The New Retirement Straits

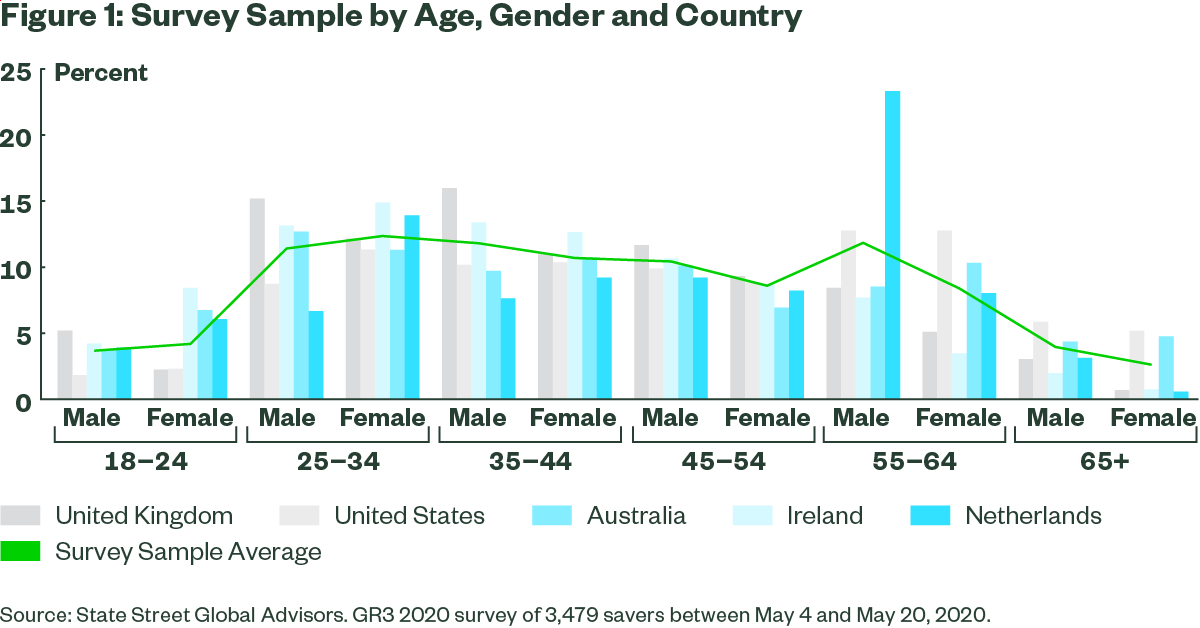

In May 2020, as the COVID-19 pandemic was gaining momentum in many countries and the status quo was replaced with stay-at-home mandates, we conducted online interviews with 3,479 retirement savers across five countries, chosen to represent a range of different retirement systems: Australia, Ireland, the Netherlands, the United Kingdom and the United States. The survey for this year’s Global Retirement Reality Report (GR3), led in conjunction with international market research firm YouGov, was intended to capture saver sentiment in the midst of the coronavirus crisis.

Similar to other studies that have published this year, we found that the current climate amplifies the extremes, increasing vulnerability for some while maintaining optimism for others. Divides along gender and generational lines suggest that people are getting squeezed from all angles. With a global population in the grips of these vises — exacerbated stress, increased societal and gender polarity and delayed personal milestones — how do we achieve retirement happiness in 2020?

This survey is the first of two installments, intended to monitor sentiment during the coronavirus crisis and provoke conversation around redefining retirement happiness.

Key Sample Characteristics

To qualify for the survey, respondents had to have access to a workplace-sponsored defined contribution (DC) retirement savings plan (or equivalent based on the market) and be working at least part-time. Meeting these criteria suggests a more financially secure survey population — particularly in the US, where nearly 40% of working Americans didn’t have access to a DC plan pre-pandemici and, as of June 2020 data, unemployment was still a historically high 13.3%,ii — and potentially inflates confidence quotients.

