Canada Snapshot

This report highlights three Canada-specific insights from the inaugural inclusion of Canadian workers in our Global Retirement Reality Report. This survey provides actionable insights that individuals, employers, financial advisors and policymakers can use to support retirement access, planning and income generation.

Do Canadian workers have the right resources to prepare for a comfortable retirement?

Canadian workers expect to live long lives in retirement, but many worry that they won’t be financially prepared to do so. That’s a key finding from our Global Retirement Reality Report (GR3) survey, fielded since 2018. For the first time this year, the study takes a close look at Canada, providing a view into how individuals and organizations across the country are preparing for retirement and what resources they need to succeed.

The study’s findings come as the rules governing retirement plans in Canada are expected to change this year—the first substantial update in more than two decades. The revised Guidelines for Capital Accumulation Plans (CAP Guidelines) are designed to better reflect the current defined contribution environment, including the sharp increase in the usage of target date funds.

The GR3 survey offers unique insights into how workers see the current retirement landscape, from their level of optimism around retirement planning to the areas where they want more support. This report also serves as an important benchmark, allowing plan operators, government officials and individual workers to see how Canadian views on retirement preparedness change over time. That data will help policymakers, administrators and workers make more informed choices—and drive more successful retirement outcomes.

Finding 1: Most Canadian workers expect to retire, but are worried about their financial preparedness.

In recent years, Canadian workers have experienced the disruptions and challenges generated by a global pandemic, persistent inflation, high interest rates and market volatility. Even so, most remain hopeful that they will retire at some point. Mirroring global averages, nearly six in 10 Canadians surveyed (57%) expect to fully retire (58% globally) and another 25% believe they will partially retire (26% globally).

Workers in all countries surveyed expect to retire around age 65 and live past 83. The average expected retirement age cited by Canadians was 64.6, with 39% of respondents estimating they’ll retire between ages 65 and 69 and 29% targeting ages 60 to 64. Retirement is expected to last somewhat longer in Canada than elsewhere, reflecting the projected longest lifespans of any country surveyed at 85.5 years.

