GCC Fixed Income: An Alternative Diversifier to Core Allocations

Major GCC countries, including Saudi Arabia, United Arab Emirates, and Qatar, are expected to enjoy strong growth over the next five years. For investors seeking to diversify fixed income portfolios, the bonds of these countries have become increasingly attractive options.

The Gulf Cooperation Council (GCC) economies, comprising Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, and Bahrain have enjoyed significant economic growth in recent years, with the aggregate gross domestic product (GDP) of the region surpassing US$2.1 trillion. While growth rates over the past five years have lagged global GDP growth, the International Monetary Fund (IMF) forecasts that the three largest economies in the region — Saudi Arabia, UAE, and Qatar — could grow by more than 4% p.a., or nearly 1.5 times the global GDP growth rate, in the five years ending 2028. This projected growth is being driven not only by influential positions in global energy markets but also by continued efforts of governments to diversify their respective local economies away from an over-reliance on the oil and gas industries.

Although GCC countries today account for about 0.5% of the global population, they contribute more than 2% to global GDP. These countries also enjoy strong financial positions with fiscal balances comfortably ahead of many developed markets — debt-to-GDP ratios average less than 50%, compared to about 130% for G7 economies. Larger GCC countries have significantly better foreign exchange reserves to GDP ratios, giving them additional financial flexibility. With such robust fundamentals, we believe an assessment of how fixed income markets are developing in the region is warranted. Alongside that analysis, we also consider the potential opportunities for local and international investors in making allocations to GCC bonds.

