A More Effective, Efficient Solution for Leveraged Loans

An innovative approach delivers indexed exposure to this valuable asset class.

Leveraged loans offer an appealing combination of attributes for institutional investors, including high yield and floating rates that effectively eliminate duration risk. Yet, historically, it has not been easy to invest effectively and efficiently in this asset class. There was no broad-based index option until recently, and active managers tend to trail the benchmark and charge relatively high fees.

An insurance company in 2024 asked State Street Global Advisors if we could build a better solution – one that could offer exposure to the leveraged loan market efficiently and cost-effectively.

Building a custom index solution

The company held an allocation to leveraged loans as part of its catastrophe claims reserve, and it valued the asset class’ unique characteristics. But the active managers the company used were lagging the benchmark by wide margins and charging high fees.

At SSGA, we are pioneering indexed investment solutions for leveraged loans. There were good reasons other firms had not developed broad leveraged loan indexes. The market tends to have relatively high costs and high turnover, and it includes many small loans that are not practical to represent in an index.

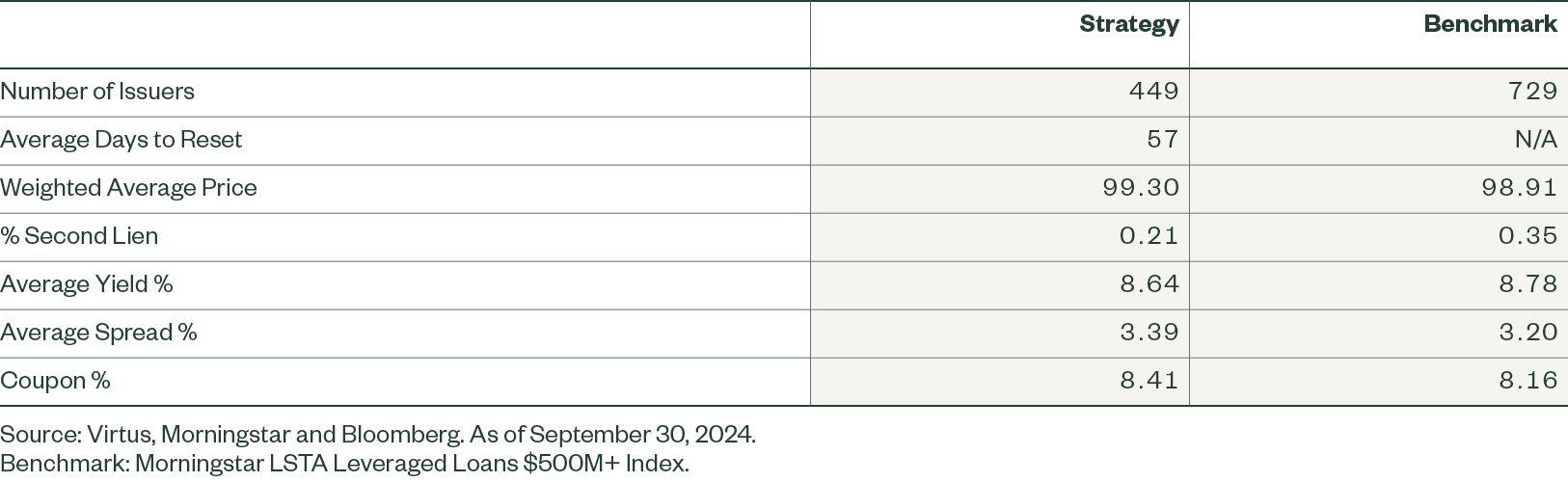

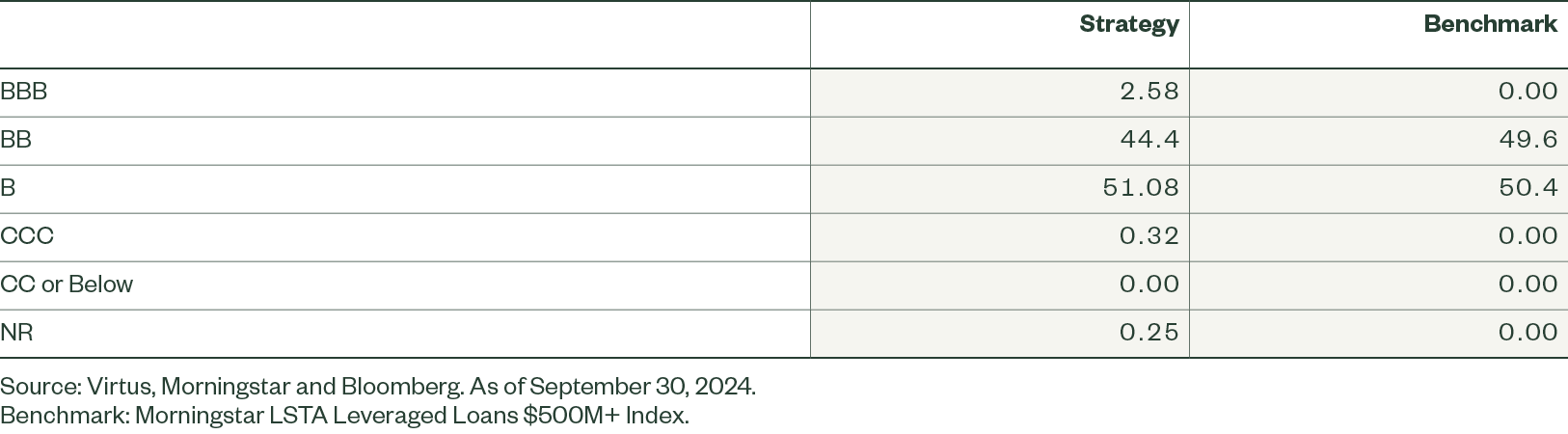

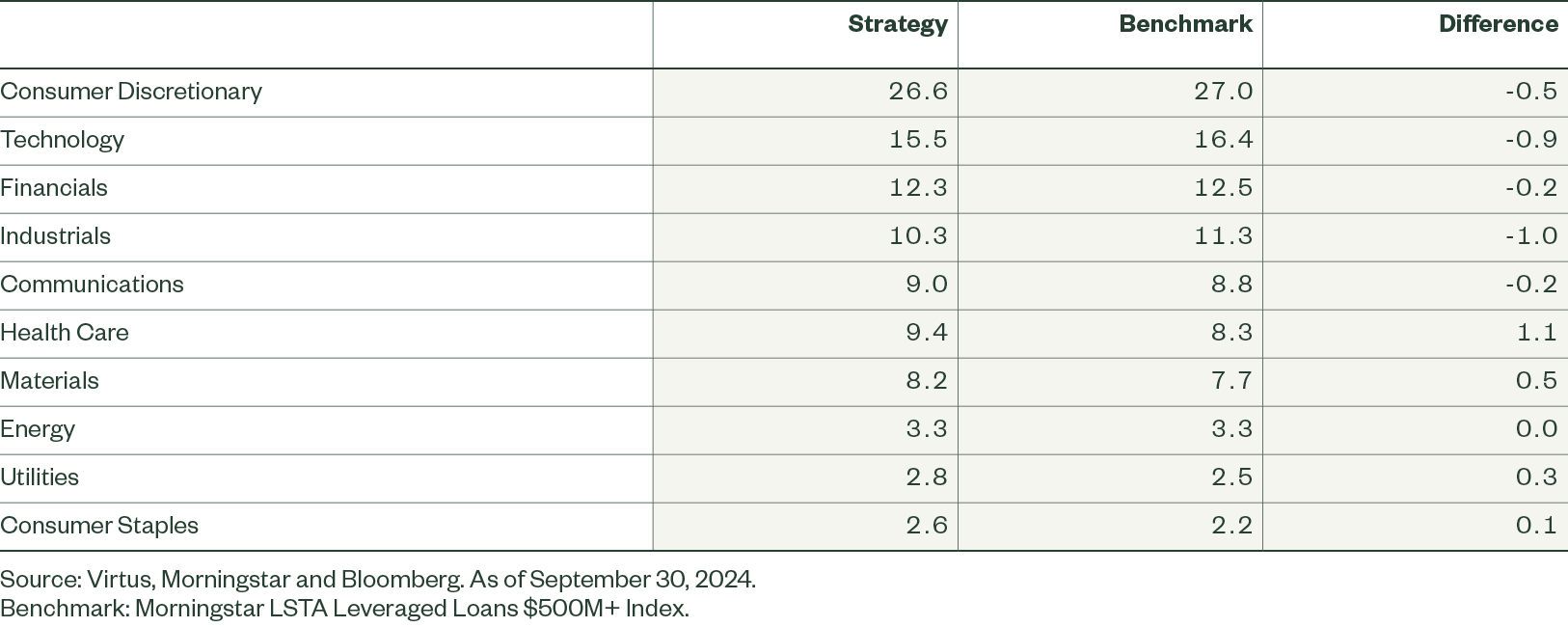

We drew on our deep experience delivering beta in complex fixed income asset classes to create an investable custom index made up of broadly syndicated loans (BSLs). BSLs – defined as loans of more than $500 million – make up nearly 90% of broad-market benchmarks. They offer greater availability and liquidity than smaller loans, making them more useful for an indexing strategy. We used stratified sampling techniques to construct a collection of BSLs that mirrored the benchmark’s risk factors, quality and sector composition, and other characteristics.

Figure 1: Portfolio: Morningstar LSTA Leveraged Loans 500M+ Index

Characteristics

Quality %

Sector Weigh %