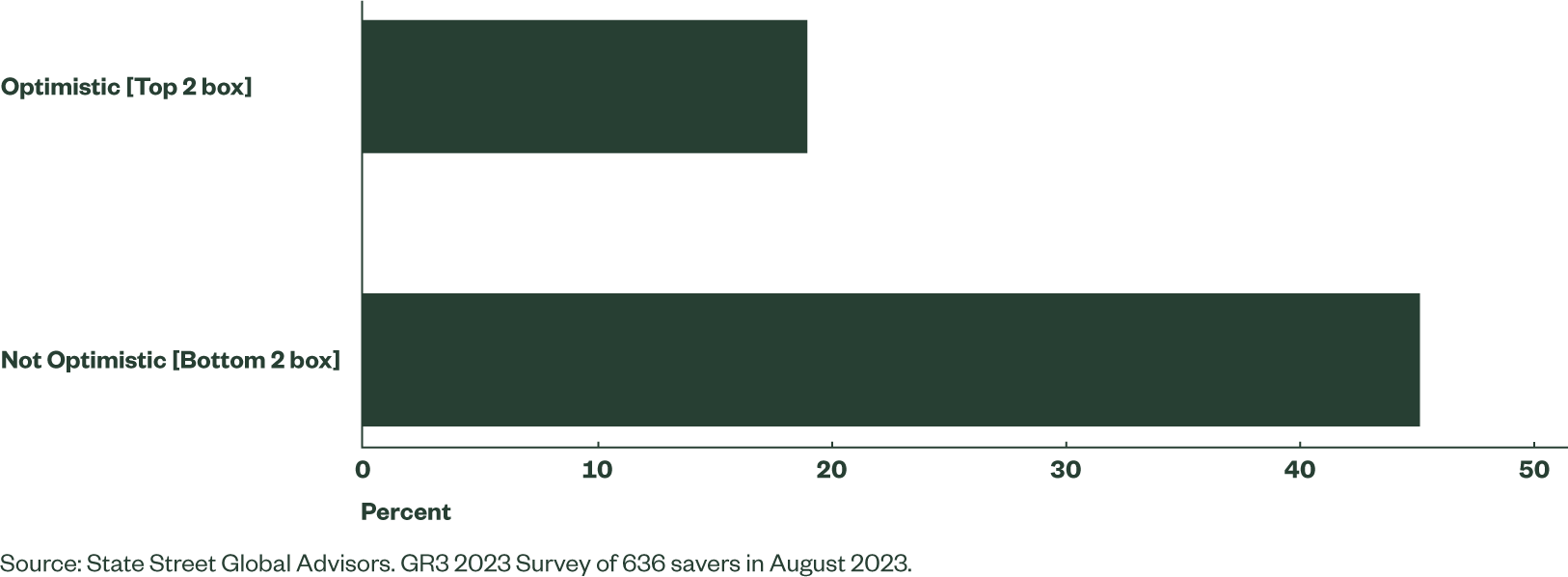

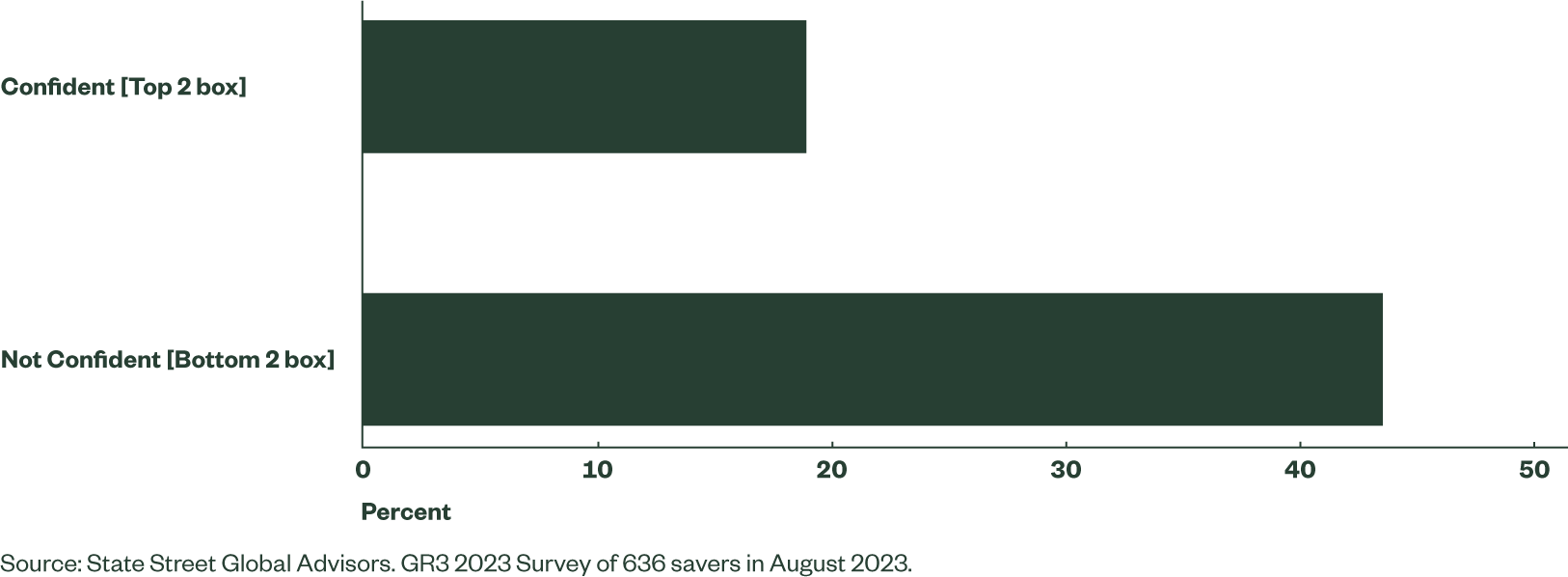

A concern for many Canadians is uncertainty that they will be financially ready to retire when they want to do so. Twice as many respondents said they are pessimistic about being financially prepared for retirement (45%) than those who reported being optimistic (19%). A large portion of the workforce believes they will need to delay retirement: More than four in 10 respondents (44%) said they don’t expect to retire on time, compared to just 19% who expressed confidence in their ability to do so.