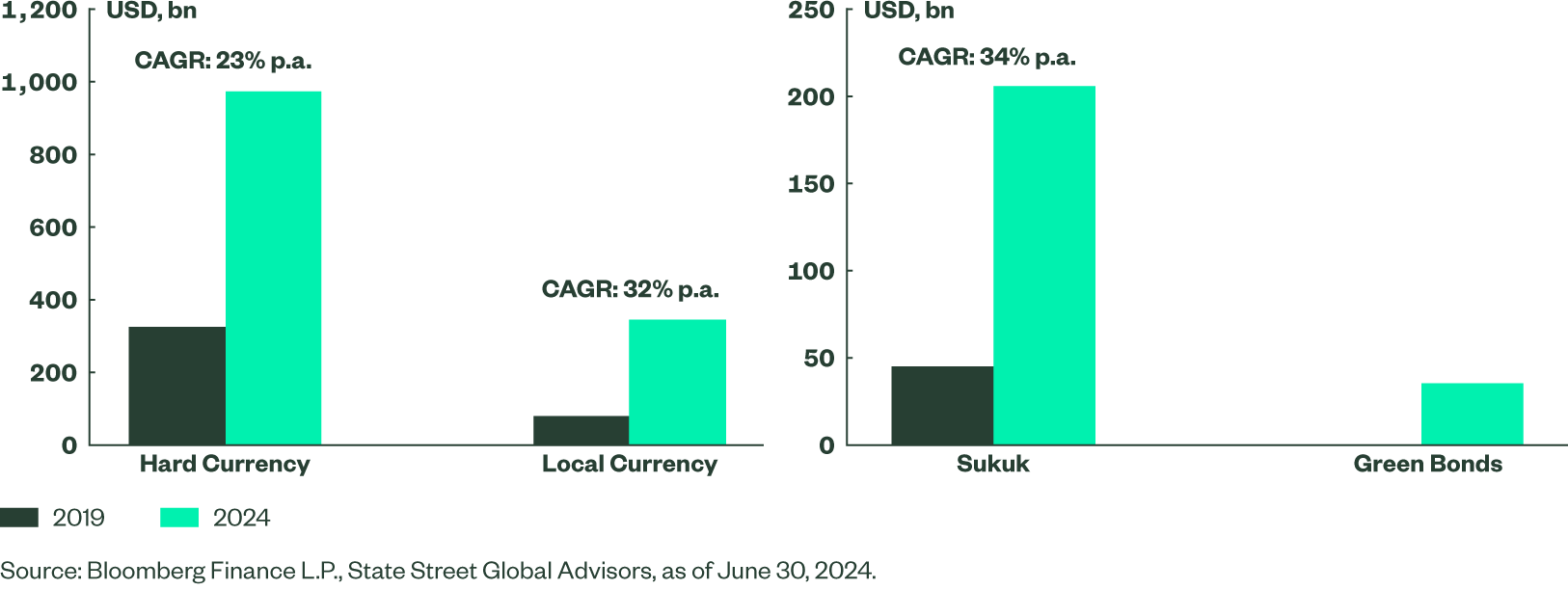

Capital Market Growth: Increase in Local Currency, Sukuk, and Green Bond Issuance

GCC countries have been very active in the bond markets over the past five years in order to fund economic growth plans based on diversifying their economic bases. As of end-June 2024, the total amount of outstanding bonds issued by this group has more than tripled since 2019 to nearly US$1.28 trillion — this is across both sovereign and corporate issuers. Bond issuance in local currency has grown from a very low base (see Figure 1), indicating an important deepening of the local bond markets and investor base. As a proportion of that total, hard currency debt accounts for approximately 75%, down from about 80% five years ago. This trend reflects ongoing policy efforts to deepen local bond markets. Sukuk issuance has also been on a significant rising trend, with Sukuk-labelled outstanding debt of US$205 billion — of which Saudi Arabia makes up about 50%. A relatively recent development has been the rise in green bond issuance in the region, reflecting efforts to diversify its economy away from hydrocarbon dependency. The total of outstanding green bonds now amounts to US$35 billion, of which UAE accounts for nearly 49%, Saudi Arabia bonds make up 32% and 16% issued by Qatar. Kuwait was the latest country to join the green bond issuer list, launching its first ever green bond in June 2024 with a USD 1bn issuance. The majority of green bond proceeds are used for renewable energy, energy efficiency (green buildings), and sustainable water management, with some proceeds also utilized for transportation and biodiversity. (See table in appendix for major GCC green bond issuers and proceeds).

Figure 1: The Growth in GCC Bond Issuance

GCC Bonds in Emerging Market Indices

GCC bonds were first included in the JP Morgan EMBI global diversified (hard currency) index in 2016 when Oman was added, with five additional countries – Saudi Arabia, UAE, Qatar, Kuwait, and Bahrain being included in 2019. The market value of GCC bonds in the index increased from 1% in 2016 to 8% in 2019, and this has risen to 19% at the end of June 2024; this equates to an outstanding value of over $140 billion across 128 bond issues.

Liquidity, as measured by Bloomberg’s LQA score (which estimates the liquidation cost of bonds, taking into account the volume, cost and time) is comparatively better in hard currency bonds compared to GCC local currency bonds. Nearly 80% of the amount outstanding in hard currency is rated with an LQA score of more than 50 versus almost 60% of outstanding bonds in local currency having an LQA score of over 50.