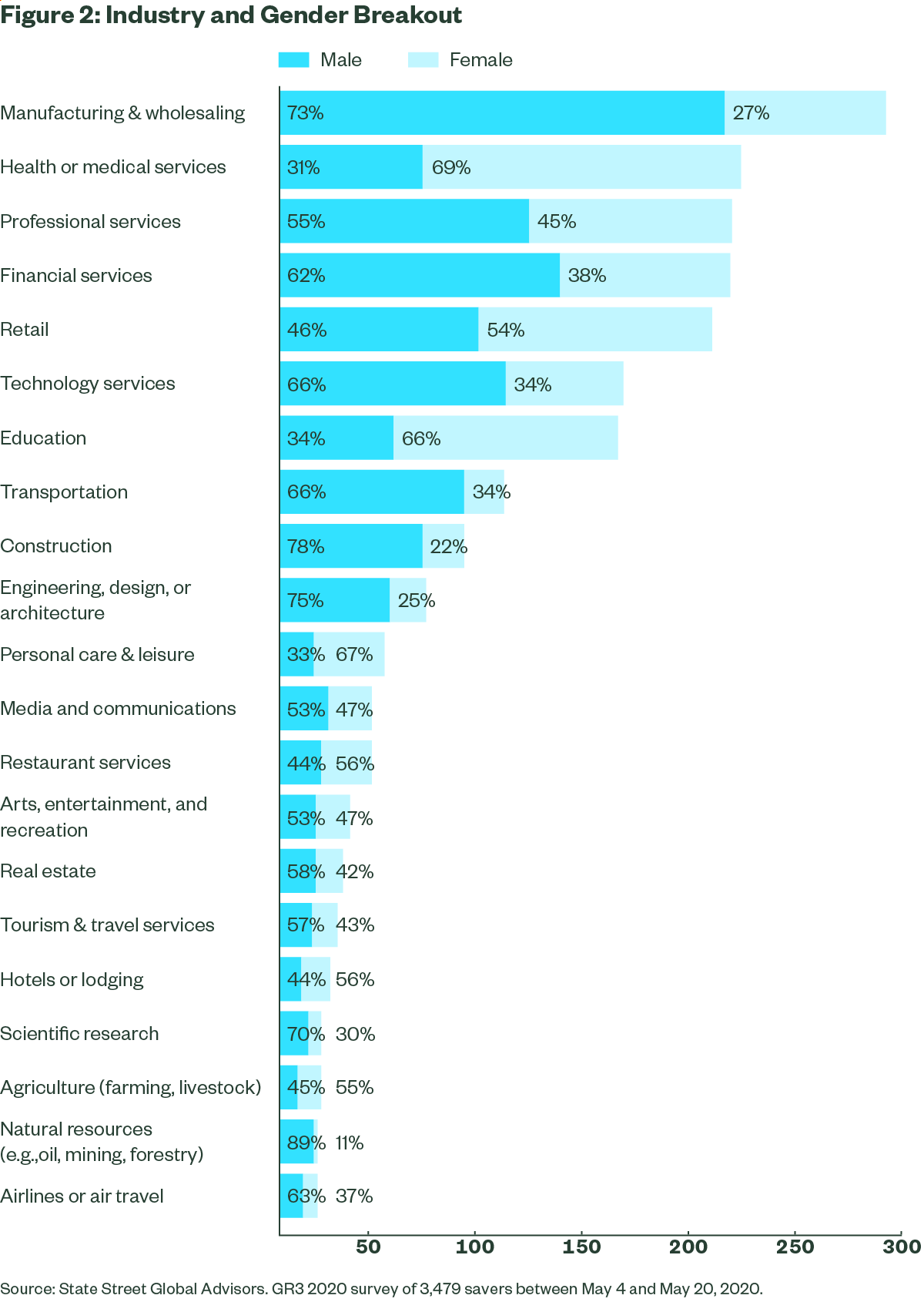

Survey Sample by Industry

Of the global population surveyed, 60% shared their professional industry. With the understanding that working women have been the most affected by coronavirus-related job loss, we added a gender overlay to add context to our respondents’ employment. Eighty-four percent of the survey is represented by the top 10 industries, which toggle between male- (manufacturing, technology services and construction) and female-dominated (health care, education and retail) sectors. There is also strong representation of mixed-gender jobs, including professional and financial services, suggesting more balance in gender sentiment.iii

