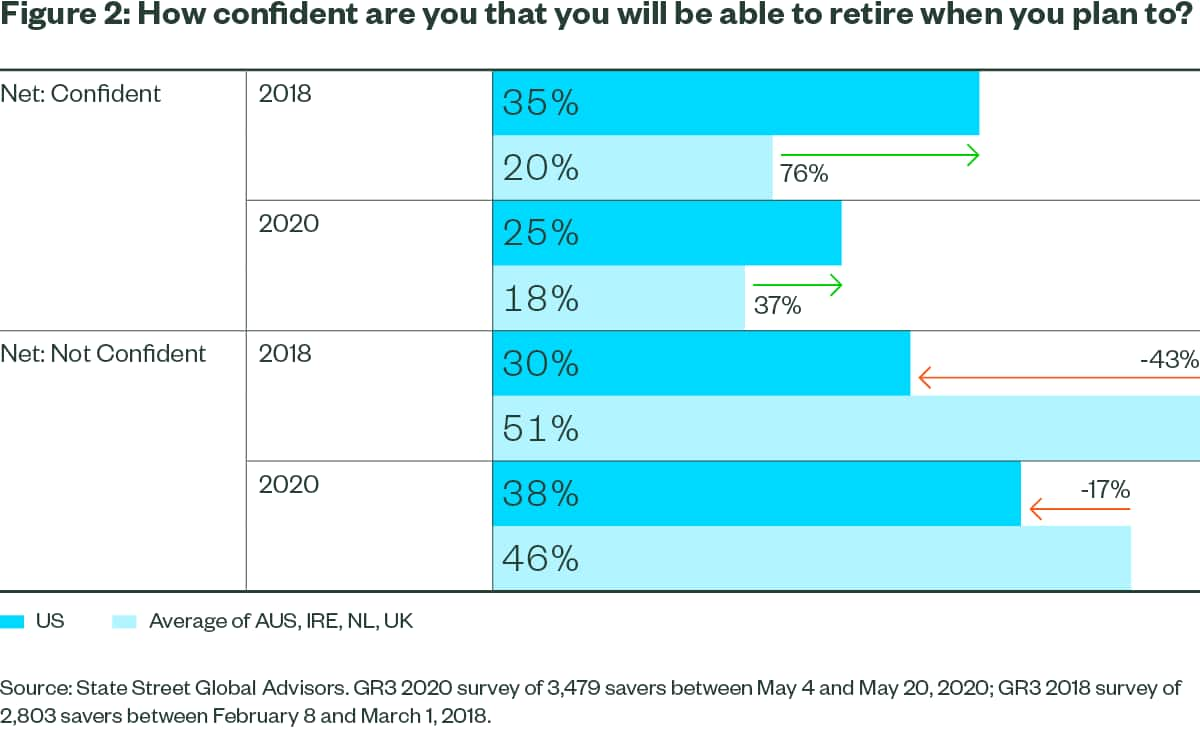

Americans are 37% more confident that they will be able to retire when planned than respondents from all other countries surveyed.*

*In 2020, Americans reported a net 25% confidence (defined by 295 participants who said they were “somewhat optimistic,” 164 who were “very optimistic” and 98 who were “extremely optimistic”) versus the ex-US average of 18%.

Even in today’s chaotic climate, US respondents reflected higher levels of optimism and confidence than aggregate global respondents, though in comparison to 2018 data, the American sentiment has downshifted, reflecting a slight decrease in hopefulness and an incremental increase in doubt.

