ETF Flows Reflect a New Rate Rhythm

With stocks and bonds falling across the globe, it may feel like the rally music stopped in April. Yet, I think of it as slowing just a bit, shifting into a new rhythm. Like the transition to the piano solo at the end of Derek and the Dominos’ Layla.

Repricing of monetary policy expectations caused the music to skip to a new beat last month. Hotter than expected inflation prints, continued supportive economic growth, recovering fundamental trends, and hawkish FedSpeak prior to the May meeting lowered 2024 rate cut expectations from three to just one.1

With such a drastic shift in forward looking expectations, investors reacted the same way concertgoers do when a band plays “something off the new album.” They took a break.

Flows Positive, Not Robust

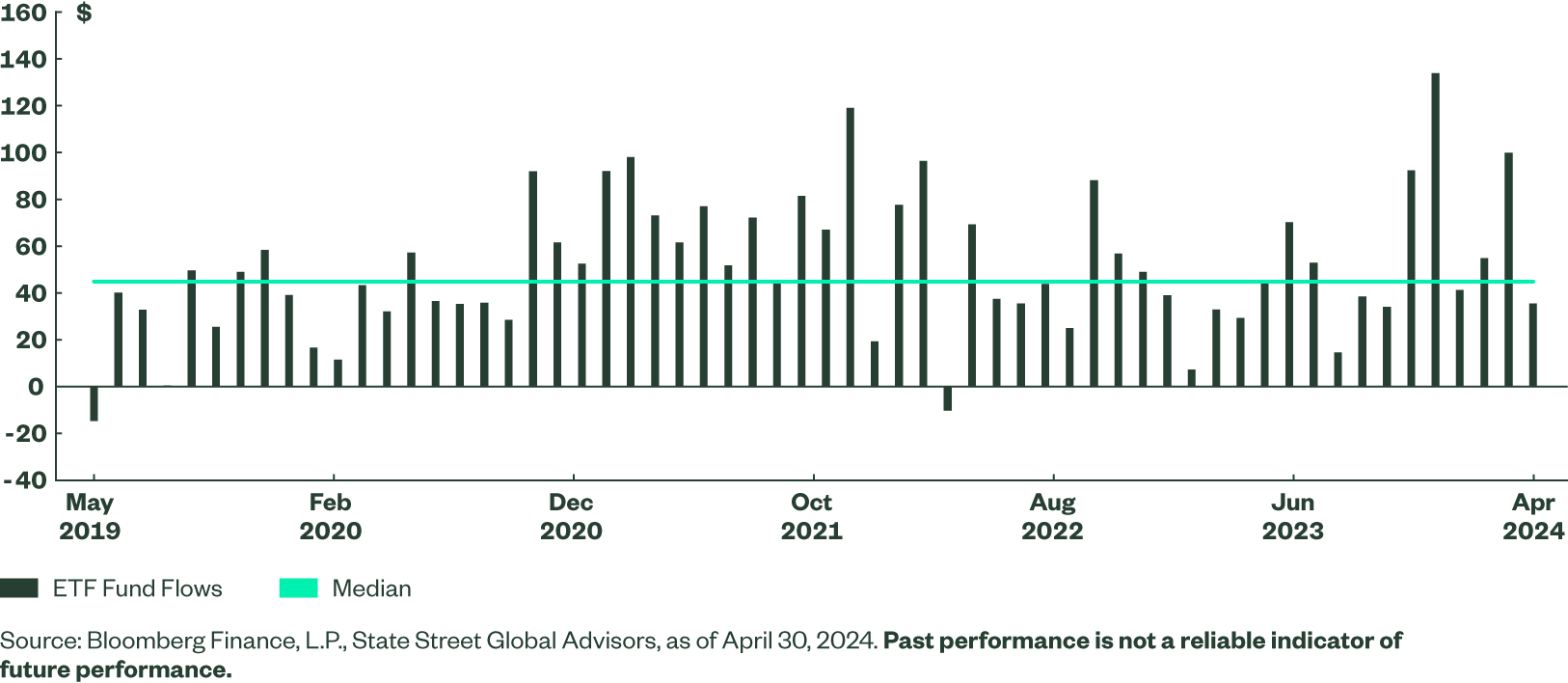

Following significant inflows in March ($100 billion, fourth-most ever), ETF buying behavior slowed in April — reflecting the same slow tune the markets were humming.

April flows were just $35 billion, 22% below their long-term historical average, and their lowest monthly inflow since October 2023 (Figure 1). Back then, those low inflow totals occurred right before the market rallied after the Federal Reserve (Fed) and Chair Powell initially pivoted away from “higher for longer.”

The catalyst for this April’s flows is related. The below average inflows are occurring right as Powell seemingly has pivoted back to an environment of “higher for longer” in hopes of quelling stubborn inflation.2

Figure 1: Monthly Fund Flows ($ Billions)

Equity ETF inflows being 40% less than their typical monthly level drove the subdued headline inflows. Yet, the $19 billion of inflows in April did extend equity ETFs’ record run of 24 consecutive months with inflows.

While equity flows were tempered, bond ETFs’ inflows were in line with historical averages: $16 billion versus $16.2 billion. This is bond ETFs’ sixth month out of the past seven with average or above-average flows, keeping them on pace to break $200 billion of inflows for the fourth year in the past five.

