A Letter From Our CIO: Indexed Fixed Income Update

Strong data prints and a paused Federal Reserve have resulted in negative-skewing bond returns in 2024. Bond performance for H2 2024 may be dependent on the timing of the first rate cut as well as the results of the upcoming November election.

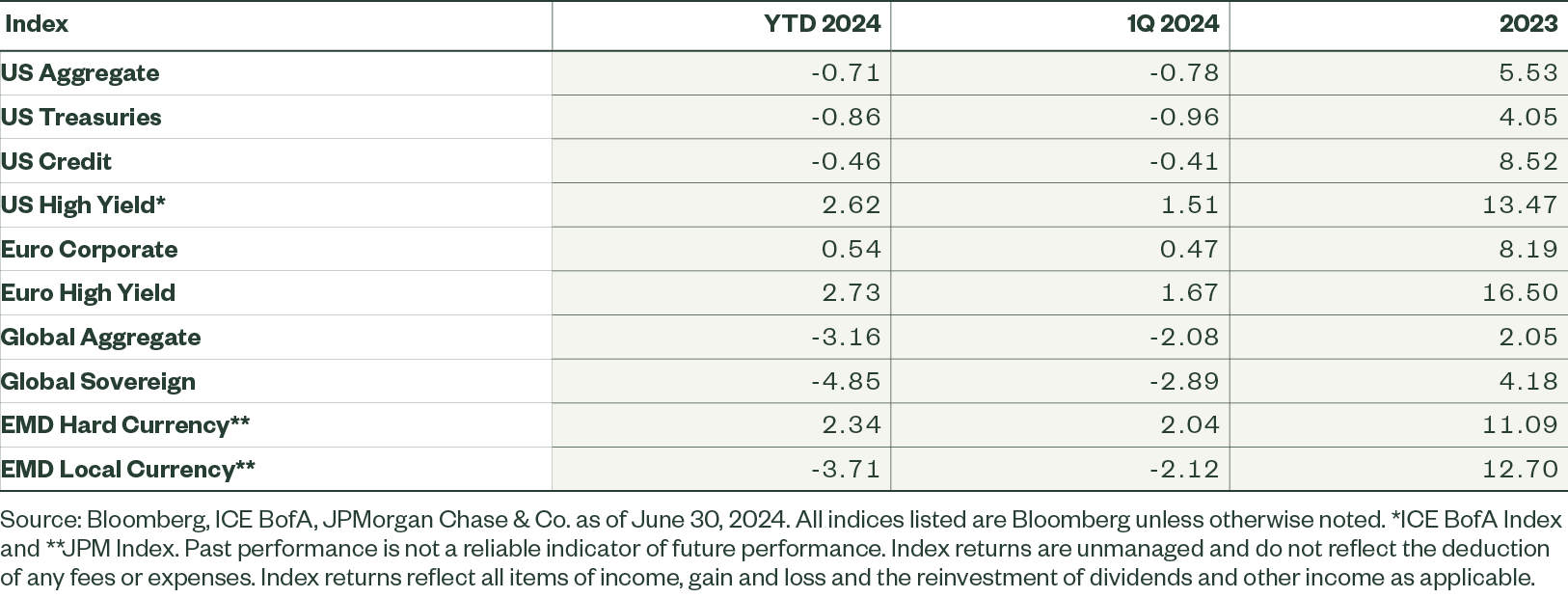

Bond investors entered 2024 with high conviction that up to six rate cuts were likely this year. However, after increasingly strong economic data prints, and a Federal Reserve (Fed) that has shown a reluctance to cut preemptively, those forecasts have been revised dramatically downwards. As a result of this persistent Fed hawkishness, most rates-sensitive US bond sectors were in the red so far this year due to the impact of rising US Treasury yields (Figure 1).

Despite the uncertainty surrounding the future path of US interest rates, investor sentiment and risk appetite globally have remained quite high, if not euphoric. Equity markets have rallied strongly, boosted by large tech, and we have seen some of this return-seeking sentiment spill over into the high yield bond market, which is more strongly correlated to equity than Treasury moves. As it stands, corporate fundamentals are still supportive, and primary market issuance has resumed with a vengeance, far outstripping the pace in 2023 on a year-over-year basis despite the now-higher borrowing costs.

The second half of 2024 may present some major challenges that will test this mindset. We expect bond performance will be influenced by factors that will shape market dynamics, namely the future path of Fed policy, the presidential election, and a delicate global geopolitical backdrop. Our own funds have historically tracked tightly to their respective indices even amid increased market volatility. We remain confident that we will continue to deliver the results our clients expect as we have done in previous challenging market conditions.

