Expectation Improves for Equities

Each month, the SSGA Investment Solutions Group (ISG) meets to debate and ultimately determine a Tactical Asset Allocation (TAA) to guide near-term investment decisions for client portfolios. Here we report on the team’s most recent discussion.

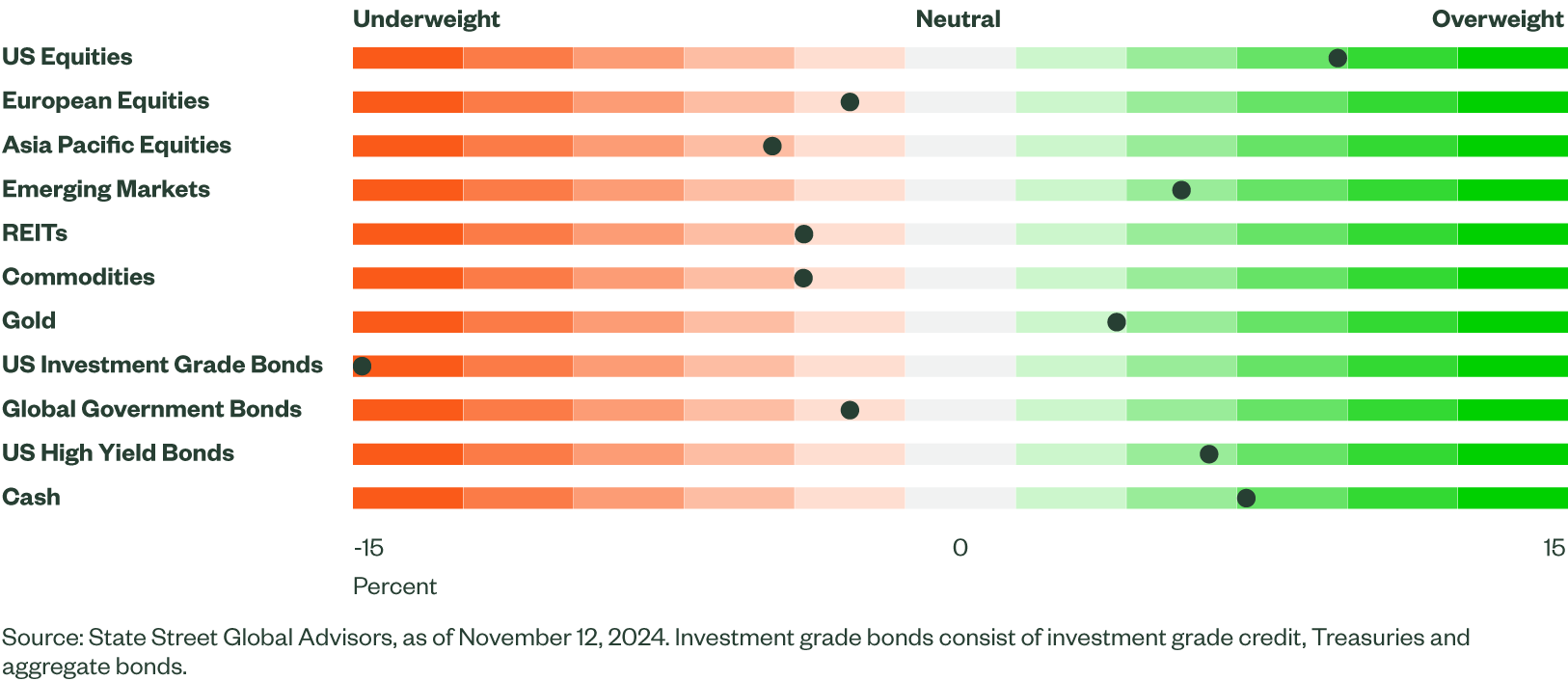

Figure 1: Asset Class Views Summary

Macro Backdrop

The US election is over, but uncertainty persists. While the results will affect our long-held view – below-trend economic growth, lower central bank rates, and lower inflation – the impact is unclear. Even as the US economy remains solid, growth elsewhere is weaker, but prospects could improve as central banks continue to reduce rates.