Fig 1a : Optimism around being financially prepared for retirement

Figure 1b : Confidence about being able to retire when planned

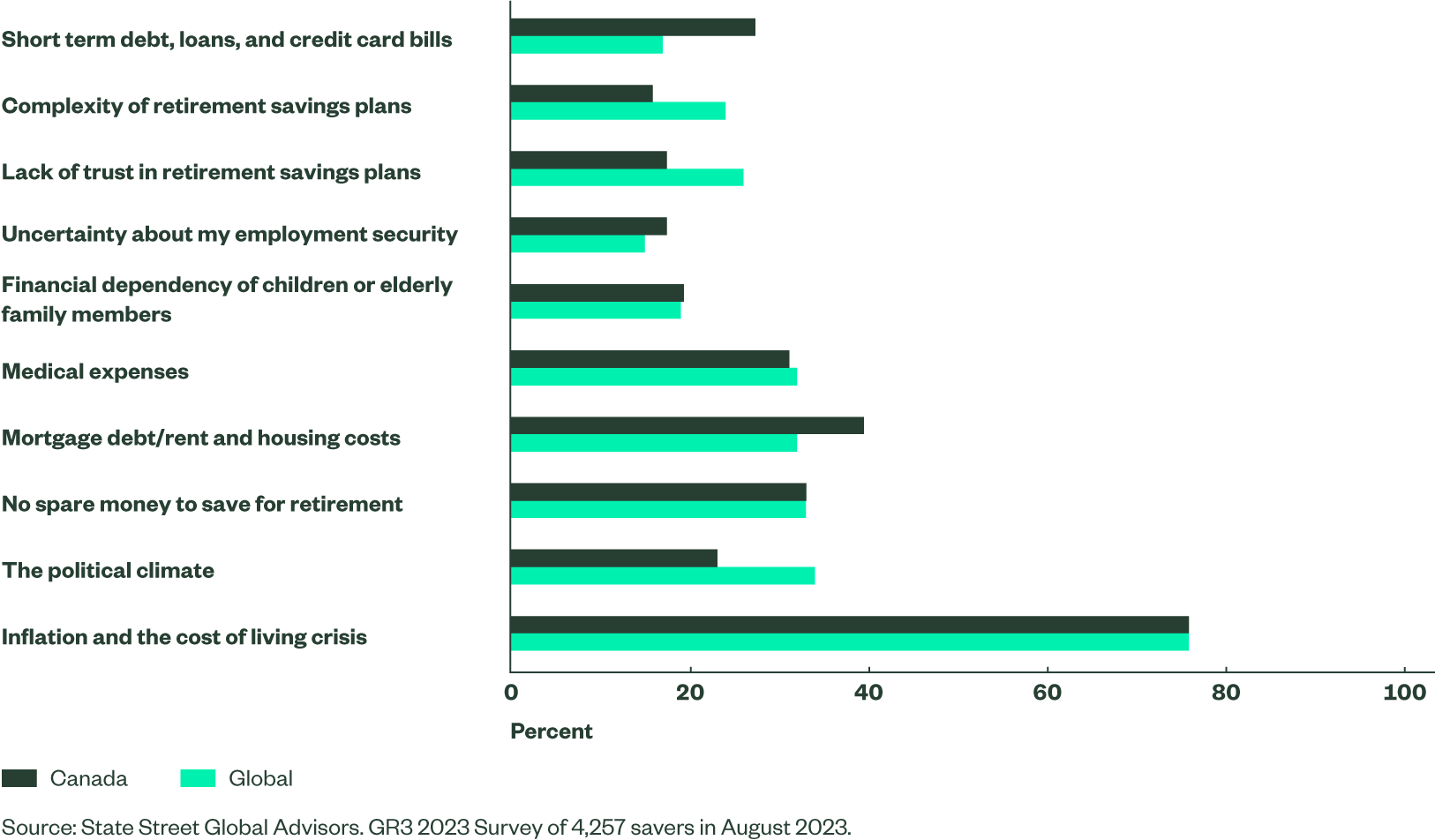

Concern about inflation and cost-of-living was by far the biggest factor negatively impacting retirement expectations, with 76% of respondents citing it as a worry. The cost of housing (39%) and a lack of spare funds to save for retirement (33%) also were significant concerns for respondents.

These pocketbook issues are more dominant in Canada than in other countries, where sharp political divisions and concerns about governmental effectiveness also worry workers. Canadians were the least likely, among all countries surveyed, to say that the political climate is a concern for retirement (23%). This contrasts sharply with the survey responses from the United States (40%) and the United Kingdom (42%).

Figure 2 : Top 3 factors that negatively affect confidence in retiring

Finding 2: Women are struggling more with retirement than men.