Figure 1: Fixed Income Index Total Returns

Despite mixed performance across fixed income sectors, our fixed income assets under management in indexed strategies reached a new all-time high of $613 billion at the end of the first quarter. This marked an increase of 2.8% quarter over quarter, and 15.1% year over year, driven by continued strong client inflows of $23 billion across the book (Figure 2). Trends in flows deviated slightly from that which we have seen in the past few years where sovereigns were the preferred strategy. Though we still saw strong momentum in sovereigns (+$4.4 billion), we saw the most pronounced flows in broader, multi-sector and aggregate strategies (+$9.0 billion) as more investors broadened their fixed income exposures by introducing some credit risk into their allocations. Investment grade credit and high yield also saw inflows of $8.1 billion and $1.7 billion respectively, largely driven by improving market sentiment, receding recessionary risks, and a general risk-on sentiment across broader markets.

In the first quarter of 2024, we experienced some outflows from inflation-linked strategies as inflation readings continued to fall worldwide, with many clients rotating into nominal sovereigns. Our emerging markets strategies only saw muted inflows, however our overall outlook on emerging markets remains constructive against a backdrop of risk-on sentiment, easing commodity prices and the repricing of distressed countries and/or debt restructurings quite advanced or already complete.

Figure 2: Q1 2024 Fixed Income Indexing Flows by Sub Sector and Channel

Innovation at State Street Global Advisors

Our global fixed income team is constantly working hard to unlock new and innovative fixed income strategies and exposures for our clients and prospects. In 2024, we are proud to announce the launch of two new and distinct strategies: the High Quality Corporate — Systematic Active Strategy, as well as our first Indexed Leveraged Loans Strategy.

High Quality Corporate Systematic Active:

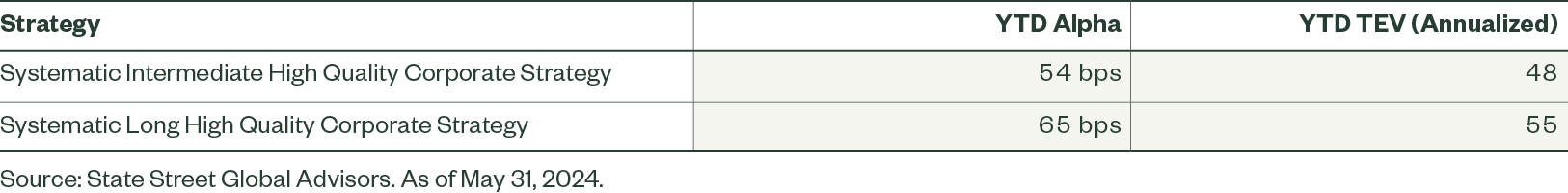

We first announced our Systematic Fixed Income capability in 2023, which brings together the quantitative research expertise of Barclays QPS and State Street Global Advisors’ leadership role in efficient implementation and precise exposure management in fixed income. Previously, the fixed income team had been managing two “smart beta” strategies, which we have transitioned to adopt a systematic investment approach. These two credit strategies are now available in the more popular maturity profiles of intermediate (1–10 years) and long (10+ years), having been converted from the Bloomberg 5–20 year High Quality Corporate Strategy and the Bloomberg 20+ High Quality Corporate Strategy.

The two strategies combine the three factor signals of Value, Sentiment, and Momentum in the security selection process and have alpha and tracking error targets of 95 bps and 61 bps per annum respectively. Both strategies have been performing well and delivering on their alpha targets in the first five months of the year. This strong start is a key proof point that the quantitative research and implementation expertise underpinning the strategies are working effectively in the live environment. What is also clear is the complementary role that at an allocation to systematic active approach can play within an overall credit asset allocation, by providing a competitive level of alpha while also enjoying a low correlation to peer-manager excess returns.

Indexed Leveraged Loans

The leveraged loans market continues to expand at a rapid pace. Year-to-date in 2024 we have seen over $765 billion in new issuance, which is over 345% the volume that we saw in the same period last year.1 What is particularly impressive is how this large issuance volume has been easily absorbed by investor demand. Recognizing this strong demand, and in response to numerous client inquiries for an investible vehicle, we sought to launch an institutional vehicle for indexed leveraged loans that would provide investors reliable exposure to the loans market at a fraction of the cost of either active approaches and/or popular ETFs.

This new indexed loans strategy is already approaching the one billion assets under management (AUM) mark, a notable accomplishment since its official seed date in April of this year. To drive this new initiative, we assembled a team with deep loan expertise from our parent State Street Bank. This team is comprised of specialist loan portfolio managers and research analysts, and we have integrated them into our own proven investment team’s capabilities and implementation expertise in indexed high yield. We believe that our indexed loans capability offers a compelling alternative strategy to established active approaches. We are looking forward to building upon this highly successful launch that has unlocked yet another complex fixed income exposure in index form for our clients and prospects. We look forward to showcasing these new strategies in the months and years to come.

Closing Thoughts

As always, we value your business and look forward to our continued partnership in 2024 and beyond. Should you have any additional questions surrounding your investments, State Street Global Advisors investment capabilities, including systematic active fixed income or leverage loans, or the markets more broadly, please do not hesitate to reach out to your client relationship manager.