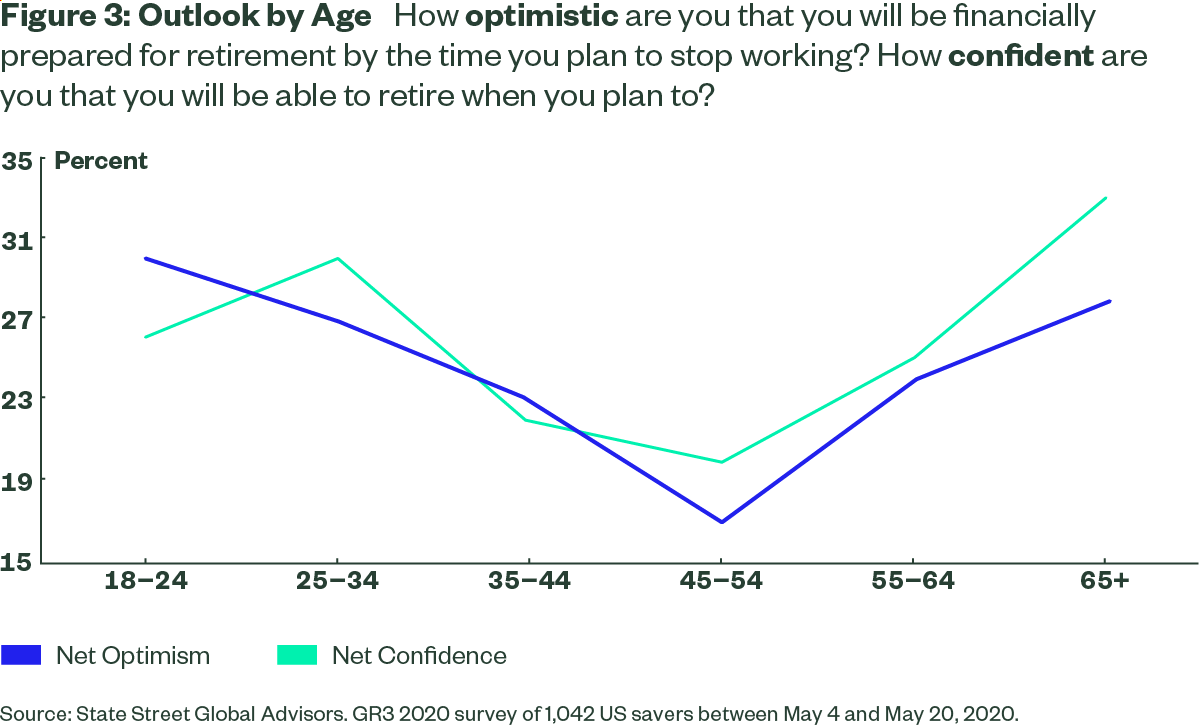

Age, not gender, plays a role in retirement optimism and confidence, with those who are mid-career, primarily of the Generation X cohort, feeling the greatest strain. Whether driven by a more complex financial life, less time for savings catch-up, an informed understanding of “what could go wrong” or a general midlife malaise, the dip in optimism is noticeable for this group and presents an opportunity for both sponsors and retirement advisors to version messaging and solutions specific to this group’s needs.

Key Finding #3: COVID-19 is not the main factor affecting retirement confidence

While 28% of the US sample said that the COVID-19 situation was having a high impact on their retirement confidence levels, the majority (72%) said that COVID-19 was having low or no impact.

Impacts more pertinent than COVID-19 to retirement confidence were:

1. Medical expenses (39%)

2. Uncertainty about retirement plans (37%)

3. No spare money to save for retirement (35%)

Of the countries surveyed, the US was the only nation citing medical expenses as a “top three” concern, let alone as the No. 1 impediment to retirement security. In fact, a study published in the American Journal of Public Health found that 66.5% of all US personal bankruptcies, regardless of age, are related to medical issues. Those over the age of 65 face greater susceptibility, owing to increased debt and decreased earning potential.

The concern of not having spare money to save for retirement seems exacerbated by COVID-19 consequences, as many respondents expressed feeling financially squeezed by supporting newly at-home adult children and overseeing elderly dependents’ care.

“Expenses are higher for my elderly parents — and logistics complex as all services must be organized remotely. In addition, my adult son lost his job and needed to move back home. I am most concerned about being able to save for the future, given that the present is so demanding.”

Key Finding #4: Many think that the impact of COVID-19 will be short-lived

It was clear from our survey that the impact of COVID-19 had limited implications for long-term retirement confidence, suggesting that there is an expectation that negative financial impacts will be short-lived.

The majority of US savers felt that the impact that COVID-19 would have on their finances would most likely last less than a year.

