It’s Starting! UK Rate Cuts and Their Implications for DB Pensions

With the European Central Bank (ECB) cutting interest rates by 25 basis points on 6th June, 2024, the financial community is abuzz with speculation regarding when the Bank of England (BoE) will follow suit.

This potential change would reverse the rate-hiking cycle that has marked the post-lockdown years, with significant implications for investors, not least for defined benefit (DB) pension schemes, which invest heavily in government bonds – the performance of which is linked to the interest rate environment. DB schemes should therefore consider their hedging strategies and leverage levels, both to take advantage of the current rate environment and to cushion their portfolios from this impending change.

BoE’s decision-making focus

The BoE’s Monetary Policy Committee (MPC) considers many factors when making interest rate decisions, but the current focus will be on three interrelated indicators: services inflation, labour market tightness and wage growth.

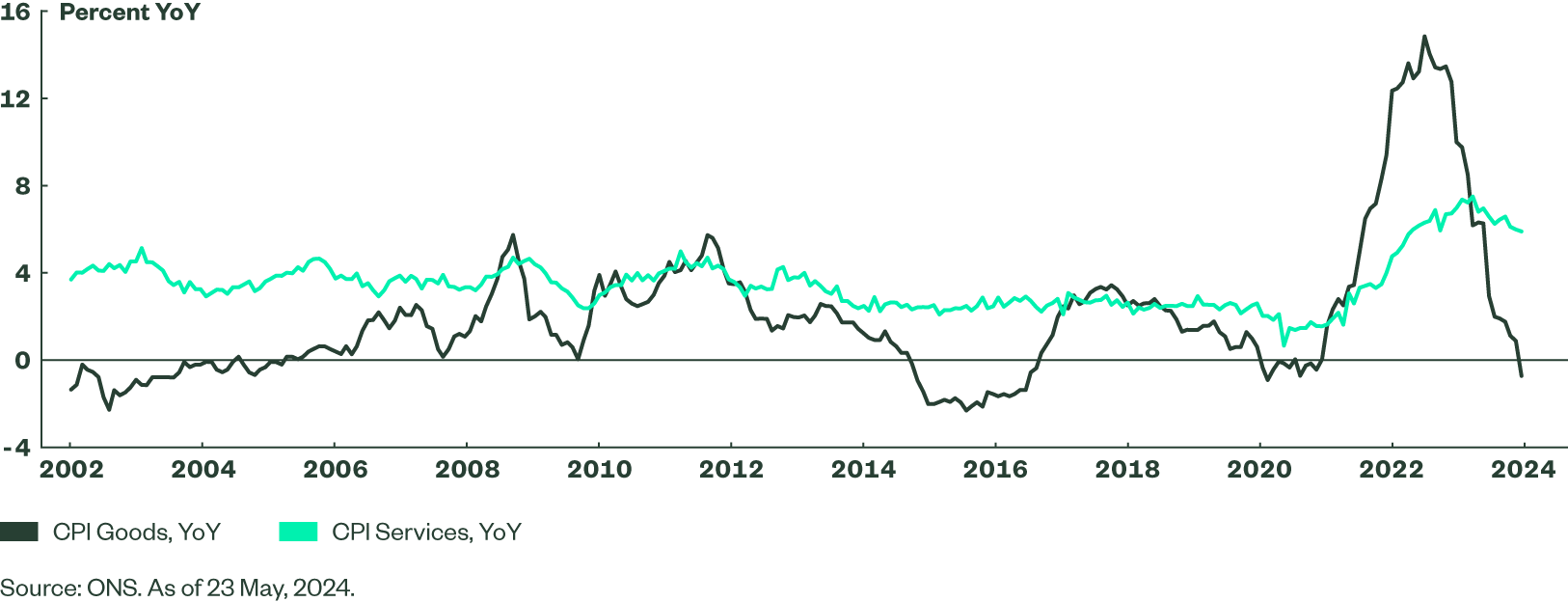

Though the BoE’s target is headline CPI, services inflation is a seen as a key barometer of domestic price pressures. This form of inflation has proved sticky, only gradually ticking down over the course of the past year with the latest reading at 5.9% YoY for April 2024 –significantly higher than goods inflation, which was in deflation territory in the latest reading.

Figure 1: CPI Inflation

However, labour costs are a large component of services costs, and both labour market conditions and wage growth paint a more promising picture.

