What About Canada?

When it comes to international asset allocation, investors have more choice than they may realize. For decades, the MSCI EAFE Index has been the default option, but it does not include an exposure to Canada, the world’s ninth largest economy.1 The MSCI World ex USA addresses this gap, providing investors with greater diversification.

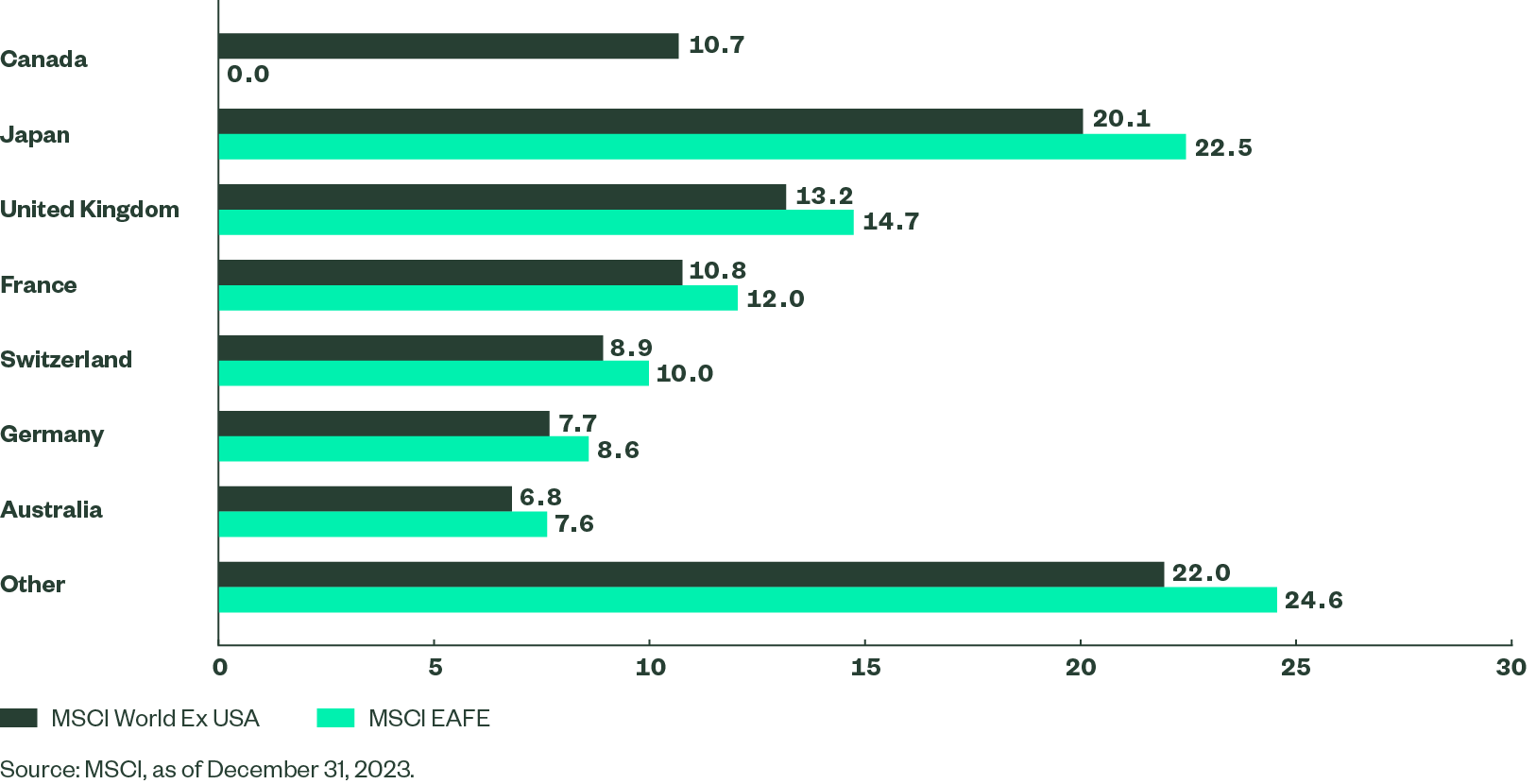

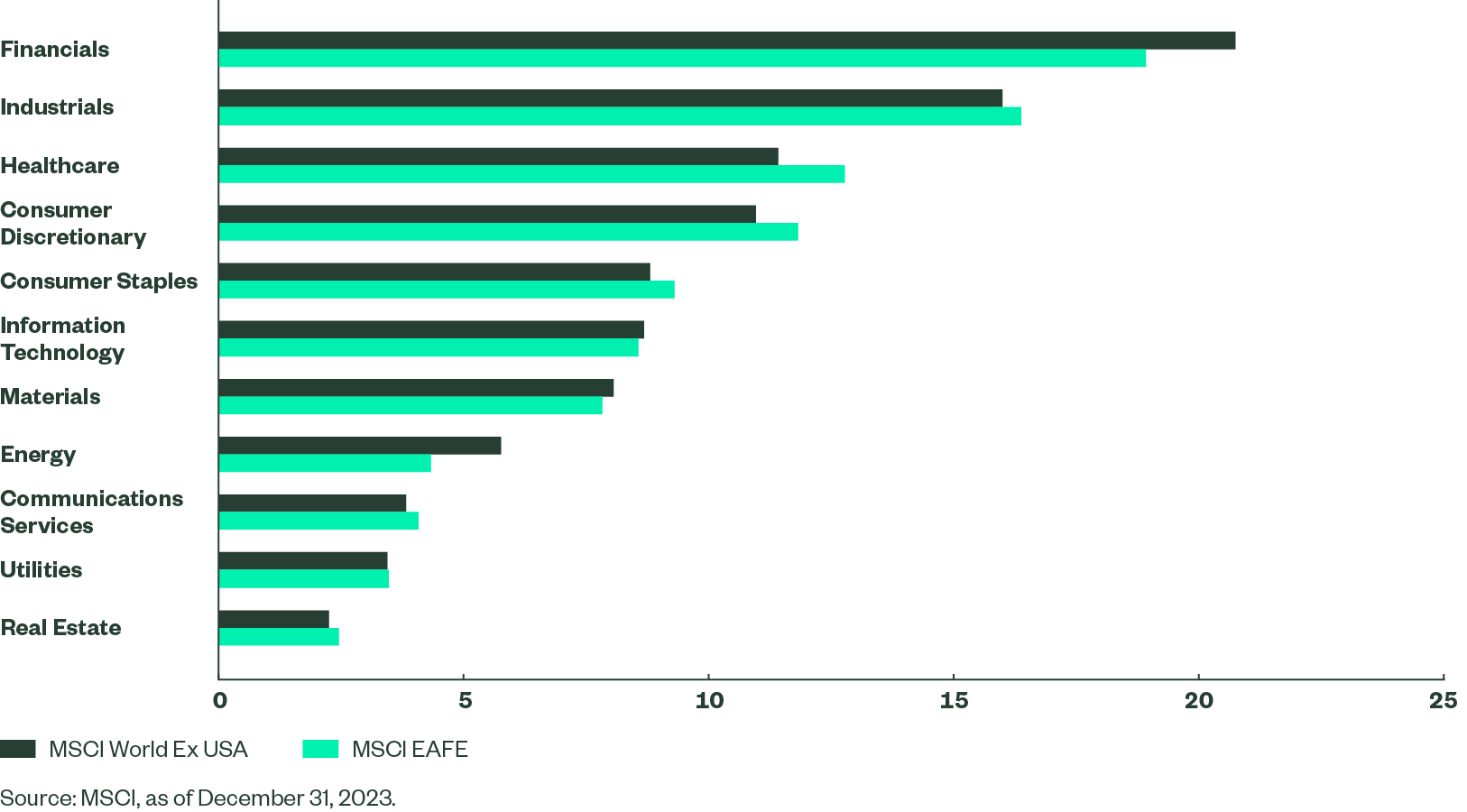

The MSCI EAFE and World ex USA indexes are similar in many ways and cover most developed markets (DM) outside the United States. However, there is one glaring difference: MSCI EAFE – being limited to Europe, Australasia, and the Far East – has no exposure to Canada. As seen below, Canada represents a significant portion of the MSCI World ex USA index. With Canada omitted, this leaves investors who choose the EAFE index with unintentional country and sector over/underweights within their DM exposure.

Fig. 1a Country Comparison MSCI World ex USA vs MSCI EAFE

Fig. 1b Sector Comparison MSCI World ex USA vs MSCI EAFE

The Case for Canada

Canada’s economy and financial markets are as vast and resource-rich as the country itself. Canada is among the world’s top ten largest economies and the Toronto Stock Exchange is one of the largest developed-market equity exchanges in the world by market cap. The country’s abundant natural resources make it a significant player in the energy space – both within oil and gas, and renewables like hydroelectricity. Its financial and banking industries are considerable as well. The prominence of these two industries means that Canadian stocks can offer a built-in barbell of value and the potential for higher income through dividend-paying stocks. What’s more, Canada’s largest publicly traded stocks include names familiar to North Americans but that are not traded in the EMEA region, including Toronto Dominion (“TD”) Bank and Lululemon.

