Can Japanese Equities Recover to New Highs?

This summer, as the 2024 Paris Olympic Games grabbed much of the world’s attention, many investor minds were diverted and fixated on the gyrations of the Japanese equity market. In early August, Japanese stocks experienced the largest single-day drop since 1987— a rout that was soon followed by a sharp rebound. These volatile swings prompted our team to reassess the prospects for Japanese equities.

Earlier this year, in a paper which outlined our bullish case for Japan, we presented our favorable outlook on Japanese equities. In this update, our key finding is that while Japanese equities retain their improving fundamentals, global macroeconomic risks cloud the outlook, and a cautious approach is thus warranted moving forward. We examine the Japanese equity market in light of recent volatility and corporate earnings. We also explore the broader macroeconomic landscape in Japan and foreign exchange dynamics, namely the potential for yen appreciation which would pressure Japanese equity performance.

Sharp Correction

The Nikkei 225, which started the year at around 33,000, moved steadily higher over the first half of 2024 buoyed by good corporate earnings, ongoing reforms, and optimism that wage increases agreed in the shunto negotiations would bolster the economy. Having passed its 1989 peak in late February, the index ultimately reached an all-time high of 42,224 on July 12. By the end of July, the index had declined to 39,101 against the backdrop of an appreciating yen. After the Bank of Japan (BoJ) surprised markets with a hawkish hike, the index fell 5.8% on August 2, before plunging 12.4% on August 5 – the biggest single-day retreat since ‘Black Monday’ in October 1987. A 10.2% rebound on the following day illustrates just how volatile the market action has become. Indeed, the volatility index of the Nikkei Stock Average jumped from the low 20s at the end of July to the 70s on August 5. The index has been recovering ever since, but is yet to fully recoup the sell-off (Figure 1).

Fluctuating Flows

In 2023, when the Nikkei 225 rose by 28%, overseas investors ploughed 6.3 trillion yen into the market, in cash and futures combined. By July 12, 2024, when the index hit its record high, foreign investors had invested another 2.5 trillion yen since the beginning of this year. Over the course of the four weeks from July 16 to August 9, foreign investors offloaded 4.2 trillion yen of equity investments (Figure 2). This turbulence of investor flows illustrates the value in studying the trading trends of foreign investors for insights into the potential direction of share prices.

Figure 2: Nikkei 225 and Foreign Investor Trading Trends

Corporate Reforms and Earnings

Corporate reforms have been continuing to gain pace in Japan. According to the Tokyo Stock Exchange (TSE)1, 86% TSE Prime and 44% of TSE Standard companies have now responded to the TSE’s request for information on how they intend to improve corporate governance. Notably, these figures are up from December 2023 data of 49% and 19%, respectively; the TSE plans to further catalyze improvements in governance, and such initiatives remain vital to the bullish case for Japanese equities.

Another key factor is earnings. Over the past 10 years, the total sales and net profits of companies in the Nikkei have risen steadily, excluding periods of economic stagnation caused by the coronavirus pandemic; net sales of 653 trillion yen and net income of 41.2 trillion yen were achieved in the fiscal year 2023. According to the consensus forecasts of analysts, sales are expected to be almost flat at 651 trillion yen with net income rising 11% to 45.8 trillion yen in fiscal 2024 (Figure 3). An important contributor to the strong corporate earnings in recent years was the depreciation of the yen alongside a significant pickup in demand for Japanese products and services both domestically and overseas.

Recent Q1 financial results (as of August 9) revealed that companies in the Nikkei 225 are on track to achieve their FY guidance, with 22% of sales and 27% of net income achieved. Compared to the same period last year, total sales and net income increased by 8% and 56%, respectively. The positive first quarter results were largely driven by banks benefiting from rising market interest rates in Japan and overseas, while inbound tourism was also a strong contributor. Across manufacturing, the recovery in the semiconductor market bolstered earnings in the chemical industry. An overarching aspect of the earnings discussion in relation to exporters is the yen, with the currency’s depreciation generating a tailwind to profits.

