UK Budget Implications for Pension Schemes

- Government set to deliver first budget since winning the election in July

- ‘Tough choices’ to be made in order to meet the fiscal rules while achieving sustainable growth

- Changes to fiscal rules and future borrowing needs may impact gilt yields

- Pension schemes’ legislation may be revised to boost tax revenues and to encourage investment

The Labour government will shortly present the October budget. As the first fiscal event since the government’s election in July, it is the moment when Labour’s election plans will meet reality, and that reality has been challenging. For pensions funds, there are two important considerations:

- How much borrowing capacity can Labour create with the new fiscal rules?

- What may be the changes to the current tax structure and how are they going to fill the current black hole in the budget?

Below, we discuss both.

Changes to Fiscal Rules

Upon assuming power, Labour promised two rules. Described in its manifesto as ‘non-negotiable’, these rules are:

- The current budget must move into balance, so that day-to-day costs are met by revenues

- Debt must be falling as a share of the economy by the fifth year of the forecast.

Labour’s objective is to create room for public borrowing, to support public investment, without spooking the market or breaking its election promise of not increasing income tax, national insurance or value-added tax.

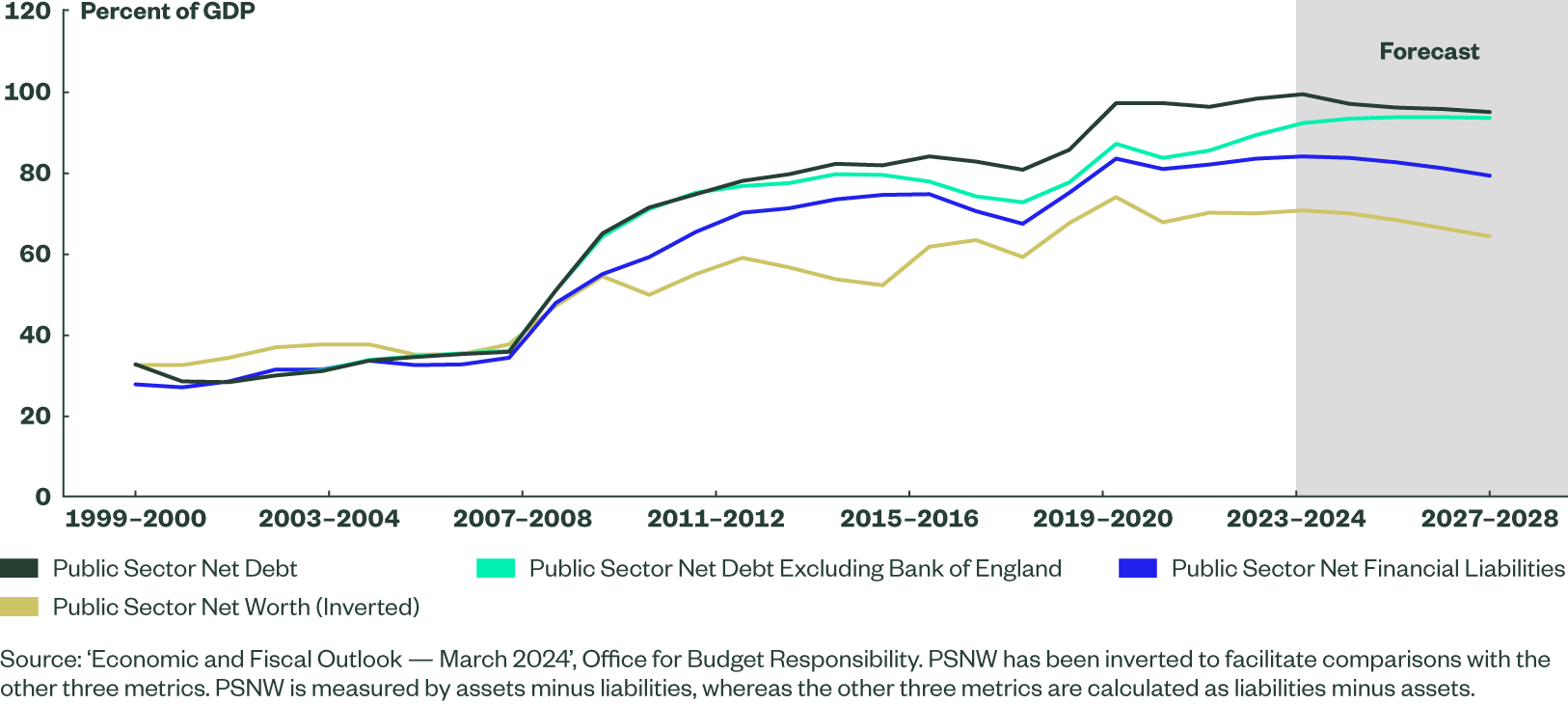

One key question for the upcoming budget — related particularly to the second rule — is how Labour will define debt1 and whether this will allow them flexibility for extra borrowing. The existing rules use public sector net debt, excluding that of Bank of England (BoE), sometimes referred to as ‘underlying public sector net debt’. There are several alternatives being discussed:

- One is to instead use public sector net debt (including BoE debt, — in Figure 1) as the measure, which is decreasing over the forecast period. This is because it has a different accounting treatment to the BoE’s losses related to the maturity and reversal of quantitative easing bond purchases on government finances (as well as including the term for lending scheme loans, which will be repaid in the forecast period). This alone could free up approximately £16 bn of extra headroom, allowing the government to cancel all the planned cuts to public net investment spending.