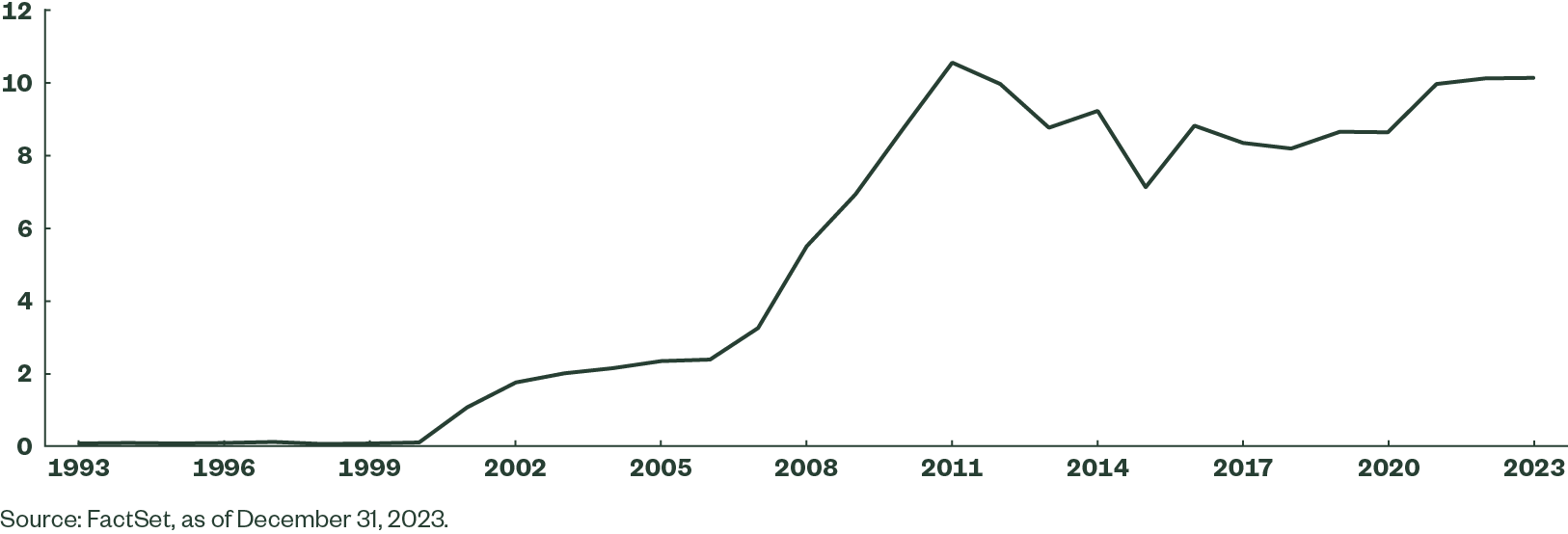

Canada’s Growing Weight in the MSCI World ex USA Index

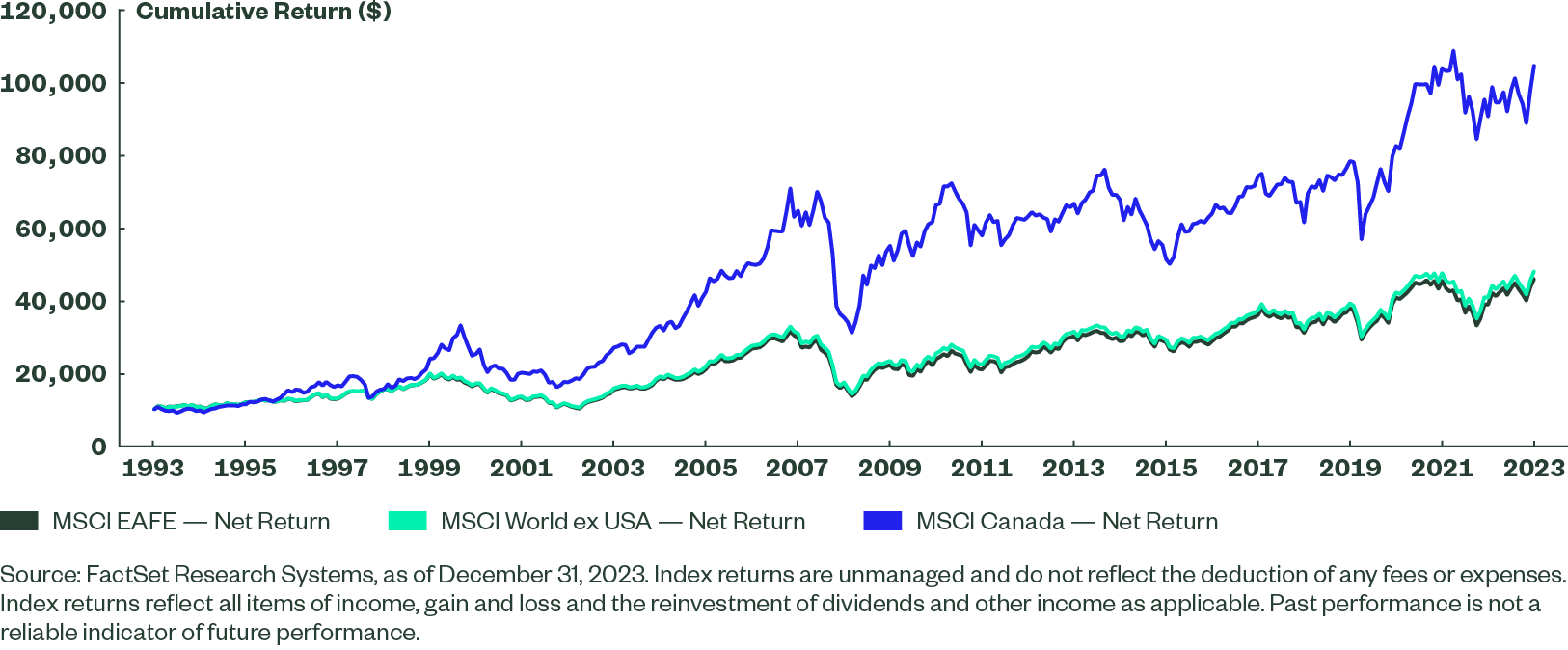

Exposure in Canada has grown notably over time in the MSCI World ex USA Index (Figure 2). In 1993, Canada made up only 0.13% of the Index. Since that time, Canadian equities have returned 945%, increasing Canada’s weight in the MSCI World Ex USA Index to 10.1% (as of December 31, 2023).* This growing imprint makes the potential impact to performance more meaningful, as shown in Figure 3.

Figure 2: Weight of Canada in the MSCI World Ex USA Index Over Time (1993 – 2023)

Fig. 3: The Growth of a $10,000 Investment Over Time

Case study: The Importance of Diversification During Inflation

Investors seeking equity exposure outside the US value the diversification a broad international allocation provides. That’s why it’s important to consider the additional layer of diversification that including Canada adds, due to the unique composition of its market. Nearly 40%2 of the Canadian market is made up of companies in Energy, Industrials, Materials – sectors that have historically performed well or proved more resilient during bouts of inflation.