Earnings Outlook and the Yen

Given the influence of the yen on companies’ profitability, particularly for exporters, the yen has become the cornerstone for sound corporate earnings. Out of the 179 companies that had reported results by August 9, 2024, 107 of them (approximately 60%) have set the expected exchange rate between 145 yen and 149 yen, thereby hovering close to the current level. If the yen continues to rally, companies are highly likely to revise their earnings forecasts downward. Hence, the yen is also the Achilles heel of Japanese equities.

Macroeconomics and the Bank of Japan

A hawkish BoJ had preceded the sharp moves in Japanese equities. The bank hiked its policy rate by a relatively meager 15 basis points (bps) in July and commenced on a well telegraphed tapering of its purchases of Japanese Government Bonds (JGB). However, the Bank was slightly more hawkish than the market’s liking, as reflected by the negative response to the release of weaker-than-expected labor market data in the US, which stoked fears of a US recession. Those concerns have abated on subsequent incoming data, yet it is clear that further normalization in Japan depends on the US Federal Reserve (Fed). Markets expect the Fed’s first rate cut to arrive in September and are pricing nearly three full cuts of 25bps by December.

Against this background, we do not expect the BoJ to hike again before December, which should alleviate some risks to equities. However, another critical macroeconomic factor is emerging as crucial for the outlook: consumption.

We are yet to observe a sustained strength in consumption, which is a vital condition for the achievement of a balanced price-wage cycle. This is not to downplay the fact that Q1 GDP growth of 3.1% (quarter-over-quarter, seasonally adjusted annual rate) was firmly driven by a 4.1% rise in private consumption. The key reason is the cost-push nature of Japanese inflation. According to the BoJ’s survey, 58.5% of Japanese households are spending more than last year, while 86.6% of them said that it is because of higher prices (Figure 5). While it is not necessarily a negative sign, the BoJ may want to confirm the channel is active before making their next move. We expect that the BoJ may have achieved the requisite confidence by December, as inflation may see a renewed push due to higher pass-through from firms to consumers amid higher materials and labor costs.

