Gold ETFs to capture the performance and resilience of gold in a single trade

Hear more from our gold experts

Gold ETFs for gold exposure

Monthly Gold Monitor

What’s happening with gold this month? In the Monthly Gold Monitor we track changes in the gold market by looking at price trends, gold ETF flows, and fundamental drivers for the precious metal.

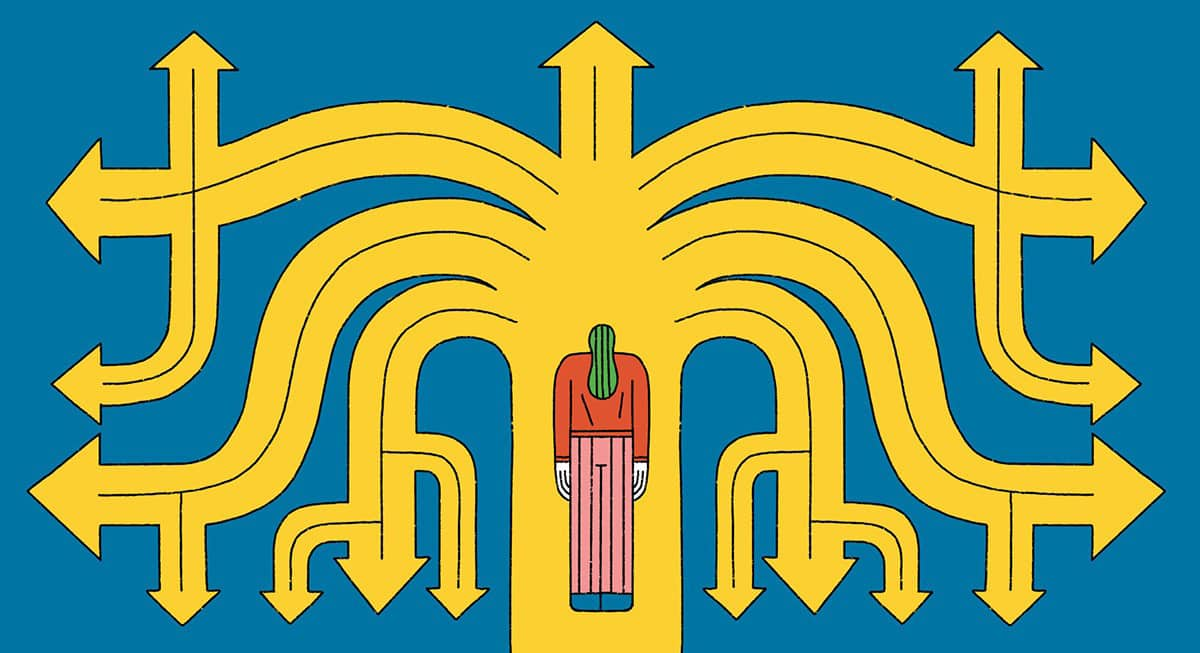

What can gold do for you?

Gold’s investment characteristics, rooted in multiple sources of demand across global economic and business cycles, may help gold serve multiple roles in an investor’s portfolio — during good times and bad.

Gold is not just another commodity

Gold is often classified as a commodity alongside other precious metals or broader commodities, like oil and real estate. But with gold’s unique fundamentals and characteristics, it may warrant its own classification in an investor’s portfolio.

Choose gold in an ETF

Gold-backed exchange traded funds (ETFs) offer a high degree of flexibility, transparency, and accessibility to the gold market — with the cost-effective liquidity benefits of an ETF wrapper.

About State Street Investment Management

Inspired by the world’s investors, we draw from our market-tested expertise and global scale to create original investment solutions and help deliver better outcomes.

Assets under management 3

When we helped launch the ETF Industry – and democratized investing forever

Creating trusted investment solutions

World’s most traded ETF 4