Insights

Australia Snapshot

COVID-19 has impacted almost every aspect of people’s lives globally. Whilst the short-term financial implications of the pandemic are front of mind for many individuals, we were interested to see whether these worries changed long-term savings behaviour. In this year’s Global Retirement Reality Report (GR3), we investigate the impact that COVID-19 has had on personal finances and behaviour around retirement planning. In this overview, we share the results of our survey of Australian pension savers, interviewed in early May.

Key Findings

Of the Australian savers in our survey, 42% said they have been negatively impacted financially by COVID-19. The crisis has seen an impact on jobs and wages through such areas as reduced pay or reduced hours in a much higher proportion compared with the United States, the United Kingdom and the Netherlands.

Although not a direct result of COVID-19, we continue to see a lack of retirement confidence in Australia. The crisis has only exacerbated long-standing issues around lack of savings and uncertainty of retirement outcomes.

Whilst the majority expect the financial impact of the pandemic to be short-lived, Australians are already reacting with respect to their retirement savings. Compared with the rest of the world, a greater proportion of Australians during the crisis:

- Checked their superannuation balance more regularly

- Switched to lower-risk investments

- Started drawing down early on their superannuation assets

Australians surveyed also showed an appreciation for lower volatility strategies and companies that were managed responsibly with regard to the crisis. These findings provide useful insight into the kinds of funds members would like to see their savings invested in.

Key Finding #1: 42% of savers have experienced a deterioration in their financial situation since the COVID-19 outbreak

We began by taking a pulse check on the current financial situations of individuals, compared with the period before the COVID-19 outbreak. We found that 67% of Australians in our survey had been impacted at work in some form, such as having reduced pay or reduced hours, a higher proportion compared with survey participants in the US, the UK and the Netherlands.

Given that a significant number of savers have seen an impact to their jobs and the income they receive, it is not surprising that almost 42% of our sample felt that they were worse off financially compared with before the outbreak.

Key Finding #2: Retirement confidence has fallen since 2018

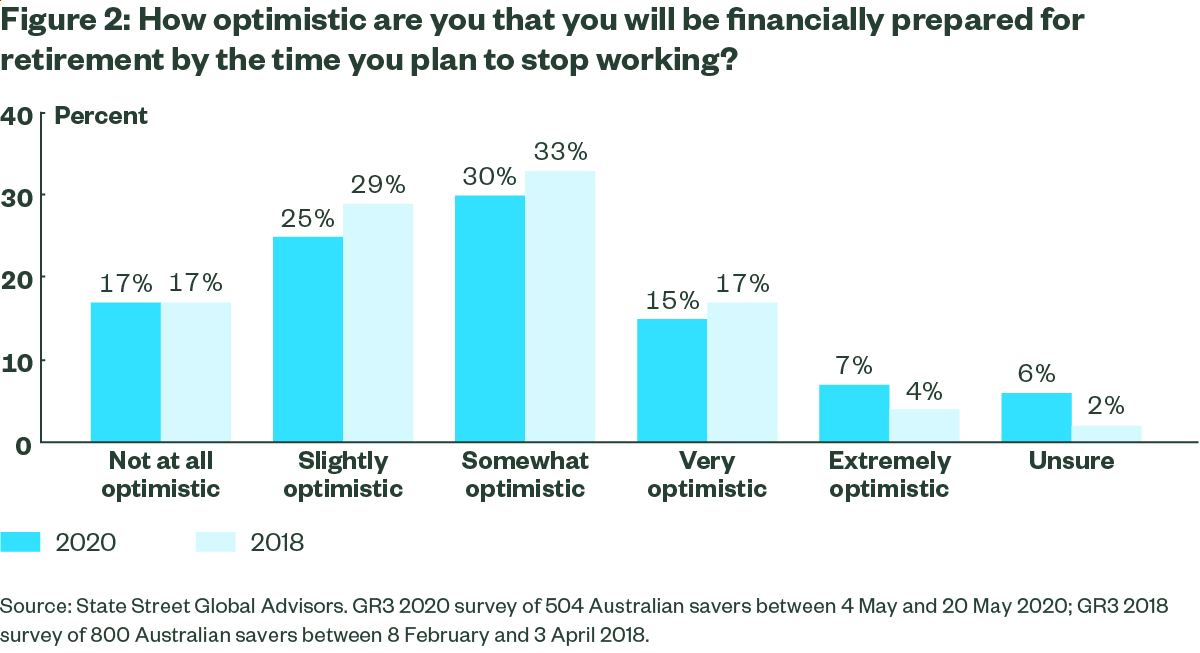

What impact do these changes in employment circumstances have on retirement confidence? Are people thinking that far ahead? We asked our savers how optimistic they are about being financially prepared for retirement.

