UK Elections: Potential for Upside Surprises

The announcement of a UK general election for July 4 caught markets and media by surprise, with a vote later in the year previously deemed more likely. With the Conservative Party languishing behind Labour in opinion polls, a change in government has long been projected. But are markets underestimating the potential for an upside surprise under a Labour government?

That Labour will win a comfortable majority in the upcoming UK general election is almost a given. After 14 years in power, the Conservative Party has accumulated too much electoral baggage — from Brexit to Liz Truss’s mini-budget to Boris Johnson’s Covid-era parties. For its part, Labour is running a disciplined and distinctly centrist campaign. Its platform is simple and perhaps best summarized as “it’s time for change and we are a pair of safe hands.” A comfortable victory seems almost certain and a likely 80-120 seat majority will ensure Keir Starmer becomes the UK’s next prime minister.

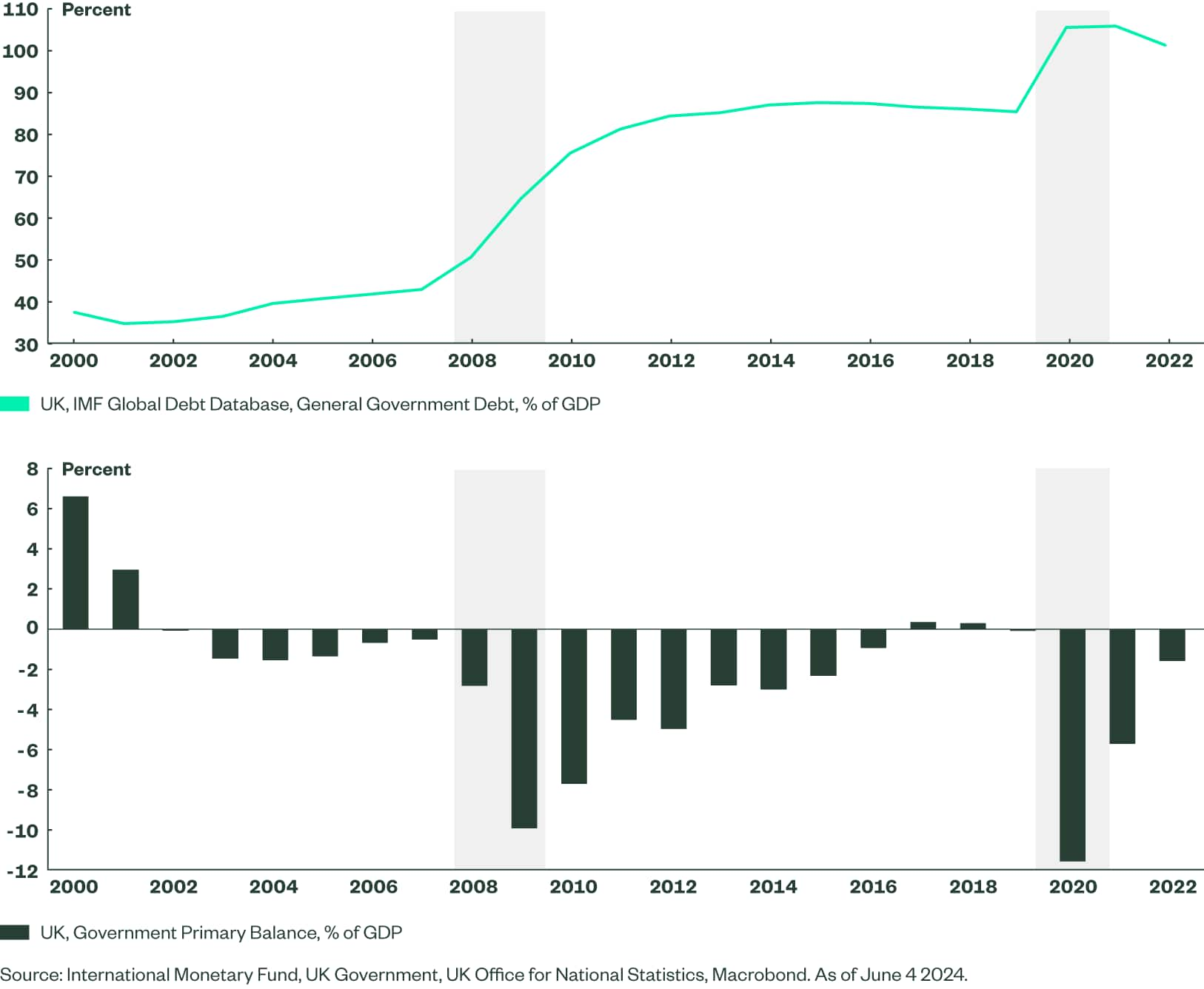

Markets have largely shrugged off the election announcement. Observers had expected the elections to be held in the fourth quarter of the year. The July date came as a surprise, yet this is ultimately not material. Mindful of Liz Truss’s experience after briefly becoming prime minister in 2022, Labour has promised to act with restraint in regard to the budget and debt. This has reassured investors on downside risks of a Labour government. However, the market also sees little upside. Without a meaningful fiscal impulse, it is considered likely that a new government can do little to invigorate chronically lagging growth.

Figure 1: UK Government Has Exhausted its Available Fiscal Space

What Labour lacks in fiscal space, it can make up with policy reform. For investors, most consequential would be structural reforms that address supply side constraints on growth. We think that under a Labour government, such reforms are more probable – if for no other reason than Conservative-led governments failed to deliver them during their 14 years in power. What could these look like?

Potential Reforms Under Labour

- The UK could further lower trade friction with the European Union (EU). For the Tories (Conservatives), which engineered Brexit, drawing closer to the EU was almost unthinkable. Labour too would hate to be viewed as undoing Brexit. However, a policy shift that softens some of the harder Brexit outcomes could be tempting. Labour could quietly fix sectoral problems by agreeing to comply with EU law where appropriate. With a comfortable majority in parliament, it would have options to break down some Brexit-related taboos.