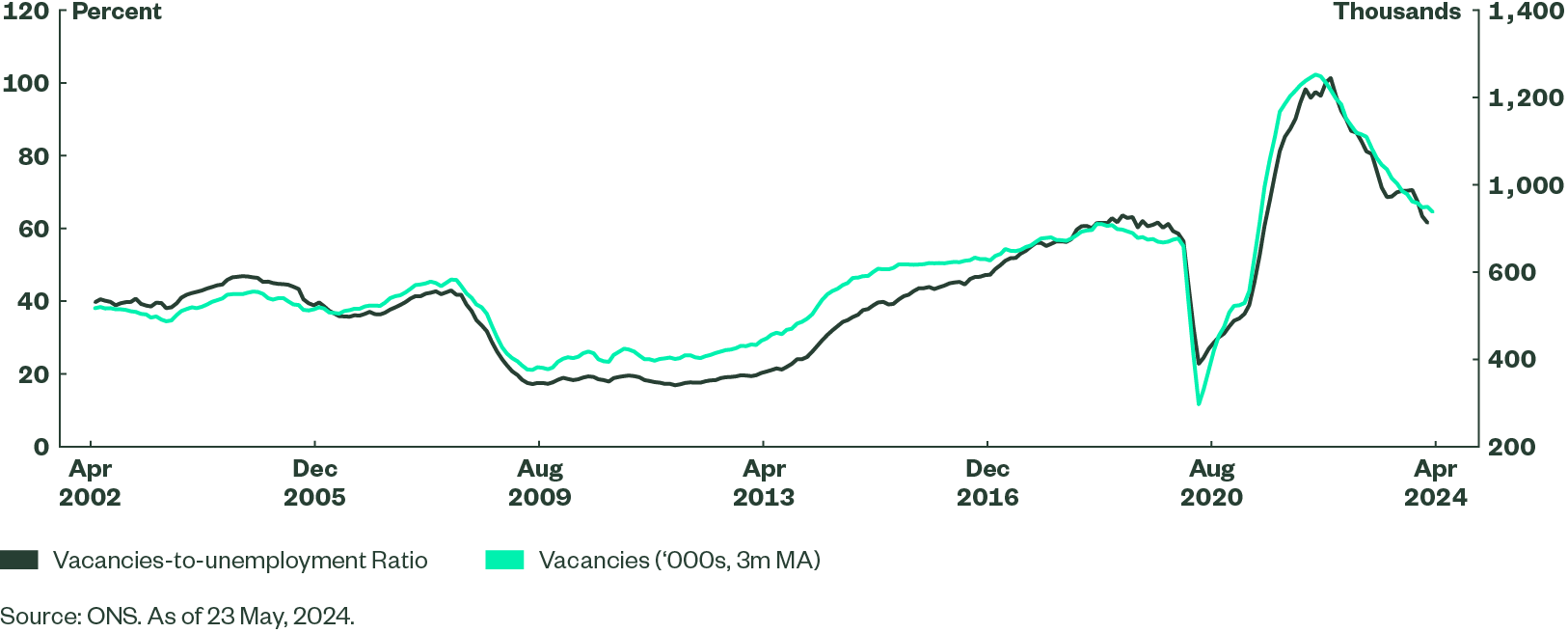

A tight labour market in economics is a situation of relative scarcity of labour supply to demand. A key metric watched by the BoE, the vacancies to unemployment ratio, shows that the UK labour market has loosened significantly since its extreme post-lockdown squeeze, see chart. However currently this is only at levels that would be considered tight before the pandemic.