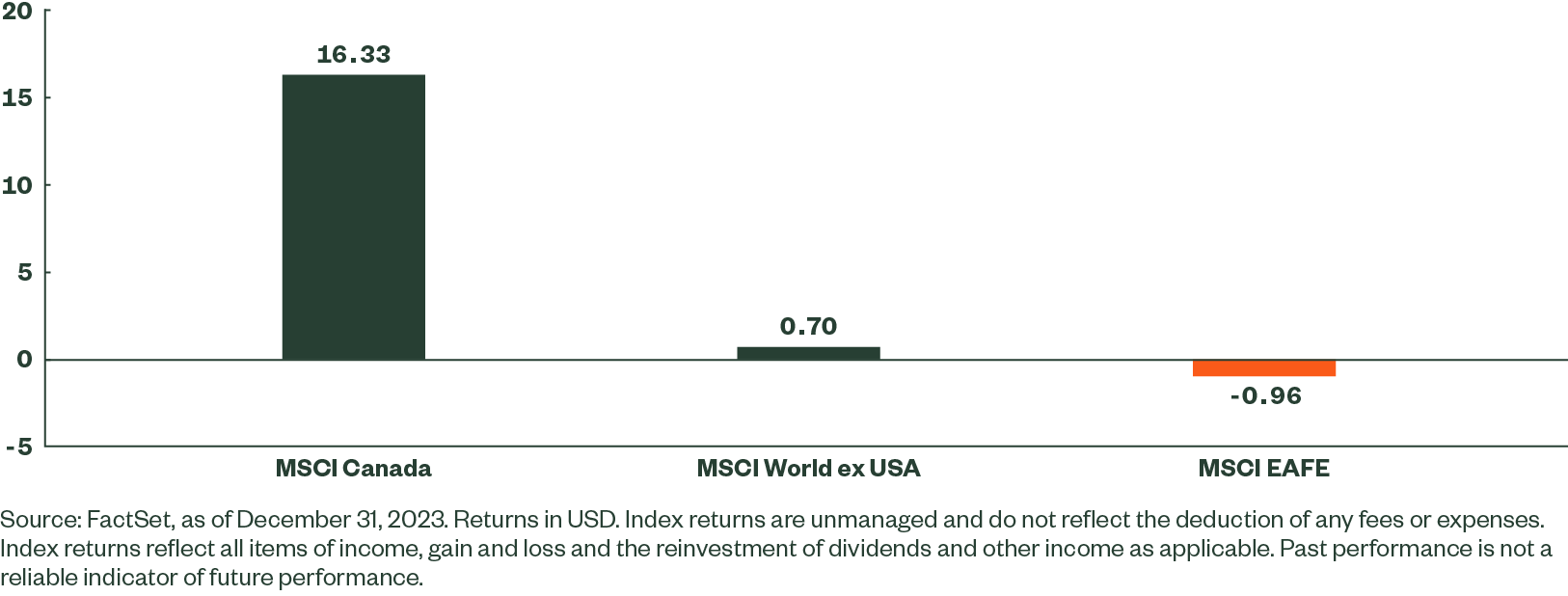

Most recently, the inflationary period that has taken hold across the globe provides a good example of how the added diversification offered by Canada proved beneficial to investors. During the peak period of inflation (January 2021 to May 2022, the Canadian stock market outperformed global equities (MSCI ACWI Index) by +14%, driven primarily by the inflation-sensitive sectors mentioned above.

Considering Canada’s growing weight in the global equity market, this outperformance proved beneficial for investors, as MSCI World Ex USA outpaced MSCI EAFE by +166 bps. This was primarily driven by the exposure to Canada.

Figure 4: Canada Performance in Relation to World ex USA and EAFE (Jan 2021 – May 2022)

Considerations for DC Investors

Beyond index selection, vehicle selection is of the utmost importance for DC investors, especially when it comes to investing in international equities. Generally speaking, ERISA Collective Investment Trusts (CITs) are cheaper than their mutual fund counterparts, due to their lower marketing, regulatory, trading and other operational costs. Additionally, DC investors can capture additional tax benefits from utilizing a CIT over a mutual fund for their international equity exposure. Discussed in further detail here, CITs receive more favorable tax treatment on capital gains and dividends when investing internationally than do mutual funds. In 2023, international developed equity investors realized +23 bps higher return solely from choosing to utilize a CIT over a mutual fund (Figure 5). These structural advantages translate to better long-term results, and ultimately more money in participants’ pockets.

Figure 5: Meaningful CIT Tax Benefits Gained in the MSCI World ex USA Index

| MSCI Country | 2023 Div Yield | ERISA Tax Rate | Mutual Fund Tax Rate | Weight of MSCI World ex USA | Impact |

|---|---|---|---|---|---|

| MSCI Canada | 3.36% | 0% | 15% | 10.60% | 0.05% |

| MSCI Japan | 2.46% | 0% | 10% | 19.80% | 0.05% |

| MSCI Switzerland | 3.08% | 0% | 15% | 9.00% | 0.04% |

| MSCI Germany | 3.32% | 0% | 15% | 7.60% | 0.04% |

| MSCI Sweden | 3.36% | 0% | 15% | 2.90% | 0.01% |

| MSCI Spain | 3.53% | 0% | 15% | 2.30% | 0.01% |

| MSCI Netherlands | 2.01% | 0% | 15% | 4.00% | 0.01% |

| MSCI Finland | 4.37% | 0% | 15% | 0.80% | 0.01% |

| Remaining Countries | 43.00% | 0.00% | |||

| MSCI World ex USA | 100.00% | 0.23% |

Source: State Street Global Advisors, as of December 31, 2023.

Bottom Line

For a more comprehensive and truly diversified developed market exposure, the question becomes: Why would you not include Canada? Choosing MSCI World ex USA instead of MSCI EAFE for international developed market allocations provides broader market exposure as well as the potential for better dividend income and resilience during inflationary periods.