Prioritizing Longevity Risk in A Glidepath: Our Growth Target Date Philosophy

State Street has managed assets for defined contribution (DC) plans for over forty years. Over this time, we have worked with some of the largest and most sophisticated investment decision makers to deliver solutions that meet the needs of a broad and diverse range of DC plan participants. The primary output of this focus is our Target Retirement platform, which has continuously evolved over three decades to address wealth accumulation goals and changing market dynamics.

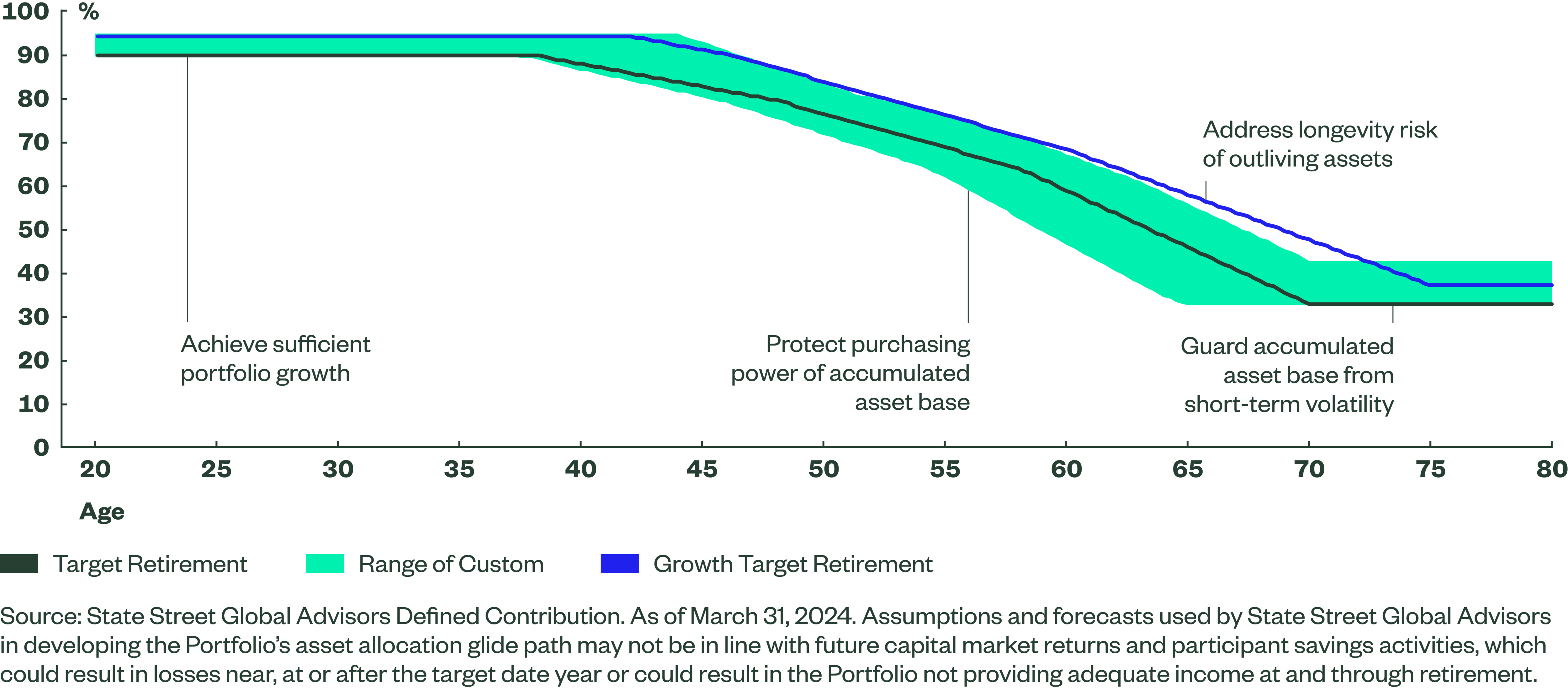

Each Target Retirement glidepath starts with a thorough understanding of the objectives that must be solved for. Since its inception in 2005, the State Street Target Retirement series has sought to deliver meaningful income replacement by balancing key investment risks – accumulation, market, inflation and longevity – based on representative demographic assumptions for the average DC participant. But plan populations are not homogenous, and for nearly three decades we’ve also worked with clients to build custom target date solutions for those plans whose demographics or objectives significantly differentiate from baseline assumptions.

A north star for DC plans is the desire to incorporate sophisticated, efficient investment solutions while maximizing ease of use – and, of course, minimizing cost. In keeping with this spirit, we identified differentiating characteristics that have historically driven the need for bespoke custom solutions and are excited to bring to market a straightforward off-the-shelf solution that addresses a common thread across these plans – the desire to prioritize longevity risk.