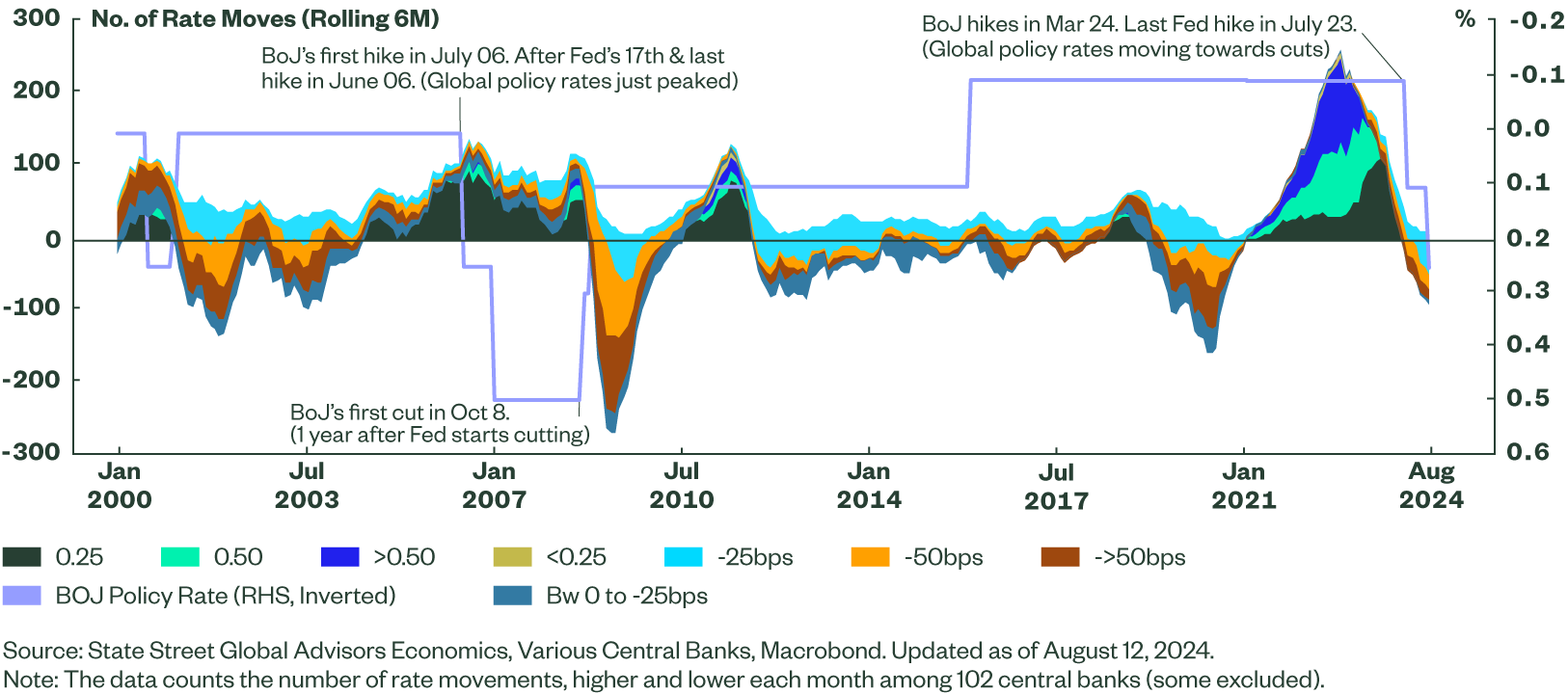

Finally, we expect the BoJ to be prudent in its policy and not raise rates in haste, as recently guided by Deputy Governor Shinichi Uchida. The Bank’s first hike this cycle came in March, eight months after the Fed’s last rate hike. This is a notable contrast from the one-month lag in 2006, when the BoJ started to cut rates with the onset of the Global Financial Crisis (GFC). While we expect a soft landing to prevail in this cycle, the BoJ is at odds with a world that is largely transitioning into rate cut mode (Figure 6). Given the consensus for a first Fed rate reduction in September, and the prediction for two to three cuts by December, the BoJ may not be compelled to rapidly raise rates. Moreover, the Bank also has ample room to reach our forecast of a 1.0% terminal rate by 2025. This gradual approach by the BoJ critically clears a crucial hurdle for Japanese equities.

Figure 6: Bank of Japan vs. Global Central Banks’ Moves by Magnitude

Foreign Exchange Focus: Unwinding of Carry Trade

As we have seen, the trajectory of the yen’s exchange rate has implications for companies, investors, the economy, and the central bank. We believe that falling global yields will drive the yen broadly higher over the next 12-18 months, bringing USD/JPY down from its current level of around 147 to a 130-135 range. The exchange rate could enter the 120s if a global hard landing materialized. This scenario may be quite concerning to investors. We witnessed a sharp unwind of the yen carry trade between July 11 and August 5, pushing the yen more than 12% higher versus the US dollar — this coincided with a fall in the Nikkei 225 of over 26% from peak to trough. We believe another 10-15% gain by the yen against the US dollar by the end of 2025 is reasonable. Could that drag Japanese equities down another 25%? And if that did happen, would such a move be orderly or more prone to sudden shifts?

First, let’s take a quick look at the unwinding of the yen carry trade that has grabbed so many headlines. The important feature highlighted in Figure 7 is that this recent sharp yen appreciation moved USD/JPY back closer to its usual alignment with interest rate differentials. The shift was not extreme, the actual excessive move was the yen weakness from late April to mid-July.