Figure 2: UK Labour Market: Vacancies to Unemployment

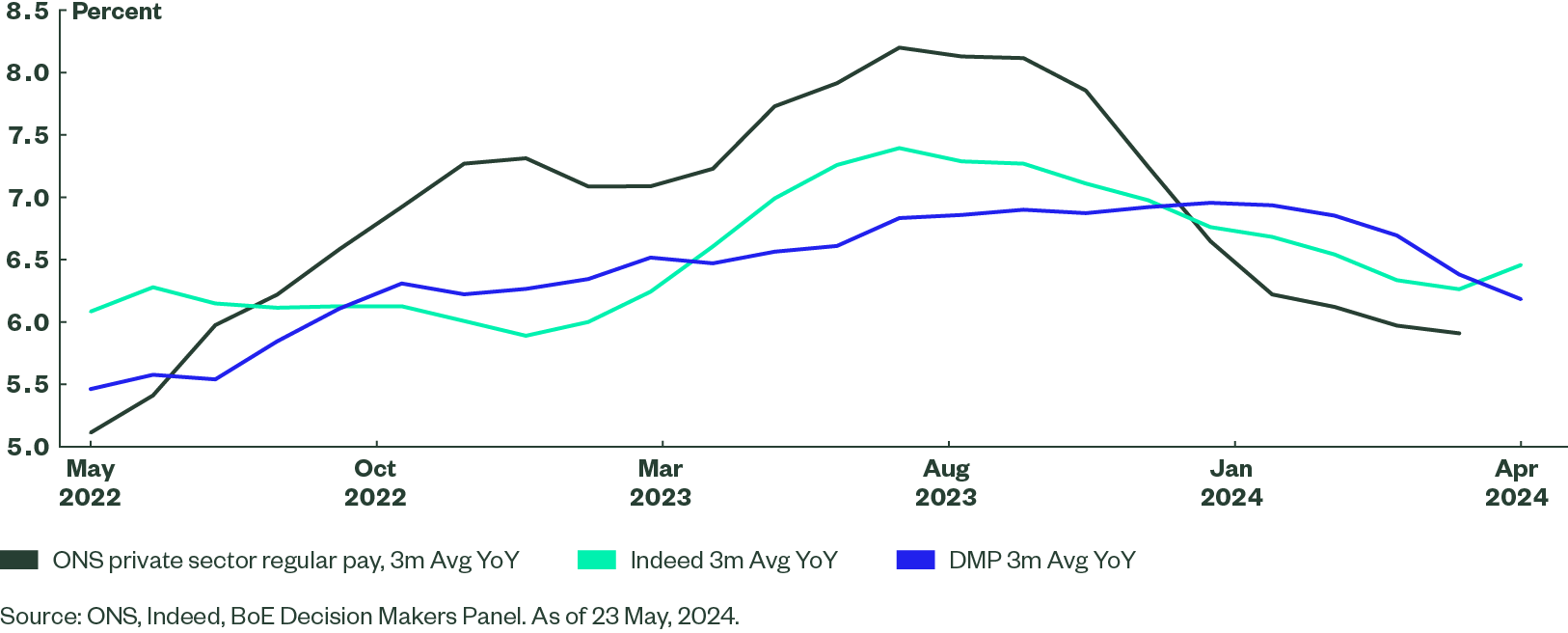

A loosening labour market has helped to slow wage growth, with the MPC’s favoured measure, private sector wage growth excluding bonuses, at 5.9% 3m YoY in March – its lowest level since June 2022. Wage growth moderation is corroborated by other indicators too. The job is not done yet though, as this is still somewhat away from a level that would be consistent with the MPC’s 2% inflation target.

Figure 3: UK Wage Growth

How many cuts will we get?

With each of these indicators in mind, it appears a cut to the UK’s Bank Rate is increasingly likely – and more members of the MPC seem to agree.

At the MPC’s meeting in March, no members voted to raise the Bank Rate for the first time since the hiking cycle began. Then, in May, Sir Dave Ramsden joined Dr Swati Dhingra in voting for a rate cut.

Amy Le, within SSGA’s Economics team, expects to see at least two rate cuts this year given that growth is gradually picking up whilst the jobs market is cooling. In addition, as the surge in April's cost pressure, which is related to the 10% rise in the National Living Wage, is showing signs of easing in May, particularly in the services sector, this would strengthen the probability of a first rate cut in August. Find out more in our economics team’s recent blog: Central Bank Check-In: What's Next Around the Globe

Implications for DB schemes

As government bond yields typically decline as central banks cut interest rates, DB pension schemes should consider further increasing the level of interest rate hedging within the scheme, both to take advantage of the current level of government bond yields and to protect themselves against future declines in yields.

Pension schemes that have gained leverage using repos within their pension schemes will directly benefit from cuts to Bank Rate as this reduces the cost of borrowing within their LDI fund. In addition, should longer dated bond yields decline alongside cuts in Bank Rate, pension schemes will benefit from an increase in the value of their collateral, which will allow them to potentially reduce the level of leverage within the scheme.

Strategic considerations for DB pension schemes

Given the potential for rate cuts by the BoE, it’s crucial for schemes to reassess their hedge ratios – the extent to which their liabilities are protected against interest rate movements.

State Street Global Advisers (SSGA) offers a compelling proposition in this regard, with custom LDI strategies that help ensure schemes are protected from the impacts of rate cuts and poised to capitalise on market opportunities.

Our clients benefit from:

- Service-led approach: SSGA’s LDI proposition comes with an enhanced level of service, offering tailored support and quick access to both experts and data.

- Improved reporting: We offer daily LDI portfolio valuation and analytics reports, tailored to suit the needs of our clients and their advisers.

- Lower fees: SSGA's proposition emphasises cost-effectiveness, enabling schemes to benefit from low management fees. These savings can quickly offset any transition costs for schemes looking to move from another LDI provider.

- Technology-led portfolio management: Each of these benefits is made possible by our best-in-class technology platform, the Charles River Investment Management Solution (CRIMS), which manages every aspect of our LDI mandates with precision and scale.

While speculation of a cut to the Bank Rate indicates a welcome return to economic normality, the upheaval associated with this policy shift may be significant. Trustees of DB schemes should work with their LDI manager and advisors to navigate this regime change and how it will impact their portfolios.