Exploring the Full Spectrum of Fixed Income Strategies

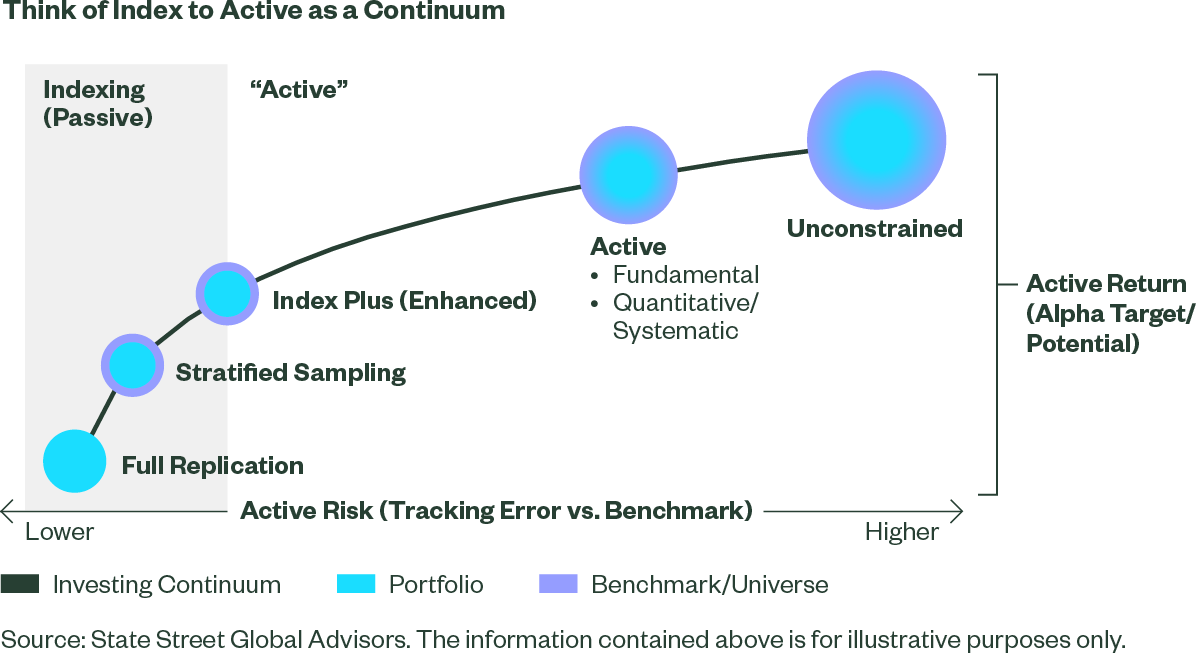

Investors have traditionally thought of there being two overarching investment styles, namely Active and Passive (or indexing). But this binary view oversimplifies the new reality. Instead, it is better to think of investment styles as sitting along a continuum, where styles become progressively more “active,” from index replication to fully unconstrained.

In addition, investors today are increasingly evaluating what their strategic fixed income benchmarks should be, and no longer simply accepting capitalization-weighted indices as their only options. This change in thinking is challenging the simplicity of traditional active/passive thinking and giving rise to custom exposure design and management.

In this paper we will explore and explain each approach - for fixed income investors specifically - with the objective of highlighting which exposures best lend themselves to each style.

The Fixed Income Continuum

The structure of the bond market has been evolving, partly in response to an expansion in electronic trading and the rapid growth of fixed-income ETFs (see The Modernization of Bond Market Trading and its Implications for more details on this subject). As a result, improved liquidity and lower transaction costs are paving the way for a broader set of approaches available to fixed income investors. This much more diverse array of strategies progress from a no alpha/replication approach through stratified sampling, enhanced indexing, active (both fundamental and now systematic), and finally to, essentially, unconstrained. We believe it’s important for investors to appreciate the full spectrum of investment styles, and the pros and cons associated with each, so as to better choose which are most appropriate for them to deliver on their own specific fixed income objectives. In Figure 1 below, we outline how each of these styles is positioned along the continuum and where they fall on the active risk and return spectrum.

Figure 1: The Spectrum of Fixed Income Investing

Indexing – Full Replication

On one end of the continuum are the purely passive approaches, also known as full replication because they seek to replicate an index as closely as possible. This approach is generally only feasible in the most liquid of exposures, such as government bonds, as market liquidity is a large determiner of the price paid for a bond. Consistently high liquidity at the individual bond level in government bond exposures facilitates full replication at a very low cost, ensuring extremely tight risk alignment and performance tracking. In these exposures there is high confidence that the beta can be delivered efficiently and reliably, which is the overarching goal of a replication approach. However, increased liquidity and price transparency also makes it more difficult to add additional alpha or beat the benchmark. The choice of a fully replicated approach is therefore best suited for very liquid sectors, and in cases where additional alpha is not the investment goal.