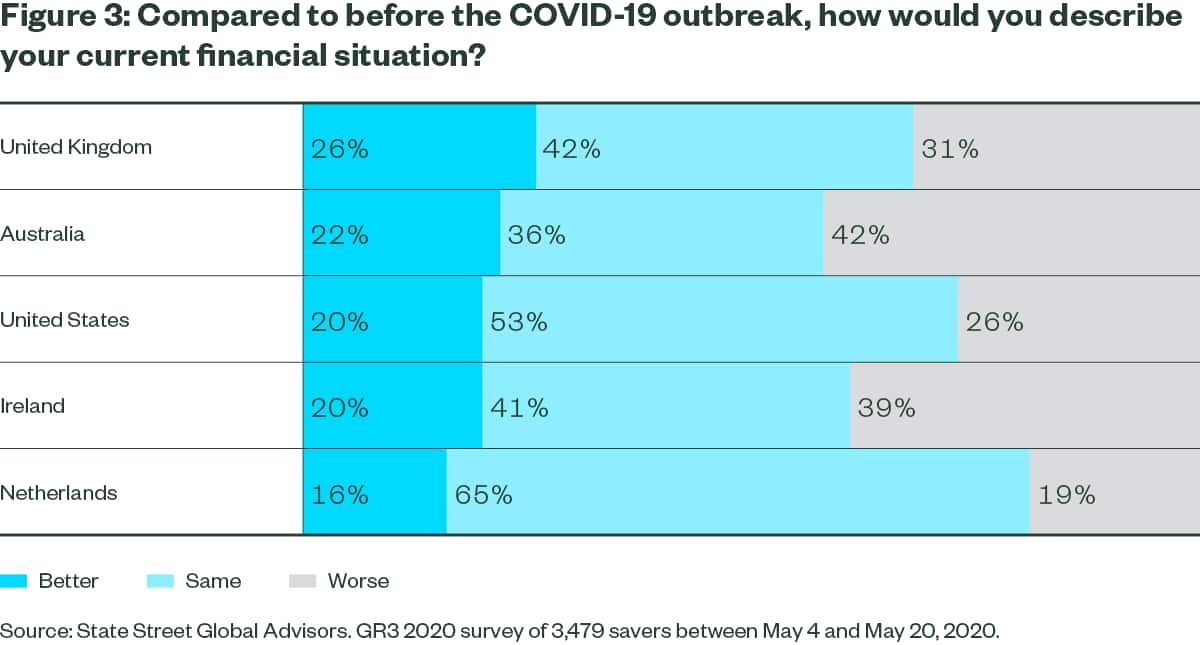

Employees’ Overall Financial Situation

57% of global respondents have faced employment impacts because of the pandemic, with “reduced hours” being the leading effect at 19%.

Job loss was reported by 4%, affecting the least number of those surveyed.

Regardless of how the crisis had impacted respondents’ employment, the majority said there had been a knock-on effect, from investment portfolio undulation to work-from-home adjustment to unexpected family obligations. As a result, three in 10 respondents (30%) said their current financial situation was worse because of the pandemic, particularly in Australia (42%) and Ireland (39%), while the Netherlands was the market that had maintained the steadiest state.

While respondents’ short- and long-term investment strategies remained largely unaltered, 72% said they have made adjustments to their living expenses, with over half (54%) having reduced spending on nonessential items, some eliminating monthly savings (12%), others accruing more credit card debt (10%) and still others increasing charitable contributions (14%), suggesting a range of “hoard or hand out” financial behaviors.

