Did inflation fall, or was it pushed… and does it matter?

Having hit 11.1% in the last quarter of 2022, UK headline inflation has settled closer to what we have come to consider as “normal”, but not without reminding defined benefit pension funds that it remains a real and present threat to their ability to pay member benefits.

Despite the central bank and government’s best intentions, inflation remains unpredictable. Faced with multiple shocks and only blunt instruments available to tackle them, anyone’s ability to control inflation is muted. Yet, fail to get it under control and the impact on many would be devastating.

So, to be ready for when this happens again, does the evidence show whether inflation fell of its own volition or was it pushed, as central banks embarked on their most aggressive rate hiking cycle since inflation targeting began?

The back story

With the benefit of hindsight, fears about a 70s style wage-price spiral may have been overblown as many of the factors that led to the inflation spike in 2022 have proved to be transitory.

Economies globally have continued to adjust to the new reality of less reliable global supply chains in goods and commodities, following recent geopolitical shocks, which has helped dissipate some of the initial inflationary shock.

Labour markets have also been brought into better balance. There have been tentative signs of softening in the labour market, with the number of vacancies declining, alongside lower wage settlements.

Tighter monetary policy may also have played its part by dampening final demand. Yet, for a central bank to truly claim victory, it needs to convince the public that it can predict and control inflation with enough confidence that it will be in line with its target over the long run.

Looking at the historical record, the chart below shows the cumulative increase in the price level since the Bank of England (BoE) became independent in 1998 and formally adopted an inflation target. The recent inflationary bout has meant the average inflation during this period has been 2.4% -- above the 2% target. This compares poorly to both the US Federal Reserve and the European Central Bank, who have come much closer to hitting their targets over the long term.

Given this history, the BoE remains on high alert as to whether the public retains trust in its ability to keep inflation consistently on target.

Public trust in the BoE is crucial to stop inflation from settling at higher levels, as history shows that expectations of future inflation are a strong determinant of actual future inflation. For instance, if firms and the public believe inflation will be high, they tend to set prices accordingly, thus cementing price rises. By contrast, if the public believes in the BoE’s ability to hold inflation steady at 2%, prices and wages are more likely to be set in line with this target, helping to stabilise inflation at desired levels.

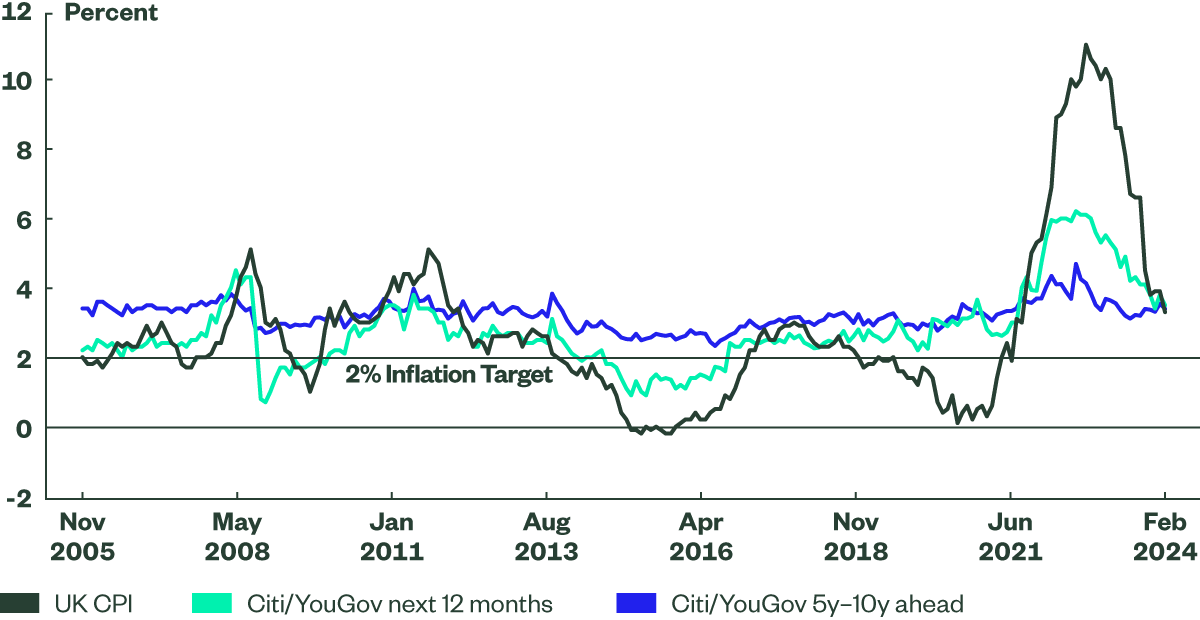

The Citi/Yougov survey of the British public on inflation expectations in the UK, is likely to give the Bank of England some relief, as we can see that longer term inflation expectations have remained relatively stable, albeit at levels that are significantly above the 2% inflation target.

Figure 2: CPI Inflation

Source: Citi Research, Yougov, ONS, as of March 26, 2024.

However when looking at global inflation-linked markets, we see an increase in inflation expectations over the past 10 years, with the most pronounced moves in the UK and Europe. The chart below shows the average expected inflation rate over a two-year period, starting in three years’ time. With the UK market based on RPI, we can see that at levels close to 4%, market valuations are more consistent with CPI inflation being closer to 3% than the 2% target (based on an assumed “wedge” of 1% between RPI and CPI). This shows that financial markets have a higher degree of sceptism over the central bank’s ability to control inflation than they have in the past.

The BoE’s own confidence in its ability to predict inflation has fallen significantly in recent years. The February 2004 inflation fan chart from its Quarterly Inflation Report forecasted a 90% chance that inflation would fall between 1% and 3% within two years, based on constant interest rates. The equivalent chart for February 2024 showed a 90% confidence interval that inflation will fall between -2% and 4% at the end of their forecast horizon- a band which is approximately 3 times wider.

Conclusion

Was inflation pushed or did it fall? The recent declines in inflation seem largely a result of external factors over which the central bank has little control. However, central bankers will argue that their actions are what stopped inflation from sustaining itself at high levels. As is often the case with economics, the lack of a counterfactual makes it impossible to know the extent to which central banks can really influence inflation, although the BoE’s forecasts indicate that it has less faith in its ability to predict and control inflation than it did in the past.

Does it matter? Yes and no:

Whilst the British public seems more forgiving of the recent inflationary episode, financial markets appear to show a greater degree of scepticism over central banks’ ability to control inflation than they did in the past.

So despite inflation heading back towards target, pension schemes need to remain alert to risks they face. By updating their liability cashflows more regularly and monitoring their inflation exposures closely, they can be better prepared for the higher levels of inflation volatility that we’re likely to face.