This view was shared among other markets surveyed, with the greatest concentration of US participants believing that the effect COVID-19 will have on their finances will last no longer than a year (36%), followed by those who don’t believe there will be an impact (17%).

Here, it is interesting to see the concentration of those who simply don’t know (18%) how long the crisis will impact their finances. This unknowing is most likely caused by the dimensionality highlighted in Key Finding #3, regarding the factors affecting retirement confidence. The length of time that the COVID-19 situation will impact individuals’ finances is not simply an issue of economic recovery or virus control; instead, multiple personal and professional levers are being pulled at once, creating a loom of uncertainty that will most likely inform the next generation of financial wellness.

Key Finding #5: 63% of participants have not made changes to their retirement saving strategy

Thanks to the March 2020 passage of the Coronavirus Aid, Relief and Economic Security (CARES) Act, those participating in an IRA, 401(k) or 403(b) retirement savings plan have been granted access to plan loans and coronavirus-related distributions of up to $100,000 without penalty and with forgivable tax treatment. It is currently unclear whether Americans are taking advantage of this relief option, though survey respondents reported little change to their retirement saving strategy. Savings levels are largely staying the same, both in short-term investments (71%) and long-term retirement plans. With regard to immediate finances, the majority (53%) said they were pulling back on nonessential spending, while others reported an increase in charitable giving (14%) and a decrease in monthly saving (12%). These day-to-day changes suggest an active adjustment to the present climate, even as survey-takers’ long-term outlook is positive and investing behaviors remain steady.

While respondents aren’t altering their retirement savings behaviors, their employers may be. Plan sponsors, primarily but not exclusively in the retail, travel, hospitality and airline sectors, have been suspending or reducing company match programs during the coronavirus crisis.v The missed match will be felt by all affected participants, particularly the undersaved; however, US survey respondents were among the most forgiving of the global sample with regard to a possible pause (31%), following Ireland (34%) and in step with Australia (31%).

Nearly a third of US savers would support their employers’ decision to suspend the retirement savings plan company match during the COVID-19 crisis.

Whether guided by pragmatism (opting for job security), employer commitment (supporting continued operations) or optimism (believing the suspension to be short-lived), those surveyed in the US were more accepting of the sacrifice.

Key Finding #6: Respondents’ appetite for financial advice is low, though their interest in investment risk is nuanced

Revisiting Figure 5, the low instance of financial advice-seeking (6%) is both eye-catching and prudent. Participants seem to have absorbed the wisdom advisors would impart, which is to ride out the market volatility and resist the urge to sell, especially if participants aren’t close to retirement age.vi