Reliable, benchmark-like results

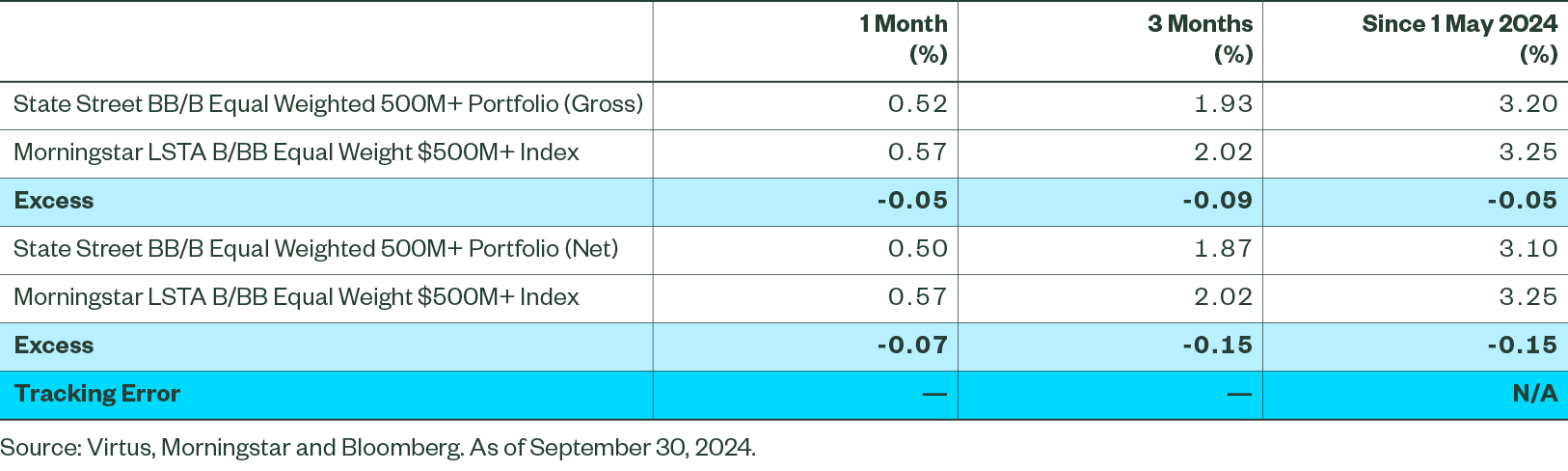

We helped the client implement the solution, using a combination of cash and in-kind allocations from the previous manager. The result is an indexed investment that delivers exposure to leveraged loan beta with low tracking error to the benchmark. The index structure reduces costs relative to active management, and SSGA’s deep trading relationships, resources, and expertise help make trading efficient. The nature of the leveraged loan market makes it difficult to provide daily liquidity without compromising exposure, so our solution provides monthly liquidity – a good fit for the insurer’s needs.

Figure 2: Returns for the period ending 30 September 2024 (USD)

Now the company has an effective, efficient tool to gain strategic exposure to this valuable asset class, helping deliver the portfolio results the company needs to meet its business goals.

Please contact us if you would like to discuss how an indexed approach to leveraged loans might help you meet your objectives.