42% of Australians are not optimistic about their retirement.1

However, when we asked members the same question in 2018, we found similar results, suggesting that this lack in confidence may not be solely attributable to the COVID-19 pandemic.

Key Finding #3: Many think that the impact of COVID-19 will be short-lived

We wanted to assess whether the impact of COVID-19 was expected to continue into the long term, therefore having greater implications for retirement savings.

The majority of Australian savers felt that the impact that COVID-19 would have on their finances would most likely last a year or less.

This view was shared among members in the other countries surveyed. Whilst we could take comfort from members not expecting a long-term negative impact, there is still a lot of uncertainty about the future state of the world.

Key Finding #4: COVID-19 is just one of the factors limiting retirement confidence

Whilst most thought that the financial impact of the crisis would be short-lived, 38% of the Australian sample said that the COVID-19 situation was having a high impact on their retirement confidence levels.

“ I am most concerned about the time it will take for my superannuation balance to recover from the fall in the stock market since the outbreak of COVID-19.”

However, other key areas impacting retirement confidence in Australia were:

- No spare money to save for retirement

- Uncertainty about retirement plans

- Lack of trust in the retirement system

Key Finding #5: The majority of Australians have not made changes to their retirement savings plan

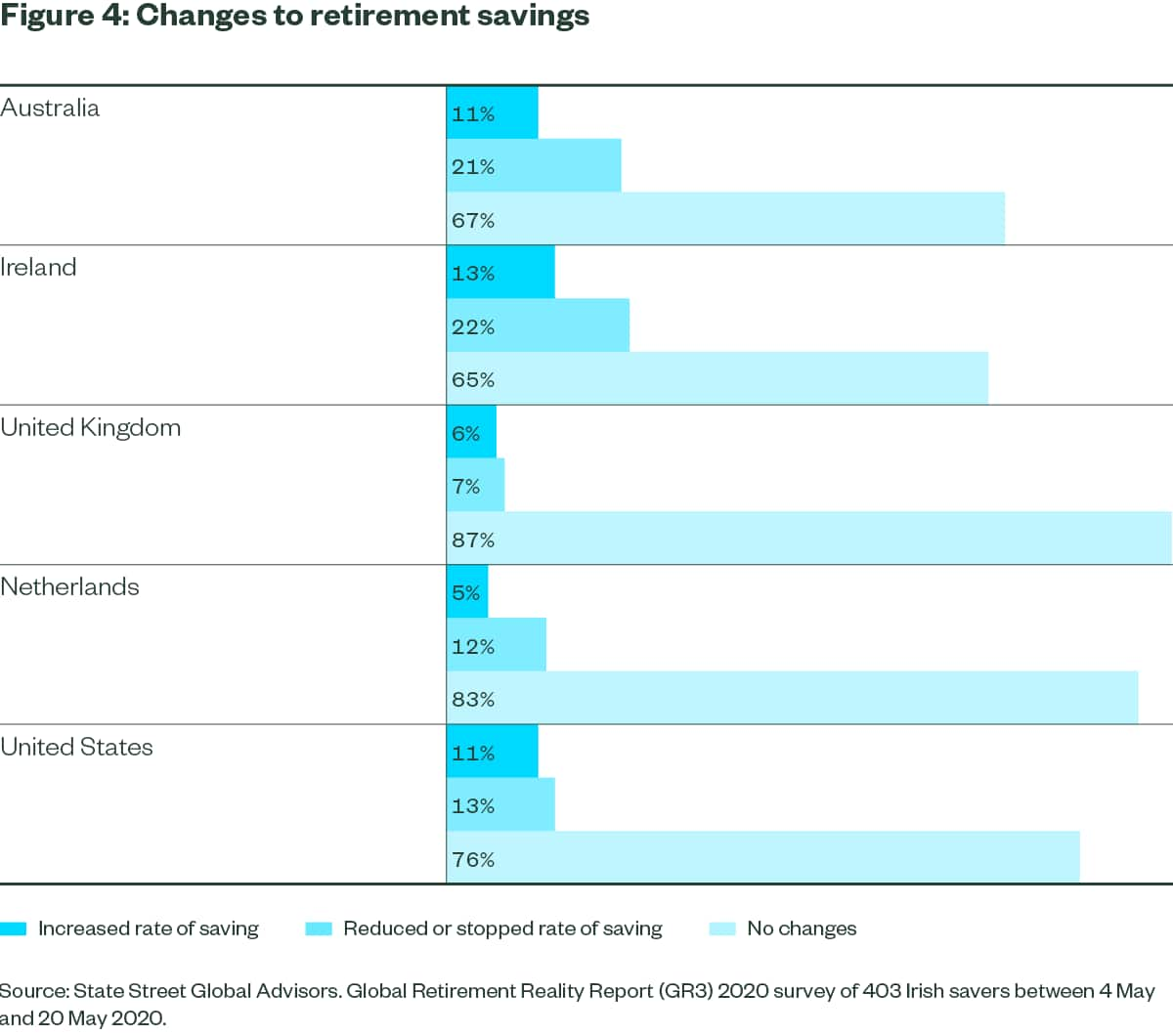

The majority of the Australian sample (67%) have not made any changes to the amount they save into their retirement savings plans; however, 21% said they have reduced or stopped their rate of saving. Only 7% of our UK sample had done the same.

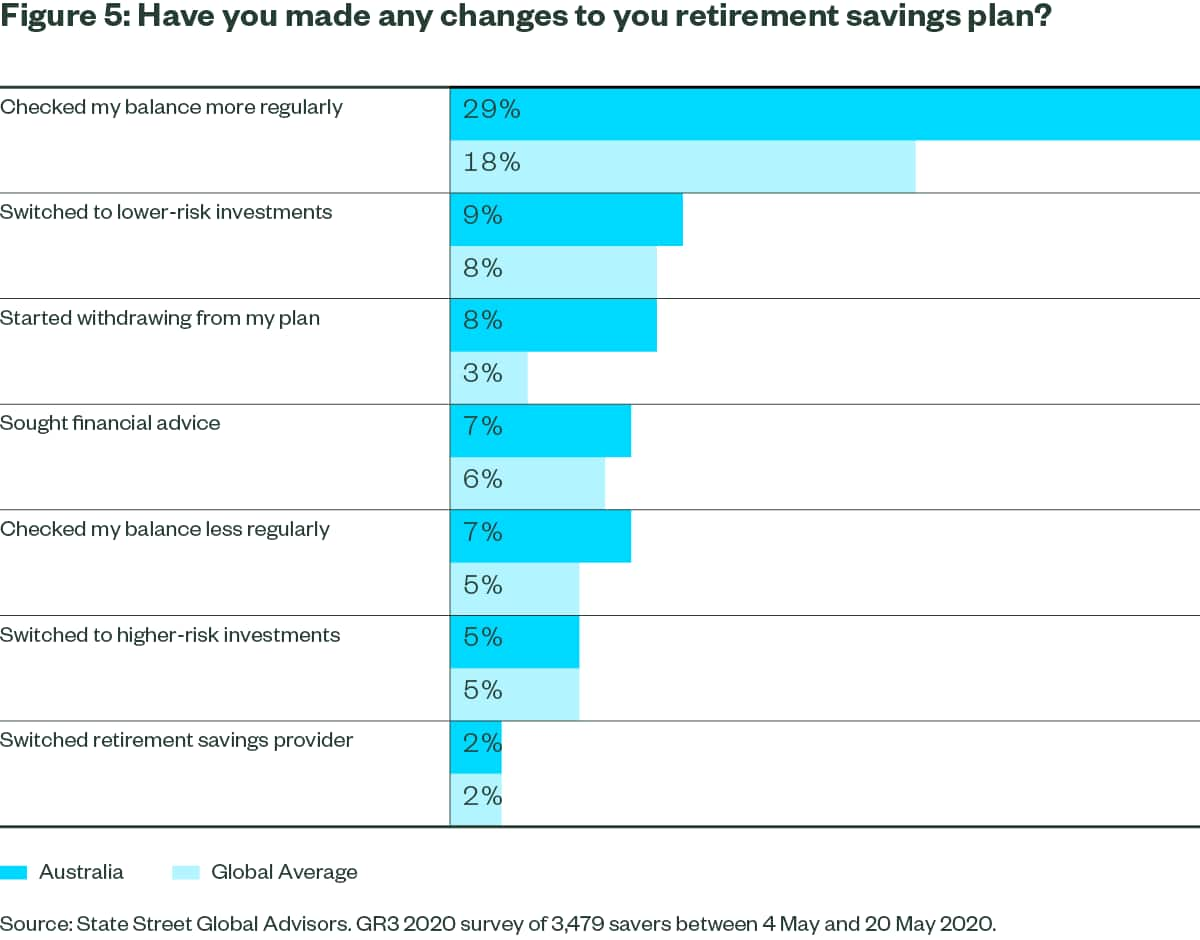

When we asked Australians if they had taken any other actions with regard to their retirement savings plans, the top three stated were 1) checking balances more regularly, 2) switching to lower-risk investments and 3) drawing down on superannuation.

