State Street Tax-Sensitive Strategic Asset Allocation ETF Portfolios

Key Facts

- Diversified, global asset allocation

- Consistent long-term approach with lower turnover and portfolio efficiency

- Captures the potential tax advantages of municipal bonds

Objective

Seeks to provide optimal capital efficiency over a long-term horizon. The more conservative model portfolios are designed to generate current income, with some consideration given to growth of capital. The more aggressive portfolios are predominantly focused on growth of capital. In all instances, the model portfolios are constructed, based on risk tolerance, to achieve market exposure across both equity and fixed income markets.

Evaluation Frequency

Annually

Pick Your Portfolio

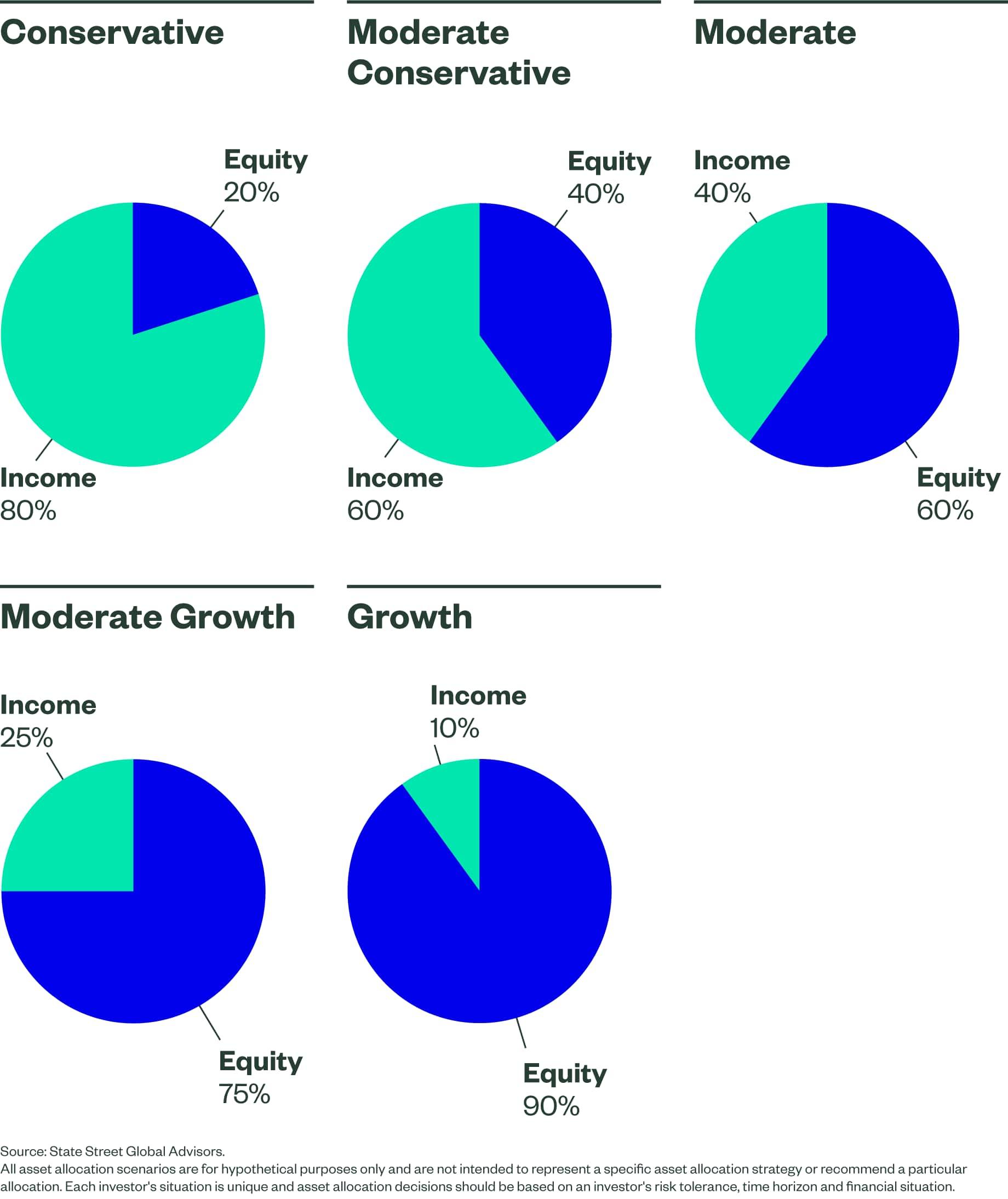

Five strategic portfolios span the efficient frontier and can be used to target a variety of return and risk objectives. Find the one that’s right for you.

Current holdings can be found in the Target Allocations file under Quick Links.

Get More Information

Get in Touch

Contact the State Street Models Team for more information or call a State Street ETF representative at 866-787-2257.

Visit the Blog

Get current insights and market commentary from our experts.

Read More

Visit our Insights page to access our latest thinking.