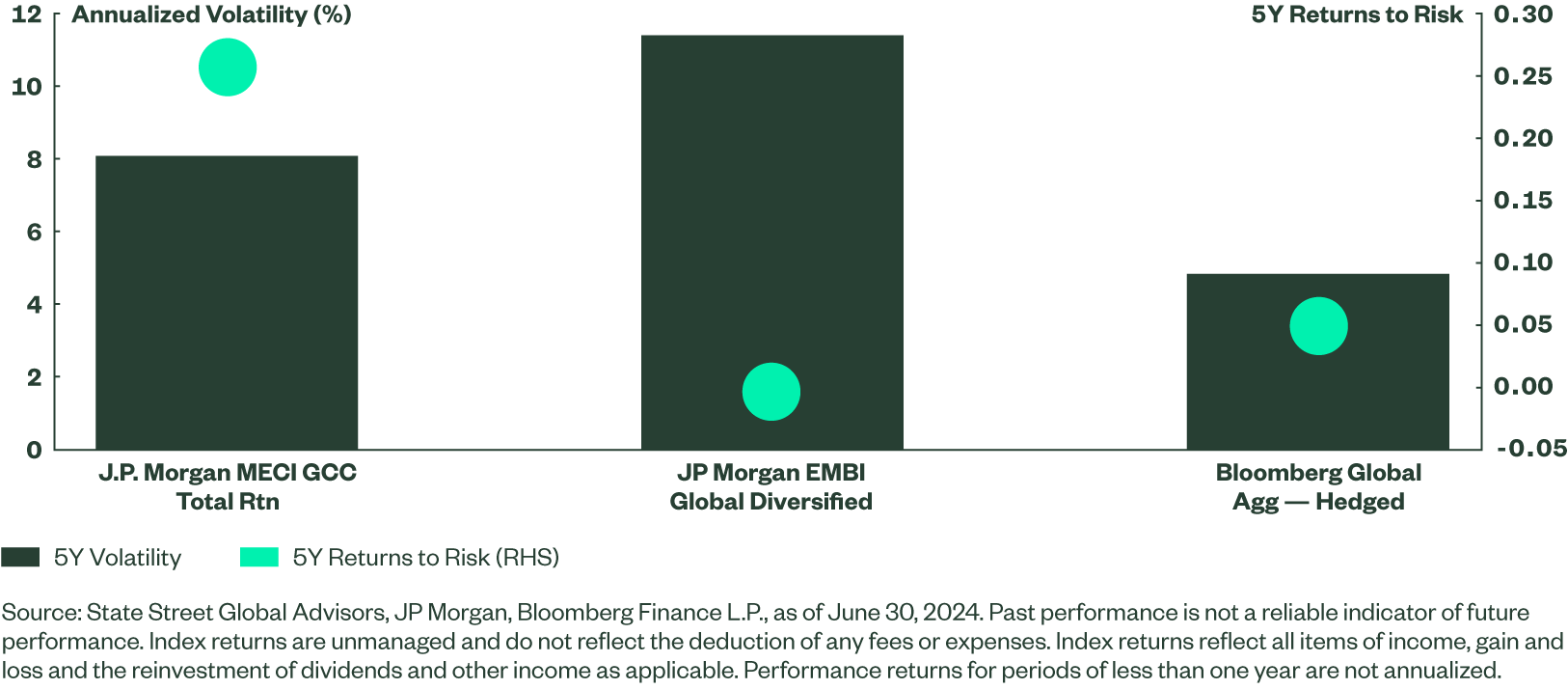

GCC Bond Performance Through Risk-on/Risk-off and Oil Price Regimes

To analyze the historical performance of GCC bonds, we consider the JP Morgan Middle East Composite GCC Index (referred to as GCC Bonds) that provides exposure to USD-denominated debt issued by sovereign, quasi-sovereign, and corporate entities in the GCC region, including Sukuk issuances, with a minimum size of US$300 million. The GCC Bonds benchmark is estimated to have an investment grade rating and is better rated compared to the broader JPM EMBI Global Diversified Index but slightly lower rated than the Bloomberg Global Aggregate benchmark — the composite rating for GCC Bonds is estimated at BBB+ vs. BB+ for EMBI Global Diversified, and A+ for Global Aggregate. All three indices have a similar duration profile (currently at around 6.5 years). While the GCC Bonds have underperformed over the past year, the five- and ten-year returns are moderately better than those of the EMBI Global Diversified index and the Global Aggregate hedged index (see Figure 2).

Furthermore, GCC bond spreads vs. Treasuries (a measure of the market-implied credit risk) have been on a steadily declining trend each year since the 2020 Covid crisis. Spreads also tightened in 2021 and 2022 amid the sharp global rates sell-off, even as there was a sharp widening in the broader EMBI global diversified index. The quality bias and spread tightening seen in GCC bonds has also resulted in lower returns volatility (as measured by standard deviation of monthly returns), leading to a better returns-to-risk ratios (see Figure 3).