The timing and scope of policy shifts remain uncertain, but they could create more regional divergence. A US-first agenda may boost US growth relative to other regions but potentially lead to higher inflation, influencing Fed policy. Executive orders on de-regulation and border control could come in early, while tariffs are likely be implemented later in 2025. Even as trade policy may hinder growth, the extension of corporate and individual tax cuts; potential increase in bonus depreciation; restoring R&P expensing as well as lesser regulations should support business investment and consumer spending.

Expectations for Fed rate cuts have been scaled back but the path still leans toward monetary easing in the US and elsewhere as central banks are likely to remain supportive. The Fed may not react immediately to election results but should want to focus on incoming data. However, sticky inflation and the potential for stronger-than-expected growth could force them to reconsider their trajectory. Fed chair Jerome Powell left the door open for a December pause but also confirmed that rates remain restrictive.

Internally, we still anticipate a rate cut in December but have removed one 25 bp worth of cut from our forecast due to better economic data, especially for gross domestic income. We now anticipate 75–100 bp worth of cuts in 2025, though the path is less certain following the Republican sweep.

Geopolitical risks persist, and uncertainty surrounds upcoming policy changes and their impact. However, labor markets remain firm, wage growth is elevated, and central banks are expected to continue to cut rates.

Directional Trades and Risk Positioning

Despite elevated geopolitical tensions, risk appetite has gradually improved in recent months, as indicated by our Market Regime Indicator (MRI). Solid US economic growth, a strong labor market, central bank rate cuts, and stimulus measures in China eased investor angst.

In our quantitative framework, signals are mixed. The biggest improvement came from sentiment spreads (risk-on and risk-off market segments), which shifted from very risk-off to neutral. Implied volatility signals remained neutral but equity trends indicated better risk appetite. Our measure for risk support and credit market sentiment still points to high risk aversion. Overall, the MRI now signals a more neutral risk environment.

From an asset class perspective, our equity forecast improved, while fixed income expectations deteriorated. The improved equity forecast was driven by better sentiment indicators, which turned neutral. Additionally, price momentum remained firm with slight improvement, and quality factors continued to offer support.

In bond markets, our model maintained a preference for high-yield bonds and cash, anticipating meaningfully higher interest rates with relatively minimal change in credit spreads. Yields rose sharply in October, and our model expects this momentum to continue. While the Q3 US gross domestic product was softer than in the previous quarter, the nominal growth rate remained above the yield of longer-dated Treasury bonds, implying further yield increases. High yield bonds were supported by positive seasonality and government bond yields, which, despite rising, remained below our look-back window.

Given the improved equity forecasts and better risk appetite, we modestly increased our equity allocation, expanding our overweight position. To fund this, we reduced exposure to the tail risk assets – gold, long government bonds, and cash. Additionally, we sold aggregate bonds, further deepening our underweight stance.

Relative Value Trades and Positioning

We made no change to our regional rankings or positioning within equities. Expectations for the US improved due to strong price momentum and sentiment. In emerging markets, while sentiment is weaker and valuations remain negative, solid price momentum, positive macroeconomic indicators, and strong quality factors offer support. Our outlook for non-US developed equities remains poor, with negative forecasts for both Europe and Pacific equities. Europe benefits from favorable valuations, but weak sentiment and price momentum is less attractive on a relative basis. In the Pacific, sentiment indicators remains decent, but softer price momentum and weak quality and macroeconomic indicators weigh on the outlook. We maintain our overweights in US and emerging market equities, with corresponding underweights to non-US developed equities.

On the fixed income side, we made no changes and continue to favor high-yield bonds and cash. The expectation of higher interest rates poses a headwind for all bond sectors. However, the monthly income generated in high yield continues to support the asset class from a total return perspective. Cash remains attractive in an environment where most other fixed income assets show modest negative expected returns.

At the sector level, we maintained a full allocation to communication services and a split allocation to energy. We increased our exposure to financials to a full allocation, rotating out of consumer staples and into technology.

Communication services remains a favored sector, performing well across all factors except macro. Our sanguine outlook for energy is driven by attractive valuations and favorable macroeconomic indicators, despite sentiment remaining negative. Financials are supported by improvement across multiple factors, with softened valuations but strong price momentum and sentiment. Our expectations for consumer staples deteriorated due to worse price momentum and sentiment. While technology valuations remain unattractive, robust price momentum, healthy balance sheets, and favorable sentiment support the sector.