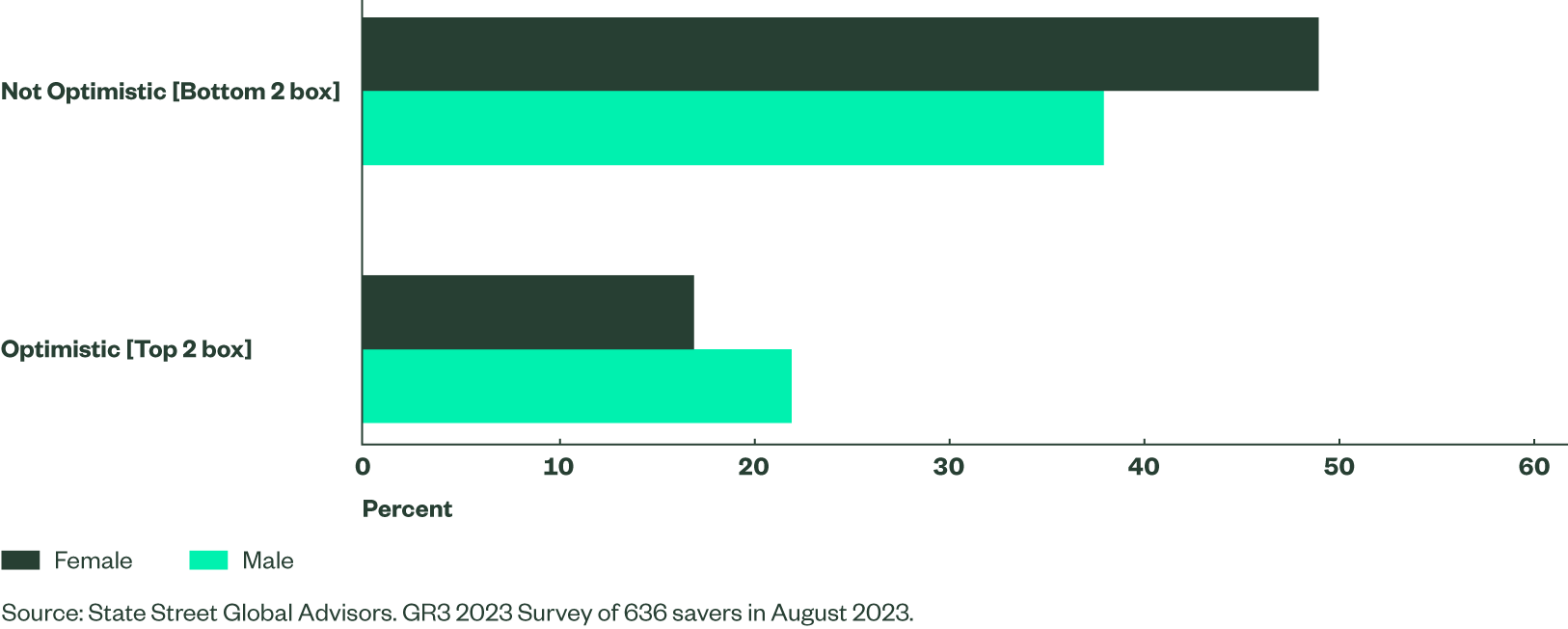

While there is concern about retirement preparedness across the Canadian workforce, those worries are more pronounced in women. Nearly half of Canadian women (49%) said they were not confident that they will be financially prepared for retirement, compared to 38% of men. This concern reflects that women generally have lower earnings, live longer and are more likely to have their careers and related retirement savings disrupted by caring for a family member. Women (25%) are less likely to have increased their savings than men (31%) in recent years.

Figure 3 : Confidence around retirement financial preparedness by gender

Understanding this, employers can play an important role in supporting women as they prepare for retirement. For instance, targeted engagement programs can deliver tools and education to help women build confidence in their ability to save for retirement. Employers also can help women avoid career interruptions with more expansive workplace benefits such as flexible scheduling.

Finding 3: Canadian workers see themselves as being responsible for their own retirement—but also report wanting help reaching their retirement goals.

Workers in Canada understand that no one is more responsible for their retirement than themselves, reflecting the country’s strong work ethic and sense of responsibility. More than six in 10 Canadians (61%) say they are primarily responsible for their retirement, dwarfing the percentage who see their employer (5%) or the government (4%) as primarily responsible.

Respondents are taking that responsibility seriously and trying to better prepare for retirement. More than one-fifth of Canadian workers (22%) have increased their contributions to retirement savings plans during the last six months compared to just 9% who have reduced contributions. More than a third (35%) are checking their retirement savings balances more regularly, versus (15%) who are doing so less frequently.

However, Canadian workers want more help in planning for retirement. Fewer than three in 10 Canadian respondents (28%) said they would be comfortable determining how to sustainably withdraw funds from retirement savings on their own, while nearly three quarters (72%) preferred to:

- Work with an independent financial advisor

- Have access to an employer-sponsored solution with set individualized rates of withdrawal

- Have access to an employer-sponsored solution with pre-selected rates based on typical saver behaviors