Figure 3: GCC Bonds Exhibit Lower Volatility

The GCC bond index has also seen lower drawdowns compared to the broader EMBI Global Diversified Index with a maximum drawdown from peak level of 14.8% (during the 2022 global bond sell-off), in a similar range as the 13.6% drawdown seen in the Bloomberg Global Aggregate index but much lower than the 26% drawdown experienced by the EMBI Global Diversified Index.

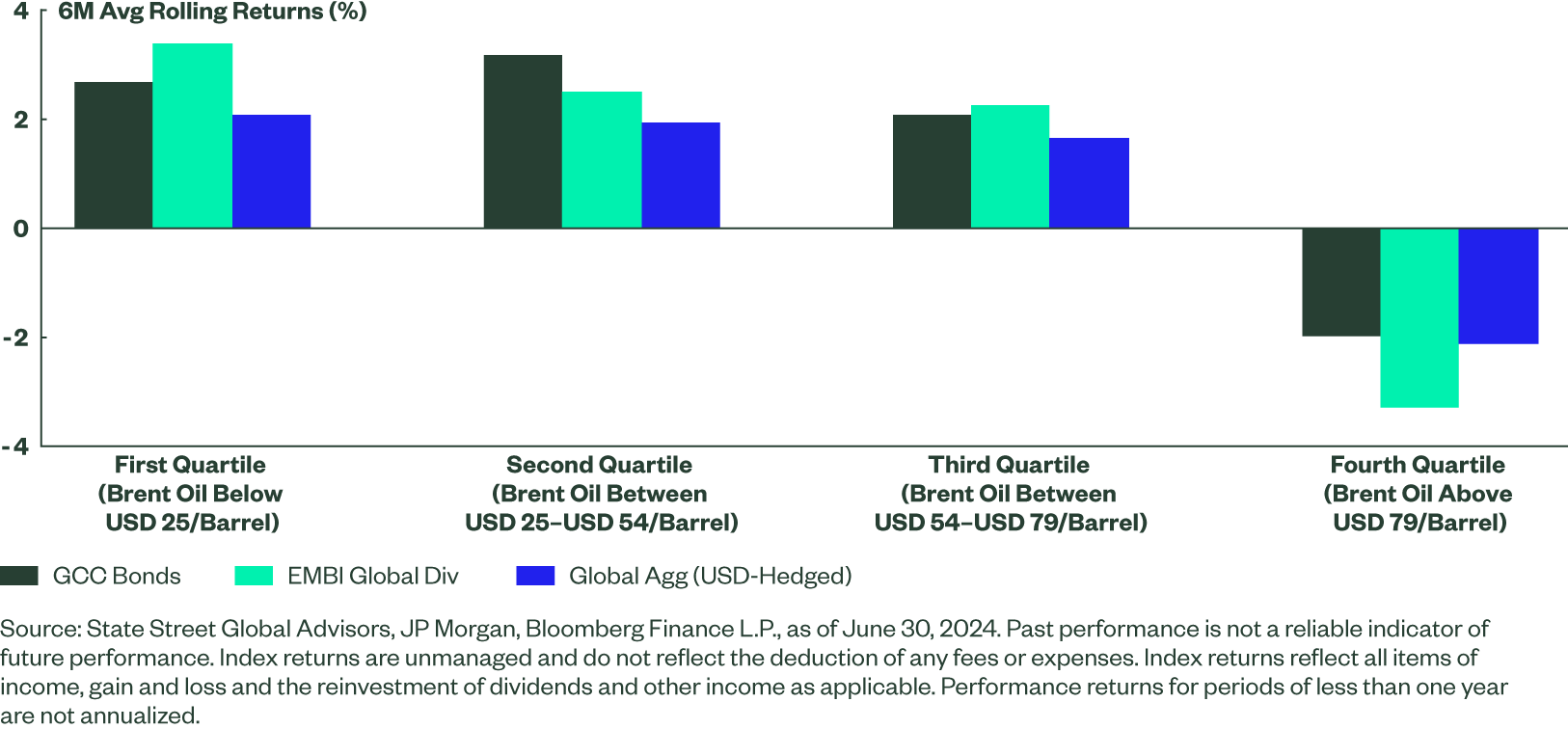

Moreover, the performance of GCC bonds has been stable (with positive spread returns) even when oil prices declined to the bottom quartile of the ten-year range (i.e. Brent below USD 25 per barrel), highlighting the strong inherent credit quality given their robust fiscal positions. This has demonstrated a level of resilience that has also underpinned confidence among investors (Figure 4).

