Investing Beyond the Magnificent 7

Recent performance of the Magnificent 7 has created a technology sector bias in the S&P 500, representing over 30% of the index. The SPDR Dow Jones Industrial Average ETF Trust (D07) could offer diversification with a focus on stability and quality.

US Large-Cap Stocks are More Than Just Tech

The vast and robust United States economy boasts market-leading companies spanning diverse sectors. However, recent focus has centred on the performance of just seven prominent technology-driven companies, dubbed the “Magnificent 7”1, which some investors now equate with the overall performance of the US stock market.

It is easy to see why a handful of massive growth companies are drawing significant attention. In 2023, the S&P 500® Index rallied more than 20% with the Magnificent 7 accounting for over half of that gain2.

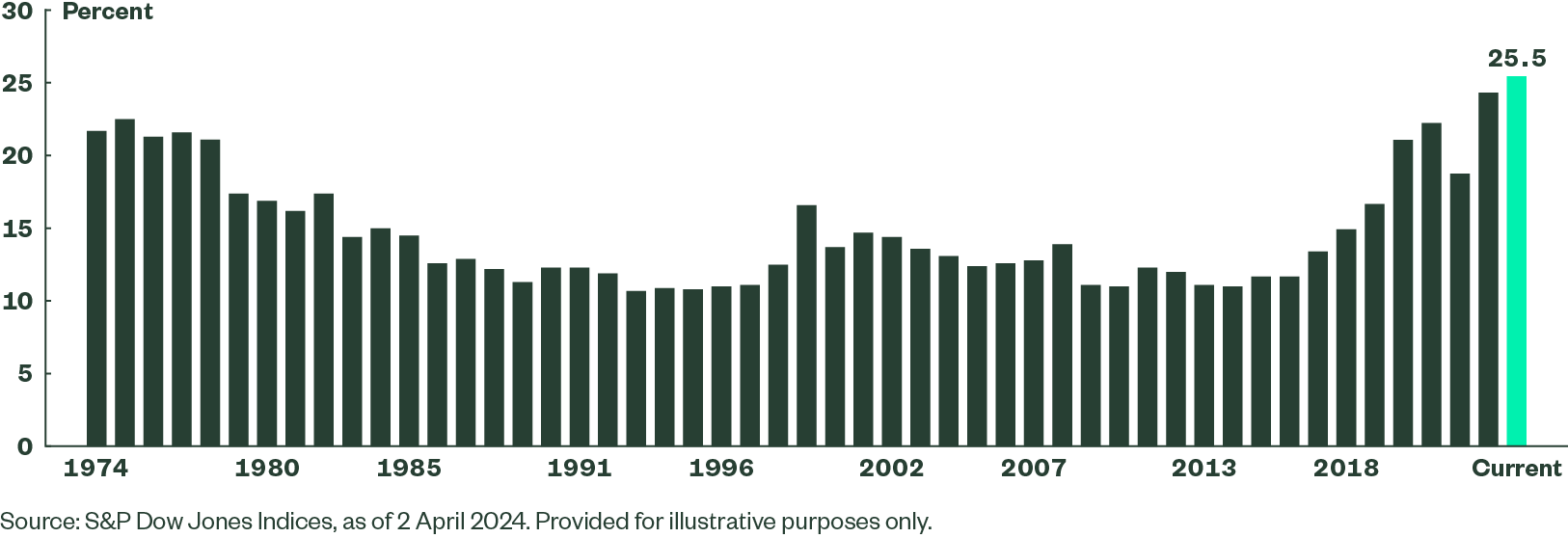

Investors have flocked to these large-cap stocks, anticipating substantial gains from the burgeoning artificial intelligence (AI) boom and other potential drivers of growth and disruption. The impressive performance of the Magnificent 7 is a key factor behind the technology sector’s almost one-third share of the S&P 500® Index, marking a historically significant level of concentration.

Figure 1: Cumulative Weight of Top 5 Names in the S&P 500®

Investors seeking diversified exposure to the world’s largest economy need to be aware of this potential concentration risk in their large-cap US allocations. For investors looking to broaden their US exposure and mitigate potential unintended overexposure to the technology sector, the SPDR® Dow Jones® Industrial AverageSM ETF Trust (D07) may be an appealing alternative.

US Large-Cap Equities: Emphasising Quality and Valuations

With the current macroeconomic environment marked by moderating inflation and earnings growth, prospects for US equities appear promising for the rest of this year. However, the upcoming elections and the looming possibility of a second wave of inflation remain key risks.

Despite potential headwinds, the sustained robust job growth witnessed through the first quarter of 2024 has raised doubts on whether the US Federal Reserve will begin cutting the fed-funds rate in 2024. Investor anticipation of multiple rate cuts in 2024 has contributed to the strong performance of the Magnificent 7 and other growth-oriented stocks over recent quarters.

During the current phase of the economic cycle, investors considering US equities may find it prudent to focus on quality, and stocks outside the Magnificent 7 could offer a more favourable price/quality balance.

While the demand for AI continues to drive growth stocks, it is essential not to overlook the potential resilience of stocks beyond the Magnificent 7 throughout the remainder of 2024. Indeed, the US large-cap stock market extends far beyond the rapid expansion of tech titans such as NVIDIA and Meta Platforms.

Investing in “Blue-Chip” US Stocks with D07

For investors seeking exposure to US large-cap equities with a tilt towards quality and stability, the SPDR® Dow Jones® Industrial AverageSM ETF Trust (D07) offers an excellent avenue. Since 1998, this ETF has provided investors with transparent and cost-efficient exposure to a diversified collection of renowned companies at the core of the US economy.

D07 is an ETF designed to track the performance of the Dow Jones Industrial AverageSM (the Dow), comprising 30 blue-chip US stocks. This approach may appeal to investors looking to invest in US large-cap stocks without an overreliance on the technology sector. Notably, while 30% of the S&P 500® Index is Technology stocks, the sector only represents 19% of the Dow Jones Industrial AverageSM.3

Although tech stocks may currently dominate headlines and investor sentiment, they are not the sole drivers of economic growth in the US. Allocating a portion of a portfolio to D07 may offer a more balanced approach that could mitigate the risks associated with concentration in the technology sector.

Over 125 Years of Index History

The Dow, which D07 tracks, boasts a rich history of encompassing industry leaders across a broad spectrum of the US economy, from consumer stalwarts like Coca-Cola and Johnson & Johnson to industrial powerhouses such as Caterpillar and Honeywell International.

The Dow uses a price-weighted measure of all US industries except transportation and utilities and is the world’s oldest continuing US market index with a history dating back to 1896. Its enduring relevance in the financial landscape is a testament to its adaptability, reflecting changes in the US economy over time. As companies and sectors rise and fall in market favour, the Dow has evolved accordingly. Its longevity and resilience underscore its enduring significance in the financial landscape.

While the allure of the Magnificent 7 remains strong, driven by the promise of AI and potential Federal Reserve rate cuts in 2024, it is important to maintain a balanced investment perspective. By incorporating D07 into portfolios, investors can harness the power of established industry leaders and diversify away from growth stocks that may already be priced for near-perfection.

Get to Know the SPDR® Dow Jones® Industrial Averageˢᴹ ETF Trust