The State Street Growth Target Retirement Series builds on the same core philosophy that underpins our approach to glidepath management, offering the simplicity of a strategic index-based approach implemented through a highly diversified mix of asset classes. In designing this solution, we sought to emphasize longevity risk for plans that necessitate a higher risk profile than our standard offering - whether driven by unique demographics or differing objectives - while retaining the key elements of State Street’s value add: low-cost, broad diversification and disciplined risk management. The result is an efficient, straightforward solution to more specifically address unique plan needs of a growing segment of the DC landscape.

Why we’re expanding our off-the-shelf Target Retirement series

While custom solutions offer a compelling value proposition for certain plan sponsors, many of whom have held these structures for years, adoption has become increasingly limited for a few key reasons:

- Resources: Many plans don’t have the resources to support what is often a more complex and operationally intensive offering,

- Costs: Fixed costs associated with custom solutions may lead to higher overall fees than off-the-shelf solutions for all but the largest plans, and

- Choice: Today, commingled strategies are available across the risk spectrum, suggesting that most objectives can be addressed through an off-the-shelf solution.

Custom target date funds play an important role in the DC ecosystem but may be an unrealistic or undesired option for many plan sponsors. This backdrop, paired with increased demand for higher growth solutions, has contributed to the rationale behind a low-cost default solution that prioritizes longevity risk.

Building for Greater Growth – Prioritizing Longevity Risk

Our standard Target Retirement Series has delivered strong outcomes, outperforming 85% of peers1 while maintaining a disciplined, strategic approach and consistent risk profile. The Target Retirement Series uses assumptions regarding the demographics of the average plan participant and constantly refined capital market expectations for the underlying asset classes. The Growth strategy has three key differentiating characteristics when compared to our standard offering:

- Higher starting equity weight: 95% of the Growth glidepath will be in equities at the starting point, compared to 90% for the standard glidepath.

- Later De-Risking/Landing point: The Growth glidepath will reach its most conservative point at age 75, 10 years after the assumed retirement date. Moving both the onset of de-risking and the landing point by five years allows the glidepath to employ a similar de-risking trajectory (i.e. slope) as the standard glidepath, while placing greater emphasis on growth in later career years.

- Higher growth in retirement: Increased exposure to growth assets provides a higher probability of reaching longevity targets. The growth glidepath holds 40% growth assets at age 75, while the standard glidepath holds 35% growth assets at age 70.

Figure 1: Glidepath addresses key risks faced by participants

Case Study: Potential Uses for the Growth Series

Company XYZ is a $500 million Defined Contribution plan. Employees generally earn more than baseline assumptions and are longer-tenured. An open cash balance benefit suggests that a meaningful percentage of the participant population has a source of retirement savings outside of their 401(k) savings. Consistent with industry trends, the committee is sensitive to fees and does not want to incur the added expenses and oversight required of a custom solution – fund accounting, legal, fact sheet generation and trust/custody fees to name a few. The committee chooses to more aggressively target the longevity risk that a lengthy retirement presents, while placing lower emphasis on volatility around retirement due to the potential cushion that higher balances and outside sources of income present. The growth series presents a low-cost, off-the-shelf offering that may better suit the demographics of the plan and the objectives of its committee.

This is a theoretical plan sponsor built off our experience partnering with many plans that meet one or more of these criteria. The majority of commingled glidepath solutions in the market today with higher risk profiles are actively managed, presenting obvious headwinds in the form of high fees and inconsistent performance of underlying actively managed building blocks. For this reason, actively managed Target Date strategies have experienced net outflows over the last five years, while index-based solutions continue to grow at a rapid pace.2 The Target Retirement growth series presents a potentially compelling alternative, leveraging our core belief that asset allocation is the key driver of long-term outcomes, and seeking to address longevity risk in a straightforward manner.