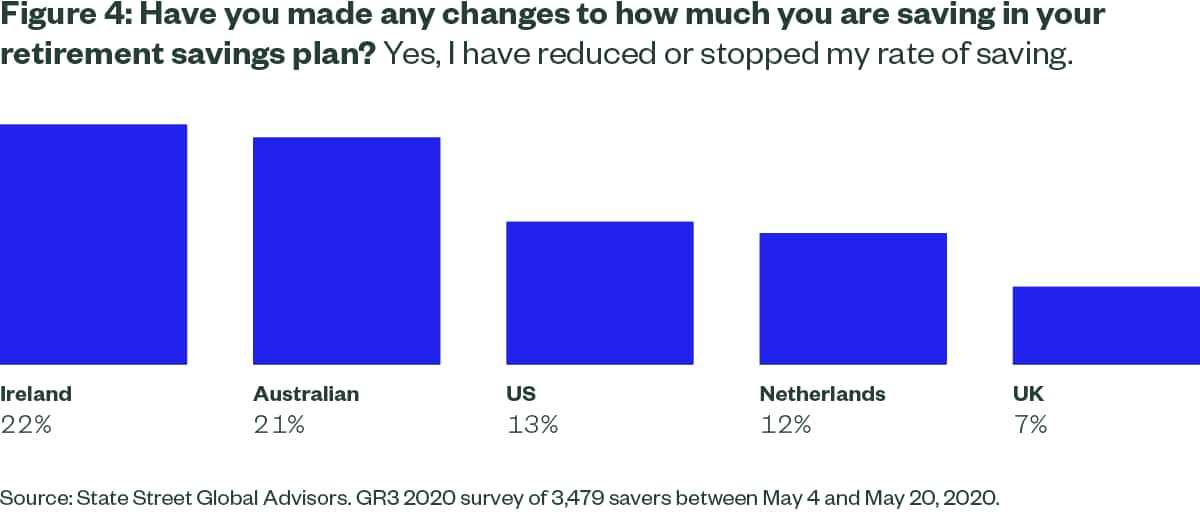

Employees’ Retirement Savings Outlook

78% of respondents had made no changes to their retirement plan.

In fact, the percentage of those who had reduced or stalled retirement contributions averaged to only 13% across the surveyed markets, with 9% reporting they had increased contribution rates.

While some employees may be scaling back their retirement saving, most aren’t in favor of their employers doing the same. Asked if they would approve of their employer pausing matching during the crisis to bolster their company’s financials, implicitly strengthening their job security, 50% of survey-takers disagreed, while 29% agreed and 21% had no opinion. Dissent for suspending the employer match was loudest in the UK (59%) while support was strongest in Ireland (34%), followed by the US and Australia (both 31%).

An explanation for the countries with less opposition could be experience. For those savers who were dependent on DC savings plans in 2008, some saw employer match reductions or suspensions during the Great Recession — and most experienced full restoration of those benefits upon economic recovery. This too shall pass may be the mindset of this survey sample.

Retirement Confidence, Investing Impacts

Retirement outlooks have shifted both over time and across age groups. In our 2018 survey, we asked survey-takers how optimistic they were about the likelihood of being financially prepared for retirement by the time they planned to stop working. Respondents in 2018 had a slightly less sanguine view than this year, with 48% expressing a lack of optimism versus their future 2020 counterparts (44%), 19% of whom were more inclined to be optimistic.

Similarly, we asked how confident they were that they could retire when they wanted. More predictably, the sentiment shifted downward, with 2018 respondents more inclined toward confidence (23%) than their 2020 counterparts (19%). Interestingly, both groups of respondents were equally doubtful (44%) about their ability to retire when they chose.

We might have expected a more dramatic delta between 2018 and 2020, given the pandemic, but the subtle shifts may be a result of this fairly inelastic sample, meaning that those who are prepared, and therefore reasonably optimistic and confident, aren’t really shaken by the current market. In addition, people’s confidence depends on their optimism and, in this case, their outlook is good, suggesting people see the coronavirus crisis as short-lived and surmountable.