- Another is to take a broader definition of debt as the target, such as public sector net financial liabilities or, bolder still, to use public net worth, both of which fall through the forecast horizon (see Figure 1).

- Define a new measure of government debt.

The question here is which one the market is likely to find most acceptable and how much room it creates.

In our view, use of public sector net financial liabilities is the most likely, as it does not drift too far from the current definition, is slightly lower currently, as well as it has a more favourable forecast for the coming years.

Figure 1: Four measures of the public sector balance sheet

Chancellor Rachel Reeves also suggested in her Labour Party conference speech that the fiscal rules should ‘recognise the benefits’ of investment spending as well as ‘counting the costs’. This suggests a potential change in approach to allow more investment-related spending. One option may be to simply exclude investment spending from the target measures, or to more explicitly acknowledge the value of physical assets and future revenue streams.

Increases in government investment will affect the gilt market in two ways:

- If the investment is debt financed, it is likely to lead to an increase in the supply of gilts, which will put upward pressure on gilt yields.

- Higher levels of investment may boost the UK’s growth rate, both in the near term, through the direct increase in economic activity, and in the long term, if the investment leads to a deepening in the capital stock or an increase in productivity. This may lessen the need for monetary policy easing in the near term, and if potential growth rates increase, neutral interest rates may also be higher.

Changes in the Gilt Remit

The Office of Budget Responsibility (OBR) will need to consider any changes in fiscal policy when updating its forecasts for the economy and projected gilt issuance.

Changes in its forecast for borrowing in the current fiscal year will have the biggest impact. An unexpected increase in borrowing will need to be financed through an increase in either bills or gilt issuance. The maturity of the instruments issued will be closely watched. An increase in bill issuance may not have a material impact on the gilt market; conversely an unexpectedly large increase in long-dated gilt issuance is likely to lead to gilt yields rising both outright and relative to interest rate swaps.

While forecasts for future years may have an impact, the market is likely to view this as a signal of the government’s commitment to sound fiscal policy. Any concerns about a loss of credibility may also lead to gilt yields rising.

What All This Means for Pension Funds

With the Labour Party reiterating its commitment to maintain the current level of income tax, national insurance and VAT, focus has shifted to other potential areas to raise tax revenues. The tax treatment of pension schemes has been highlighted as a source of income, and wealth inequality and such issues may be considered:

- Changes to tax relief on pension fund contributions: Currently, tax relief is calculated on the basis of the individual’s marginal tax rate. A move to a lower, flat rate tax system will reduce the amount of tax relief given to higher-rate taxpayers who contribute to their pension schemes.

- Changes to amount of tax-free withdrawal: Currently, 25% of a pension can be taken tax-free. The government might consider introducing a cash limit on the size of the withdrawal, which would only impact those with the biggest pension pots. Reports have emerged of UK wealth managers warning Chancellor Reeves about people already taking money out of their pensions early on this rumoured change.

- Changes to Inheritance tax treatment of pension pot: Currently, pension pots do not count as part of a person’s estate for inheritance tax. Removing this exemption will raise a comparatively small amount of money, although it may rise over time given the introduction of ‘pension freedoms’ in 2015, which will likely see more people dying with pension wealth.

- Reform National Insurance Contributions (NICs) treatment of employer pension contributions: Employer contributions to pensions are not subject to employer or employee NICs. While this could be viewed as going counter to Labour’s manifesto, one possible option is to levy employer NICs on employer pension contributions as well.

More broadly, any changes to the tax and spending plans will have a direct impact on economic activity. The OBR will provide an updated forecast for the economy based on changes to fiscal policy. Any tightening in fiscal policy may need easier monetary policy to support the economy, which could impact schemes’ liability hedging portfolios.

Finally, following the conclusion of the ‘call for evidence’ for the first phase of the Pensions Investment Review, we may hear further from the chancellor on measures aimed at boosting investment in UK equities, improving outcomes for savers and reinvigorating UK capital markets. In particular, we await further news on any potential change to the Pension Protection Fund to allow it to act as a public sector consolidation.

In conclusion, the budget will serve as the first major update from the new government on the state of public finances, and is likely to contain a raft of measures that will both directly impact the gilt market and the pensions landscape.