European Equities Overweighted

Each month, the SSGA Investment Solutions Group (ISG) meets to debate and ultimately determine a Tactical Asset Allocation (TAA) to guide near-term investment decisions for client portfolios. Here we report on the team’s most recent discussion.

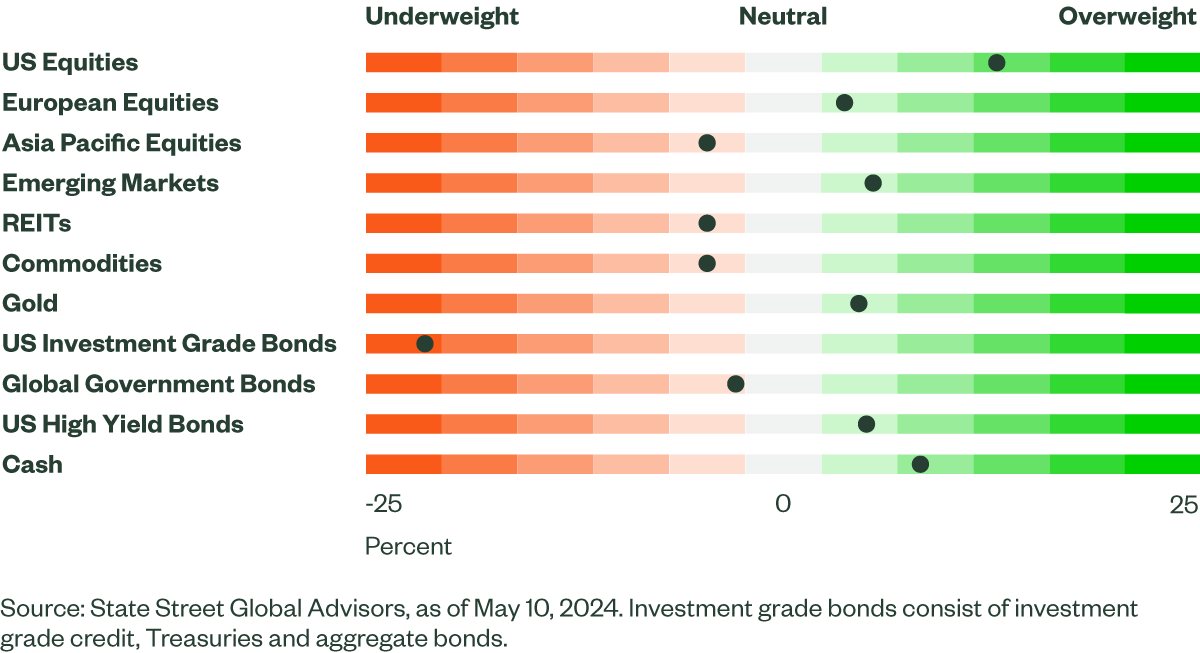

Figure 1: Asset Class Views Summary

Macro Backdrop

For the Federal Reserve (Fed) to administer a soft landing in the US, inflation will need to ease further and growth soften but not collapse.

From a growth perspective, recent developments support a slowing but solid economy. First-quarter US gross domestic product (GDP) surprised to the downside at a subpar 1.6%. However, the majority of the weakness stemmed from trade and inventories, with final sales to domestic purchasers growing at a respectable 2.8% and signaling firm demand.

Both manufacturing and service activity declined in April, with new orders slowing and both purchasing managers indices (PMI) in contraction. The labor market appears to be experiencing a better balance between supply and demand. Payrolls were weaker than expected, with the unemployment rate rising slightly. Additionally, both the job openings and the job quits rate in the quarterly job openings and labor turnover survey (JOLTs) report moved lower.

Initial jobless claims spiked, but while the jump to 231,000 claims was the highest in almost a year, the 4-week average — which smoothens out volatility — remains in line with the average over the past year. Continuing claims have also risen, which typically signals it is becoming more difficult to find a new job. While the 4-week average has risen off post-pandemic lows, it remains historically low. All in all, the labor market continues to soften but still offers support for consumption. Despite some weaker data, the Atlanta Fed’s GDPNow is tracking at 4.2% for the second quarter, which signals a potential rebound in growth. Overall, the economy is slowing, but on solid footing — a good scenario for the Fed.

