Is the US Facing a Grand Era of De-Regulation?

The US Supreme Court’s decision to overturn the Chevron doctrine could herald a new era of structural de-regulation. What are the broad implications of this development for markets?

The recent ruling by the US Supreme Court to overturn the 40-year legacy of the Chevron doctrine has accelerated the trend of legal challenges to the decision-making scope of federal regulatory bodies. In practice, the ruling diminishes the interpretative power of regulatory agencies and requires either the legislature or the judiciary to clarify ambiguities in the law.

Until June 2024, the standing Chevron doctrine had empowered regulatory bodies to interpret legislation as they see fit and guided by the executive. Given the increasing complexity of businesses and industries, this had meant the regulatory bodies wielded ever growing power to affect markets or industries.

Is This a Significant Market Development?

The practical effect of the ruling will be to:

- Encourage greater litigation against regulatory decisions

- Deter regulatory agencies from issuing new regulations

- Force regulatory agencies to narrow their existing mandates

- Push greater responsibility for regulatory details onto the legislative process

Together, in our view, this heralds a new era of structural de-regulation, or at a minimum a marked slowdown in regulatory growth. The biggest winners of this shift will be large-cap corporations, both for their ability to legally challenge regulation as well as their financial and political influence to lobby for favorable legislation. This applies particularly to industries highly exposed to costly regulation, notably energy, finance, and technology.

Some observers claim this simply asserts recent reality where many regulations suffer legal challenges and are deemed inapplicable. We disagree and consider this a milestone in the US regulatory framework that will usher in an era of diminished regulatory interventions. The reliance on legislative process to resolve technical details will ultimately slow down the overall volume of new regulation as well as dilute the overall impact of any new regulation.

In general, Congress does not possess the technical expertise for detailed regulation and relies heavily on input from industry as well as regulatory bodies. The past practice of drafting laws with general objectives and leaving details to the technical experts will no longer be open. Likewise, courts are less likely to provide actual technical clarifications and will rather simply affirm or invalidate existing regulation. The net effect will be de-regulation across wide swathes of the economy.

Macroeconomic and Political Implications

To be clear, the impact will be slow-moving and will transpire over years. The immediate effect is to reduce the power of the executive and its political appointments. This should reduce regulatory swings in election cycles and provide more predictability for businesses. Conceptually, the costs of regulation on corporate balance sheets also declines and this should be positive for profit margins.

In practice, this should help lift productivity in its basic calculation as inputs relative to outputs decline. Under this assumption, overall economic growth potential should enjoy a net tailwind from reduced regulation. The counter argument is that these regulatory costs are simply an expression of negative externalities, which in the absence of regulation, will simply have to be borne by either the sovereign (e.g., bailout costs) or household balance sheets (e.g., higher insurance premiums). Judging today, it is impossible to render a refined judgement on which dynamic will be more influential.

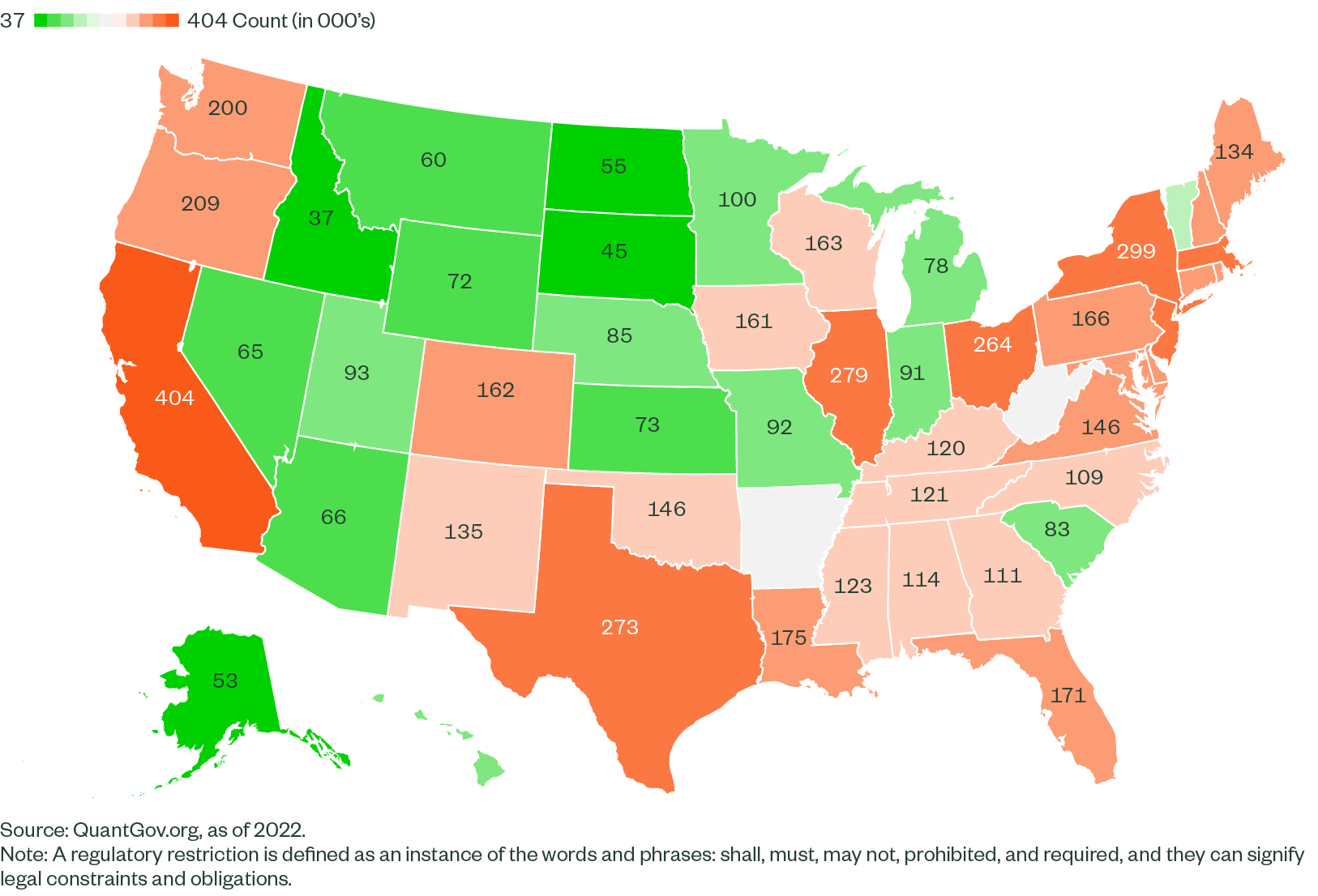

In contrast, we do think there will be a quantifiable wider dispersion in economic performance among US states. The weakening of the federal regulatory framework will further raise the importance and differentiation of state regulations in terms of relative regulatory depth (Figure 1).

Figure 1: Total Number of Regulatory Restrictions by State

Over time, this should lead to greater differentiation in economic outcomes, by states generating higher economic growth due to regulation-friendly environment or due to better quality-of-life outcomes attracting and retaining more businesses and workers. As such, this move also makes the US economy less cohesive than prior to the court ruling.

The Bottom Line

For some observers, the recent overturning of the Chevron doctrine simply asserts a current reality where many regulations are merely legally challenged and are deemed inapplicable.

We, however, consider this as a milestone in the US regulatory framework that will usher in not only an era of diminished regulatory interventions and a further favorable environment for large-cap companies but also that will have far-reaching economic and political implications.