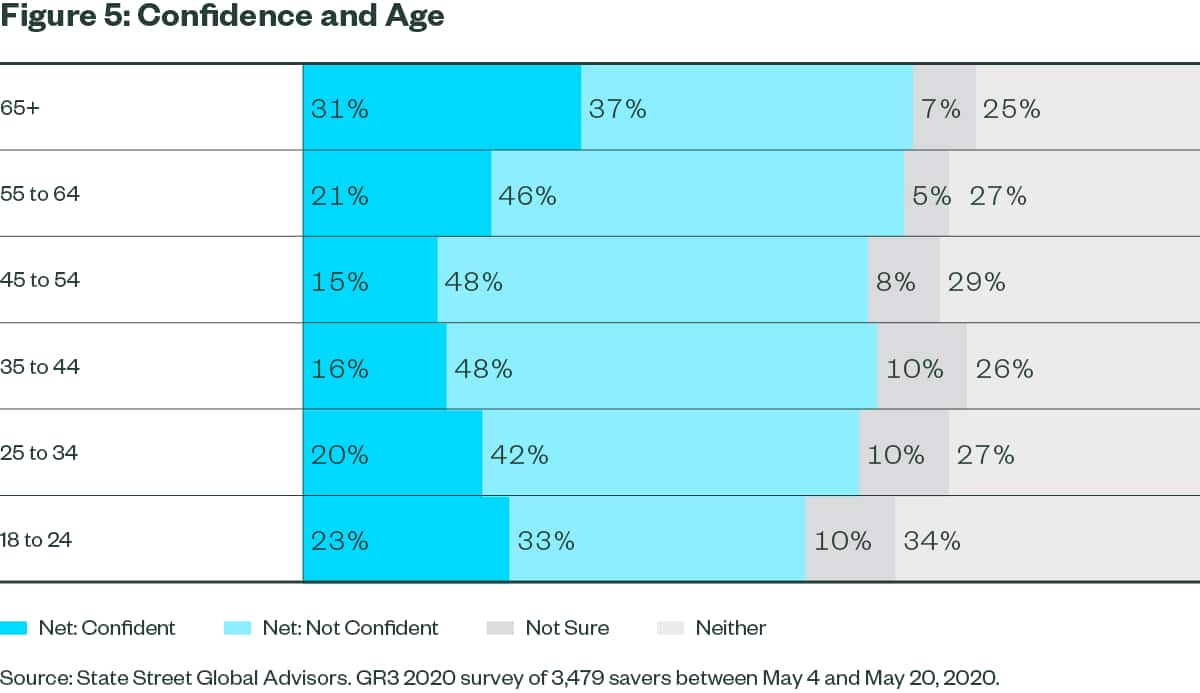

A better gauge of lagging retirement confidence is gained through age splits. Here we see a more familiar story: Those in Generation X, made up of people born between 1965 and 1980 and now between 40 and 55 years old, are more anxious about their retirement future than other generations. Nearly half (48%) are doubtful that they will be able to retire when planned, as compared to the population of older (37%) and younger (averaging 38%) responders experiencing low confidence. This population is likely to have more financial obligations than the older cohort and less time to fill savings gaps than their younger counterparts. Additionally, the mid-career segment is close enough to their retirement future to anticipate a range of challenges, but not so close as to feel assured in the solutions.