Recent inflation trends have not inspired confidence, and the trend of hotter-than-expected inflation prints continued. This has forced members of the Fed to acknowledge that rates will remain elevated for longer, while consumer inflation expectations — both short and long-term — in the University of Michigan survey rose in April. While PMIs declined, the prices paid components in both services and manufacturing increased and remain elevated.

Wages are generally moving lower, with average hourly earnings continuing to soften. But the employment cost index — the Fed’s preferred measure — outpaced expectations in Q1, rising 4.2% year over year, down from the high of 5.1% in 2022, while still remaining elevated. Further, the core personal consumption expenditures price inflation index rose greater than consensus estimates, led by services, and the 3-month annualized pace increased for the third consecutive month. Looking forward, elevated labor costs could support sustained service sector demand, while the potential for higher housing costs and bottoming goods deflation are upside risks to inflation.

While developments on growth support our expectations for a soft landing, recent inflationary trends and restrictive monetary policy are risks to the downside for our outlook.

Directional Trades and Risk Positioning

With inflation outpacing expectations and further conflict in the Middle East, investor anxiety began to weaken risk appetite during the first half of April. As the month progressed, a combination of softer PMI readings, a downside surprise to US GDP, and softer US jobs reports boosted confidence in the Fed administering a soft landing — and in turn, improved risk appetite.

Our measure for risky debt spreads has remained benign, but easing implied volatility in both currency and equity drove our Market Regime Indicator (MRI) down into a low-risk regime. After spiking into crisis, implied volatility has dropped back into low-risk zone where it currently resides. Overall, the risk environment has improved and is supportive for risk assets.

Our quantitative forecast for equities strengthened with improvements across multiple factors. The pullback in equities during April improved valuations, but they remain stretched. Elsewhere, price momentum is strong, balance sheets still appear healthy, and better sentiment indicators – both on the earnings and sales fronts – buoy our positive outlook.

Within fixed income, our outlook has deteriorated, with our model anticipating higher interest rates. Manufacturing activity weakened in April but remains stronger than our lookback value and implies higher rates. Additionally, our momentum indicator suggests the recent rise in yields could continue, while strong nominal GDP suggests yields should continue to rise. Our model is predicting a modest steepening of the yield curve due to lower inflation expectations and recent momentum. Finally, our expectations for high yield have been tempered a bit due to seasonality no longer supporting and increased equity volatility.

Against the backdrop of strong risk appetite, improved equity forecasts, and a weaker bond outlook, we have increased our exposure to equities using proceeds from the sale of high yield and aggregate bonds.

Relative Value Trades and Positioning

Within equities, our quantitative forecasts improved for most regions and there is now less dispersion amongst our forecasts. European equities experienced the largest increase, with macroeconomic factors and valuations becoming more positive. Additionally, balance sheet health remains solid and price momentum is still positive. Positive expectations for the US are driven by strong price momentum, favorable expectations for both earnings and sales, along with sturdy quality factors. Within the US, our model prefers small-cap equities due to more attractive valuations and stronger macroeconomic indicators.

Our forecast for Pacific equities improved, supported by positive sentiment indicators, but on a relative basis, remains below other regions. We sold US large-cap, but when combined with the addition to global equities from our directional trade, there was a small purchase at the total portfolio level. Additionally, we sold Pacific equities, increasing our underweight. Proceeds were deployed to US small-cap and European equities. At the portfolio level, we now carry an overweight in US, both large and small, Europe and emerging markets.

Given that our model is calling for higher government bond yields, we made no changes to our fixed income positioning. We maintain a healthy underweight to aggregate bonds with targeted overweight positions to high yield and cash.

Finally, at the sector level, we have maintained allocations to industrials, communication services, and energy. We have rotated the split allocation out of technology and into financials. Our forecast for technology remains positive, but has softened, while our expectations for financials has improved. Technology still exhibits encouraging price momentum but to a lesser degree, and analysts’ expectations for earnings have deteriorated. The upgraded outlook for financials is driven by meaningful improvement in analysts’ expectations for sales and earnings along with better valuations.

Elsewhere, price momentum remains supportive. For energy, a combination of appealing valuations, strong balance sheet health, and better sentiment indicators buoy our outlook. Industrials benefit from excellent short and longer-term price momentum, while macroeconomic indicators and strong earnings expectations buttress the sector. Communication services is the top sector in sentiment and price momentum while ranking well across all factors except macroeconomics.

Click here for our latest quarterly MRI report.

To see sample Tactical Asset Allocations and learn more about how TAA is used in portfolio construction, please contact your State Street relationship manager.