The political opening for better relations with the EU exists, but does the political will? According to polls, the majority of people in the UK now think that Brexit was a mistake; the majority of Labour voters certainly do. And in Europe, new priorities, not least in defense and security, could create new avenues for collaboration. Unlike Labour under Jeremy Corbyn, the party itself is now led by people who advocated for the UK to remain in the EU. Labour has talked little of this in the campaign, but the silence could also be an electoral strategy to target conservative-leaning voters.

- Labour could ease domestic impediments to growth. Rigid planning rules are a known supply side constraint for the UK economy. For years, these have hobbled activity in the country’s construction sector, from infrastructure to residential real estate – despite a massive need. Unlike the Tories, whose electorate skews heavily toward homeowners, Labour’s electoral coalition is younger and more urban, and it has a higher share of renters. This allows for bolder decisions to tackle planning rules that prevent projects from moving ahead. For housebuilding in particular, Labour has promised a million and a half new homes. That is an ambitious target. However, current building levels are so low that even a moderate increase could have a broader positive impact.

- Where could we see change? In our view, Labour could aim for an ambitious policy path. Internationally, we think that meaningfully closer relations with the EU through the next parliament is a reasonable expectation. Domestically, we think it could be successful on planning reform, more on residential real estate and less on infrastructure. In aggregate, this could shift upwards the country’s medium-term growth potential. That would translate to markets by way of a stronger pound (higher capital inflows) and increased valuations of UK assets (higher returns linked to higher growth expectations); this would especially be the case for those in sectors closest to the reforms (e.g. UK small caps and export-oriented manufacturing generally in the case of the EU). The credit risk premium on UK assets could also narrow, all else being equal, though not perhaps for sovereign yields, as the country’s fiscal position will likely remain challenging. As structural reforms are a long-term bet, the best time to implement them is as soon as possible. It could therefore be clear where we stand shortly after the election, but certainly by year end.

The Bottom Line

In short, we believe there is room for an upside surprise from the election. Markets see little downside uncertainty, but equally, there are low upside expectations. This is too pessimistic in our view, given the centrist and reform-minded policy stance of the prospective Labour government that could have a material positive impact on the country’s macro fundamentals in the medium term.