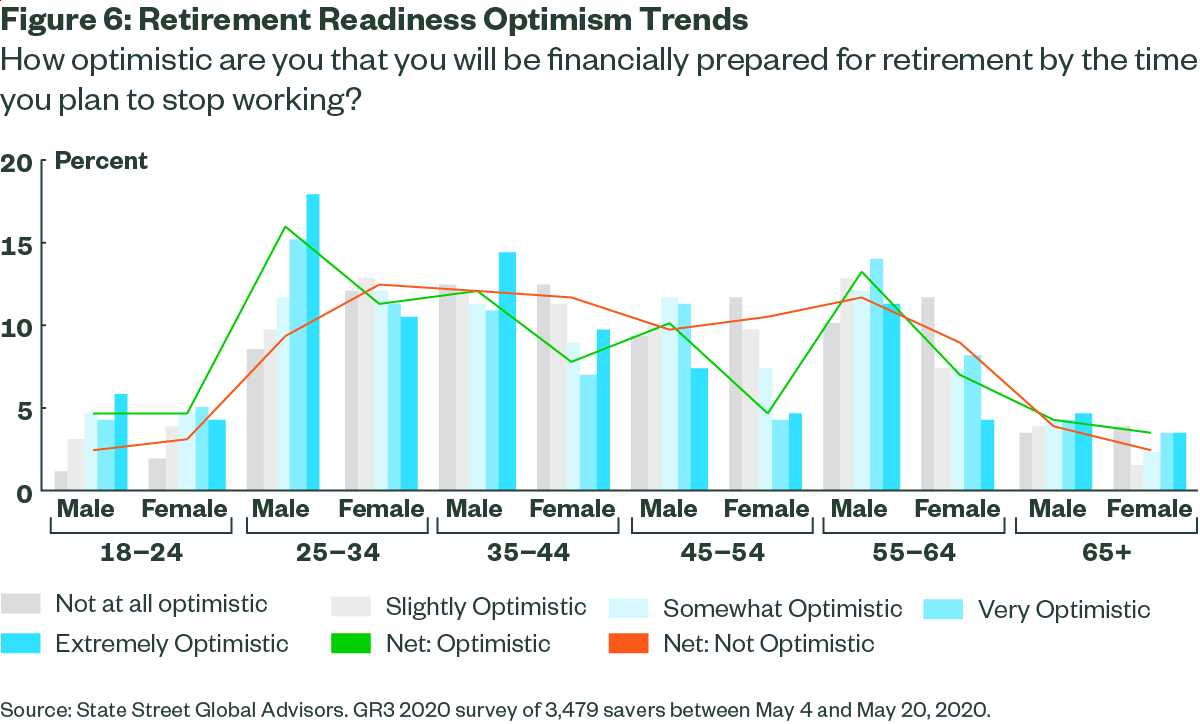

When combining age and gender filters across the surveyed countries, a consistent though more intricate picture appears, showing women to have lower incidence of optimism, particularly within the oldest age groups: 5% for 45 to 7% for 55 to 65 and 4% for 65+. Interestingly, women also showed the highest level of doubt (13%), though within the 25 to 35 age group, suggesting opportunities across women’s working lives for investment information and other gender-specific financial planning support.

Despite uneven confidence, 66% of respondents said they weren’t making changes to their retirement plans. Very few were seeking financial advice (6%), switching to higher-risk (8%) or lower-risk (5%) investments or moving plan providers (2%). Staying steady in this environment is both prudent and an interesting reflection of human behavior.

Are savers actively doing the “right thing” or cowed by inertia? We looked further into altruistic attitudes by asking if savers were evaluating investments through the lens of the COVID-19 crisis. Forty-five percent said no, but 55% expressed interest. Of those savers motivated by companies’ COVID-19 response, nearly one in three (29%) would be keen to invest in companies that treated their workforce well during the crisis, 27% would invest in those organizations innovating COVID-19 vaccines and treatments, 25% would invest in companies that contributed resources to the crisis and 25% would not invest in companies that had unfairly taken advantage of a disruption in the market. Here, it is interesting to consider how the “G” in ESG (environmental, social and governance) could take on increasing importance in investor preferences, as employees are now experiencing the impacts of corporate governance, either directly or through social media.

Brandwatch, a UK company that aggregates social media data to analyze brands’ online presence, used an artificial intelligence assistant during the month of March to uncover positive stories around the world’s biggest brands, from manufacturers like Dyson forging into the ventilator space to mega-employers like Microsoft ensuring that hourly employees continued to be paid to brand icons like Coca-Cola redirecting advertising budgets to COVID-19 relief.iv The world is watching.

Looking Ahead

Survey-takers were asked to what extent the following negatively impacted their confidence with regard to being financially prepared for retirement (ordered by impact, determined by the persistence of the answer in each country’s top three concerns):

1. Uncertainty about my retirement plans

2. No spare money to save for retirement

3. Lack of trust in retirement savings plans

4. Complexity of retirement savings plans

5. COVID-19 situation (38% cited high impact on preparedness in both Australia and Ireland)

6. Medical expenses (39% cited high impact on preparedness in the US)

7. Mortgage debt and housing costs

8. Financial dependency of children or elderly family members

9. Short-term debt, loans and credit card bills

Interestingly, known expenses like housing costs, family support or short-term debt ranked as the lowest concerns, possibly because these items could be planned and, to a degree, controlled. The issues raising the greatest anxiety offered more existential threats: uncertainty, scarcity, institutional distrust.

Concern about COVID-19-related consequences falls in the middle, potentially reinforcing the idea that the coronavirus crisis isn’t the problem, but the magnifier, increasing existing retirement security concerns.

At State Street Global Advisors, we believe that a well-diversified retirement savings strategy can help address the feelings of destabilization that savers are facing across the globe. Beginning with a carefully considered investment menu and thoughtful plan design, bolstered by participant communication proficiency and informed by public policy expertise, our global team can help foster conversations around retirement readiness for both employers and employees.

Let’s use this present moment to prepare for our collective future, championing changes that ease existing pressures and pursuing a balance between financial flexibility and security in retirement.