Whilst there is a genuine industry concern around apathy from superannuation members, the results suggest that Australian investors at least know how, and where, to access information and balance updates.

It is also interesting to compare global results from savers who started drawing down earlier on their retirement pool of assets. In Australia, the government allowed individuals who were financially affected by COVID-19 to access their super early. In our survey, 8% of Australians had accessed this facility, which was more than twice the global average. The economic fallout from the crisis has not finished, so how many more Australians will need to draw down early on their super? No one knows that yet, but another critical reflection point for members accessing their super early will be when the country’s current JobKeeper subsidy is either reduced or stopped completely.

Key Finding #6: Members prefer lower volatility over higher returns

Our survey was conducted in May 2020. Whilst there were dramatic stock market falls in February and March, a recovery in April combined with strong returns during 2019 meant a typical one-year return for a workplace superannuation fund was a modest loss of -2.5%.2 However, volatility was still elevated at this point, with the VIX well above 50 at the end of April, having peaked above 80 in March. Whilst some investors flocked to safe assets, others took the opportunity to buy at lower prices.

Despite the market rebound and the muted one-year loss, when it came to risk preferences, the majority of Australians said they would prefer an investment that had a lower expected return but with less chance of a loss.

59% would prefer lower expected returns if it means less chance of a loss.

Key Finding #7: Almost a third of Australians are in favour of responsible investments

The COVID-19 crisis has shone a light on the way that companies are managed with regard to environmental, social and corporate governance (ESG) principles. Immediate issues such as employee health, serving and protecting customers, and ensuring the overall safety of supply chains have important implications for company performance.

We explored the extent to which savers shared this view and whether they would prefer their retirement savings to be invested in companies that have taken some of these issues into account in their response to the crisis. Conventional wisdom would suggest that in times of crisis, investor panic pushes any thoughts of responsible investing clean out the window. Perhaps surprisingly, our survey of Australians found that 31% want their retirement savings to be invested in companies that treated their workers well during the COVID-19 crisis.

Close to one-third of respondents want their investments to incorporate companies that treated their workers well during the crisis.

Closing thoughts

- We continue to see a lack of retirement confidence in Australia caused by COVID-19, as well as long-standing issues such as having no spare money, uncertainty around retirement plans and lack of trust in the retirement system. This reinforces the need for saving regular amounts; superannuation funds providing clear member communications to help navigate uncertainty; and regulators enacting legislation to ensure a transparent, efficient and robust system.

- Members expect the impact of COVID-19 to be short-lived, and aren’t changing their retirement saving behaviour. Australians’ priorities are understandably going to be focused on the short- and medium-term challenges associated with the crisis, but it is critical that retirement savings are not put on the back burner, leading to negative long-term consequences.

- A preference for investments with lower volatility came through, even if this means lower returns. Big drops in value have the potential to knock members’ confidence, and it is therefore important that superannuation funds limit severe drawdowns and that these benefits are communicated to members.

- Managing the social impact of the crisis is seen to be important, with immediate issues such as employee health, serving and protecting customers, and ensuring the overall safety of supply chains having implications for company performance.

What can you do?

- Consider targeted communications to help build member confidence in times of uncertainty. Emphasize key messages such as the importance of saving for the long term and how to navigate retirement choices.

- Continue to support and encourage employer contributions into superannuation funds.

- Incorporate volatility protection mechanisms into retirement plans to reduce drawdowns.

- Speak to your asset manager about how their stewardship activities are promoting good ESG behaviour in response to COVID-19.

Survey Methodology

As the COVID-19 pandemic was peaking in many countries this spring, and many had adjusted to the new normal enforced by nationwide lockdowns, State Street Global Advisors commissioned YouGov to conduct an online survey across five countries. YouGov surveyed 3,479 individual savers with access to defined contribution schemes:

| Region | Number Surveyed |

| Australia | 504 |

| Ireland | 403 |

| Netherlands | 510 |

| United Kingdom | 1,020 |

| United States | 1,042 |