Within bonds, Aggregate bond ETFs’ $11.6 billion of inflows, driven by active funds (54% of all April Aggregate flows), were the most in April as well as 2024. The emergence of active ETFs amid ongoing rate volatility is likely to continue to support the broader Aggregate bond category.

More broadly, despite below average equity figures and average bond flows, the rolling differential between the two asset classes remains in risk-on territory. Equities’ $87 billion more than bond inflows over the past three months still hovers around the 80th percentile.

Risk-on Positioning Outside the US

Positioning outside the US reveals signs of changing investor sentiment and risk-on positioning.

- International-developed ex-US funds took in $5 billion in April, a record 46th consecutive month with inflows and sixth month in a row with flows over $1 billion.

- Emerging markets (EM) ex-China ETFs had $177 million of inflows in April, increasing their year-to-date total to $4.2 billion and continuing investors’ preference for EM, but not China.

- Over the past year, the all-inclusive EM category has had $8.4 billion of inflows, but EM ex-China has had $9 billion of inflows, meaning all other EM funds have had net outflows (Figure 3).

- Single-country ETF longer-term strengths are masked by weakness from China, as China-focused ETFs have had $3.1 billion of outflows over the past year.

- Japan and India are being overweighted. Those two countries took in $300 and $750 million in April, respectively. And cumulative flow trends for those two countries since the start of 2023 are strong — $10 and $7 billion, respectively.

Cyclicals and Growth Favored over Defensives

Sectors posted modest inflows of $413 million, their fourth consecutive month with inflows. This is the longest streak of raising capital since 2021. But the strength has been centered in Tech and cyclicals.

Those two cohorts accounted for $2.5 billion and $1.5 billion in April, respectively. The Energy sector powered cyclicals with $1.1 billion of inflows last month, consistent with other inflation-sensitive natural resource positioning highlighted below with the commodity flows.

Defensive sectors dragged down the headline figure, as that grouping lost $3.3 billion. All three defensive sectors (Consumer Staples, Health Care, and Utilities) had outflows in April (led by Health Care’s $2.1 billion) and now have $6.4 billion of outflows in 2024.

Figure 4: Sector Flows

| In Millions ($) | April | Year to Date | Trailing 3-mth | Trailing 12-mth | Year to Date (% of AUM) |

|---|---|---|---|---|---|

| Technology | 2,514 | 10,989 | 8,588 | 19,325 | 4.68% |

| Financial | 1,216 | -753 | -770 | -3,239 | -1.12% |

| Health Care | -2,170 | -1,934 | -1,943 | -8,444 | -2.06% |

| Consumer Discretionary | -419 | 754 | 1,008 | 4,611 | 2.01% |

| Consumer Staples | -1,093 | -2,029 | -1,709 | -7,202 | -7.74% |

| Energy | 1,158 | 592 | 429 | -144 | 0.76% |

| Materials | -649 | -43 | -50 | -3,585 | -0.12% |

| Industrials | 982 | 2,144 | 2,153 | 3,140 | 5.19% |

| Real Estate | -787 | 1,270 | 803 | 4,107 | 1.70% |

| Utilities | -135 | -2,464 | -1,511 | -4,096 | -11.24% |

| Communications | -205 | -317 | 227 | 2,511 | -1.47% |

Source: Bloomberg Finance, L.P., State Street Global Advisors, as of April 30, 2024. Top two/bottom two categories per period are highlighted. Past performance is not a reliable indicator of future performance.

The cyclical over defensive trade has been in place since the original Fed pivot back in October, with cyclicals outpacing defensive ETF funds flows by $18.7 billion since then. And like cyclicals, there has been a preference for growth. Growth ETFs’ $3.8 billion added in April marks a record 15th month in a row with inflows and raises the year-to-date total to $30 billion, nearly twice the total of Value-oriented funds.

This continued preference for Growth and cyclicals and the lack of risk-off positioning with defensive sectors, Low Volatility factor ETFs, or gold exposures since the start of 2023 illustrate investors’ desire to pick their spots to be risk-on (Figure 5). But gold did see inflows in April (+$33 million) as the CBOE VIX Index rose — a historically strong driver of inflows to gold ETFs.3

Looking ahead, even with this potential prolonged pivot back to a hawkish-tinged tune, the cyclical trade still likely has legs given the catalyst for the change is stubborn inflation alongside positive economic and fundamental growth.

Positioning for the Market’s New Rates Rhythm

In time, investors will get used to the market’s new beat.

For bonds, this means looking at sectors with the potential to generate income but with low rate volatility, as evolving monetary policy is likely to keep rate risks elevated. And for stocks, focusing on quality exposures with durable growth, low-debt levels, and supportive margins can help mitigate any potential drag “higher for longer” has on bottom-line growth.

Of course, anticipating how the market’s music will change in a week, a month, or a year is a complex task that few have the acute ear for. With that in mind, if the music were to stop, and we don’t hear a thing, owning exposures with low correlations to traditional assets that can march to their own drumbeat may help keep portfolios in tune.

For more insight, download our Chart Pack or bookmark our market trends page.