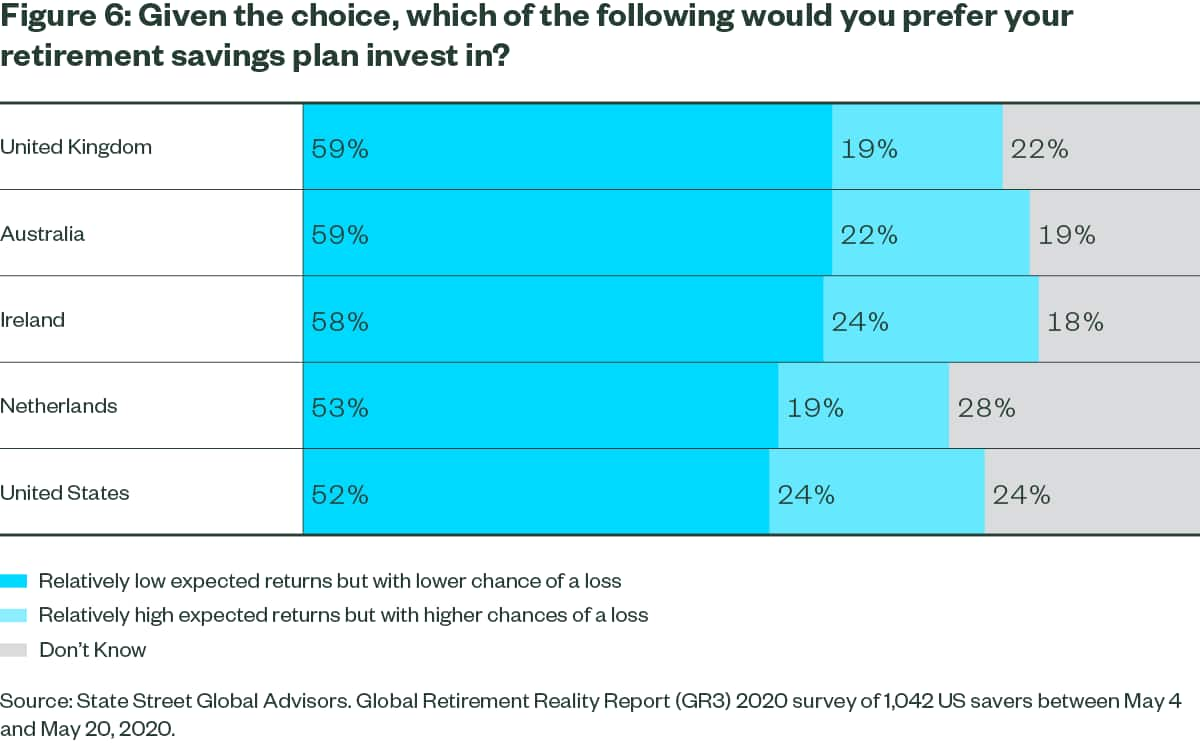

Participants’ risk appetite is dampened, with half seeking less loss over higher returns, but still is larger than savers in other countries surveyed.

When survey-takers were asked about their investment outlook in light of COVID-19-related stock market volatility, the majority (58%) said they believe now is a good time to buy equities for the long term, with 13% inclined to sell stocks and seek lower-risk vehicles. If given the choice, 52% of US respondents said they would prefer investment options that offer less chance of a loss in exchange for lower returns. Interestingly, the US respondents’ desire for safer investments lagged behind all other countries surveyed. Australia and the UK led (59%) with demand for low-risk options, followed by Ireland (58%) and the Netherlands (53%).

Of the countries surveyed, the US and Ireland were putting the greatest priority on return over risk (24%), an appetite that may be fed in the States, given the Department of Labor’s recent ruling allowing the inclusion of private equity funds — notorious for high risk and high fees for the promise of higher returns — within 401(k) plans.

Key Finding #7: More than half of American respondents will consider companies’ COVID-19 response when investing

The COVID-19 crisis has shone a light on the way that companies are managed with regard to environmental, social and corporate governance (ESG) principles. Immediate issues such as employee health, serving and protecting customers and ensuring the overall safety of supply chains have important implications for company performance.