We believe that the unwind of short-term speculative carry positions is largely done. However, the yen is still slightly weak compared to current interest rate differentials and USD/JPY is likely to track down toward 140 by the end of 2024. The structural carry positions, very large Japanese holdings of global equity and debt positions with historically low currency hedge ratios, have yet to unwind. If we are correct that US and global yields will track lower over the next 12-18 months, then the resulting fall in hedging costs, as well as increased losses and volatility on unhedged currency exposures, will encourage Japanese investors to increase hedge ratios and/or limit additional exposures to unhedged foreign assets. In line with this view, we see good potential for a sustained bull market in the yen that brings USD/JPY down toward 130 by the end of 2025. If a hard landing forces central banks to ease rather than just normalize monetary policy, we see risks of USD/JPY falling into the mid-to-low 120s.

It is worth noting that this bullish yen view is not dependent on the Bank of Japan. Even if the BoJ is able to raise rates by another 50 or even 75 bps, this is modest relative to the potential for the Fed to cut by 200-225 bps. If the BoJ finds itself unable to raise rates further, that likely means global central banks will also be cutting rates aggressively and our bullish yen call on falling yield differentials still holds. The risk to the thesis is a resurgence of global inflation that drives yields higher once again.

The Yen Effect on Japanese Equities

How much Japanese equity underperformance can we expect if the yen appreciates by 10%, taking USD/JPY back to 130? Obviously, it is extremely difficult to predict such an outcome. To gain a general sense, we can look at the 10-year period (2009-2019) before the pandemic and subsequent inflation shocks. During that time, the Nikkei 225 tended to underperform the MSCI ACWI ex-Japan Index by 0.4% for every 1% appreciation in the yen, a relative equity beta of -0.40 to the yen. That implies that the Nikkei 225 index could underperform global equities by about 4% through the end of 2025 if the yen appreciates as we expect. This is in contrast to the period since 2019 during which the relative performance of the Nikkei 225 to the ACWI has had a -0.8 beta to the yen — a 1% yen appreciation is associated with a 0.8% underperformance of the Nikkei 225 relative to global equities.

But the 2009-2019 decade could be considered somewhat unique given the ultra-low inflation and real yields of the time as the world rebuilt damaged balance sheets following the GFC in 2008. Now it appears that inflation and real interest rates may be somewhat higher given a number of structural and behavioral factors such as re-shoring/near-shoring, high global debt levels, labor shortages, potential tariffs, and the simple behavioral changes to wage- and price-setting dynamics.

With these structural changes in mind going forward it seems more reasonable to expect Japanese equities to underperform by 0.5-0.6% for every 1% appreciation of the yen. Therefore, our expected 10% appreciation in the yen should result in a 5-6% underperformance of the Nikkei 225 relative to global equities. For unhedged non-Japanese investors this move would likely be substantially offset by the appreciation of the yen. For local investors fully exposed to the 5-6% underperformance related to a stronger yen, it would be more painful. This potential situation would warrant greater caution, but is not necessarily worthy of an underweight due to the structural improvements in Japanese corporate profitability mentioned earlier.

Political Uncertainty

Japan is set to welcome a new Prime Minister in September as the ruling Liberal Democratic Party (LDP) elects its new leader. The current Prime Minister Fumio Kishida will not contest the elections, raising some uncertainty about policy. There is a strong chance Japan faces a very competitive LDP presidential vote on September 27, extending to a second round of voting between the leading two candidates that same day. Political uncertainty is another factor that could prevent a near-term hike by the BoJ as the Bank may seek more clarity on fiscal policy before acting.

The Bottom Line

Japanese equities are recovering well after correcting sharply in early August 2024. The underlying prospects continue to be positive for Japan’s economy and present strong tailwinds for domestically-focused Japanese companies in particular, while easing global interest rates could bolster demand for Japanese products in other countries. However, as we noted, the narrowing of the interest rate differential between Japan and other developed economies will likely have continued implications for the yen. As we anticipate further strengthening of the yen – which has historically weighed on Japanese equity performance – corporate earnings and other cyclical or structural drivers of equity valuation will be even more important in delivering gains that overcome the downside drag from yen appreciation.