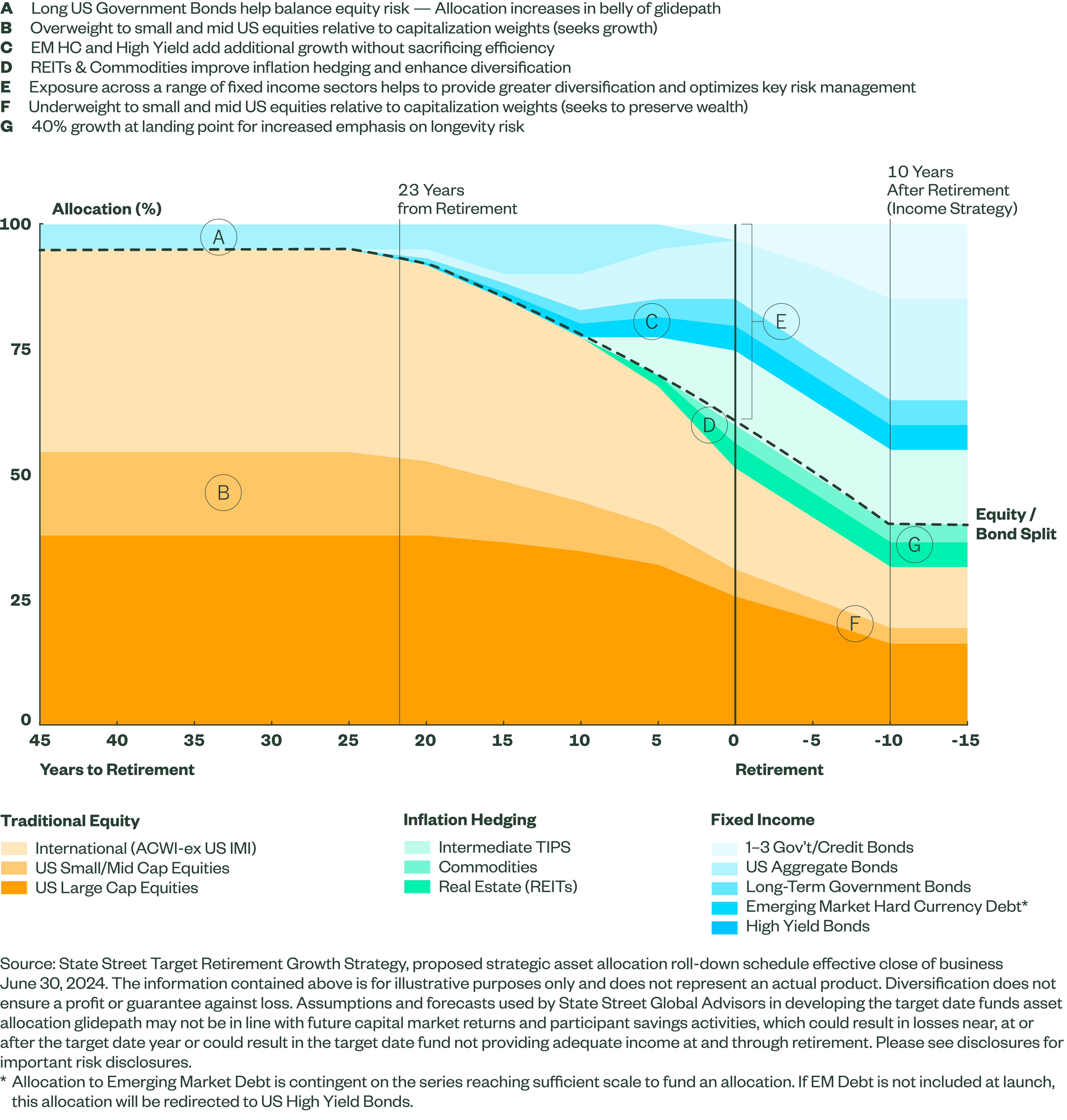

Figure 2: Target Retirement Growth Glidepath

Impact on Outcomes

All else equal, higher growth throughout the glidepath leads to greater expected balances at retirement, which suggests a later age of depletion during the decumulation years. However, taking on more equity exposure naturally begets higher risk and potentially lower efficiency, which increases the likelihood of adverse outcomes in downside scenarios. This is a reasonable tradeoff for some, depending on objectives, but make no mistake that it is a tradeoff. Introducing excess volatility in an effort to prioritize longevity risk becomes imprudent if it drives extreme outcomes.

Similar to our standard offering, the growth series employs a granular set of underlying building blocks – using 11 underlying funds to capture diversification benefits from different sources of risk - driving a higher expected return without materially impacting efficiency. While some elevated downside risk is a necessary cost of higher expected returns, this is managed through diversification versus simply increasing equity exposure. Using the commonly cited S&P Target Retirement benchmark as a frame of reference, we explore the expected distribution of outcomes for participants at retirement.

Figure 3: Distribution of Wealth Outcomes

As the table indicates, the growth series improves expected outcomes in all but the ‘worst case’ scenario and the distribution of outcomes skews positively. A modest increase in market volatility for participants approaching retirement is compensated by a 7% higher expected balance in the median case. Using a standard assumptions for retirement spending,3 this generates four additional years of spending before assets are depleted. At a time when joint life expectancy suggests that our longevity target is age 92, this meaningfully reduces the probability of outliving one’s retirement savings.

The Bottom Line

A strong foundation and constant evolution are equally important factors in continuing to deliver successful outcomes for a broad range of plan participants. Transparently addressing key investment risks while adhering to consistency in philosophy, process and implementation creates that foundation. Our curated offerings allow plan sponsors to more intentionally target the key investment risks that are most relevant to them while benefiting from the shared foundation of State Street’s approach that have added value for nearly 30 years.

Improved outcomes drive all of our product development efforts, and we are focused on evolution beyond asset allocation. We look forward to sharing more of our commitment to innovating a comprehensive platform of solutions that promote successful retirement outcomes – from accumulation to decumulation – and address the specific needs of a constantly evolving workforce.