Indexing – Stratified Sampling

As we move beyond liquid government bonds, a more pragmatic and increasingly sophisticated approach to portfolio construction is required. Sectors with more variable liquidity profiles such as investment grade credit can introduce higher transaction costs, effectively resulting in a performance drag versus the benchmark. A sampling approach solves the liquidity problem by allowing for flexibility around individual holdings, while still keeping the portfolio aligned to the benchmark along its key risk dimensions, such as maturity, sector, issuer etc. Moreover, advances in electronic trading technology and protocols (i.e. portfolio trading) have unlocked less liquid parts of the market thereby enabling more efficient implementation. Sampling also allows for the use of additional value-add techniques such as participation in new issues, relative-value security selection, and a considered approach to rebalancing. These techniques can often result in what we at SSGA call “implementation alpha”, and are vital tools in reducing the performance drag inherent to trading in more complex exposures.

Indexing Plus/Enhanced Indexing

Next along the continuum is Index Plus, also referred to as enhanced indexing, which expands on the value-add techniques used in stratified sampling in order to deliver a higher level of implementation alpha. While this approach seeks to add alpha, it does so while still operating within the constraints of a more traditional indexed portfolio, unlike a fully active strategy which gives managers discretion around security selection. Alpha is instead generated through the aforementioned implementation alpha techniques and by utilizing out-of-index proxy exposures.

Active – Fundamental

Traditional active managers seek to outperform a benchmark index within a set risk budget, typically 100-200bps of tracking error volatility per annum. As such, they have the discretion to express their convictions or views through active exposures to a number of risk factors such as duration targets, sector rotations, plus sector allocations, and individual security selection. Fundamental active strategies are most effective in sectors that are viewed as having greater inefficiencies (such as credit, high yield, and emerging markets debt), thus having a greater opportunity to generate alpha.

Active – Systematic

Systematic active strategies seek to outperform a benchmark index through a rules-based, data-driven approach to security selection. Individual bonds are scored based on a number of quantitative signals, and security selection is dictated by the highest scoring bonds. A systematic approach reduces biases in decision making, ensuring a disciplined adherence to a predefined strategy. Systematic investing can be advantageous in managing large complex portfolios where scalability and efficiency are paramount, allowing for precision risk management and cost control. Systematic strategies are perhaps most widely utilized in credit sectors, where there is an abundance of historical data, data coverage of the investment universe is extensive, and the alpha signals have demonstrated consistency and efficacy over different time periods and market environments. Given the data-driven approach to investing, systematic strategies often perform more consistently than a more traditional active strategy, and will generally have lower risk budgets and alpha targets.

Active – Unconstrained

Unconstrained strategies can invest in a broad range of fixed income sectors, ratings, currencies, and geographies without being tied to a specific benchmark. As a result, unconstrained investing is very flexible and can offer uncorrelated outcomes and a high degree of customization. However, an unconstrained approach also carries a higher level of risk due to the human decision-making and oversight involved.

Use Cases

Use Cases for Passive/Index Investing

- An investor may choose a passive fund for a very liquid sector (such as US Treasuries) where it can be more difficult to add value or beat the benchmark.

- Pension investors can also use an index/passive approach for de-risking purposes within the defined benefit space, and in liability-driven investing where it is important to have known, steady cash flows.

- Due to changes in the fixed income markets, it is becoming harder for active managers to beat the index consistently in more complex sectors such as high yield (HY) and emerging market debt (EMD), leading to increased adoption of an indexed approach within these sectors. The main reasons for the shift to indexing include fees, tracking error budgeting, and a disaggregation in fixed income exposures.

- Passive/indexing offers opportunities to add value through new issue markets, relative value security selection, efficient trading, and reducing turnover.

Use Cases for Fundamental Active

- Investors often use active strategies to achieve certain alpha targets – i.e., beating a benchmark.

- Active management is most useful in sectors that have inefficiencies to exploit (such as credit, HY, and EMD).

- Fundamental active is suited to investors looking for a discretionary approach with human inputs. Credit analysts can make buy/sell/hold recommendations based on relative value assessment; structural, cyclical, and tactical trends; and financial analysis of cash flows, capital structure, industry and issuer-specific fundamentals.

- Investors seeking tactical market opportunities look to fundamental active to add value by taking advantage of short-term market dislocations (supply/demand imbalance, competing investor objectives, etc.).

- Institutional investors working to adhere to specific mandates, or investing within certain views set by an investment committee – whether based on duration, sector weight, country, or other considerations – often employ fundamental active strategies.

