Credit Style Factors Can Provide Crucial Insights During Late-Cycle Market Resilience Credit Commentary – May 2024

For over a year since the banking turbulence in March 2023, credit markets have been relatively boring. Looking closely at style factor data, alongside market structure and market participant behavior, are important for understanding why the market remains resilient despite being late in the credit cycle.

Spreads Are Tight and Fundamentals Remain Stable

Investment Grade

Despite the lateness in the credit cycle, spreads on the US investment grade (IG) and high yield (HY) corporate bond indices have tightened to historically rich levels of under 90bps and around 300bps, respectively.1 Meanwhile, fundamentals from both a macro and credit perspective look decent, and market technicals remain supportive with Treasury yields near their highs over the past 15 years. Continued resilience has been the dominant theme in US markets over the past year. The following helps explain the steadiness in IG corporates:

- Strong Macro Backdrop. Propped up by strong spending and consumption, the economy has managed to avoid the more significant downturn that was anticipated in prior quarters, and rate cut expectations have shifted dramatically from six at the beginning of 2024, to less than two as of mid-May. A soft landing is now the market’s prevailing base case.

- Attractive Yields. Despite tight spreads, investors continue to view 5.5% and 8% yields in IG and HY as attractive2. On the IG side, bond funds have seen strong inflows of $138.5 billion year to date per JP Morgan, with strong gross supply (+30% year-over-year)3 following strong demand from retail investors, overseas buyers, buy-and-hold insurance companies, and de-risking pension funds.

- Solid Credit Metrics. Furthermore, IG credit fundamentals have managed to avoid the cyclical downturns reminiscent in previous cycles. Higher interest expense and debt overall, alongside lower interest coverage, could dampen fundamentals moving forward, but thus far, credit metrics remain solid and supportive of historically rich valuations (Figure 1).

High Yield

On the high yield side, we believe that changes in market structure can help explain market resilience late in the credit cycle. In particular, a significant slice of speculative transactions have moved from public to private markets, increasing the seeming resilience of the former, and potential vulnerabilities in the latter.

The high yield market has been similarly boring and well supported. Default activity is muted, and issuance activity is normalizing. We saw $73 billion in new issuance in Q1 2024 per Barclays, which is on pace for $250-300 billion in total issuance for 2024—in line with the average annual issuance from 2010-2021.

Here again, market structure can explain a lot of the resilience. Speculative transactions and/or more complex structures are moving into different markets, and visibility into these deals is less apparent in public markets. Private credit at approximately $1.64 trillion in market value is now roughly the size of the $1.6 trillion public HY corporate bond market, per Pitchbook.

Style Factor Signals Can Add Value When Spreads Are Tight

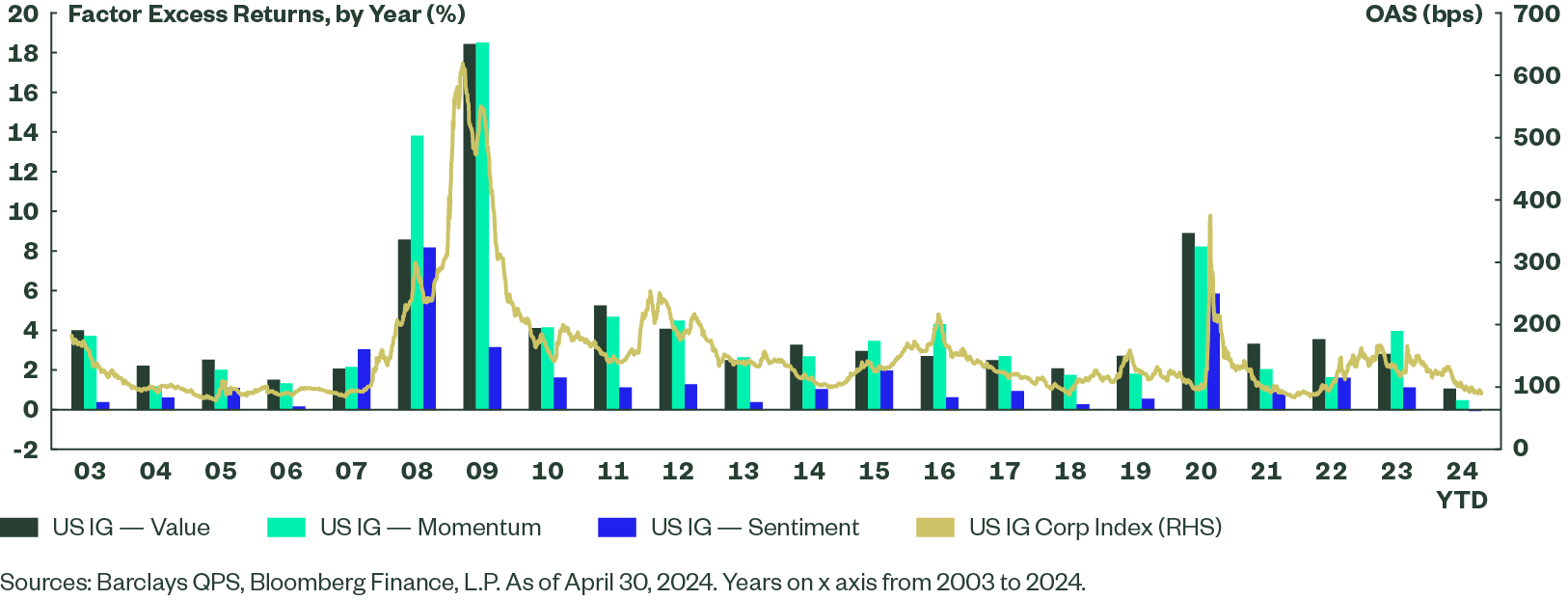

We can look to credit style factor data to help guide decision making at all parts of the cycle, including late cycle when valuations are becoming more stretched. Where purely value-oriented investors may have begun selling credit several months ago when spreads were already well on the rich side of long run fair value, momentum could be the differentiator that, used in conjunction with value, keeps you invested through the turn in the cycle. Below we show the performance of “exposure-matched” portfolios that tilt toward high factor exposure for value, momentum, and sentiment individually, while accounting for risk factor exposures (Figure 2). Doing so properly isolates the impact of the credit style signals. In 2023, momentum shined in a year when spreads continually tightened to historically rich levels.

Figure 2: Momentum Was a Strong Performance Driver in 2023

The Bottom Line

Understanding market structure and the institutional constraints that drive investors is key to our active investment philosophy, on both the fundamental and systematic sides. Our experience in credit markets and recognition of the structural changes therein helps us to make better investment decisions, even when spreads are tight and markets are showing the type of resiliency that we are seeing today.

We can look to credit style factor data to help guide decision making at all parts of the cycle, including late cycle when valuations are becoming more stretched. Where purely value-oriented investors may have begun selling credit several months ago when spreads were already well on the rich side of long run fair value, momentum could be the differentiator that, used in conjunction with value, keeps you invested through the turn in the cycle.

Understanding market structure, participants in the market and what’s driving their behavior, and what the style factor data can tell us – utilizing the full, comprehensive toolkit – can help add value to the investment process and create better outcomes for investors in the long run.