Figure 4: Performance of GCC Bonds Through Oil Price Regimes

GCC Growth and Bond Issuance Set To Continue

Major GCC countries, including Saudi Arabia, United Arab Emirates, and Qatar, are expected to witness a period of strong growth in the next five years. Their influential position in energy markets, strong net foreign assets (much higher than similarly-rated IG sovereigns), and continued non-oil diversification and socio-liberalization efforts underpin a strong sovereign credit rating. Fixed income markets have also taken cognizance of these positive developments, as witnessed by a steady narrowing of credit spreads. Amid robust economic growth (with strong contributions also from the non-oil sector), we expect the local currency debt markets to deepen further as debt sustainability ratios still remain within a comfortable range. Notably, GCC bond markets are also broadening as observed by the significant increase in Sukuk and Green Bond issuance and trading.

Since GCC currencies are pegged to the US dollar, most local currency bonds have been priced using the corresponding US dollar sovereign curves. However, over the past four years, the growth of local currency bonds has led to Saudi Arabia having its own local currency yield curve. Saudi Arabia is also currently under review for inclusion in JP Morgan’s flagship local currency benchmark (GBI-EM), a family of indices tracked by approximately $231 billion of funds (as of April 2024). Confirmation of inclusion should also lead to passive inflows into the market, and improve local currency bond liquidity further. Given their defensive characteristics (even during periods of low oil prices) and strong credit ratings, GCC bonds represent a viable diversification alternative to global investors for their core fixed income allocations.

Appendix 1: Top Green Bond Issuers in GCC and Proceeds

| ISSUER NAME | AMOUNT OUTSTANDING (In USD million) | PROCEEDS ALLOCATION |

| GACI FIRST INVESTMENT - (Public investment Fund Saudi Arabia) | 8,500 | 1. Energy Renewable 2. Energy Efficiency 3. Sustainable Water Management 4. Pollution Prevention and Control 5. Green Buildings 6. Sustainable Management of Living Natural Resources and Land Use |

| STATE OF QATAR | 5,000 | 1. Renewable Energy 2. Energy Efficiency 3. Sustainable Water Management 4. Green Building Development |

| FIRST ABU DHABI BANK PJS | 2,618 | 1. Renewable Energy 2. Energy Efficiency 3. Sustainable Water Management |

| ABU DHABI NATIONAL ENERGY | 2,000 | 1. Renewable Energy 2. Sustainable Water and Wastewater Management 3. Energy Efficiency 4. Clean Transportation 5. Terrestrial and Aquatic Biodiversity |

| MAF SUKUK LTD (Parent: Mubadala Treasury Holding Co LLC) | 1,700 | 1. Green Buildings 2. Renewable Energy - Solar and Wind 3. Sustainable Water Management 4. Energy Efficiency |

| DP WORLD CRESCENT LTD | 1,500 | 1.Renewable Energy & Energy Efficiency 2. Aquatic Biodiversity 3. Green Buildings 4. Climate Resilience |

| MDGH GMTN RSC LTD (Parent: Mubadala Treasury Holding Co LLC) | 1,500 | 1. Pollution Prevention and Control 2. Energy Efficiency 3. Green Building 4. Renewable Energy 5. Clean Transportation |

| SWEIHAN PV POWER CO PJSC | 1,330 | 1. Renewable Energy |

| SAUDI ELEC GLB SUKUK | 1,300 | 1. Energy Efficiency 2. Renewable Energy |

| SAUDI ELECTRICITY SUKUK | 1,200 | 1. Energy Efficiency 2. Renewable Energy |

Source: State Street Global Advisors, Issuer Data, as of June 30, 2024.