Use Cases for Systematic Active

- Systematic is most effective in environments where data-driven models can identify patterns and opportunities that may not be apparent through fundamental research methods.

- This management style is advantageous in managing large, complex portfolios where scalability and efficiency are paramount, allowing for precision risk management and cost control.

- Most widely used in data-rich credit sectors where alpha signal back testing has demonstrated efficacy and consistency through different market environments.

- Systematic active typically has a smaller risk budget and return objective than other active styles, so it suits investors who wish to take a large number of small risk exposures which can add up to substantial, consistent outperformance.

Use Cases for Unconstrained Investing

- Using an unconstrained approach covers a wide range of objectives, such as total return, higher yields, sector focus, exclusion screening, etc.

- Unconstrained investing is extremely tactical, giving investors the freedom to express viewpoints and convictions, and avoid certain sectors/names/durations in periods of market stress;

- Unconstrained returns are often uncorrelated to benchmarked returns, providing diversification within a larger asset allocation.

- Similar to fundamental active, this approach also uses a top-down analysis of global economic trends, market factors, and interest rates combined with individual security selection to customize a portfolio.

- Investors must accept a larger degree of risk due to the discretionary aspect and behavioral bias.

The Bottom Line

Institutional investors require flexibility and a range of options within their asset allocations. The evolution of fixed income markets now allows for customized solutions and strategies that can help deliver target returns and, as we discussed in Optimizing a Global Credit Portfolio (ssga.com), a combination of multiple investment styles is often the best solution to optimize investors’ portfolios at specific risk budgets.

Whether it be risk-controlled indexing, unconstrained managers, custom benchmarks, or utilizing active strategies, the tool set has grown, and investors would benefit from choosing a manager that has a wide breadth of investment style capabilities as fixed income evolves further into a solutions asset class.

Our Capabilities

State Street Global Advisors is well positioned to provide a straightforward and balanced response to investors’ fixed income requirements, having served our clients’ index and active investment needs and objectives for over 40 years. We have a broad suite of fixed income, cash management, and currency solutions that – when combined with the depth of talent in our investment management, trading and research teams – has supported the growth of our business. We are now one of the largest institutional managers in the world, with over $1.2 trillion in fixed income, cash, and currency assets under management as of December 31, 2023. In aggregate, our fixed income desks traded $442 billion in 2023.

Indexing Management

We have a long track record across a broad array of US and global sectors, with gross performance typically in line with, and sometimes ahead of, the benchmark return. This is achieved through a value-additive investment approach designed to minimize costs in a tightly controlled tracking process.

The key features of our approach are included below:

- Our investment teams specialize by asset class. Deep subject matter expertise is key in each of these segments, and the team’s partner with specialist traders to garner considerable market insights. This knowledge is enhanced by the ETFs that they manage, where flows are often sizeable and frequent.

- Stratified sampling is applied to manage most of our indexed fixed income exposures, as we seek to minimize costs and risks by matching the key risk features of the underlying index. In this sampling approach, we resist expensive trading, where practical, provided we can design a portfolio that is consistent with the benchmark’s risk characteristics.

- We use the primary market to access liquidity and to extract the new issue premium.

- We aim to minimize portfolio turnover relative to index turnover by making informed decisions about the value or impact that this turnover may have on risk and returns.

- We believe our experienced global trading desk gives us clear advantages that add to clients in terms of tighter spreads and better access to primary markets. This is clear in both the tight tracking we have consistently delivered over both medium- and long-term time horizons.

Active Management

Supported by a deep knowledge of fixed income markets and the opportunities to potentially outperform within particular sectors, our fixed income team also manages active strategies in US Government, MBS, and Credit. Within these markets, we believe that fixed income returns are driven by three primary sources:

- Structural risk premiums which are generally driven and supported by longer-term trends.

- Cyclical opportunities which arise due to deviations from fair value or trends in various markets.

- Tactical opportunities where events may cause temporary market dislocations. We believe these opportunities can be identified from both a top-down and bottom-up investment process incorporating fundamental investment research complemented by quantitative rigor.

Systematic Active

Our factor-based insights, powered by Barclays Quantitative Portfolio Strategy (QPS), seek to identify alpha opportunities following a robust and systematic investment process across the fixed income universe. Moreover, our portfolio implementation expertise allows us to capture risk premia effectively with high sensitivity to the desired style factors. The screening process allows us to filter for and control liquidity constraints and transaction costs.

Our fixed income offering is underpinned by a highly talented credit analyst team, sector specialist traders, and experienced portfolio managers who maintain a strong focus on risk to exploit market correlations and protect assets in down markets. We believe that leveraging state-of-the-art technology, including proprietary tools, is critical in assessing, monitoring, and attributing the risk positioning versus the benchmark in order to deliver on client objectives.