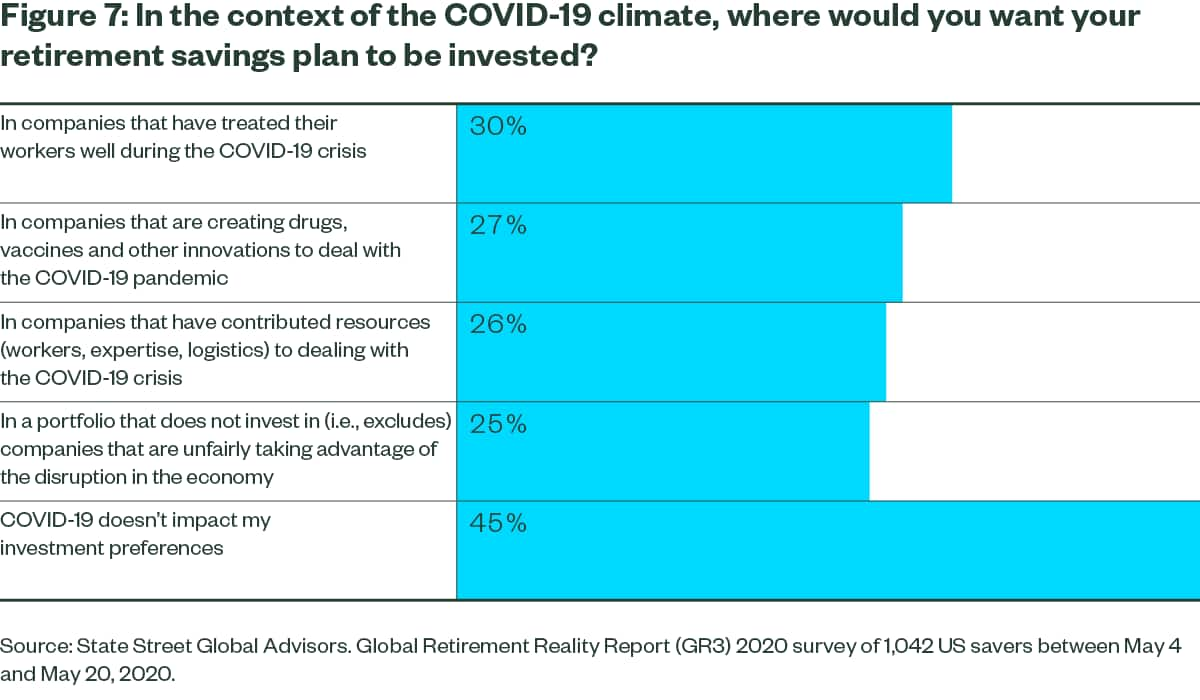

Close to one-third of respondents said they would want their retirement savings invested in companies that treated their workers well during the crisis.

We explored the extent to which savers shared this view and whether they would prefer their retirement savings to be invested in companies that have taken some of these issues into account in their response to the crisis. Over half (55%) would consider companies’ COVID-19 response when investing, 30% would be keen to invest in companies that treated their workforce well during the crisis, 27% would invest in those organizations innovating COVID-19 vaccines and treatments, 26% would invest in companies that contributed resources to the crisis and 25% would not invest in companies that had unfairly taken advantage of a disruption in the market. Here, it is interesting to consider how the “G” in ESG (environmental, social and governance) could take on increasing importance in investor preferences, as employees are now directly experiencing the impacts of corporate governance.

Closing thoughts

- Confidence is a cultural tenet, and while that extends to participants’ retirement outlook, it does not come at the cost of realism. US respondents are experiencing anxiety around uncontrollable future costs — primarily medical expenses and extending to dependent care — and are adjusting short-term spending and saving in response.

- Participants expect the impact of COVID-19 to be short-lived and aren’t changing their retirement saving behavior. That said, they are more forgiving of employer measures taken to maintain liquidity, even if that means a suspension or reduction of the retirement plan company match. Employers should consider this grace period temporary: When the economy returns and employment becomes competitive, benefits and employee treatment will be scrutinized.

- Lower-return investments promising less loss are popular among respondents, but that’s not the complete risk story. Of those surveyed, US respondents had the biggest appetite for high-risk, high-return investments and the lowest incidence of “not knowing” what to do next in today’s market, suggesting an informed and engaged segment seeking a more sophisticated investment insight — and meaningful potential for the financial advisor market.

- Managing the social impact of the crisis is seen to be important, with immediate issues such as employee health, serving and protecting customers and ensuring the overall safety of supply chains having implications for company performance.

What can you do?

- Consider targeted communications to help build participant confidence in times of uncertainty. Emphasize key messages such as the importance of saving for the long term, how to navigate retirement income decisions and the benefits of the default.

- Continue to support retirement savings plan company matching, as much as possible.

- Incorporate volatility protection mechanisms into default investment strategies to reduce losses.

- Speak to your asset manager about how their stewardship activities are promoting good ESG behavior in response to COVID-19.

Survey Methodology

As the COVID-19 pandemic was peaking in many countries this spring, and many had adjusted to the new normal enforced by nationwide lockdowns, State Street Global Advisors commissioned YouGov to conduct an online survey across five countries. YouGov surveyed 3,479 individual savers with access to defined contribution schemes:

| Region | Number Surveyed |

| Australia | 504 |

| Ireland | 403 |

| Netherlands | 510 |

| United Kingdom | 1,020 |

| United States | 1,042 |