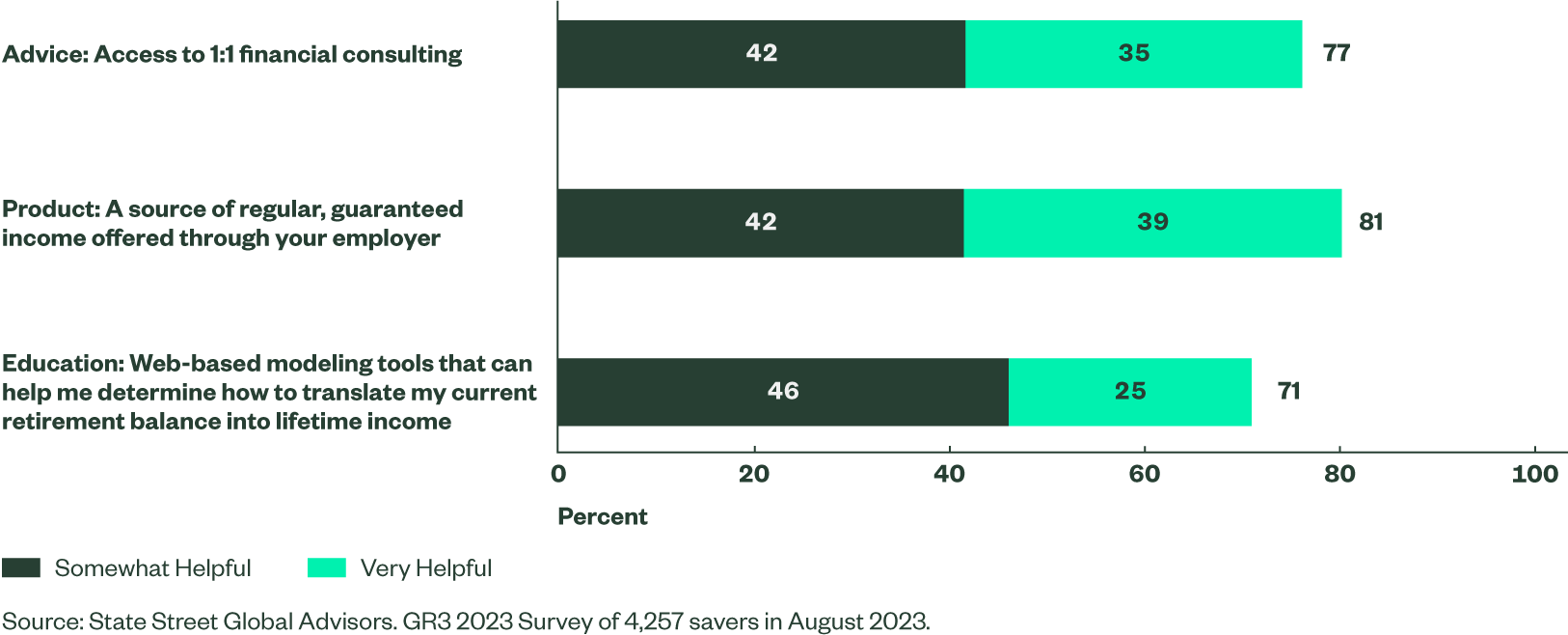

Roughly three quarters of respondents agree that education and advice are helpful retirement resources. Workers say that financial consulting and web-based modeling tools would be beneficial resources as they prepare for retirement. Three quarters of Canadian respondents (77%) say one-on-one financial advice would be helpful. More than seven in 10 (71%) say online income calculators that help them spend down their retirement savings over the course of a lifetime would be beneficial.

Figure 4: Top 2 box helpful retirement resources

Closing Thoughts

This inaugural survey of Canadian workers provides actionable insights that individuals, employers, financial advisors and policymakers can use to support retirement access, planning and income generation:

- Worries about retirement preparedness are widespread among Canadian workers. Fewer than one in five survey respondents are confident they will be able to retire when they want, and 11% say they can’t imagine ever being financially secure enough to afford retirement. This is the time for workers to increase their savings and think carefully about how to build their nest eggs.

- Women need additional resources to accomplish their retirement goals. Canadian women report less confidence about retirement than men, with five out of six women not assured that hey will be able to retire on time. Targeted education programs can help women address worries that inflation, disruptions in career earnings and other challenges will keep them from achieving their long-term financial goals.

- Workers are anxious for support around retirement. More than three quarters of Canadians said they would value advice and education, such as web-based tools, income calculators and programs that would inform how to save for and spend in retirement.

Survey Methodology

Our global online survey, conducted during August 2023 with international data analytics firm YouGov, engaged a total of 4,257 individuals participating in workplace-sponsored savings plans (or the market equivalent) in Canada, Australia, Ireland, the UK and the US. Surveyed countries represent a range of retirement systems. Gender, age, and regional quotas were balanced to reflect employed populations within each country. By gaining saver sentiment, we’re seeking to further our global goal of making retirement work for people, plans and policymakers in a changing world.